JackRichards1987

@t_JackRichards1987

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Classict BTC Bart simpson Pattern

Gotta love the classic BTC Bart Simpson pattern LOL

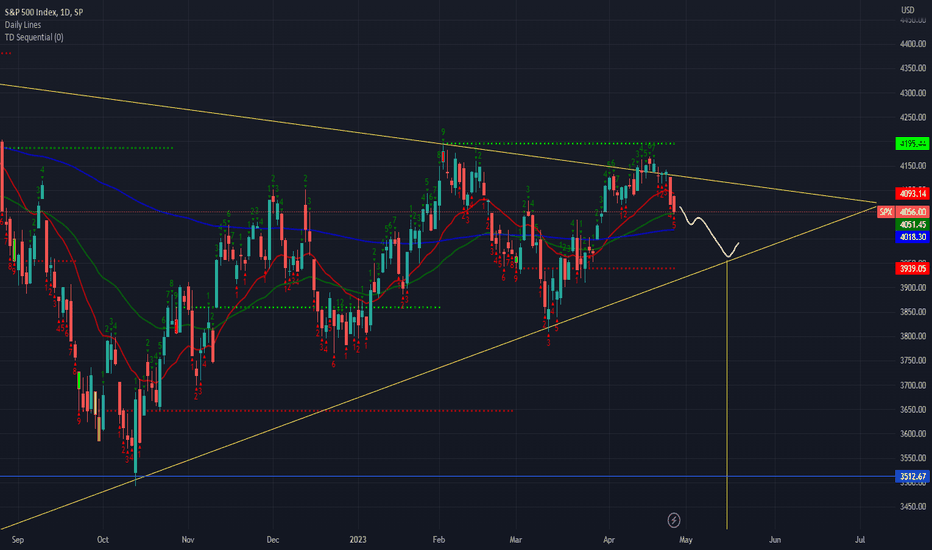

SPX Test 200 the lower trend line

SPX heading to test the 200 then possibly the lower trendline in this triangle if that breaks. Could be a big leg down if the triangle breaks.

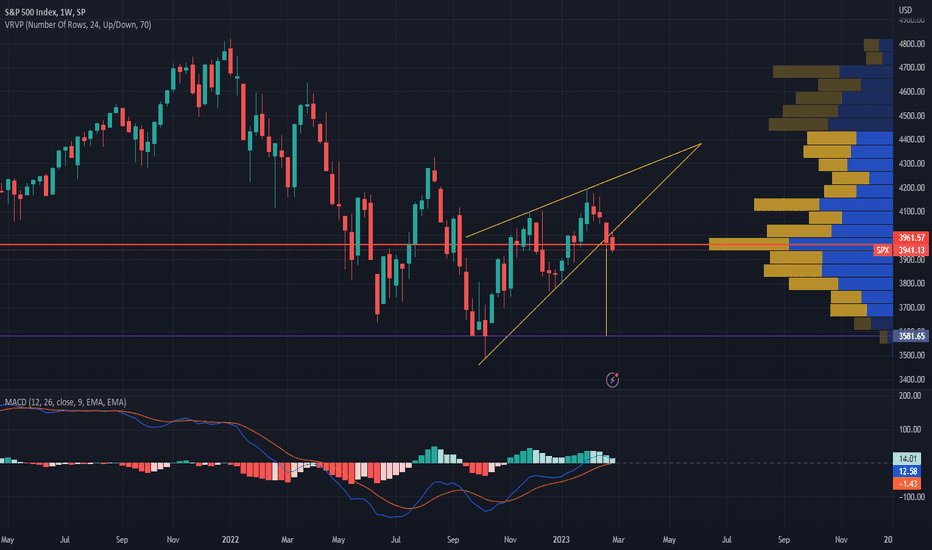

SPX Rising Wedge Breakdown

If this wedge breakdown confirms, we are headed for previous lows.

Symetrical Triangle Breakout vs Ascending Wedge

Many have noted the "breakout" of the triangle over the last several sessions. I have not been convinced it has any legs. We are also developing a nice ascending wedge. My guess is the ~40% of target we hit was all the triangle had, and the wedge will play out to the downside.

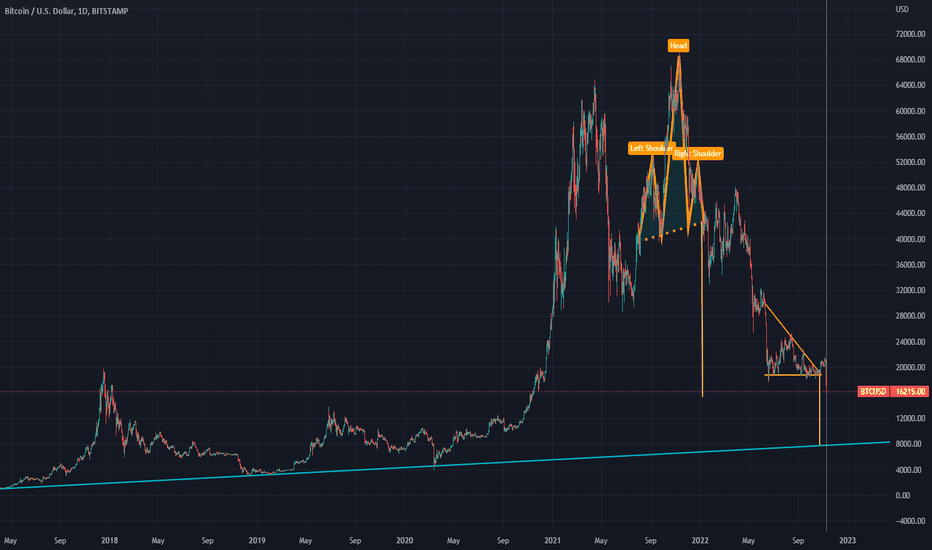

The many Patterns of BTC

BTC has been textbook pattern after textbook pattern in this bear market. Fun learning experience (for me anyway).

