Heruprabowo

@t_Heruprabowo

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Heruprabowo

فرصت خرید عالی در TURBO/USDT: لانگ پرقدرت پس از نقدینگیگیری!

Price swept the liquidity (SSS) and instantly reacted with a strong bullish push. Structure is shifting short-term, giving a clean long opportunity as price taps the demand zone. Entry: 0.0023623 Stop Loss: 0.0022647 TP1: 0.0024859 TP2: 0.0026079 Final TP: 0.0028359 #TURBO #TURBOUSDT #TURBOUSDTPERP

Heruprabowo

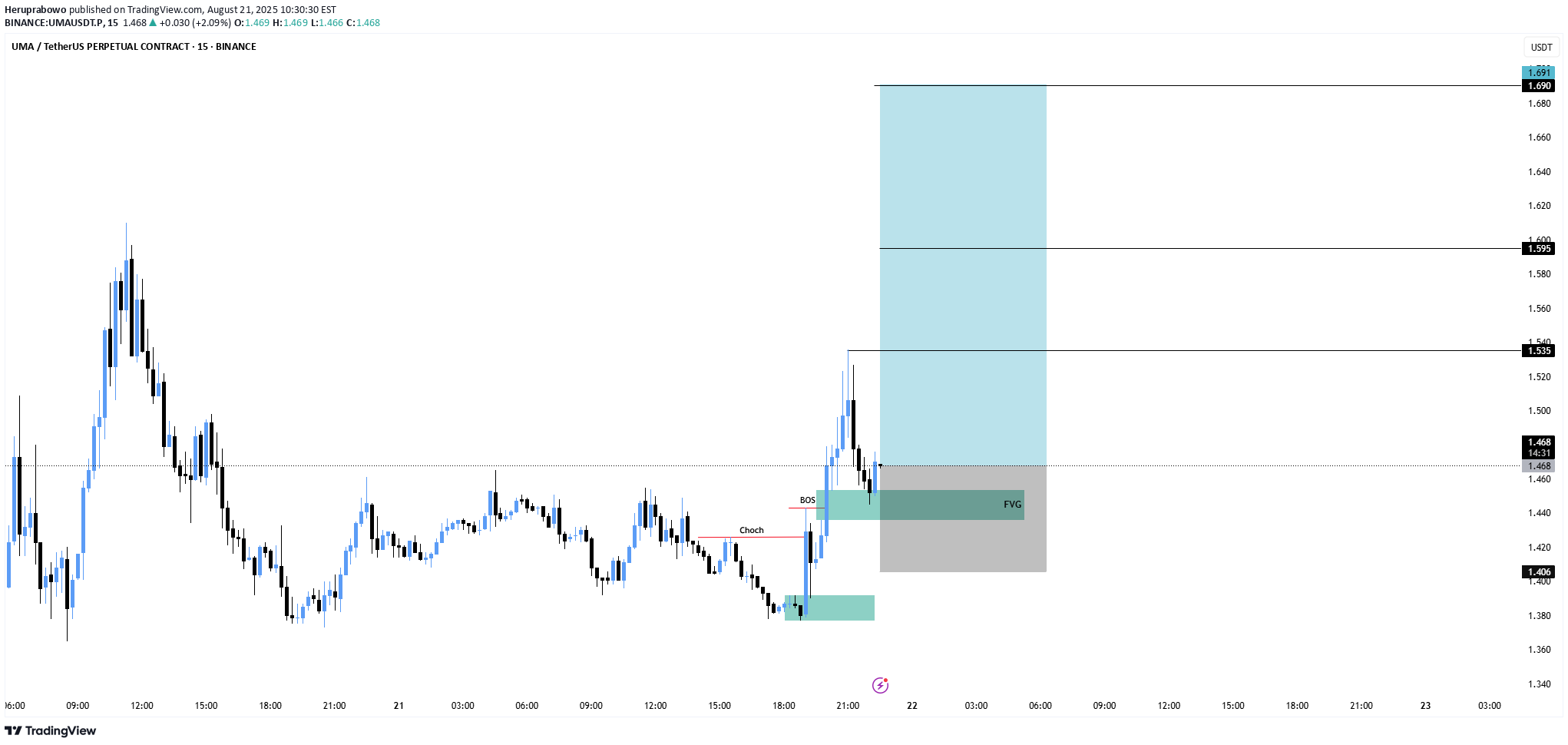

UMA Loading a Big Move – Don’t Miss This Setup!

