Le_mah

@t_Le_mah

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Le_mah

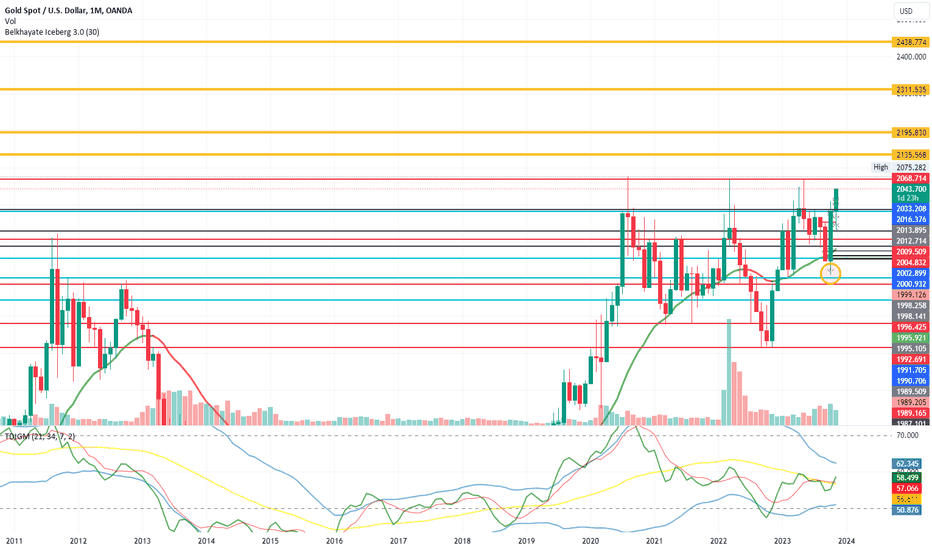

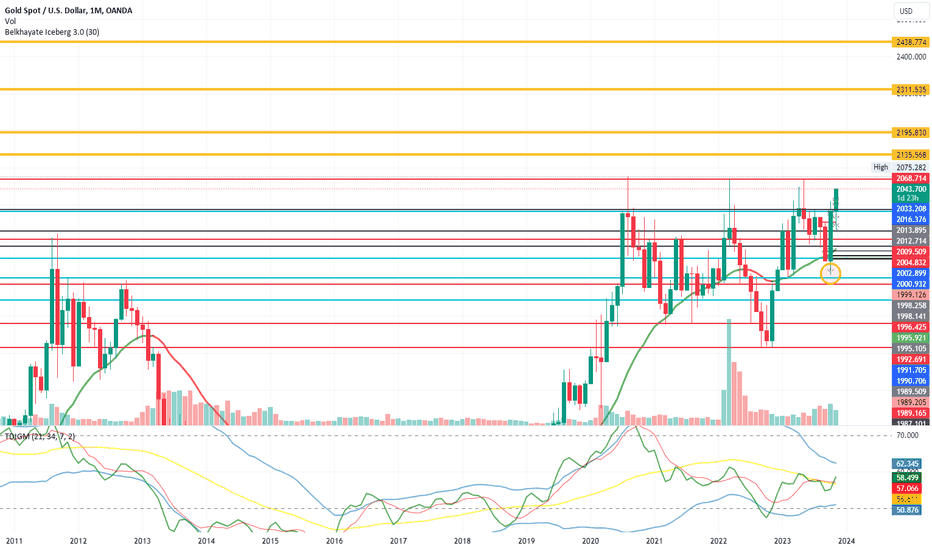

New Support & Resistance for the Gold CFD market in 2024

Fundamental Analysis : Since we all know the geopolitical tension we are living right now : Russian and Ukranian War, Palestinian and Israel conflict, Tension between USA and China, BRICS buying gold massively. Also increasing inflation all over the world, increase in interest rates is globalised...Gold also is very correlated with US CPI, GPD, Housing sector who is not doing well (maybe new bubble)... anyway hope the best for the dollar... who is being challenged in this new geopolitical era. Technical Analysis : Gold is doing well, most agressive move are bullish move (volumes weighted). Very healthy trend, that is obvious to oscillator expert. TDI, is the best indicator to use since it's a combination of 5 well known indicatorsFirt Resistance at 2135 worked perfectly, and rejected the MarketTomorrow Fed Interest Rate! stay tuned Gold WILL FLY to 2311plan was executed by the market perfectly

