KainT21

@t_KainT21

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

KainT21

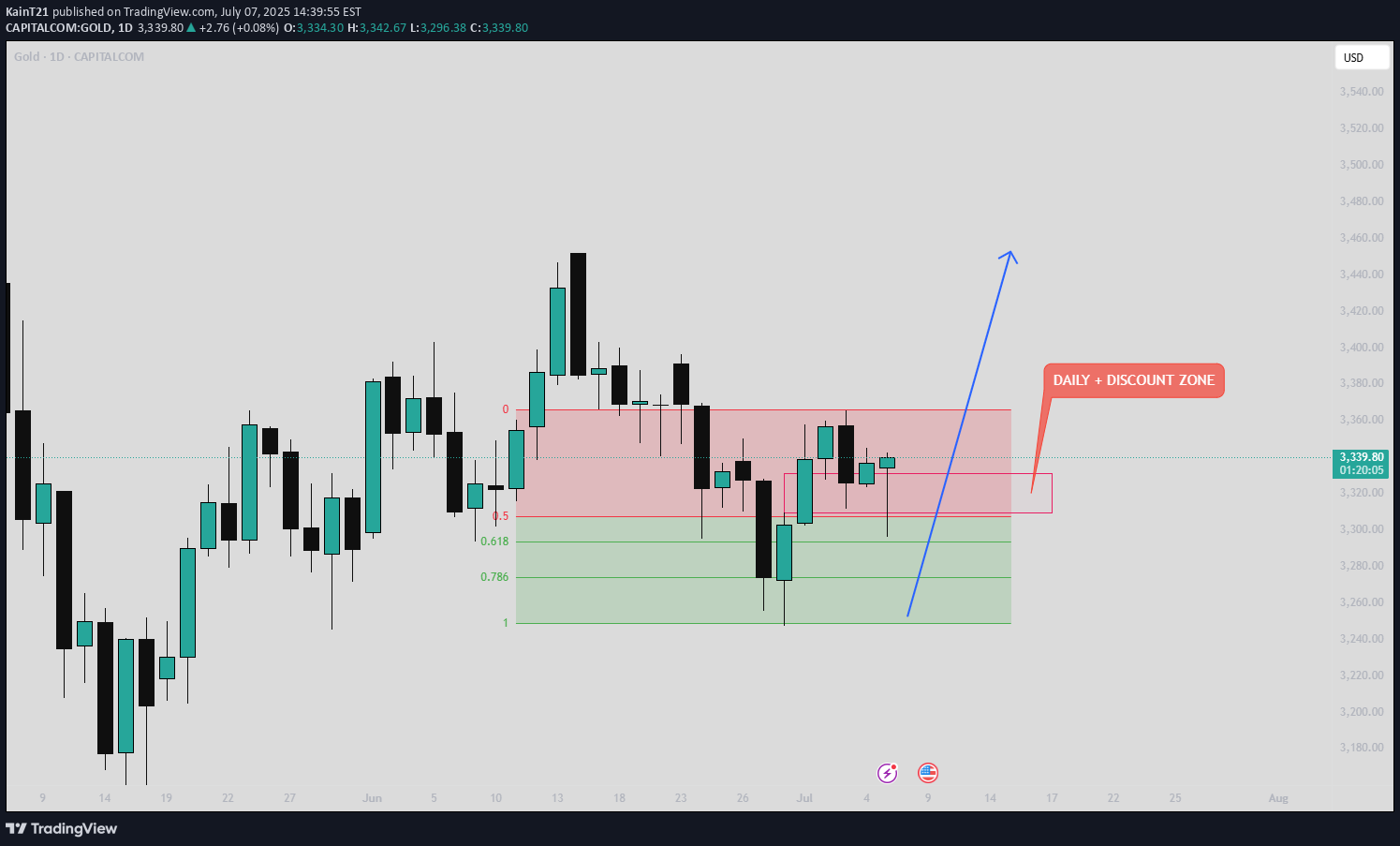

GOLD Analysis – Weekly Outlook

GOLD Analysis – Weekly Outlook 🟡📈Price has just tapped into our Daily PD Array, precisely the Fair Value Gap (FVG), which was clearly marked. It also entered the discount zone, aligning with our bullish bias.Additionally, we’ve seen a liquidity sweep, followed by a strong bullish reaction — a classic sign of smart money accumulation.📍 Key Targets:First Target 🎯: 3396Second Target 🎯: 3451As long as price holds above this zone, we expect the bullish move to continue. Let’s see how it unfolds over the coming sessions.🔔 Follow for more weekly insights.📊 See you next time!#Gold #XAUUSD #TradingView #SmartMoneyConcepts #FVG #LiquiditySweep #PriceAction #MarketAnalysis

