Jamtara_Trader

@t_Jamtara_Trader

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Jamtara_Trader

Timeframe: 15m Market Bias: Bullish (Long only) Setup Type: Liquidity Sweep + BOS + Retest 📌 Breakdown: Liquidity Sweep Identified: Price dipped below the previous support zone, triggering stop hunts and grabbing liquidity. Marked as a clear sweep of lows, signaling possible reversal. Shift in Structure: Following the sweep, price printed a Higher High and Higher Low, confirming change in structure. At this point, we shift bias to Long Only trades. Retest & Entry Zone: After bullish momentum, price has pulled back to a key resistance-turned-support zone (highlighted in pink). Looking for long entry on confirmation if price reclaims the resistance again (~181 zone). 📈 Trade Plan: Entry: On reclaim and candle close above 181.00 SL: Below the recent structure low (~180.00 or dynamic based on confirmation) TP: Previous high at 184.60 zone (approx 1:3 RR) 🧠 Trading Psychology: Patience is key — wait for structure confirmation and avoid pre-emptive entries. The liquidity sweep setup gives us a solid probability edge when combined with market structure shift. #SOLUSDT #CryptoTrading #SmartMoneyConcepts #LiquiditySweep #TradingSetup #BOS #MarketStructure #ReversalPattern #CryptoAnalysis #LongTradeOpportunity #PriceActionTrading #15MinSetup

