Maks_Klimenko

@t_Maks_Klimenko

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Maks_Klimenko

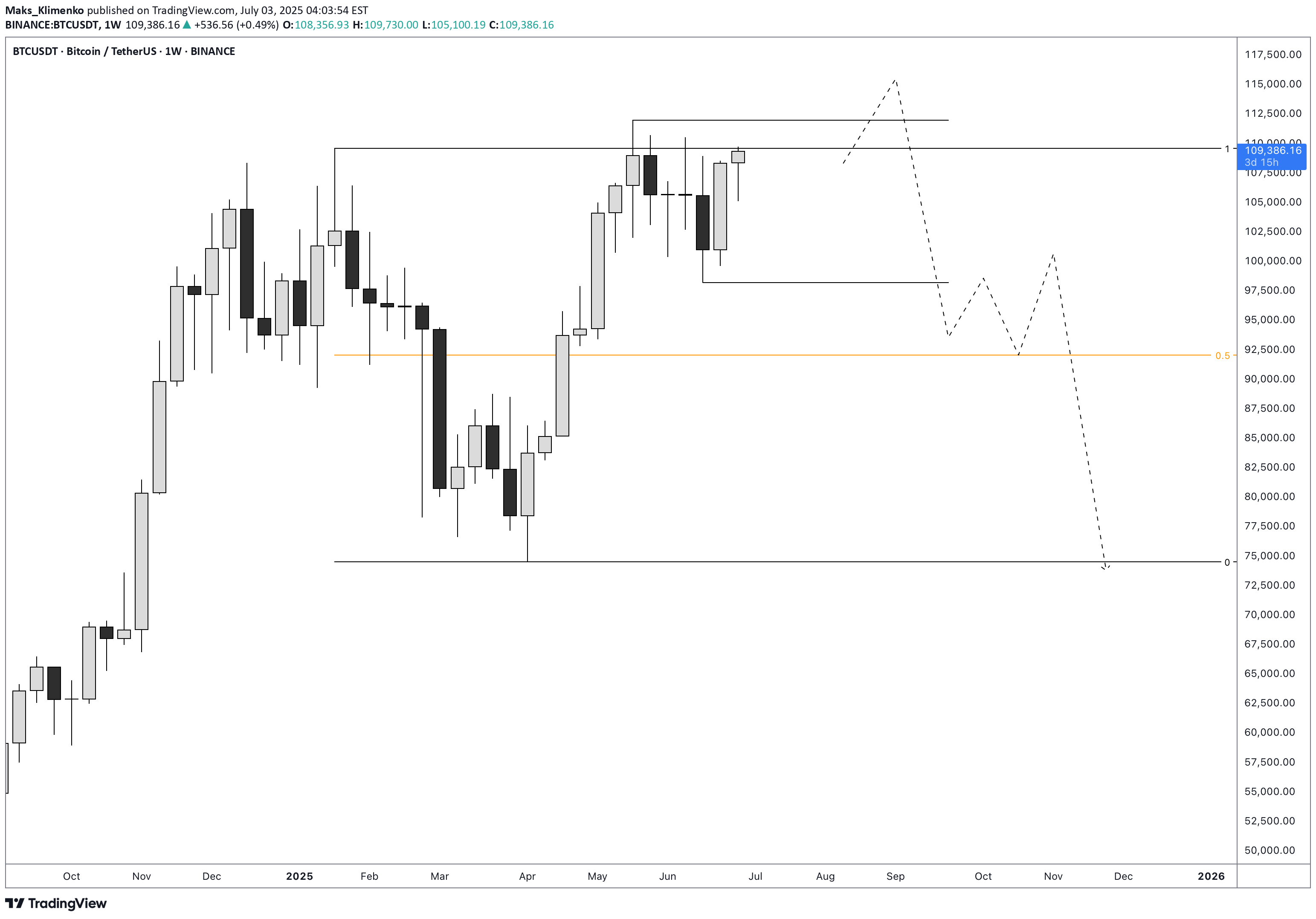

BTC - Probable SHORT Scenario

My main trading principle is that the price always moves from swept liquidity levels to untouched liquidity levels. In particular case we clearly can see the following context: price swept 1M key liquidity level and left untouched level lower + forming LTF range. But to take more statistically probable trades we should wait for some type of lower timeframe confirmation, and in this case we should wait for MSB or reaching 0,5 range mean Your success is determined solely by your ability to consistently follow the same principles.