UMA has shown a clear change of character with a bullish break of structure. Price is now retesting the fair value gap (FVG) area, setting up for a possible continuation move upward. Entry: 1.47 Stoploss: 1.406 Targets: 1.535 1.595 1.691 If buyers defend the FVG zone, UMA could rally toward higher targets with strong momentum.

Heruprabowo

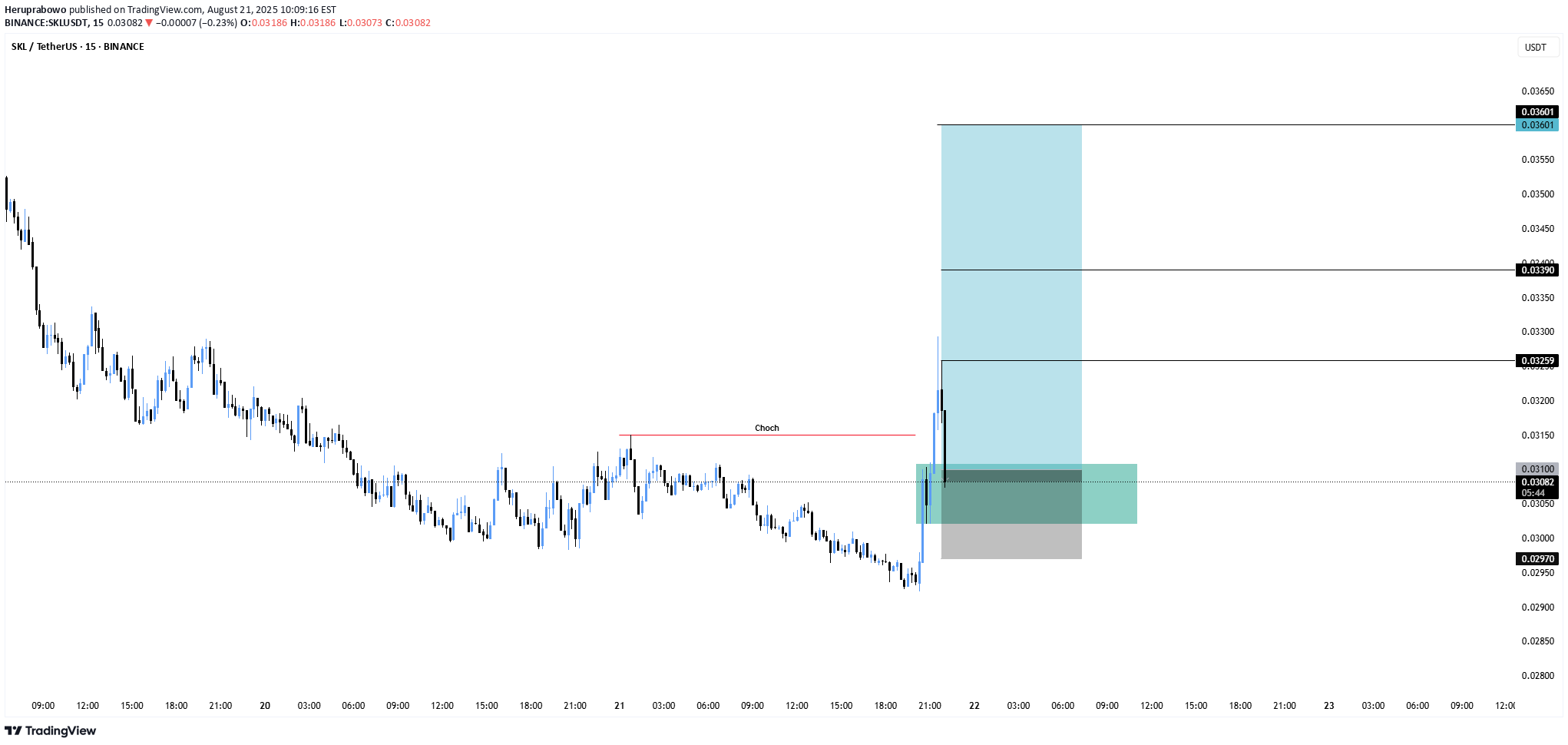

SKLUSDT – Possible Reversal in Play

SKL shows a change of character (ChoCH) after long consolidation and now trying to push upward. Price already retested the zone, giving a chance for continuation if momentum holds. Entry: 0.0310 - 0.0307 Stoploss: 0.0297 Targets: 0.0326 0.0339 0.0360 Let’s see if SKL can maintain strength and push into higher targets.