Jamtara_Trader

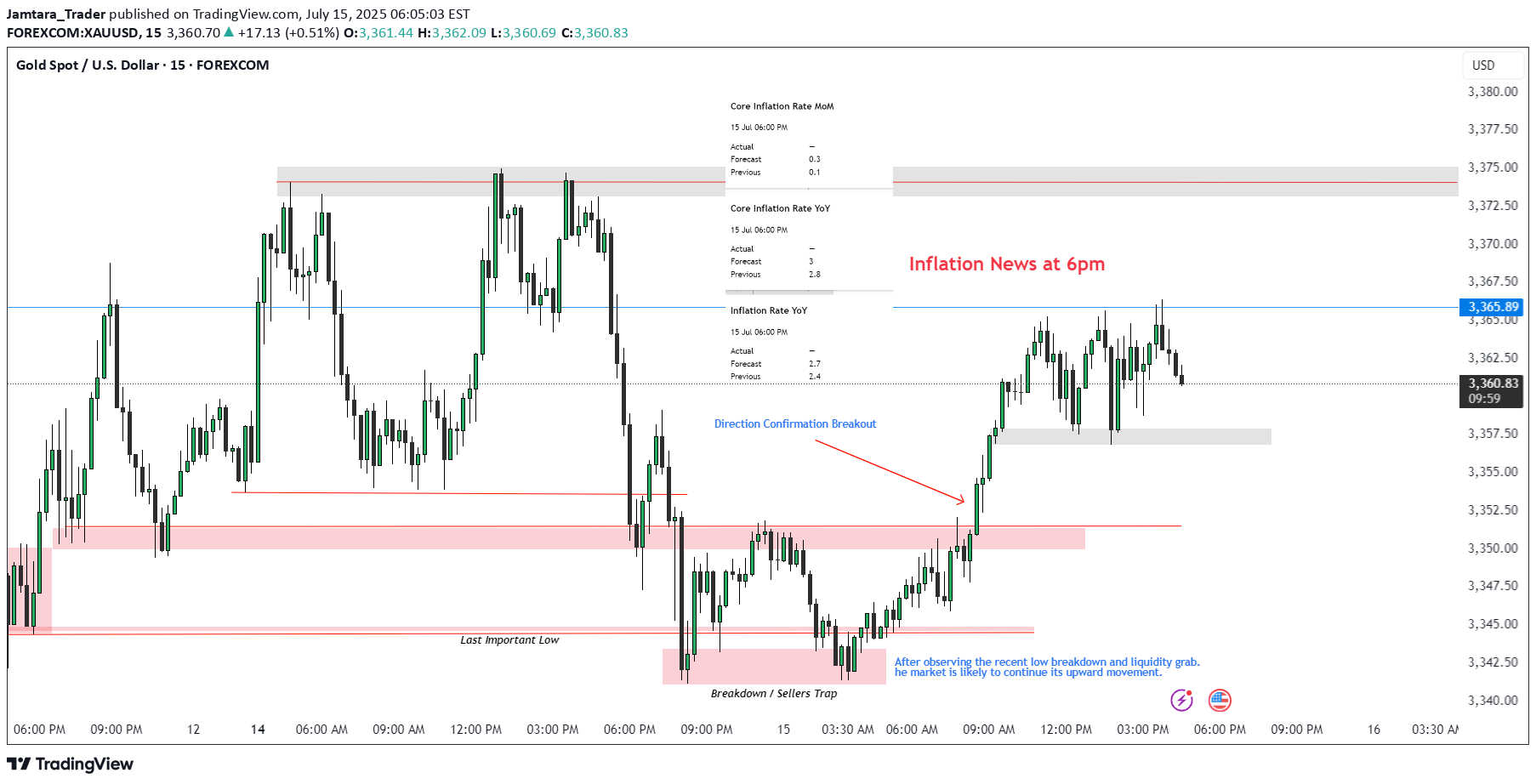

Core inflation data drops at 6 PM IST and traders are watching closely 👀 📈 Forecast says inflation is heating up — if actuals are higher, expect: 💵 USD strength ⬆️ 🥇 Gold (XAUUSD) down ⬇️ 💣 Volatility to spike! 🔥 Trade with logic, not emotion. Protect your capital. Let the market react — we react to the reaction 🧠📊 #XAUUSD #ForexNews #InflationReport #GoldAnalysis #CoreInflation #USData #TradingMindset #SmartMoneyMoves #ForexLife #PriceActionTrader #MacroMoves #TradingPsychology #NewsEventTrading #ReelForTraders #ReelTradingUpdate #GoldSetup #USDStrength

Jamtara_Trader

After observing the recent low breakdown and a clear liquidity grab, we saw a strong direction confirmation breakout. This suggests that the market is likely to continue its upward momentum. 🔄 Breakdown/Seller Trap triggered the reversal 🔹 Last Important Low respected 📈 Breakout confirms bullish direction ✅ Plan: I’ll be watching for a pullback into the grey demand zone (highlighted area) for a potential long entry. 🕵️♂️ No FOMO — I’ll only enter after price shows clear bullish behavior in this zone. 🎯 Target: 3,365.89 resistance 📍 Entry Zone: Grey box (based on previous structure) Let me know your thoughts — are you also watching this zone? #XAUUSD #GoldAnalysis #LiquidityGrab #SmartMoneyConcepts #PriceAction #TradingPlan #TradingView

Jamtara_Trader

XAUUSD 🔍 Analysis Overview:Price has just broken above a 4H descending trendline for the first time. However, I remain cautious due to the following key observations:📌 NOTES:The broader market sentiment is still bearish due to recent tariff-related news, which often fuels risk-off behavior.Historically, the first breakout of a strong trendline often fails, trapping early buyers.This breakout is likely attracting buy-side liquidity, giving institutions an opportunity to hunt stops.My observation shows buying interest started around the 3308–3313 range, suggesting smart money accumulation and a possible trap.📉 I'm watching for a fake breakout and potential reversal targeting the liquidity zones marked below around 3307 and possibly lower.The liquidity sweep below equal lows could offer a better risk-reward setup.💡 Conclusion:If price fails to hold above this breakout and shows signs of rejection, I will be anticipating a return towards the previous demand zone for a liquidity grab.#XAUUSD #GoldAnalysis #SmartMoneyConcepts #LiquidityGrab #ForexTrading #TrendlineBreak #MarketPsychology #TradingSetup #SMC #PriceActionSorry I mentioned LONG!!!! It's for short !

