IAm_Ryder

@t_IAm_Ryder

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

IAm_Ryder

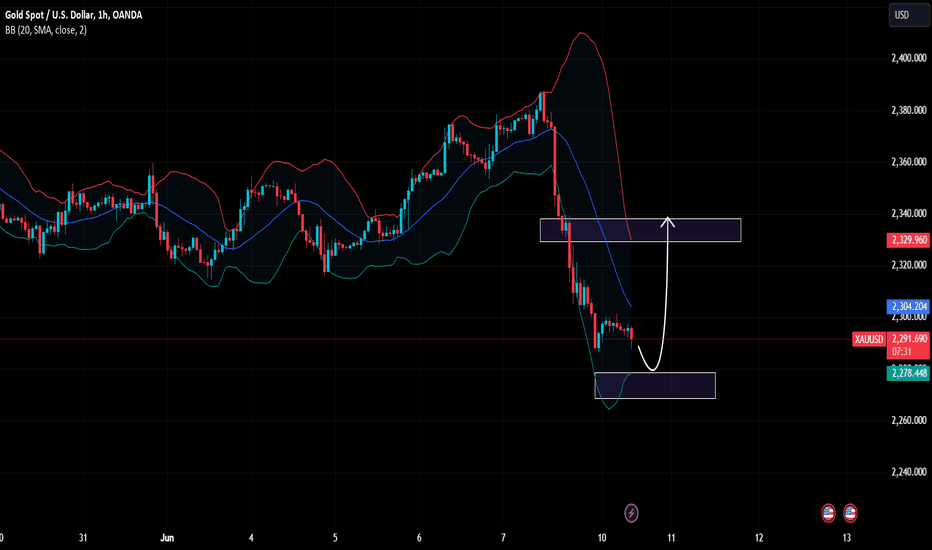

New gold day trading strategy

Dear traders! Today gold is trading at 2318 USD and has not changed much compared to the previous trading session. Talking about impact news: Impacted by the recovery of the USD and rising bond yields, while investors look forward to economic data and comments from US Federal Reserve (Fed) officials for more clarity on the roadmap to cut interest rates. Talking about the new prospect of news that could turn around: Although gold prices are falling, gold is in a favorable environment. Data released last week showed that labor market and price pressures are showing signs of cooling. Because recent data showing signs of weakness in the US economy could weaken the USD and increase expectations for future interest rate cuts. It is predicted that gold will still move around 2,300 to 2,400 USD. But first, I expect gold to attack the $2,335 resistance level as long as the 2,300 support level holds its own in a gradually narrowing BB environment.

IAm_Ryder

Gold price remains under selling pressure amid hawkish Fed tilt

Dear friend! Gold price (XAU/USD) meets with a fresh supply during the early European session and erodes a part of Friday's positive move in the wake of the Federal Reserve's (Fed) hawkish surprise. In fact, policymakers lowered their forecast for the number of rate cuts this year to one from three projected in March. This remains supportive of elevated US Treasury bond yields, which allows the US Dollar (USD) to stand tall near its highest level since early May touched on Friday and is seen as a key factor driving flows away from the non-yielding yellow metal. That said, the possibility of two Fed rate cuts in 2024 remains on the table amid signs of easing inflationary pressure in the US. This, in turn, is holding back the USD bulls from placing aggressive bets and lending some support to the Gold price. Apart from this, persistent geopolitical tensions in the Middle East, along with political uncertainty in Europe, should help limit losses for the safe-haven metal. Hence, it will be prudent to wait for some follow-through selling before positioning for the resumption of the XAU/USD's pullback from the all-time peak touched in May. Plan traded on June 17 ✅ XAUUSD SELL zone 2319 - 2321 🔰SL 2324 🔰TP 2300 - 2295Trade activeComment: Gold price (XAU/USD) meets with a fresh supply during the early European trading hours and erodes a part of Friday's positive move in the wake of the Federal Reserve's (Fed) hawkish surprise.

IAm_Ryder

Latest gold updates and strategies

Hello dear friends, let's explore the gold price after yesterday's big fluctuations! About developments and news results: Gold prices experienced significant volatility on Friday, maintaining stability above the $2,300 mark and reaching $2,332, highlighting gains of 320 pips. This happened as US Treasury yields fell, benefiting the precious metals market. Conclusion about gold and the trend: In general, the main trend of the market is still down on almost every time frame. But! The fact that gold is still above 2,300 USD/ounce proves that buyers still actively consider corrections and price drops as good opportunities to increase gold holdings. Personally, Ryder expects that from the resistance limit of the gold channel, the market may sell off to the $2,250 mark because the correction trend of gold has not ended yet.Trade activeTrade active

IAm_Ryder

Gold prices are still under selling pressure

Dear traders! As I predicted earlier, recent technical selling in the gold market has turned to a short-term bearish trend. Talking about impactful news: the Fed decided to keep the current interest rate unchanged. Since then, gold has lost much of its previous momentum. Despite being under pressure, the fact that gold is still above 2,300 USD/ounce proves that buyers still actively consider corrections and price drops as good opportunities to increase gold holdings. Talking about the new outlook for XAUUSD: I expect the channel resistance at $2318 to hold amid the correction and sell-off. Therefore, the technical downtrend may continue, the nearest potential target on H1 could be the 2300-2288 area.Trade activeComment: If gold breaks the horizontal zone (resistance), the scenario will changeComment:

