Miamberke_

@t_Miamberke_

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Miamberke_

Analysis of XAU/USD for the coming days, based on daily chart and recent market information. Technical Analysis Trend & Patterns Since late December 2024, gold has been in a strong uptrend, breaking out of the descending channel that formed in December–January. Recently we’ve seen a brief consolidation around the $3,300–$3,400 zone after peaking near $3,500. Indicators The RSI sits just above 50, pointing to continued bullish momentum. The MACD lines remain positive, though they’re approaching a potential turning phase. Support & Resistance Resistance: $3,400 (recent daily highs), then $3,500 (all-time high). Support: $3,300 (current consolidation floor), followed by $3,250 and $3,100 as deeper support levels. Short-term Outlook Gold is likely to trade sideways between $3,300–$3,400, with dips offering buying opportunities. A decisive break above $3,400 would open the door to retests near $3,450–$3,500. If XAU/USD falls below $3,300, it could quickly slide toward $3,250–$3,100. Fundamental Catalysts Safe-haven demand from geopolitical and trade tensions continues to underpin gold prices. Fed policy: the odds of a rate cut before summer remain low, as Fed officials emphasize patience. That limits downward pressure on the dollar (and thus supports gold). Macro agenda: May 2: US Non-Farm Payrolls May 7: Fed meeting & Powell remarks May 13: CPI report vs. rate guidance These releases could trigger significant intraday volatility. Conclusion & Near-term Outlook Given the technical bullish bias and upcoming US data, I expect over the next few days: Consolidation: $3,300–$3,400 Bullish scenario: recovery above $3,400 leads to retests of $3,450–$3,500 Bearish scenario: a break below $3,300 triggers a swift drop toward $3,250–$3,100 Stay alert around the NFP, Fed, and CPI releases—they’ll drive the near-term direction.

Miamberke_

Technical Analysis Trend & Patterns Since late December 2024, gold has been in a strong uptrend, breaking out of the descending channel that formed in December–January. Recently we’ve seen a brief consolidation around the $3,300–$3,400 zone after peaking near $3,500. Indicators The RSI sits just above 50, pointing to continued bullish momentum. The MACD lines remain positive, though they’re approaching a potential turning phase. Support & Resistance Resistance: $3,400 (recent daily highs), then $3,500 (all-time high). Support: $3,300 (current consolidation floor), followed by $3,250 and $3,100 as deeper support levels. Short-term Outlook Gold is likely to trade sideways between $3,300–$3,400, with dips offering buying opportunities. A decisive break above $3,400 would open the door to retests near $3,450–$3,500. If XAU/USD falls below $3,300, it could quickly slide toward $3,250–$3,100. Fundamental Catalysts Safe-haven demand from geopolitical and trade tensions continues to underpin gold prices. Fed policy: the odds of a rate cut before summer remain low, as Fed officials emphasize patience. That limits downward pressure on the dollar (and thus supports gold). Macro agenda: May 2: US Non-Farm Payrolls May 7: Fed meeting & Powell remarks May 13: CPI report vs. rate guidance These releases could trigger significant intraday volatility. Conclusion & Near-term Outlook Given the technical bullish bias and upcoming US data, I expect over the next few days: Consolidation: $3,300–$3,400 Bullish scenario: recovery above $3,400 leads to retests of $3,450–$3,500 Bearish scenario: a break below $3,300 triggers a swift drop toward $3,250–$3,100 Stay alert around the NFP, Fed, and CPI releases—they’ll drive the near-term direction.