Maks_Klimenko

BTC - Where to Buy? Answer in Video

My main trading principle is that the price always moves from swept liquidity levels to untouched liquidity levels. In particular case we clearly can see the following context: price swept 1W key liquidity level and left untouched level higher. But to take more statistically more probable trades we should wait for some type of lower timeframe confirmation, and it this case we can notice sign of strength, so potentially there is a higher probability to see price higher Your success is determined solely by your ability to consistently follow the same principles.First target hitMain target (ATH) reached, congratulations!+15% gains, bro

Maks_Klimenko

BTC - What the Next Movement? Wyckoff Method

The Wyckoff Range typically manifests as horizontal price action (sideways movement) on a chart. It represents a phase where supply and demand reach a temporary balance, and large institutional players accumulate or distribute their positions. Wyckoff Range manipulations are deliberate actions by large market participants (like institutions or "composite operators") to deceive retail traders, creating a false sense of market direction. These manipulations are integral to the Wyckoff Method, designed to exploit liquidity and accumulate or distribute large positions without causing significant market impact.Lower you could see how I predicted BTC movement

Maks_Klimenko

BTC - Short Setup

My main trading principle is that the price always moves from swept liquidity levels to untouched liquidity levels. In particular case we clearly can see the following context: price swept 1D key liquidity level and left untouched equal lows lower. But to take more statistically more probable trades we should wait for some type of lower timeframe confirmation, and it this case we can notice sign of weakness, so potentially there is a higher probability to see price lower. Your success is determined solely by your ability to consistently follow the same principles.Got the entry at 1:2RR between target and protected high (high that swept liquidity level)fixed all the position in +2R

Maks_Klimenko

ETHUSDT - Short Setup

My main trading principle is that the price always moves from swept liquidity levels to untouched liquidity levels. In particular case we clearly can see the following context: price swept 1D key liquidity level and left untouched level lower. But to take more statistically more probable trades we should wait for some type of lower timeframe confirmation, and it this case we can notice sign of weakness, so potentially there is a higher probability to see price lower. Your success is determined solely by your ability to consistently follow the same principles.-1R, but idea was right

Maks_Klimenko

XRPUSDT - Potential Long Setup

My main trading principle is that the price always moves from swept liquidity levels to untouched liquidity levels.In particular case we clearly can see the following context: price swept 1D key liquidity level and left untouched level higher.But to take more statistically more probable trades we should wait for some type of lower timeframe confirmation, and it this case we can notice sign of strength, so potentially there is a higher probability to see price higherYour success in this business is determined solely by your ability to consistently follow the same principles.I recommend you to not enter before CPI news, wait until it realize

Maks_Klimenko

LINKUSDT - Short Setup

My main trading principle is that the price always moves from swept liquidity levels to untouched liquidity levels.In particular case we clearly can see the following context: price swept 1D key liquidity level and left untouched level lower.But to take more statistically more probable trades we should wait for some type of lower timeframe confirmation. For me the best way to confirm higher timeframe context is structure.So, if price closes below red line (MSB), we will have the valid short setup.Your success is determined solely by your ability to consistently follow the same principles.Got the entryLFG+2R

Maks_Klimenko

DOGEUSDT - Potencial Short Setup

My main trading principle is that the price always moves from swept liquidity levels to untouched liquidity levels.In particular case we clearly can see the following context: price swept 1W key liquidity level and left untouched level lower.But to take more statistically more probable trades we should wait for some type of lower timeframe confirmation. For me the best way to confirm higher timeframe context is structure.We can notice the red line - break of market structure (sign of weakness) on key liquidity level, so there is a higher probability to see price lower at least on opposite level (marked lower).Your success is determined solely by your ability to consistently follow the same principles.Nice reaction+2R

Maks_Klimenko

XAUUSD - Long Setup

My main trading principle is that the price always moves from swept liquidity levels to untouched liquidity levels.In particular case we clearly can see the following context: price swept 1D key liquidity level and left untouched level higher.But to take more statistically more probable trades we should wait for some type of lower timeframe confirmation. For me the best way to confirm higher timeframe context is structure.We can notice the break of market structure (sign of strength) on key liquidity level with GAP, so there is a higher probability to see price higher at least on opposite level (marked higher).Your success is determined solely by your ability to consistently follow the same principles.Got the entryGoing great =)+2R

Maks_Klimenko

XAUUSD - Short Setup

My main trading principle is that the price always moves from swept liquidity levels to untouched liquidity levels.In particular case we clearly can see the following context: price swept 1D key liquidity level and left untouched level lower.But to take more statistically more probable trades we should wait for some time of lower timeframe confirmation. For me the best way to confirm higher timeframe context is structure.We can notice the break of market structure (sign of weakness) on key liquidity level, so there is a higher probability to see price lower at least on opposite level (marked lower).Your success is determined solely by your ability to consistently follow the same principles.If close below red line (market structure break) - stop at BEStop at BE

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.