Wedge broke, Ultimate Head and Shoulder fulfilled.

The wedge I've been waiting for over the last few weeks has finally broken down. Next stop I believe is around $13,500 and ultimately back to the long term trend line at $8,000.

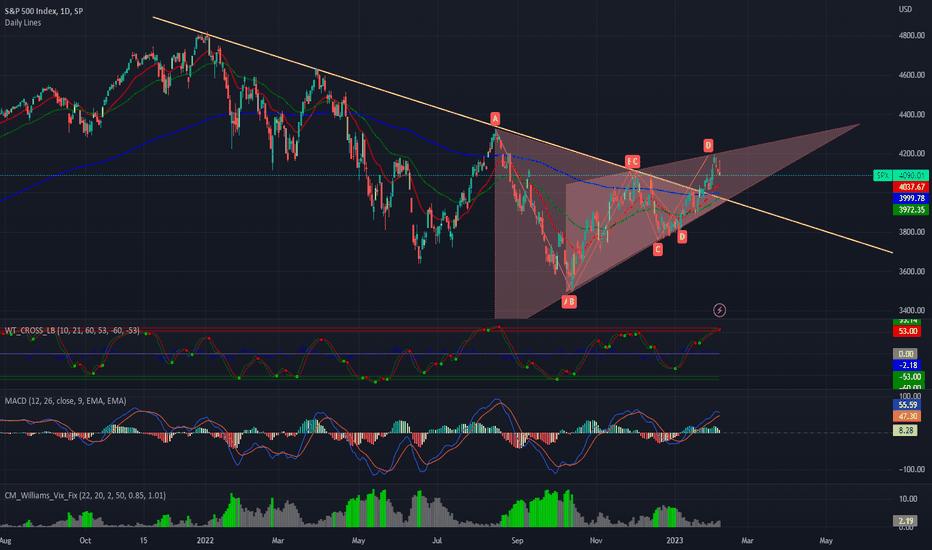

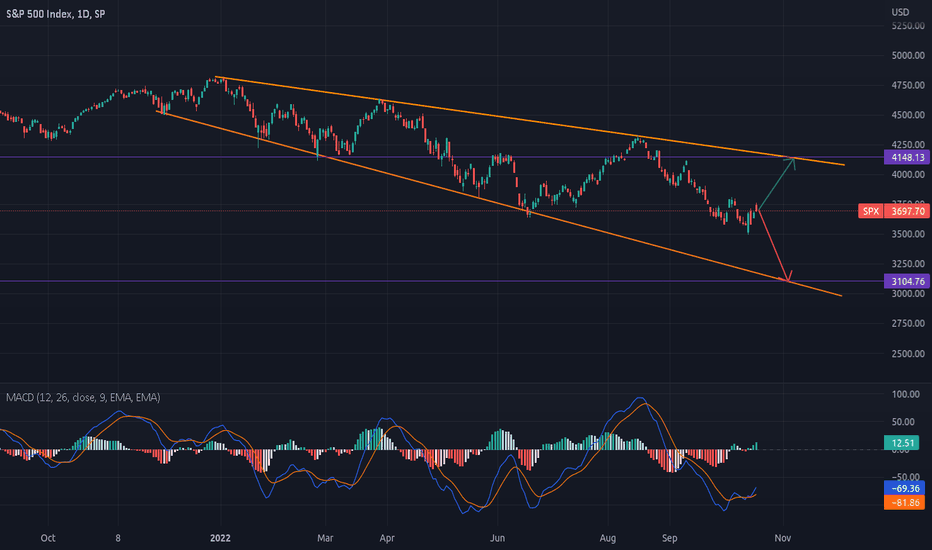

Bulls to 4150 Bears to 3100

Bulls are calling for SPX to 4150 bears to 3100. Which trend-line are we headed for? My personal belief is we are dead cat bouncing on the way to 3100 but time will tell. If the bulls rush in we could definitely see a squeeze to 4150... If reality takes hold 3100...I am actually not convinced this rally will go all the way to 4100. Everyone is bullish but my gut says reversal is coming. Time will tell.Upper trend line tested and rejected.

Bitcoin Descending Triangle Breakdown

We are at the end of a descending triangle in BTC on the weekly/daily. I am expecting we drop suddenly then chop around in the $12k-6k range. Historically speaking the bottom should occur somewhere around the month of November which would coincide with a likely Fed pivot timeframe. Thoughts..?

Sub $15k BTC

Following this since the head and shoulders formed.. Multiple bear flags followed. I don't think $15k is the bottom either..

BTC Double Head and Shoulders Top

Waiting to see if this double head and shoulders top plays out. If it does it will be like watching the Titanic sink. If we break below the $30-35k support level, dead cat bounce off of $20k on the way to the $10,000 range.Still in play. Recent patterns confirm.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.