ImMrToreda

@t_ImMrToreda

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

I just opened a long position on SOL after it returned to my test zone at $200–$210. It swept the previous structure and the weekly VAL. There was a test of the weekly POC, which is acting as support. **Target:** $250 Market conditions don’t seem very favorable at the moment. However, I couldn’t resist taking this setup I had planned. I’m not in with my full risk. Good luck to us!Lost. GG

I'm longing SOL as it's breaking through the 200-210 range, which was a particularly tough level. Let's see if it holds on the daily candle. Honestly, the safest move would be to wait for the daily close, but I'm impatient XD. Stop loss is around 201. We have this week's POC as support, plus the previous two weeks' VAH. Entry is around 211-213, with the first target at 247. Note: There's an ascending wedge forming, which usually isn't great for longs, so keep that in mind. Good luck to us.

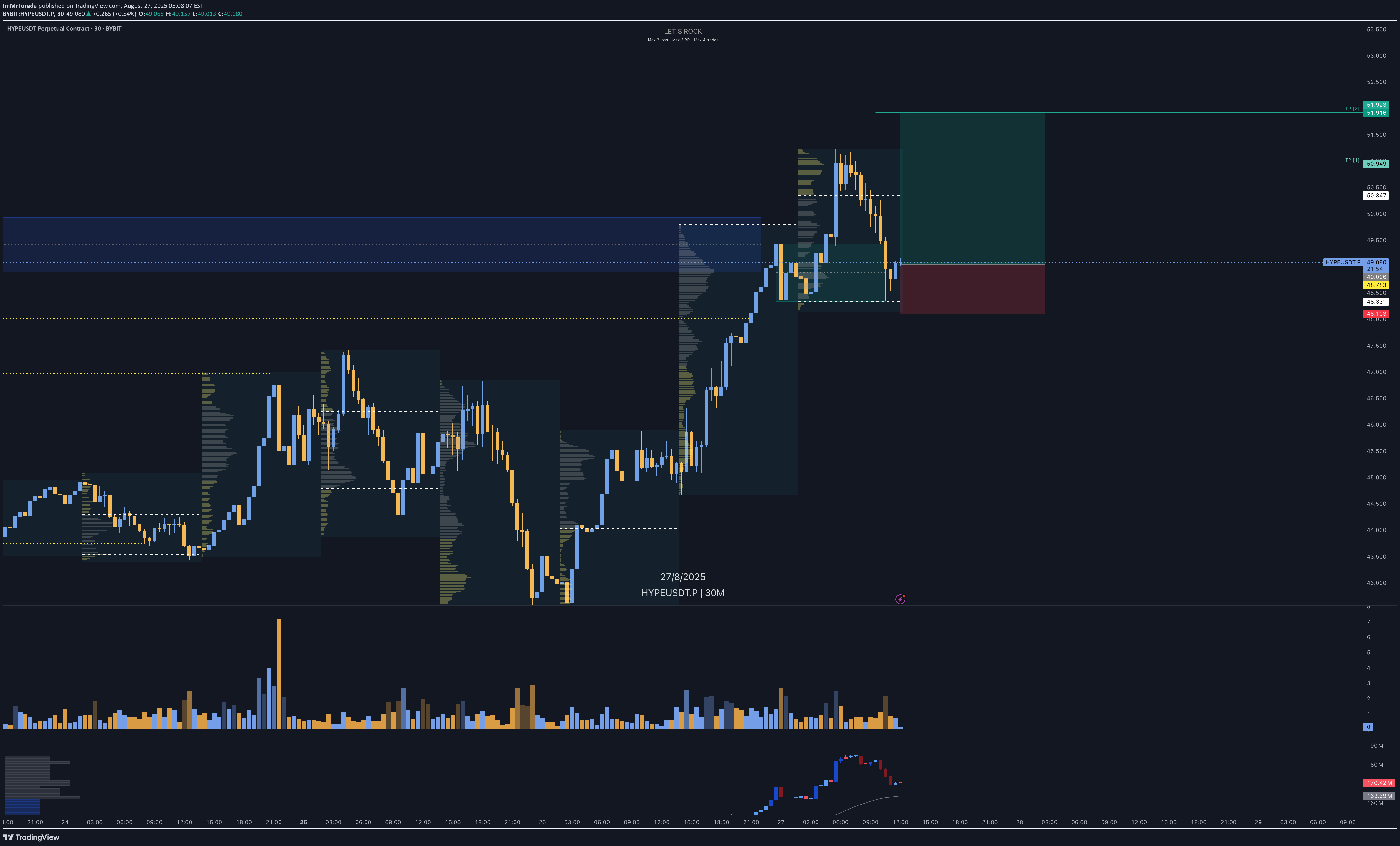

Opened a quick scalp trade after seeing a test of the previous ATH and both the previous and current 4H POC. Entry was a bit aggressive, but given the strong hype, I think it made sense. TP1 is just below the ATH, and TP2 targets $52 (51.91), which is a psychological round number. GL to meAlready moved to BE. It's now or never. I don't want to get stuck in a choppy market, especially since I have other open positions.BE. GG

Entered long on ETH near support, close to the monthly and previous weekly POC that had never been tested before. There’s also a daily order block and an H4 breaker confirming my idea. **Cons:** This area is very obvious, BTC looks weak, and September could bring a month of ranging and poor price action. I’ll be very conservative with break even and partials if we get a bounce.

This morning, I entered a long position on the retest of the weekly Volume Area High, which aligned with the significant imbalance left after Powell’s speech yesterday. I’m considering increasing my position if price breaks above the high at $3.10, and may adjust the stop loss to manage risk accordingly. T1 is intentionally conservative. Upon reaching this level, I plan to move my stop loss to break-even without taking any partial profits, allowing the entire position to run while minimizing risk. GLClosed for now BE. I’m going to bed. Usually at night my IQ drops. Tomorrow I’ll probably re-enter higher after breaking the red box if it was just a shake out. GLSorry, as i said. I'm already out break even.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.