Jamtara_Trader

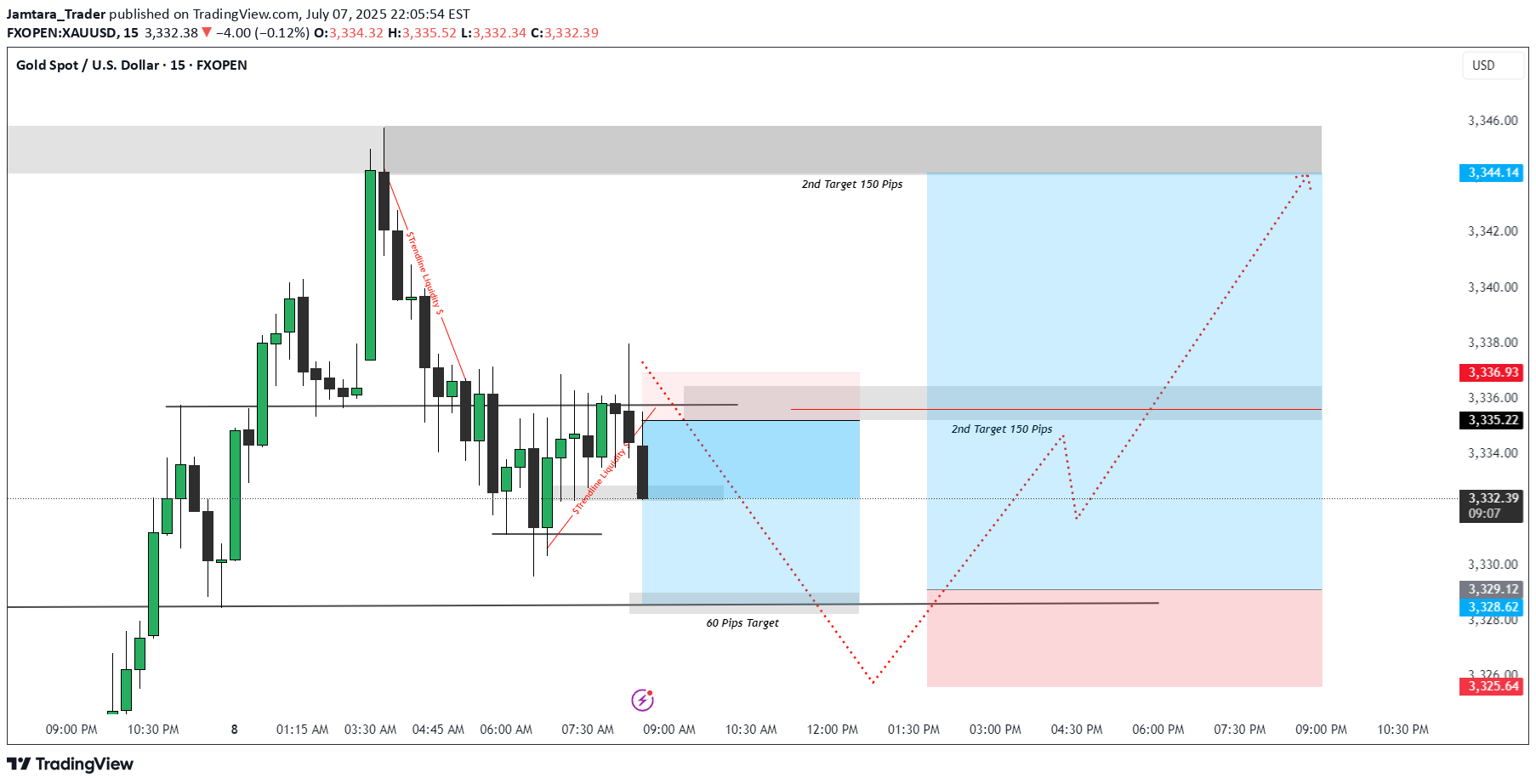

XAUUSD Liquidity SweepsSmart Money Concepts (SMC)Trendline LiquidityDemand/Order BlocksRisk-Reward Structure🔻 First Trade Idea – Short Position (Sell Setup)🧠 Psychology & Liquidity Insight:The market formed equal lows before a sudden rally which attracted retail traders.Price created a bearish structure with lower highs, signaling weakness.A strong liquidity sweep occurred by breaking trendline liquidity twice (as shown by red lines), targeting early buyers' stop losses.A supply zone (red box) was respected near 3337, providing an ideal entry point for shorting.📉 Trade Logic:Entry: Near 3336.93 (Supply Zone)SL: Above 3344.14 (Liquidity Sweep zone)TP: 3328.62 / 3325.64 (Targeting demand imbalance & internal liquidity)R:R: Approx. 1:2+🔺 Second Trade Idea – Long Position (Buy Setup)🧠 Psychology & Liquidity Insight:After the initial selloff, price taps into the demand zone (blue box) created by the last impulsive move.Internal liquidity is built again near 3328–3330, where retail traders expect a continued fall — ideal for smart money to reverse.Price is expected to accumulate and reverse with a strong rally toward the upper liquidity resting above 3344.📈 Trade Logic:Entry: Near 3328.62 (Demand Zone Tap)SL: Below 3325.64TP: 3344.14 (Major Liquidity Target)R:R: Over 1:3 – a high-quality reversal play.🎯 Why This Trade Setup is Powerful:✅ Both trades are liquidity-driven, not just indicator-based.✅ Incorporates smart money logic and price structure.✅ Clear risk-to-reward, validated by price behavior and institutional order flow.