Le_mah

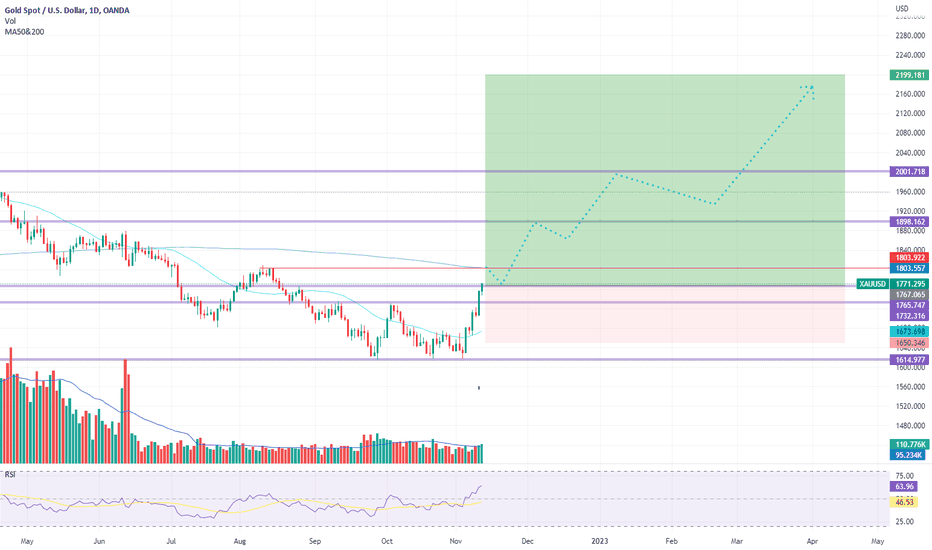

GOLD to Reach new ATH this year

War on Ukraine - Asian dumping the dollar - Gaz & Oil crisis - Food crisis - Inflation - Everyone will get back to gold | A new geo-political era is coming, and I think without the supremacy of the USDGold took directly +200 usd ! +2 000 pips AnlysisAll what I said in my fundamental analysis was accurate ! PhD's are always the bestGold as expected is still following his healthy trendNEW ATH reached

Le_mah

New Support & Resistance for the Gold CFD market in 2024

Fundamental Analysis : Since we all know the geopolitical tension we are living right now : Russian and Ukranian War, Palestinian and Israel conflict, Tension between USA and China, BRICS buying gold massively. Also increasing inflation all over the world, increase in interest rates is globalised...Gold also is very correlated with US CPI, GPD, Housing sector who is not doing well (maybe new bubble)... anyway hope the best for the dollar... who is being challenged in this new geopolitical era. Technical Analysis : Gold is doing well, most agressive move are bullish move (volumes weighted). Very healthy trend, that is obvious to oscillator expert. TDI, is the best indicator to use since it's a combination of 5 well known indicatorsFirt Resistance at 2135 worked perfectly, and rejected the MarketTomorrow Fed Interest Rate! stay tuned Gold WILL FLY to 2311plan was executed by the market perfectly

Le_mah

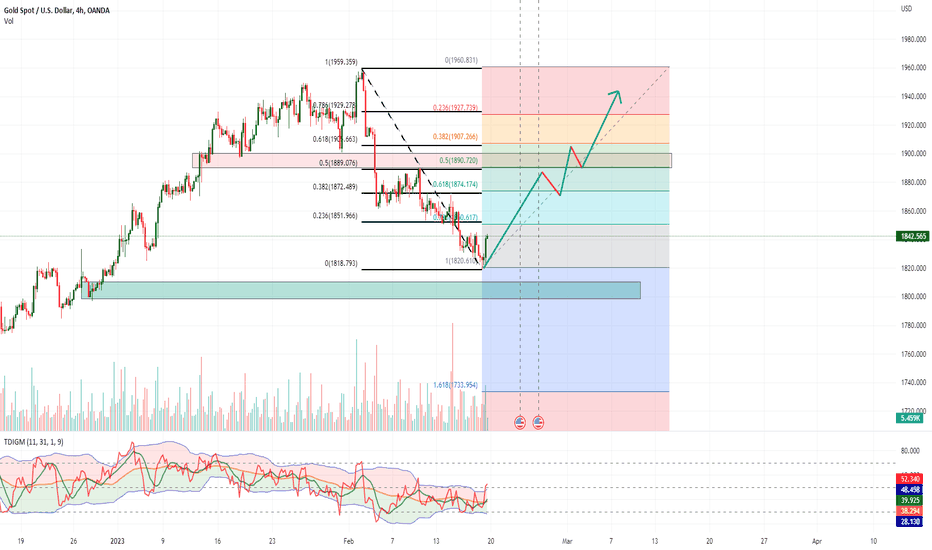

Gold Expected to be bullish this week

Based on the Fibonacci and Fibonacci extension analysis, it appears that the gold market has reached its maximum downside elasticity, particularly in light of the news from the previous week. The RSI and Stochastics indicators also suggest an oversold market. Moreover, the fundamentals for gold are bullish.

