JMazu84

@t_JMazu84

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

$407 Solana by July 2024?

Using this Cypher pattern we could potentially be seeing a $400 solana by this July 2024.

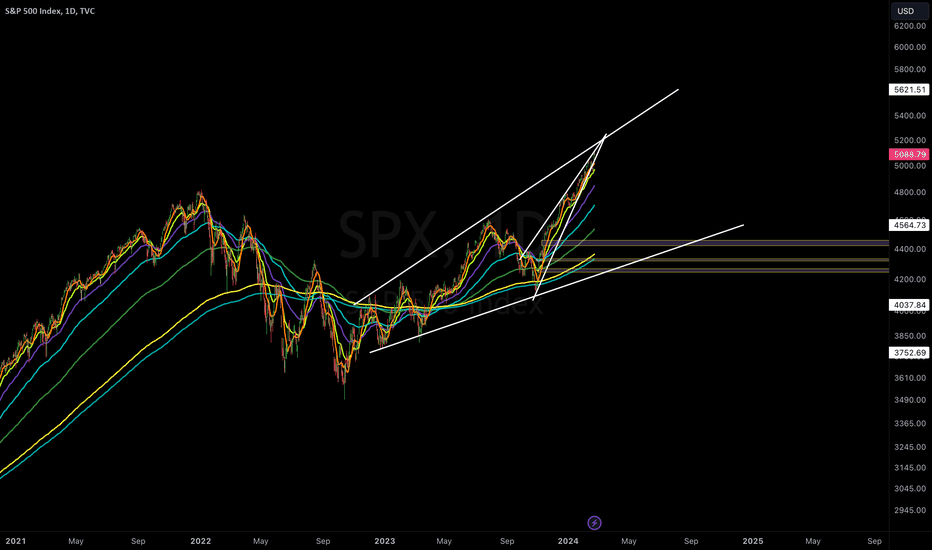

Rising wedge within a larger ascending broadening wedge

The S&P500 looks to be due for a correction in the near future. It has formed a very sharp rising wedge while playing in a macro ascending broadening wedge. The next FOMC meeting in March should provide clarity and may even be the catalyst for the stock market to pullback.

VERY LONG TERM OUTLOOK

In the next 2-3 decades, i expect Gold to be trading at around $3000-$4000 dollars. I would like to buy gold as a long term investment around $1400-$1800

Bitcoin Simple Channel Fib

Bitcoin looks to be playing within the very important golden pocket channel fib. I've circled in white, the areas where this pocket has determined the fate of bitcoin. -In 2013 it was the All time High (ATH) -In 2017 it provided support for bitcoin before it ran up to the ATH -In 2018 it proved to be big resistance and bitcoin fell another 47% from the pocket -In 2019 Bitcoin had the short rally up before eventually succumbing to the large Covid dump in 2020 -At the end of 2020, Bicoin broke through the pocket and created a new ATH in 2021 -From summer 2022 Bitcoin has tapped the golden pocket 3 more times and this is where we currently sit today, at the end of 2023. Bitcoin is currently playing within the pocket at the upper ranges. The top side of this pocket sits around $45.5K. Bitcoin has already tapped the upper side of the pocket too. With that said I still believe the next ATH for Bitcoin will occur in 2024-2025.

Vechain looking for a bullish pump

VET is one of the few cryptos that has not gotten a significant bullish rise over the past several months. It is currently testing a historical parallel trend line that was previous support over the past few years. We could be seeing a 4-5 cent vechain if it find support here.So far this is going as planned. VET reached the 4-5 cent projection. I would like to see Vechain stay above the pink parallel channel to confirm strength and use it as support. The next macro targets is 7-8 cents. However Vechain needs to reclaim 9 cents and hold it as support if we really want to see fireworks.

HELIUM on the weekly

This might be an area of resistance for helium. I would like to see a break of this descending parallel channel before assuming a macro reversal in price.

35K incoming

35K incoming Still looking for the CME gap at 35K to get tapped. Need to hold above 26.6K and breakthrough 29.3K to see continuation towards 35K area. That could end up being the high for 2023 but if the global macro economics shift more bullish, then we can look for higher prices. 40-43K should be hard to breakthrough. The ultimate bullish target is 47K. Eventually we will fill the 20K CME gap as well. there is still the 9.8K cme gap as well. I dont see it getting filled in the near future but im aware that its still a possibility if things get really bearish.

Bitcoin and mid-term Pi Cycle

Bitcoin and mid-term Pi Cycle Bitcoin could be winding up for its final push up to the $35K-$41K area. As you can see, in the years that follow the Pi Cycle top, bitcoin usually has a mid-term touch of the green moving average during its Reaccumalation phase. If we do see that touch this year, then i expect another correction down to lows. $15K may not be this cycle's macro low. I wouldn't be surprised to see $9K-$14k be tapped as well. however i will take it level by level with an open mind. Long term, If the cycles keep playing out, then i expect to see another ATH in 2025.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.