Jamtara_Trader

XAUUSD Psychological SetupThis trade is rooted in the psychology of smart money and retail behavior. After a sharp drop in price, most retail traders expect continuation (trend-following). However, institutions often manipulate liquidity zones — hunting for stop-losses before a true reversal. This trade capitalizes on that behavior.🔍 Technical Explanation:🔻 1. Market Structure:Price was previously in a downtrend, forming lower highs and lower lows.A falling wedge pattern (red lines) formed after a strong bearish move, signaling potential bullish reversal.Price broke the wedge to the upside — a classic reversal signal.🔁 2. Liquidity Concept:Below the wedge: The market grabbed liquidity by taking out stop losses of buyers who entered too early.Above the wedge (TP Areas):TP 1 Area (red box): This is the first logical resistance where previous supply sits — many sellers will enter here, providing buy-side liquidity.Next Target Liquidity (grey box above): This is a major imbalance zone and likely where stop-losses of early short sellers are stacked.Price is expected to grab liquidity from that area (marked by the red arrow).✅ Entry & Trade Logic:Entry Zone: After liquidity was swept at the bottom of the wedge, a bullish engulfing candle formed near demand — signaling institutional interest.Risk-Reward Setup:Targeting 0.80% move (approx. 26.48 points).Trade is based on reversal from demand zone + wedge breakout + liquidity grab confirmation.🎯 Target Projections:TP1 Area: Conservative target, just above recent structure.Final Target: High-probability liquidity zone where market is drawn to clean up resting orders (grey zone).🧠 Why This Trade Matters (Trading Psychology Insight):Most retail traders get trapped in emotional entries — entering shorts after a drop or longs too early in a wedge.Smart money waits for liquidity sweeps before moving price in the desired direction.This setup shows the importance of patience, structure, and understanding market psychology rather than reacting emotionally to price action.📌 Key Takeaways:📉 Trap: Falling wedge builds false bearish confidence.🧠 Psychology: Stop hunts create fuel for reversal.📈 Reaction: Smart money absorbs liquidity, moves price toward next inefficiency.Hashtags:#XAUUSD #SmartMoney #LiquidityHunt #TradingPsychology #GoldTrade #PriceAction #WedgeBreakout #FXOpen #TechnicalAnalysis #SupplyDemand