Le_mah

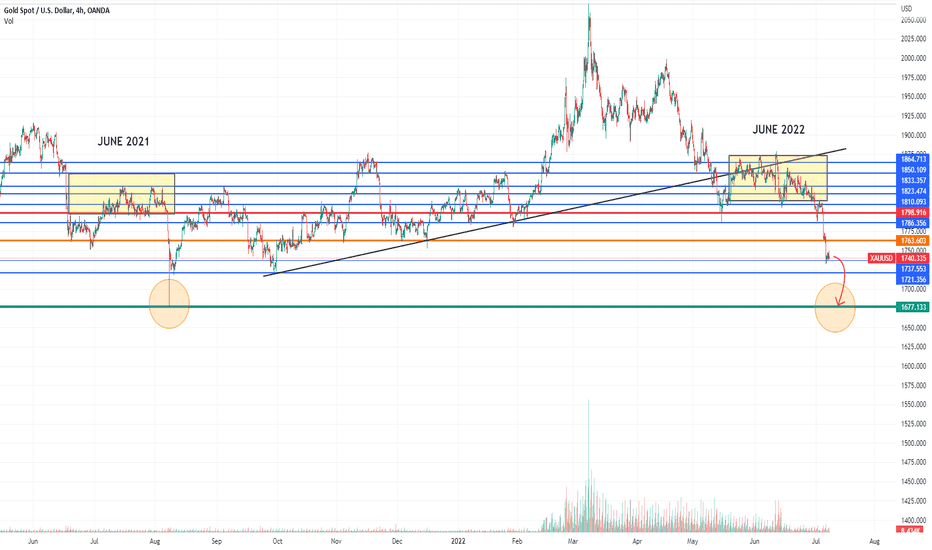

Gold going for the 1680 key level

Gold is having a bad week. With the Dollar outperforming... we can easily see gold reach 1680 before it rebound like we saw the same month of last year.Gold behaved as planned