Heruprabowo

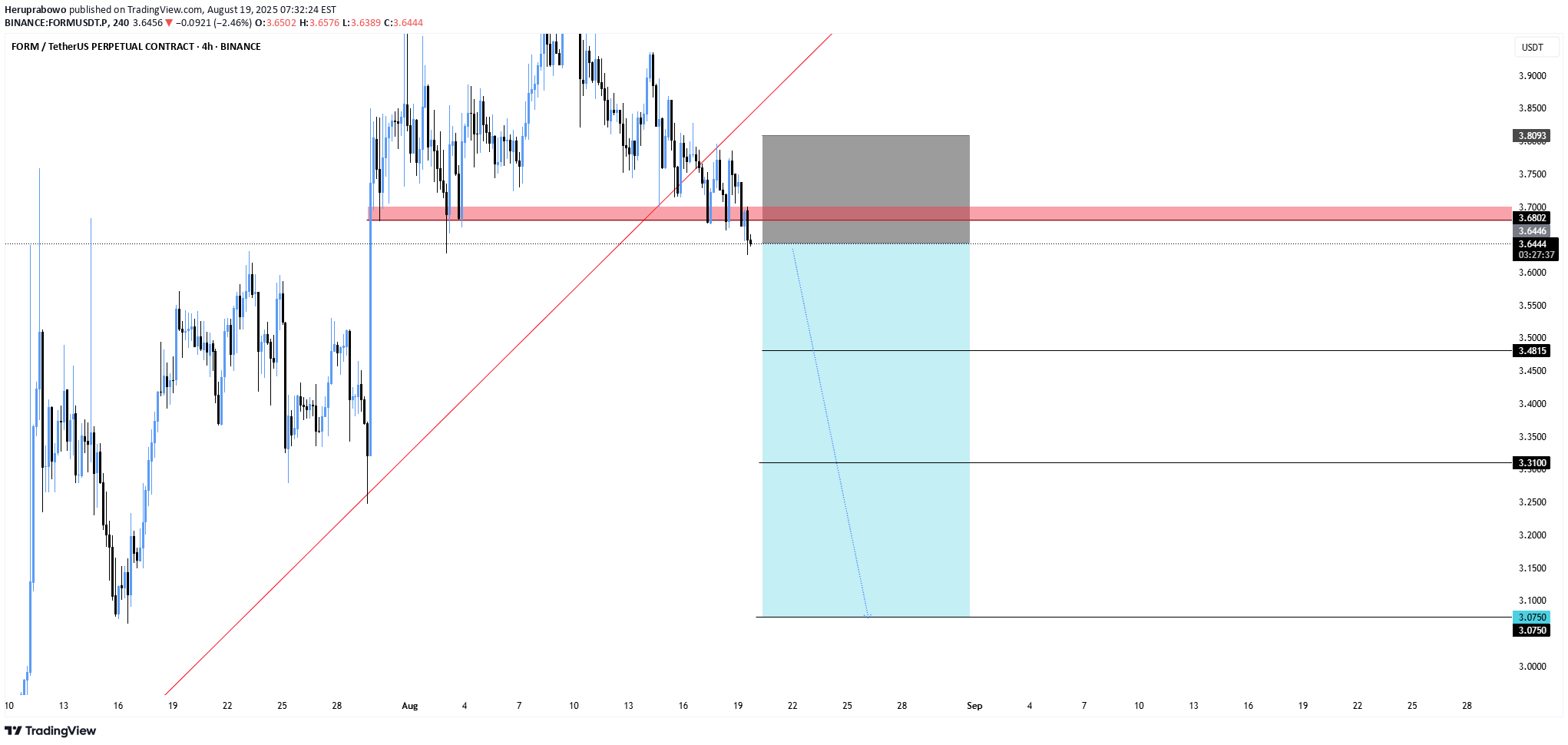

FORMUSDT.P – Break Below Support

FORMUSDT – Break Below Support FORM has broken its trendline and slipped under the support zone. As long as it stays below this area, the momentum looks bearish with more room to the downside. Entry: 3.64 Stoploss: 3.8093 Targets: 3.48 3.31 3.075 Let’s see if the breakdown continues or if buyers step back in.Closed with small profits!