Miamberke_

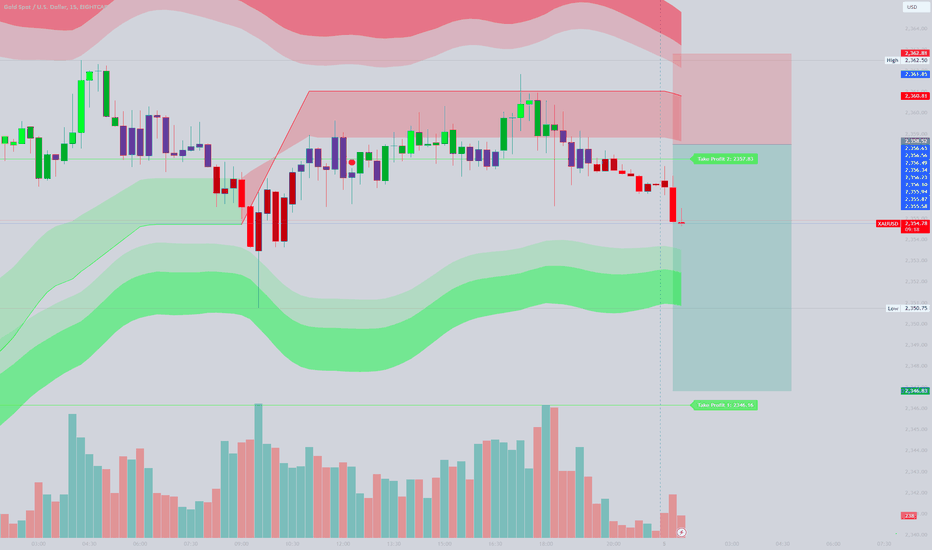

Think GOLD is gonna desent a little bit take profit 2346,83 probably

Miamberke_

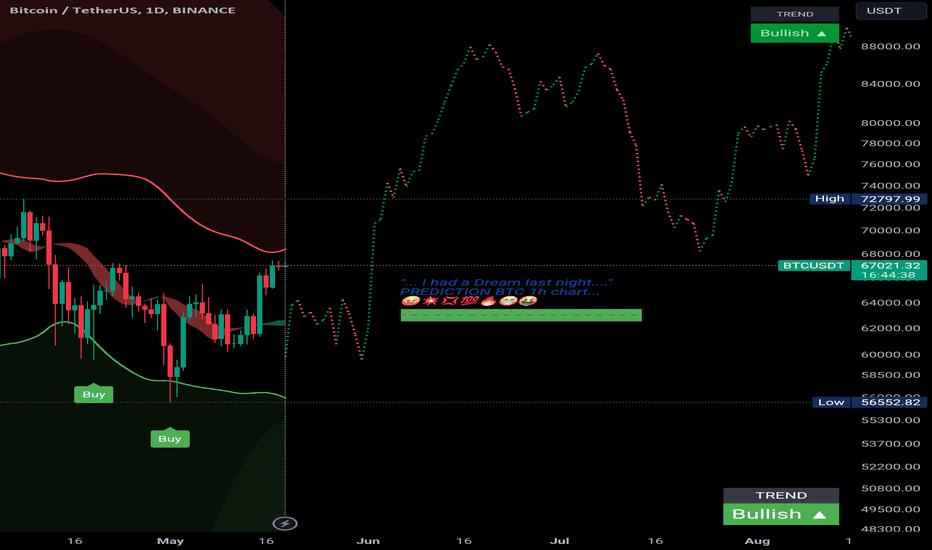

".... I HAD A DREAM LAST NIGHT..." PREDICTION BTC 1H CHART ... Let the Dream Come True....

