Maximus20000

@t_Maximus20000

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Maximus20000

جنون انویدیا (NVDA): آیا حباب بزرگترین سهم جهان ترکیدنی است؟

NVIDIA (NVDA) has become the perfect embodiment of market insanity — a company worshipped like a religion, not analyzed like an investment. The stock has exploded 20x as if infinite growth were guaranteed forever, and somehow, investors think that’s normal. It’s not brilliance — it’s mania. At this point, NVDA’s valuation defies logic, gravity, and common sense. Every quarter is treated like divine revelation, every CEO quote like scripture. The market no longer values earnings — it values belief. And that’s the most dangerous thing of all. NVIDIA might make great chips, but the stock has become the chip on the market’s shoulder — proof that speculation has replaced discipline. When reality catches up, NVDA will be remembered not as a tech miracle, but as the crash course in what happens when everyone believes they can’t lose.

Maximus20000

سقوط رابینهود (HOOD): افشای چهره واقعی گرگهای پوشیده در لباس سرمایهداری خردهفروشی!

Robinhood (HOOD) is the perfect example of how greed, hype, and ignorance can masquerade as “democratizing finance.” Let’s be honest — HOOD didn’t empower retail traders; it exploited them. A platform that turned investing into a casino app, gamifying financial ruin while pretending to be a hero of the people. The stock itself is a masterpiece of irony — a company built on reckless speculation, now the subject of reckless speculation. HOOD’s inflated valuation, constant manipulation of retail sentiment, and history of freezing trading when things got tough make it one of the most shameful chapters in market history. If PLTR represents delusion, HOOD represents corruption wrapped in marketing. A 21st-century cautionary tale where the wolves wore hoodies and the sheep thought they were winning. 🐺💸

Maximus20000

بازار دیوانه شد! حباب یا اوج هیجان؟ چه بلایی سر سهام آمده؟

This market has gone completely crazy! Either we go from overselling to overbuying, or we witness a total bubble! When is this circus going to stop? Soon, half on SPY will have P/E ratio of 100 and everyone will find that normal!

Maximus20000

As you can imagine on this day... the trade is validated. and I'

As you can imagine on this day... the trade is validated. and I'm OUT OUT OUT

Maximus20000

ETH — Trade Closed! Massive Profit Secured

I’m officially closing my Ethereum position — this trade is now a success story! I posted right here that ETH was a buy at $2400, then doubled down at $1800. I even echoed the call on Reddit for good measure. Today, I’m liquidating the entire position with a huge gain. No regrets, just clean execution. 🧠💸 To all the mad lads still holding — good luck and may your conviction be rewarded. See you next year for the next big swing. Take your profits, you lunatics! 😄🔥

Maximus20000

Speculative Madness: The Market’s Bubble Stocks Some stocks are

Speculative Madness: The Market’s Bubble Stocks Some stocks aren't just overvalued—they're in full speculative bubble mode. Fundamentals? Irrelevant. When euphoria takes over, rationality disappears. Here’s my list of bubble stocks that scream unsustainable pricing: SBUX, T, PLTR, BMY, PYPL, NFLX, GS, ISRG, ARM, C, SHOP, BSX, SPOT, UBS, IBKR, RELX, CEG, CRWD, MSTR, MMM, DASH, COF... And let’s not forget the obvious: TSLA, META, AMZN, AVGO, GOOGL, JPM, MA, V, WMT. Honestly, the entire banking sector, brokers, and tech are in bubble territory. What the hell is going on with this market? Why are algos just buying, buying, buying, squeezing all the shorts?! Unbelievable. The dump will be insannnnnnnne!!! 🚨

Maximus20000

Speculative Madness: The Market’s Bubble Stocks Some stocks are

Speculative Madness: The Market’s Bubble Stocks Some stocks aren't just overvalued—they're in full speculative bubble mode. Fundamentals? Irrelevant. When euphoria takes over, rationality disappears. Here’s my list of bubble stocks that scream unsustainable pricing: SBUX, T, PLTR, BMY, PYPL, NFLX, GS, ISRG, ARM, C, SHOP, BSX, SPOT, UBS, IBKR, RELX, CEG, CRWD, MSTR, MMM, DASH, COF... And let’s not forget the obvious: TSLA, META, AMZN, AVGO, GOOGL, JPM, MA, V, WMT. Honestly, the entire banking sector, brokers, and tech are in bubble territory. What the hell is going on with this market? Why are algos just buying, buying, buying, squeezing all the shorts?! Unbelievable. The dump will be insannnnnnnne!!! 🚨

Maximus20000

What’s Your Bullish Price Target for ETH?

