Juicemannn

@t_Juicemannn

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Juicemannn

حقیقت تلخ ترید: چرا دانش بیش از حد شما را شکست میدهد؟

A real breakdown for traders who actually want clarity, not confusion. Most traders don’t fail because they’re “missing a secret concept.” They fail because they’re drowning in information that doesn’t matter. The truth is simple: The more clutter you add, the less you can see. The less you can see, the slower you think. The slower you think, the more you hesitate. Hesitation kills traders. Let’s strip the ego out and get direct: ⸻ 📍 1. The Market Only Runs on a Few Core Realities Everything you see on the chart — every candle, every sweep, every displacement — connects back to a small handful of factors: • External structure (macro swing flow) • Internal structure (micro order flow) • Premium/discount pricing • Inducements / engineered liquidity • Order flow shifts at key levels • Narrative alignment across HTFs That’s it. No magic indicator. No super-obscure model. No 99-step “advanced SMC” blueprint. If it’s not tied to structure or liquidity within structure, it’s irrelevant noise. ⸻ 📍 2. More Knowledge ≠ More Skill Trading isn’t school. You don’t get rewarded for memorizing more concepts. Most of the “extra knowledge” traders chase only creates: • Paralysis • Over-marked charts • Conflicting signals • Emotional swings • Analysis loops • Missed moves Pros don’t hunt for more concepts — they refine fewer ones. The people who win long-term master what’s essential, not what’s trendy. ⸻ 📍 3. Liquidity Without Structure Is Useless A massive mistake in the community is labeling every high/low as “liq.” Not true. Not all sweeps are equal. Not all liquidity is engineered. Not every takeout is meaningful. The only liquidity that matters is: • IDM / engineered liquidity (purpose-driven) • Inducements that fuel the real move • Liquidity aligned with the HTF order block and narrative Everything else? Just market noise dressed up with fancy terminology. ⸻ 📍 4. A Clean Blueprint Beats a Complicated One The more experienced I became, the more I realized: Trading mastery is deletion, not addition. When you cut away unnecessary concepts, what’s left is: • Cleaner charts • Faster decisions • Simpler narratives • Higher confidence • Fewer emotional flips • More consistency A trader with a refined system will always outperform a trader with a “complicated system.” ⸻ 📍 5. Here’s the Real Pipeline of a Professional SMC Trader If you want to win consistently, your process should be this clear: HTF trend → Premium/discount → Identify the inducement → Locate the OB → Wait for the internal structure shift → Execute with precision That’s the Smart Money engine. That’s the whole formula. Everything else is just reworded versions of the same thing. ⸻ 📍 Final Thought for Anyone Reading This If you feel overwhelmed, confused, or inconsistent… it’s not because you don’t know enough. It’s because you know too much of the wrong things. Trading becomes consistent when your blueprint becomes simple. Less noise. More clarity. More precision. More profits. Strip the chart back to what matters — and the market finally starts to make sense.