KainT21

Gold (XAU/USD) Analysis – 4-Hour Timeframe Date: January 2, 2025

Gold (XAU/USD) Analysis – 4-Hour TimeframeDate: January 2, 2025Technical Overview:Gold (XAU/USD) has shown significant bullish momentum on the 4-hour timeframe, breaking above its previous resistance zone of 2645. This breakout indicates potential for further upside movement, with key targets outlined in the upcoming sessions.Potential Scenarios:Upside TargetThe price is likely to aim for the range between 2685 and 2690 over the next 24–48 hours. This zone represents a significant resistance level, making it a critical area for observation.Retest of Support ZonePrior to a continuation of its bullish trend, the price may retest the 2655–2645 support zone. Such a retest could offer a low-risk entry for buyers, provided the zone holds strong and shows a rejection to the downside.Key Strategy for Traders:Multi-Timeframe Analysis:Before taking a position, switch to a lower timeframe (e.g., 15 minutes or 30 minutes) to assess the structure and ensure a clean entry. Look for signs of a change of character, such as strong bullish candles or a rejection wick, to confirm the upward move.Low Drawdown Entry Points:Identify entry points where potential drawdown is minimal. This approach reduces risk while maximizing reward potential. Waiting for the price to consolidate or retest support before entering can improve the likelihood of a successful trade.Risk Management and Discipline:Use proper risk-to-reward ratios to manage capital effectively.Avoid impulsive trades and focus on clear signals. Making no money is better than losing money.Final Thoughts:The overall trend suggests high probabilities for an upward continuation. However, patience and confirmation are key. Conduct thorough analysis before taking any long position and always prioritize protecting your capital.Disclaimer:This analysis is for informational purposes only and does not constitute financial advice. Use your own expertise and strategy to make trading decisions.

KainT21

Bitcoin (BTC/USD) Analysis – December 21, 2024

Bitcoin (BTC/USD) Analysis – December 21, 2024Overview:Let’s focus on Bitcoin (BTC/USD). Over the past few weeks, Bitcoin has been pumping steadily, but it now appears to be losing momentum. The market structure has created an imbalance, suggesting a potential decline in the coming weeks.Trade Idea:Potential Buy Zone: The price could fall to the marked zone around $73,000.Entry Timing: Avoid entering immediately when the price reaches this level. Instead, wait for a clear reaction—such as bullish confirmation or upward momentum—before considering a buying opportunity.Key Considerations:This setup is similar to the structure seen in the German Index (DE40), which showed comparable behavior before a significant drop. The resemblance in patterns could signal a similar outcome for Bitcoin.Monitor price action closely in the coming weeks for signs of reversal once the price reaches the anticipated zone.Risk Management:Do Not Rush: This is not financial advice. Always wait for clear entry signals before making any decisions.Stay Disciplined: Protecting your capital is more important than making profits. Use proper stop-loss levels to safeguard your trades.Trading Requires Patience: A reactive approach is key. Trading is about responding to what the market shows you, not forcing predictions.Final Note:Making no money is always better than losing money. Watch Bitcoin closely in the coming weeks, and stay disciplined in your analysis. Let’s see how the market unfolds. See you in the next update!

KainT21

Gold Spot (XAU/USD) – 30-Minute Time Frame Analysis

Gold Spot (XAU/USD) – 30-Minute Time Frame AnalysisMarket Context:The price is currently retesting a potential support level around 2,707, following a retracement from a recent high.This level might act as a pivot for possible bullish activity, suggesting a scenario where the price could move upward.Key Observations:Support Zone at 2,707:The price is hovering around 2,707, which could act as a significant support zone.Potential Upside Scenario:If the price holds above 2,707, there is a possibility of a move toward 2,705, which could serve as a short-term target.Invalidation Level:If the price drops below 2,700, this setup may be invalidated, and further downside movement could occur.Risk Management Reminder:Making no money is still better than losing money. Always prioritize protecting your capital over taking impulsive trades.Hypothetical Trade Setup:Potential Long Case:If the price holds above 2,707, the next level to watch could be around 2,705.Invalidation Zone:A move below 2,700 would render this setup invalid.Final Notes:This is a technical observation based on the 30-minute time frame. Please interpret this as an analysis of possible market scenarios rather than financial advice. Trade smart, protect your capital, and avoid impulsive or revenge trading.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.