Le_mah

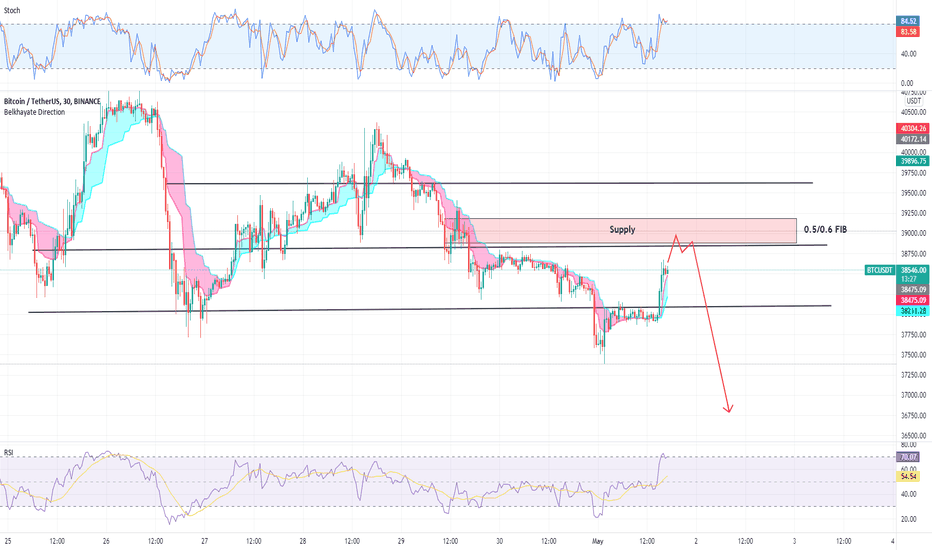

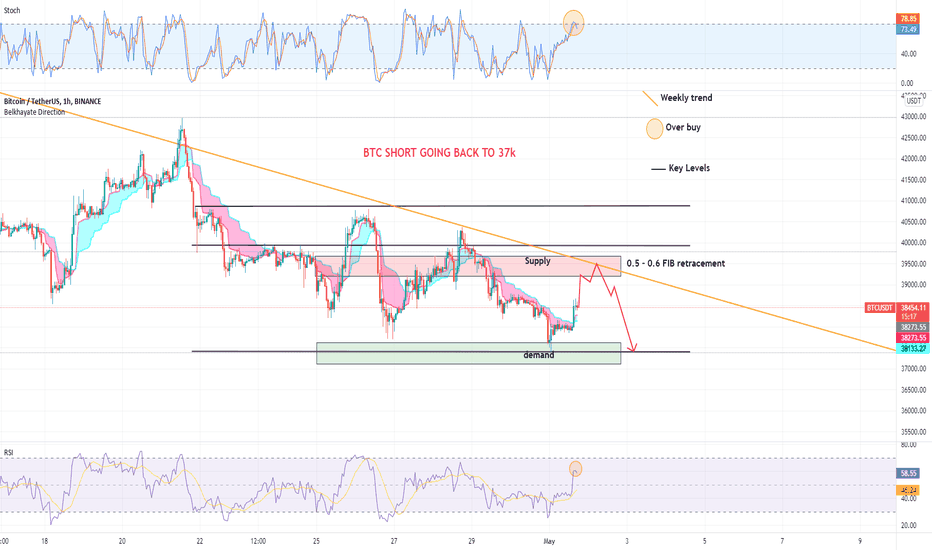

BITCOIN PROBABLY RETESTING 37K SOON

Oscillators in overbuy levels, both RSI and Stochastic. Also, the supply zone matches exactly with 0.5 - 0.6 Fib and the weekly trendline. Very good set up to short BTCSniper Shot - perfect analysis. BTC followed our predictions

Le_mah

Le_mah

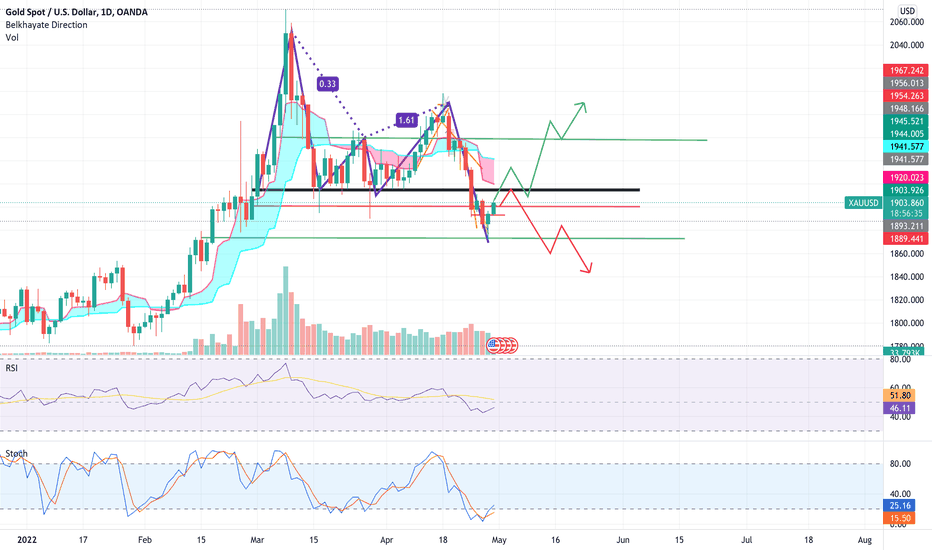

Gold analysis Friday 30 on Daily

Gold analysis for Friday 30 avril . Wait for the right entry after the Pullback on the key levels

Le_mah

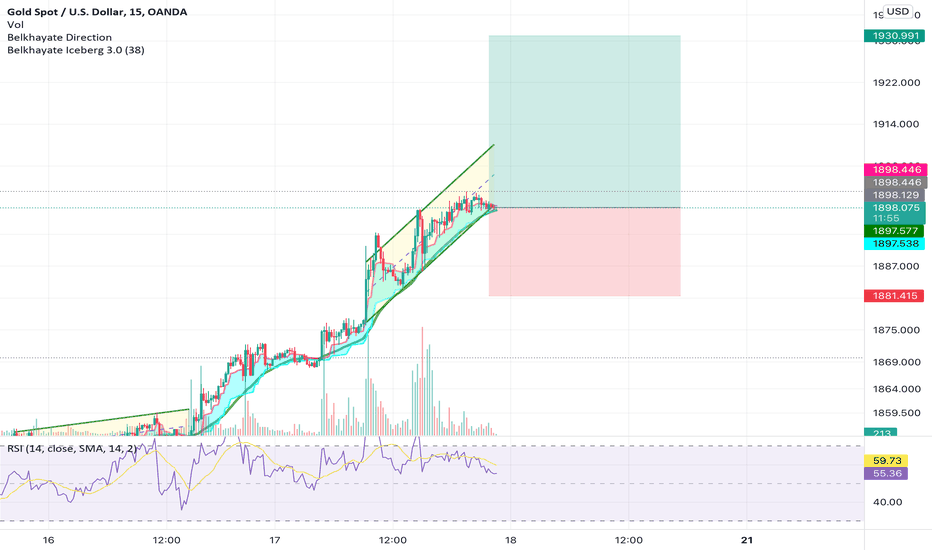

Gold to Reach 1930

Gold is following his ascension to the moon. TP at 1930 by tomorrow 12GMT

Le_mah

Sell signal on XAUUSD, Take profit at 1841.16

we can see that gold is bearish today, going to hit his old support at 1841.16. SL at : 1858.10

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.