Juicemannn

چرا بکتست در معاملات اسمارت مانی (SMC) شکست میخورد و راه حل طلایی چیست؟

Why Backtesting Fails for True Smart Money Concepts Trading (and what you must do instead)” When you trade using SMC — meaning you’re analysing structure, inducements, order-flow footprints, liquidity sweeps and institutional behaviour — you’re not simply trading fixed setups that repeatedly behave in identical ways. That means the classic “backtest historical data, cycle optimized entry, rinse & repeat” mindset breaks down. Here’s why: 1. Uniqueness of each market scenario Institutional footprints don’t repeat like mechanical patterns. Liquidity and order-flow respond to current context: structural highs/lows, prior supply/demand, inducements, time of day, major news, correlated markets, market sentiment. So what happened last month may look similar, but the underlying cause & effect will differ. 2. Hidden Smart Money behaviour Smart Money isn’t labelled on the chart. You don’t have a tag “institutional buy here” in history. You’re inferring it via structure, retests, inducements, inefficiencies. These signals evolve. Backtesting that uses rigid rules can’t properly capture the nuance of when and why Smart Money enters. 3. Changing context and fractality The market is fractal: your higher-timeframe structure influences the lower timeframes, but the exact interplay shifts. Backtesting often ignores this evolving interplay. The same trigger on 30M may have a different consequence depending on the 4H structure. That means the recycled historical trigger won’t always behave the same. 4. Emotion, flow, and live execution You can test entries historically, but not replicate the live environment: real-time spreads, slippage, late reactions, news shocks, liquidity vacuum. On top of that, your emotional state in live execution adds variability. Backtesting doesn’t generate the same pressure. If you rely on backtested “perfect” outcomes, you’ll be unprepared for the live market’s messiness. 5. Forward skill development beats retro “rules” The real value is not in optimizing past data but in sharpening your forward-looking skill: reading structure, reacting to inducements, identifying the moment Smart Money acts. That means you must practise in live or near-live conditions (smaller size, low risk) to train your brain, your timing, your discipline. In summary: Backtesting treats the market like a fixed machine; SMC trading recognises the market is an adaptive ecosystem. Your edge is in identifying intent, reading footprints, and executing in live time — not relying solely on historical “this pattern worked 7 of 10 times”. Train the skill live, respect structure and inducement, and your entries will come from genuine alignment, not forced replication of old outcomes. Stay sharp. Stay structured. And always ask: “Where is Smart Money acting now?”, not “What happened historically?”Retail says: “Trading is a game of probabilities.” Smart Money says: “Trading is a game of precision.” The retail side lives by backtesting — scrolling through history trying to validate a pattern or a setup that “worked before.” But here’s the truth: when you trade Smart Money Concepts, there is no fixed pattern to backtest, because every move in the market is unique, built from intent, structure, liquidity, and timing. You can’t backtest institutional intent. You can only read it live, as it unfolds. 💡 The SMC solution: Forward Testing Backtesting gives you awareness; forward testing gives you adaptability. Trade live, even if it’s with small risk. Use tiny positions if needed, but get your brain used to how Smart Money actually moves. “Smart Money reacts differently every week — your job is to react with it, not repeat it.”

Juicemannn

BTCUSD - Bullish Bias

🔹 Pair: Bitcoin (BTCUSD) 🔹 HTF Overview: Price remains strong and bullish, respecting higher-timeframe structure with clear upward momentum. 🔹 MTF Outlook: Waiting for midterm alignment—once a lower-high (LH) breach occurs, we’ll position for continuation with fresh OB areas. 🔹 LTF Setup: Currently in a deep anchor OB. Waiting for the hold and CHoCH switch before committing to long entries. 🔹 Targets: Higher liquidity zones above recent highs, aligned with bullish intent. 🔹 Mindset Note: Let smart money lead—patience ensures optimal timing and execution.

Juicemannn

XAUUSD - Bullish Bias

🔹 Pair: Gold (XAUUSD) 🔹 HTF Overview: Market structure remains bullish, with strong upside intent still intact. 🔹 MTF Outlook: Waiting for price to sweep short-term sell-side liquidity and mitigate the deeper OB below—this will refine the continuation play. 🔹 LTF Setup: Once MTF objectives are cleared, I’ll align with CHoCH and fresh OB prints on the lower timeframe to position long. 🔹 Targets: Eyes remain on higher liquidity pools in line with bullish market rhythm. 🔹 Mindset Note: Timing is everything—patience until MTF and LTF structure align.

Juicemannn

BTCUSD - Weekly Outlook

Pair: BTCUSD Bias: Bullish HTF Overview (4H): Bullish structure remains intact. Dropping to lower scales to anticipate continuation within the broader trend. MTF (2H/1H/30M): Structure is mapped and refined. A CHoCH has printed from a deep anchor zone. Now waiting for the sell-side liquidity (SSL) sweep 🧹 before dropping to lower confirmations. LTF (30M/5M): Once mitigation from the higher zone is complete, we’ll wait for a breach of the LH. Once applied, we’ll attend the bullish leg. Targets: • TP1: 5M highs • TP2: 30M highs (depending on market delivery) Mindset Note: Crypto loves liquidity sweeps — let BTC clear the SSL and confirm with structure before committing to the long side.