IAm_Ryder

Gold prices continue to rise today

Dear traders! Gold prices edged higher in today's trading session, after a weak US inflation report caused the US Dollar Index and US Treasury bond yields to fall. Besides, gold prices are having new buying momentum due to consumer prices cooling down more than expected in May, according to some economic experts, this could create an opportunity for the US Federal Reserve (FED). ) interest rate reduction this year. In the short term, gold may still be under technical pressure from the exponential moving average EMA 34.89, but gold basically still receives good support. I expect to still receive good buying pressure above the support threshold of 2300 USD. It is expected that if the upward momentum continues, the next target to watch is 2,360 USD.Trade activeTrade active

IAm_Ryder

Latest gold update today

Dear friends! Today's world gold price is listed on Kitco at 2,314 USD/ounce, an increase of 11 USD/ounce compared to yesterday's trading session. Currently, traders are worried about the Fed's policy meeting on June 12 because if the inflation report does not show any improvement, the Fed will not signal to lower interest rates soon. This means that both the USD and US yields will rise, to the detriment of gold.Trade active

IAm_Ryder

Gold shows signs of recovery

Dear traders! Gold is falling exactly as Ryder expected last week after not being able to overcome the resistance level of 2,300 USD as expected. From a personal perspective, Ryder is still optimistic about supporting the 2277 USD area (coinciding with the time of testing BB's support level from a technical perspective from TradingView). If this level breaks, the precious metal price could be pushed down to $2,220 while a hold would result in a recovery back targeting the BB band resistance cap at $2,335. This week the market is interested in some notable information such as the consumer price index (CPI) in May, announcements on monetary policy of the US Federal Reserve (Fed), and data on unemployment benefits. American industry and the monetary policy of the Bank of Japan.Comment: 2305Trade activeComment:Trade closed: target reached

IAm_Ryder

Gold price today: Stable waiting for signal

Dear traders! After suffering the strongest sell-off in nearly four years due to stronger-than-expected US employment data, world gold prices remained stable at the beginning of the week, while investors awaited the monetary policy meeting. currency of the US Federal Reserve (Fed) this week to further clarify the future policy direction of the US Central Bank. The gold market will be very exciting this week as it enters a waiting mode for important events and data, including the June policy meeting, the Fed Chairman's speech and the price index report. consumption. Currently, the market is almost certain that the Fed will not make any changes at this policy meeting. However, statements from Fed Chairman Jerome Powell and changes in economic forecasts from policymakers may impact the direction of gold. Further information awaited by the market is US inflation data, expected to be published on Wednesday. Conclusion about gold and the trend: if bears hold strong resistance at 2328 USD and 2050 USD or the US Central Bank's interest rate forecast shows the possibility of delaying interest rate cuts, the gold market may witnessed another strong sell-off, pushing prices down further.Trade activeTrade activeComment: what do you think?

IAm_Ryder

Gold breaks out of the 2300 levels and falls

Dear traders! Overall gold experienced significant volatility yesterday with a drop of over 800 pips to reach 2294 over the weekend. Accordingly, from a technical perspective on the 4-hour chart, the 2300 USD Psychological Resistance Zone continues to hold the price amid a correction and sell-off after a clear breakout on the chart. Personally, I appreciate that the downward trend seems more certain and that the $2,282 support zone could be retested and rebound. If it is quickly controlled by the bears and breaks out of the support level of 2282 USD, it is expected that gold will continue to realize bearish distribution.Trade activeTrade activeComment: According to the results of Kitco's survey on gold price trends on Wall Street, 18 analysts responded, of which 11% thought that gold prices would increase again but up to 61% thought that gold prices would continue to decrease, only 28% of opinions predict gold prices will go sideways.Comment: Not only did the information that the Central Bank of China stopped buying gold make investors worry that the gold price increase cycle will be shaken. US macroeconomic data such as the employment report showing that the number of new jobs created exceeded forecasts also affected gold.Comment: The US economy continues to be optimistic, showing that the roadmap for the US Federal Reserve (FED) to cut interest rates is still unclear about the specific time. These factors prevent the recovery of gold prices.

IAm_Ryder

Gold bearish strategy, target 500 pips

Hello friends! A descending price channel is gradually starting to appear on H4 which usually determines our outlook. Speaking of news: Gold prices remained under strong selling pressure during the European session, extending losses below $2,350. China has paused purchases of gold reserves after 18 consecutive months, exacerbating the decline in gold prices. Talking about the upcoming outlook of XAUUSD: From the 4-hour chart, gold is moving towards the support level of 2332 USD, it is likely that the price will FOMO to retest the downtrend resistance level to accumulate before continuing to gradually decrease. The target for the downside ahead lies at $2270. And you?Trade activeComment: Gold prices accelerate their bearish stance for the day, putting the $2,300 region to the test following the publication of the US labour market report for the month of May.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.