Jamtara_Trader

BTC/USDT Long Trade Setup – 1H Chart Analysis BTCUSDT Hello traders! Sharing a recent long entry I took on Bitcoin (BTC/USDT) based on price action and liquidity concepts. This trade is taken on the 1-hour timeframe and aligns with my strategy of combining liquidity sweeps, support zones, and market structure shifts.---🔍 Trade Overview:Entry Price: 104,704 USDTStop Loss: 103,660 USDTTake Profit (Target): 108,349 USDTRisk-to-Reward Ratio (RRR): Approximately 1:3---🧠 Trade Idea Behind the Entry:As you can see on the chart, BTC had been in a downtrend and recently made a strong move into a key liquidity zone. This zone had previously seen multiple touches and rejections, making it an area of interest for both buyers and sellers.The price swept liquidity below the previous low (labelled as “Liquidity Sweep $$$”), grabbing stop losses of early buyers and triggering limit orders of smart money. This move into the liquidity zone was followed by a strong bullish reaction – a signal that buyers may be stepping in.Additionally, the "Break of Structure" (BOS) confirms a potential shift in market direction. The reaction from the liquidity zone indicates that this level is holding as new support.---🛠️ Why I Took the Trade:1. Liquidity Sweep: The wick that pierced the liquidity zone signals stop-hunting and accumulation. These moves often precede a strong reversal.2. Demand Zone Reaction: After the sweep, the candle closed bullish inside the demand box. This shows buyer strength.3. Risk Management: The stop loss is set just below the liquidity zone to protect from deeper sweeps while keeping the RR healthy.4. High Probability Target: The target is placed near the next resistance level around 108,349, which also aligns with a clean imbalance that price may want to fill.---📊 Technical Confidence:Confluence Factors:✅ Liquidity sweep✅ Demand zone reaction✅ Market structure shift✅ High RR✅ No immediate resistance till targetThis type of setup reflects smart money behavior – first pushing price below structure to grab liquidity and then reversing sharply. The bullish momentum after the sweep gave extra confirmation.---🧭 What I’m Watching Now:I will continue monitoring how price reacts around the 105,500–106,000 range. If momentum continues with higher highs and higher lows, I may trail my stop loss to lock in profits.---Let me know what you think of this setup! Have you taken a similar trade or are you waiting for confirmation? Drop your thoughts or charts below 👇Stay disciplined, manage your risk, and trust the process. 🚀#Bitcoin #BTCUSD #PriceAction #LiquiditySweep #SmartMoney #CryptoTrading #TradingSetup #TechnicalAnalysis #TradeJournal

Jamtara_Trader

📊 XAUUSD 15m – Long Trade Plan After Liquidity Grab XAUUSD Hello Traders! 👋Spotted a clean setup on Gold (XAUUSD) on the 15-minute chart, and I wanted to break it down for everyone looking to learn and grow with smart money concepts and liquidity-driven trading.---🔍 Trade Breakdown:After a sharp bearish move, price aggressively broke below the Old High structure and formed a New Breakdown Low. This move likely triggered stop-losses and induced sellers — a classic liquidity grab scenario.What followed is key:Price tapped into a demand zone and showed clear rejection wicks.It then consolidated just below the old structure — potentially accumulating orders for a reversal.This gave me confidence to look for a long opportunity as part of my "Smart Money Reversal Strategy".---📌 Trade Plan Details:Entry Zone: Around 3,358 – 3,360Stop Loss: Below the recent low (~3,350)Target 1: Previous structure resistance near 3,366 – 3,370Target 2: Full range fill toward 3,389 – 3,390+If price breaks and holds above the red supply zone, I’ll look for additional confirmation for scaling in or trailing.---🧠 Why This Matters:This setup highlights the importance of:Trading after liquidity sweeps, not during.Recognizing how market makers trap early sellers before reversing.Using structure and zones — not just indicators — to guide entries.---📘 Note for Members:This trade is shared for educational purposes only. Always manage your risk and never blindly follow — plan your trades, then trade your plan!Let me know your thoughts or how you'd approach this differently.— Happy Trading! 💰#XAUUSD #SmartMoney #LiquidityGrab #Forex #GoldAnalysis #TradingView

Jamtara_Trader

Re-entryWhen the price breaks below the trendline and support, retail traders typically enter short trades.

Jamtara_Trader

Psychological trade the market behavior and trader psychology that can drive price movements during breakout events. Traders often react to certain price levels, trends, and patterns in ways that influence decision-making and price action.How to Manage Psychological Challenges in Breakout Trades:Plan and Discipline: Having a clear plan helps avoid the emotional traps that can lead to rash decisions. This includes setting entry points, stop losses, and take profits ahead of time, so traders don’t rely on emotional reactions to price moves.Risk Management: Proper position sizing, stop losses, and using a risk-reward ratio can help mitigate the psychological stress of a breakout trade. When risk is controlled, traders are less likely to panic during a false breakout or sudden market reversal.Avoiding Overtrading: Traders who become overzealous or overly excited about breakouts can end up entering trades without proper confirmation or at bad risk-reward ratios. Sticking to a strategy and being selective with trades helps in avoiding emotional burnout.Recognize False Breakouts:False breakouts can be psychologically draining, especially when traders experience significant losses. Being able to step back, reassess, and avoid chasing every breakout can help reduce the psychological impact.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.