ManMcPriceaction

@t_ManMcPriceaction

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

ManMcPriceaction

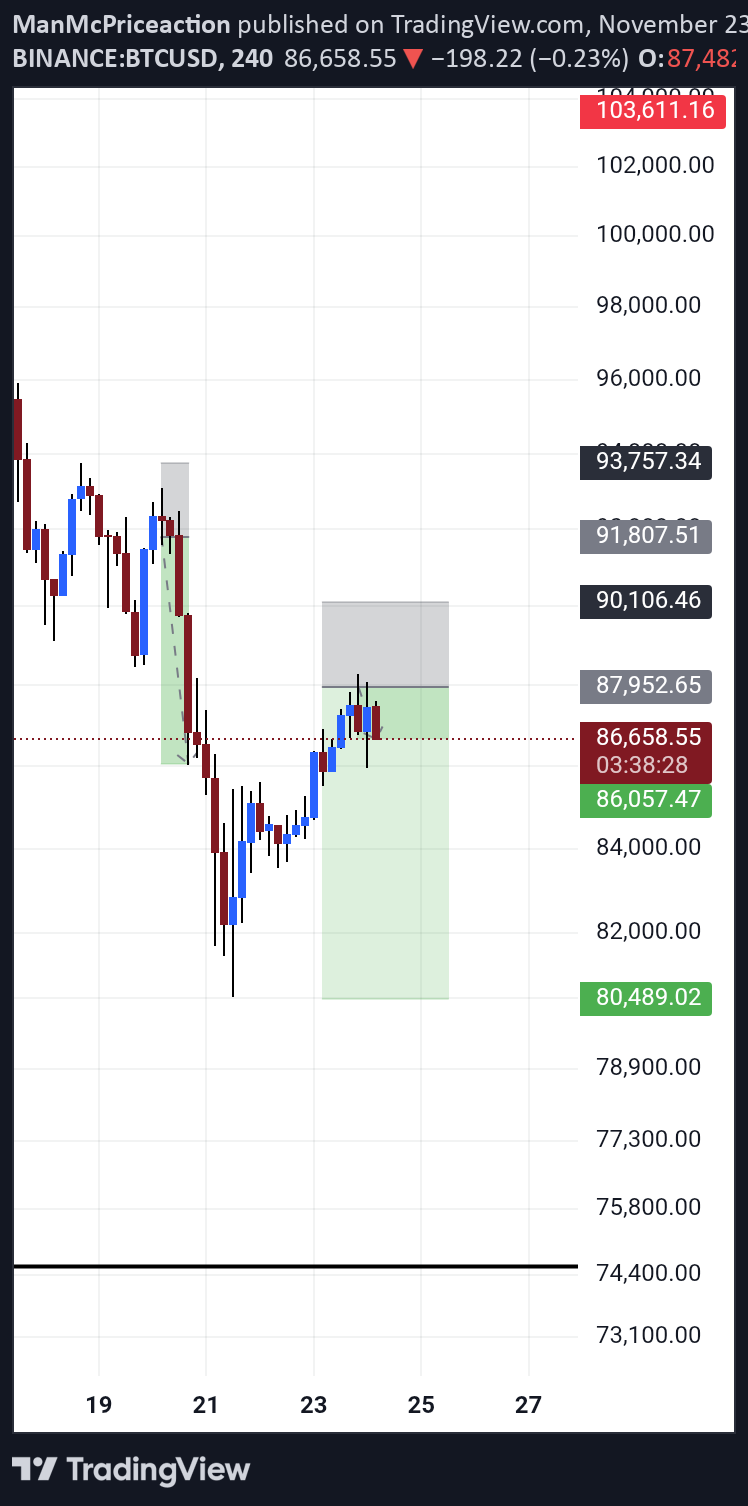

BTCUSD sells???

I've added the entry at the bottom for reference. If you remember I posted an expedition for price to first hit supply (green) before seeing a continuation to the downside, price wicked to that area however I would still like to see candle body close above all remaining internal liquidity highs before heading down, if sellers are strong that wick could be a good SL area, will keep posting more... Scroll down 👇🏿