Heruprabowo

SPX/USDT — Change of Character Signals Bearish Move Incoming

The structure has shifted with a clear CHoCH (Change of Character), suggesting that bullish momentum is weakening. Price recently pulled back into a supply zone around 1.6140–1.6910, setting up a potential short opportunity. 🔍 Technical Breakdown: Price broke below recent higher low = CHoCH confirmed Bearish BOS followed by retracement into premium zone (FVG/Supply) Expecting rejection and continuation to downside if price fails to reclaim 1.6140 🔧 Trade Plan: Entry Area: 1.6140 Stoploss: Above 1.6910 Targets: • TP1: 1.5290 • TP2: 1.4630 • TP3: 1.3500 This setup aligns with internal structure + supply zone + CHoCH. Wait for confirmation candle or bearish engulfing in entry area before executing.

Heruprabowo

FETUSDT.P Breakdown Incoming? Supply Zone + Rising Wedge

FET just tapped into a strong supply zone and formed a rising wedge — usually a bearish sign. Price looks weak here and might break down soon. If the wedge breaks, I’m looking for a short setup. Entry: 0.716 - Wait for breakdown Stoploss: 0.746 Target 1: 0.685 Target 2: 0.657 Target 3: 0.607 Waiting for confirmation before jumping in. Let’s see how it plays out.

Heruprabowo

TAO/USDT.P Short Setup – Riding the Downtrend with Precision

Trade Details: Leverage: CROSS 15x - 20x Entry: 348 - 351 USDT Stop: 361.1 USDT Targets: TP1: 332 USDT TP2: 319 USDT TP3: 300 USDT Why This Trade Makes Sense: ✅ Risk Management: Stop-loss placed at 361.1 USDT ensures protection above the supply levels. ✅ Strategic Targets: The targets are set at key support levels (332, 319, and 300 USDT), where price is likely to react. Final Thought: With tight risk management and logical profit-taking targets, it offers a solid chance to ride the market lower. Patience and discipline are key—keep an eye on price action and stick to the plan!

Heruprabowo

SUI/USDT.P Short Setup — Ride the Wave to Profits!

Trade Details: Entry: 3.56 - 3.6 USDT Stop-Loss: 3.6935 USDT Take-Profit Levels: TP1: 3.4215 USDT TP2: 3.2700 USDT TP3: 3.0640 USDT With clear targets set and a tight risk management strategy, this setup offers a great opportunity to ride the wave of the market’s next move. Patience and discipline are key. Stay focused, follow your plan, and let's make this trade count!

Heruprabowo

FARTCOIN/USDT.P – Smells Like a Clean Short

Entry’s cooking, and this setup is dripping with RR juice. Let's break it down: 📍 Entry Gameplan: Short Zone: 1.0660 – 1.0710 SL: 1.1195 (tight and right above the wick) TP1: 1.025 TP2: 0.9835 TP3: 0.9055 (send it 💨) Why I Like This Setup: That choch ➝ BOS combo? Chef's kiss. Price tapped into supply and reacted fast = strong sellers present Beautiful RR — no overcomplications, just structure, imbalance, and timing This thing's been cooking sideways long enough. Now that it’s broken structure and filled its pockets with early buyers, we might finally see a solid dump. Let’s see if FART delivers the gas.

Heruprabowo

ENJ/USDT – Fresh Short Opportunity After Rejection!

ENJ/USDT.P Price just broke beneath a key support and is now pulling back into a small supply zone. Early signs of weakness are showing — potential for a nice short opportunity if this level holds.Trade Plan:• Entry Zone: 0.10&• Stop Loss: 0.112• Target 1: 0.1009• Target 2: 0.0962• Target 3: 0.0874Structure Notes:- Clean shift from higher highs to lower highs - Rejection already forming at the retest zone- Support levels below acting as logical take-profit areasThis setup offers a solid short opportunity with clear invalidation and multiple target levels. As always, wait for price confirmation around the entry zone before taking the trade.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.