Juicemannn

XAUUSD (Gold) - Weekly Outlook

Pair: XAUUSD Bias: Bullish HTF Overview (4H): Structure is mapped and refined, with momentum clearly showing toward the upside. MTF (2H/1H/30M): Watching for sell-side liquidity (SSL) to be taken. Once slashed and the OB is fully mitigated, confirmations for continuation higher will be in play. LTF (30M/5M): Waiting for HTF sync and full mitigation. Once a CHoCH is confirmed with a LH break, we’ll attend to the bullish leg. Targets: • TP1: 5M highs • TP2: 30M highs (depending on delivery) Mindset Note: Gold moves aggressively — let the SSL clear and mitigation align before entering. The CHoCH keeps you disciplined inside the volatility.

Juicemannn

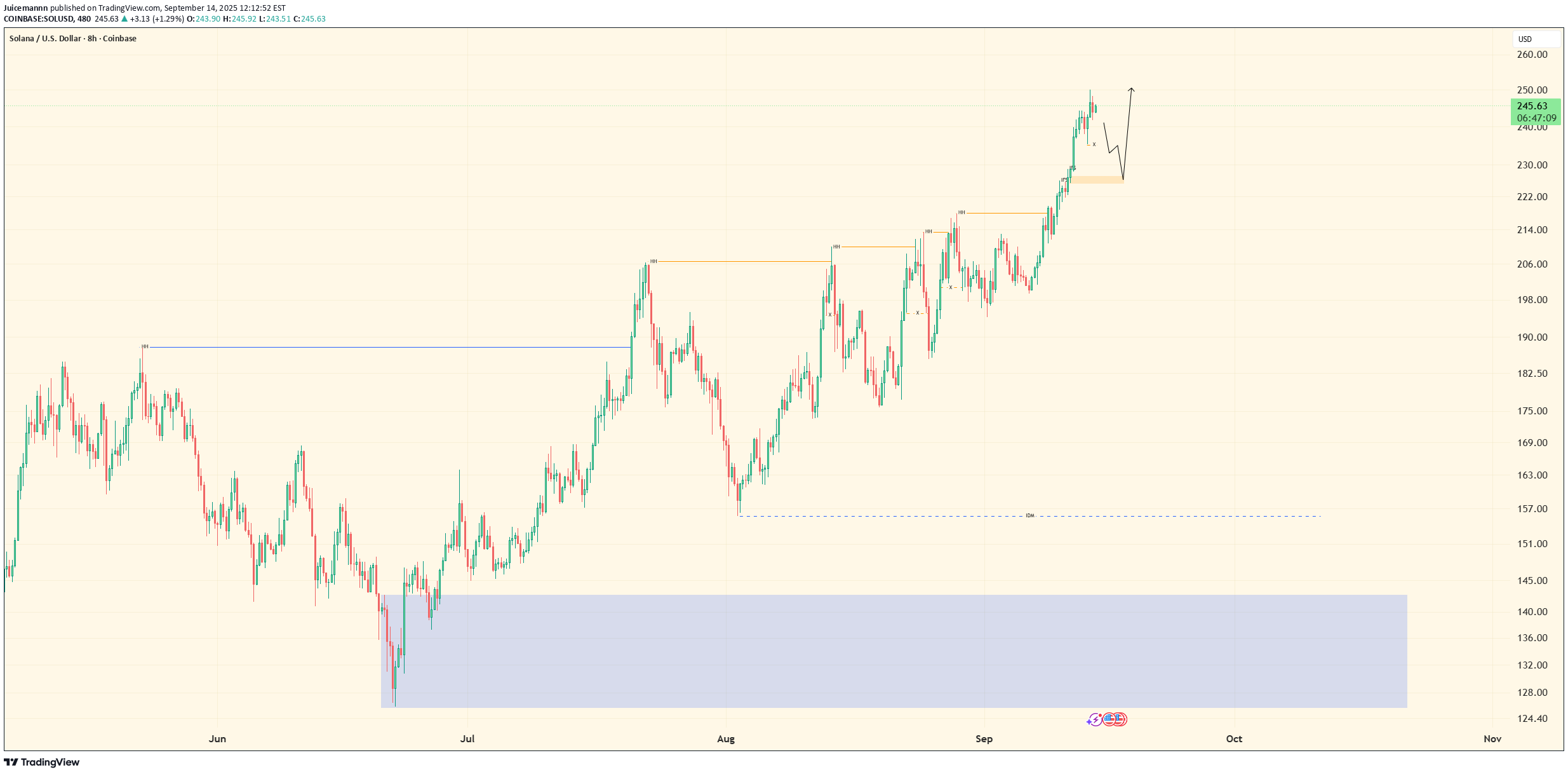

Solana ( SOL/USD) - Bullish Continuation Setup

Bias: Bullish High-Timeframe (4H/1H): Structure is clearly bullish. Price has broken significant highs, showing strong upward momentum. HTF structure has been mapped and refined, indicating that smart money is in control and continuation is likely. Mid-Timeframe (30M): Dropped down to monitor continuations. Structure is aligned with HTF bullish intent and has been refined at its finest. Currently waiting for a deep sell-side liquidity sweep to properly mitigate the internal order blocks within the framework. Patience is key here—no premature entries. Lower-Timeframe (5M): After proper mitigation occurs, we drop to 5M for precise confirmations. Look for price to hold the mitigated area and ensure internal courtyard liquidity is absorbed. This sets up for riding the furthest highs with smart money support. Entry Zone: Pending proper mitigation of mid-timeframe order blocks. Targets: • Lower timeframe highs (5M) • Mid-timeframe highs (30M) • Extension to HTF highs, depending on market delivery Mindset Note: Smart money leads, we follow. No forcing trades—wait for full mitigation and lower timeframe confirmation before engaging. Patience and precision are the edge.

Juicemannn

Gold (XAU/USD) - Bullish Continuation in Play