ManMcPriceaction

آیا بیت کوین آماده جهش است؟ تحلیل دقیق روند صعودی BTC/USD

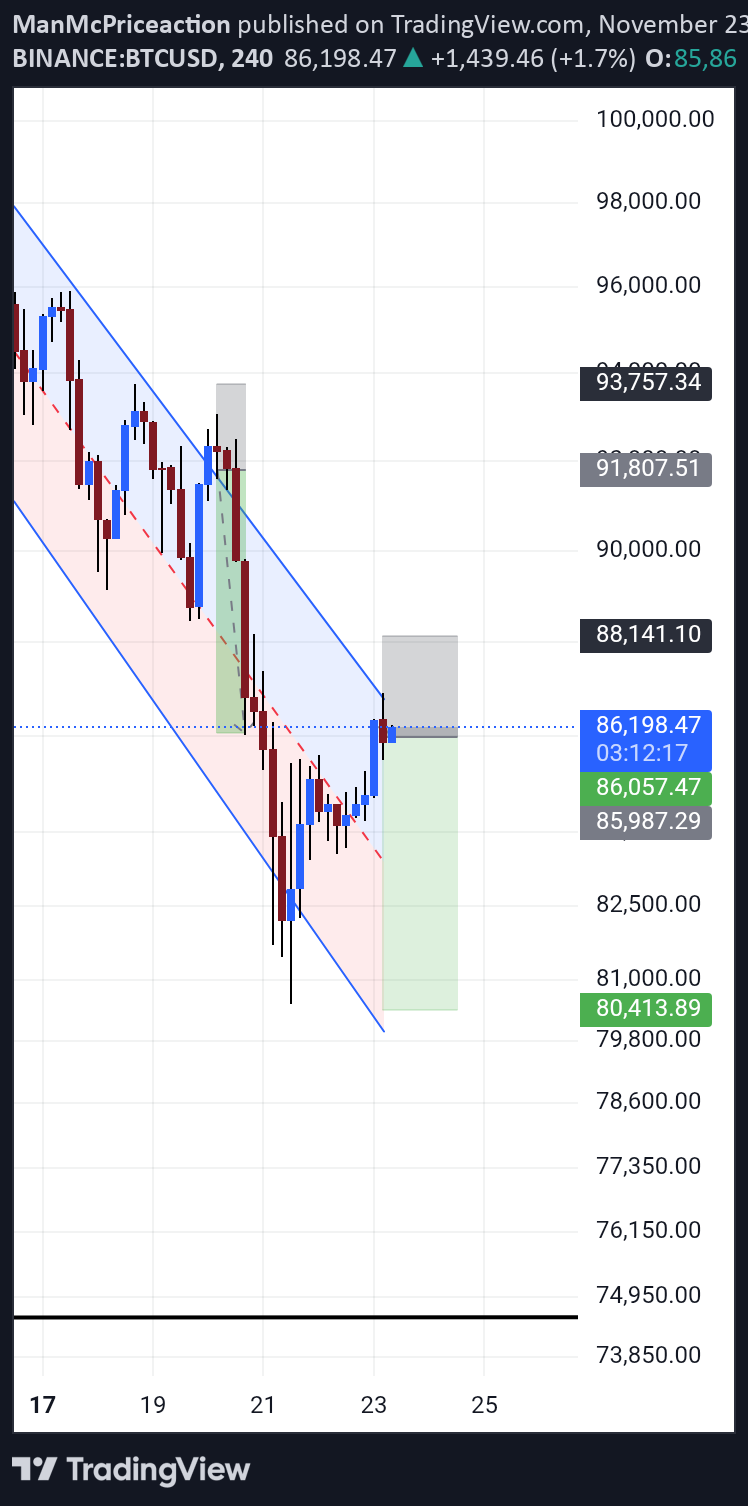

Yes bitcoin is buying for me on lower tf such as the H1 and H4, I'm looking for price to take out internal liquidity and tap into supply then continue the fall unless I see a significant break outside resistance trend

ManMcPriceaction

آیا بیت کوین سقوط میکند؟ تحلیل و سیگنال فروش BTC برای معاملهگران!

My bitcoin entry just got tagged in. Scroll down to see sell stop. I post all my entries and trade updates here follow if you're interested in copying my trades. Good luck.

ManMcPriceaction

آیا بیت کوین سقوط میکند؟ اصلاح پیشبینی مهم درباره قیمت BTC

Had to post this to correct my earlier entry on bitcoin.

ManMcPriceaction

فروش بیت کوین (BTCUSD): فرصت ورود در بازار امروز!

Bitcoin continues to sell. Actual, entry. I post all my entries here follow if you like this content! Good luck

ManMcPriceaction

Gold buying?

The markets are only ever 2 things trap retail, liquidate them, understand this and you will be that much better. When price is about to go up, it will manipulate support, if going down it will manipulate resistance. This manipulation is the key to your success in trading.

ManMcPriceaction

Gold bullish?

Check it out!What do you think?Is this smart money or what? If this is correct I'm about to make millions, enter at your own risk

ManMcPriceaction

Gold short term short?

After great profits in the past week on gold bulls, we've hit TP which was that liquidity point, looking a bit deeper I was able to spot my requirements for a short term shorts.I provide in depth analysis on my YouTube and telegram, leave a message on post to receive invite.

ManMcPriceaction

XAUUSD (Gold) buys?

Gold has been pushing up with no sign of slowing down, if you are familiar with my strategy you know I look for liquidity grab then a shift of structure aka (ChoCh) then entry.Still only interested in buys on gold until price takes out both liquidity highs (higher timeframe buy side liquidity).If you're interested in my entries, comment in that chat with your WhatsApp I'll add you.Good luck traders!

ManMcPriceaction

Gold (XAUUSD)

Gold presenting beautiful price action, talking out liquidity then taking out highs and creating new highs.No sign for gold bears, structure remains bullish, only looking for more buys setups on lower timeframes....

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.