Miamberke_

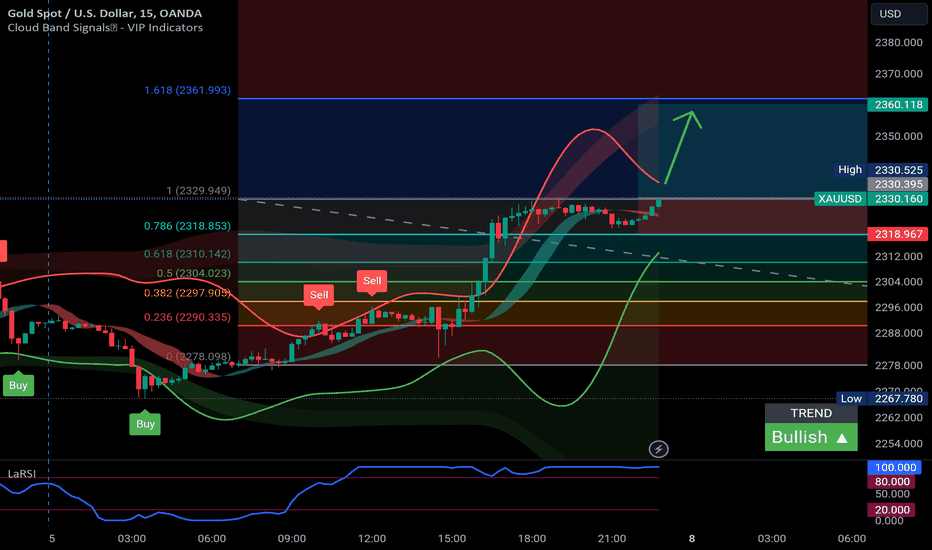

XAUUSD strong upward movement, continuation of bullish trend

Miamberke_

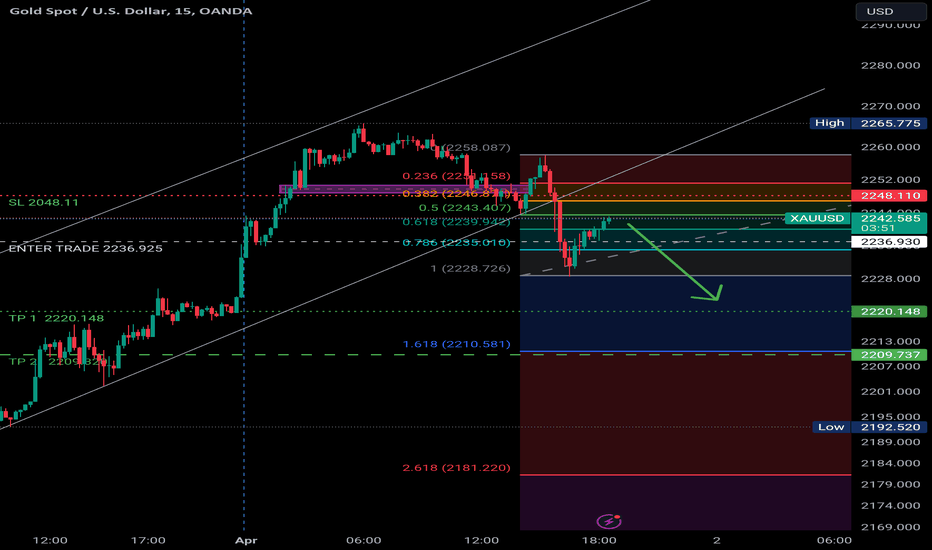

possible GOLD gonna descending further to 2220.148 , maybe TP 2 beyond the fibo at 2209,82

Miamberke_

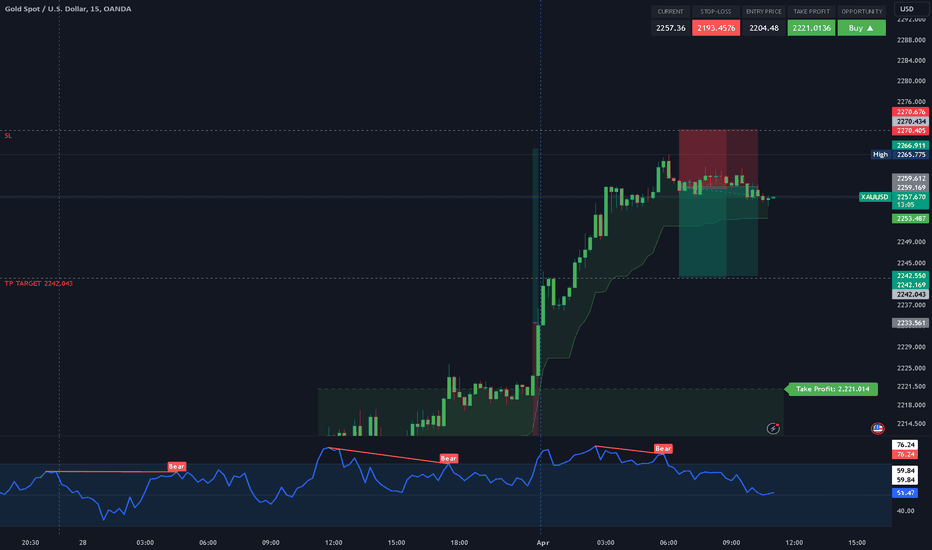

GOLD SELL 5M. Is there someone that support my idee ? Gold descending to 2242GOING WELL, 3 lots already 2088 € profit , still running

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.