Bias: Bullish High-Timeframe (4H/1H): Price is showing a strong bullish structure with momentum firmly to the upside. Volume candles indicate imprinted buying, suggesting continuation potential. Smart money is clearly in control of this leg. Mid-Timeframe (30M): We’ve spotted a sell-side liquidity sweep. Waiting for the deeper “slash through the courtyard” to properly mitigate the underlying order block. No entries yet—patience is key. This zone shows where smart money absorbs stops before resuming the bullish leg. Lower-Timeframe (5M): Once mitigation is complete, we drop to the 5M for precise confirmation. Look for price to hold the mitigated area, showing smart money support. Entry confirmation aligns with micro-structure flips and final inducements. Entry Zone: Pending proper order block mitigation. Targets: • 5M highs for quick continuation trades • 30M highs for extended bullish movement Mindset Note: Let smart money lead the way. No rushing entries—precision beats impulse. Wait for proper mitigation and confirmation before committing.

Juicemannn

Bitcoin | HTF Bullish Breaker + Mid TF Anchor Zone

On the higher timeframe (HTF), Bitcoin shows a strong bullish Break of Structure (BoS) to the upside, leaving price at new highs. From there, we’ve seen a major pullback, which shifted focus down to the mid timeframe (MTF) for continuation clues. Price dipped deeply into a refined higher timeframe anchor order block, highlighted in purple, giving a clean liquidity sweep and reaction. This tells us smart money has acknowledged the zone. At this stage, we remain patient: • ✅ Waiting for a mid timeframe CHoCH to confirm directional intent. • ✅ Once the MTF confirms, we’ll step down to the lower timeframe (LTF) for continuation setups and precision confirmations. • ⚠️ Until then, discipline is key — let smart money guide price where it needs to go. Mindset Note: Patience pays. The market is bullish, but confirmation comes in layers. Trust the process, not impulse.

Juicemannn

GOLD | Waiting for Pullback

Pair: XAUUSD Bias: Bullish overall HTF (4H): Market extended; expecting corrective pullback. MTF (30M): Inducement forming into $3,500–$3,465 demand zone. LTF (5M): Look for CHoCH + OB entry confirmation inside that zone. Targets: 1. TP1: Next clean 5M highs that form if price holds — first leg confirmation. 2. TP2: Extended leg to $3,600–$3,640+ — higher-timeframe liquidity zone. Mindset Note: Don’t chase highs. Let the market collect liquidity in the pullback zone, confirm via 5M structure, then step in. Patience > impulse.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.