Ethereum has been trailing behind some of the alts in the top 100 and even BTC when it comes to parabolic runs. However, I’ve been analyzing the charts, and things are starting to look VERY interesting. Here’s my take:- On the **3-day chart**, I see a strong **resistance level around $3,830**. - Using a **Fibonacci extension**, the **1.6 level targets just over $5,000**—a number that feels astronomical but achievable in a bullish scenario. 📈 - The **daily MACD** is screaming **LONG**, indicating potential upward momentum. ### **Positive ETH Data to Back It Up** Ethereum's fundamentals are stronger than ever: 1. **Total Value Locked (TVL):** Ethereum continues to dominate DeFi, holding **58%+ of all DeFi TVL** at ~24B. 2. **24H Trading Volume:** Ethereum sees an average of **$6-8B traded daily**, showing its massive liquidity and adoption. 3. **Burn Mechanism:** Since the London Hard Fork (EIP-1559), over **3.9M ETH (~6.3B)** has been burned, contributing to its deflationary narrative. 4. **Staked ETH:** With **32M ETH staked**, nearly **26% of the supply** is locked up, reducing selling pressure.### **What's Driving the Bullish Sentiment?** Recent activity in the **layer-2 ecosystems** is fueling optimism: - **Optimism (OP)** and **Arbitrum (ARB):** Both L2s have seen substantial adoption, with millions of dollars in daily transactions and climbing TVL. - **Lido Finance (LDO):** The largest liquid staking protocol continues to thrive, with **~30% of all staked ETH** on its platform. These projects are growing **on Ethereum**, reinforcing the network’s pivotal role in the crypto ecosystem.---What’s your price target for ETH in a bull run? Do you see $5,000 as achievable, or do you have even higher targets in mind? Let's discuss!

Maximus20000

I just sold all my bitcoins after this huge rally that shows no

I just sold all my bitcoins after this huge rally that shows no significant volume... the correction on BTC and ETH will be brutal. OR NOT hahahaIt's often a cautious move to exit positions when a significant price surge lacks strong volume, as it can signal a weaker foundation for sustaining the rally. This can indicate that the market is being driven more by speculation than by robust buying pressure. If a correction does come, it might shake out weaker hands quickly and reset the market with more sustainable trends.

Maximus20000

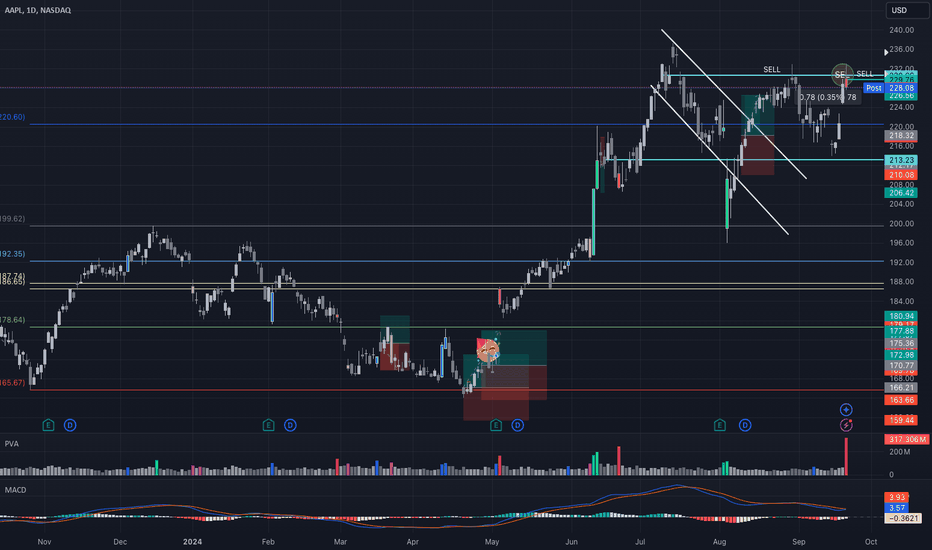

Title: Exiting AAPL: Liquidating My Entire Position After Double

Comment: After identifying a clear double, and potentially triple, top pattern on AAPL, I made the decision to liquidate my entire position. Having bought in at $166-169 before the breakout, the subsequent +28% move was a great run, but the technical resistance at these levels signaled it was time to lock in profits and shift focus elsewhere. Better to exit strong than risk a reversal!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.