Herotraderfx

@t_Herotraderfx

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Herotraderfx

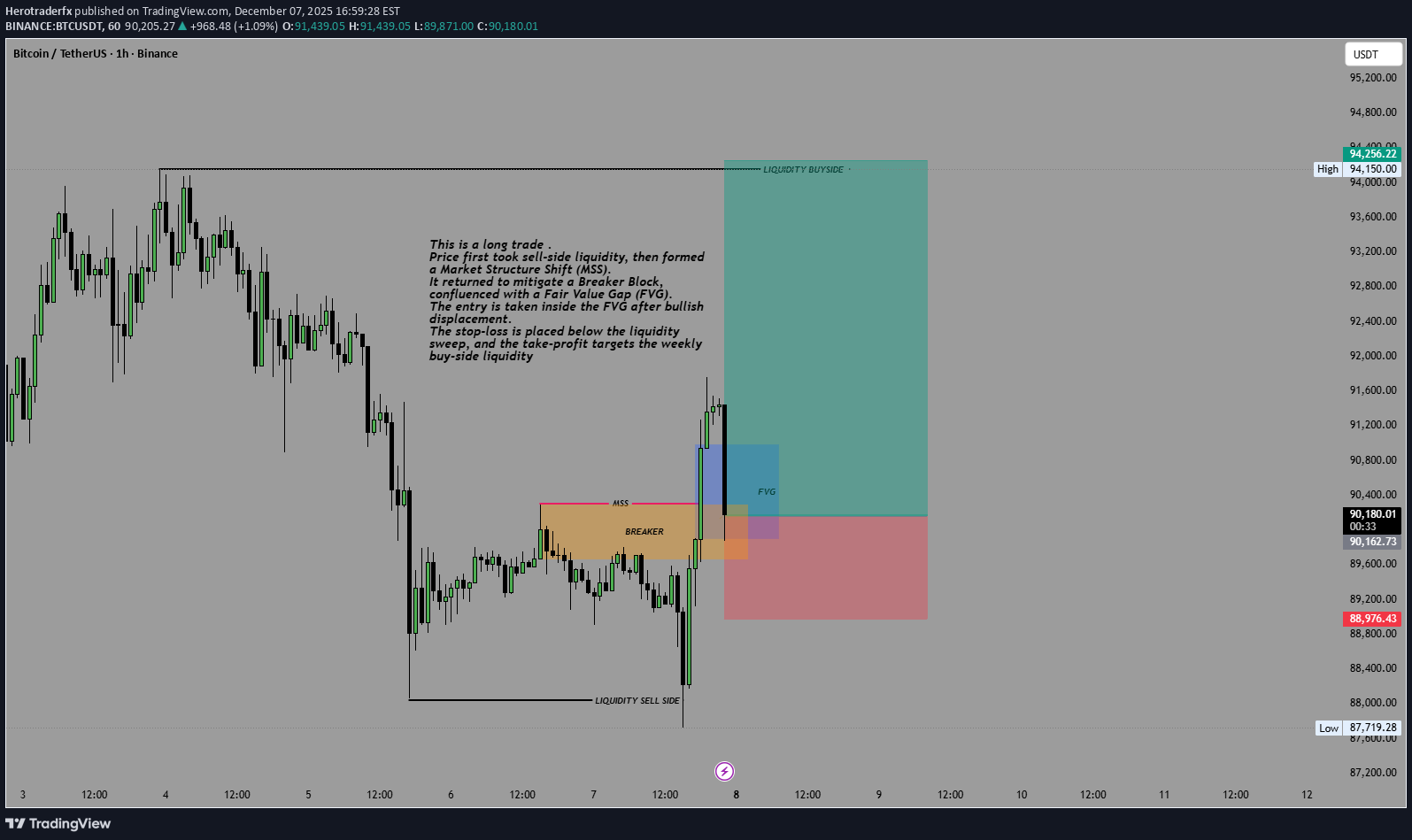

BTCUSDT LONG TRADE

This is a long trade based on ICT structure. Price first took sell-side liquidity, then formed a Market Structure Shift (MSS). It returned to mitigate a Breaker Block, confluenced with a Fair Value Gap (FVG). The entry is taken inside the FVG after bullish displacement. The stop-loss is placed below the liquidity sweep, and the take-profit targets the weekly buy-side liquidity

Herotraderfx

تحلیل هفتگی بیت کوین: آیا سقوط بزرگ بعدی در راه است؟ (سطوح کلیدی ۹۵ هزار تا ۷۵ هزار)

Bitcoin is currently in a corrective phase after a strong weekly sell-off. Price has a clear Weekly Fair Value Gap (FVG) sitting around the previous weekly high in the 95k–97.5k area. 📌 Technical idea: Price could retrace back into the weekly FVG to rebalance inefficiency and grab liquidity above the previous weekly high. After tapping that zone, a bearish reaction is expected. Final target is the previous weekly low, where major liquidity rests. 📍 Key levels: Weekly FVG zone: 95,000–97,500 Liquidity grab above previous weekly high Target: previous weekly low around ~75,000 🎯 Bias: Bearish after mitigation

Herotraderfx

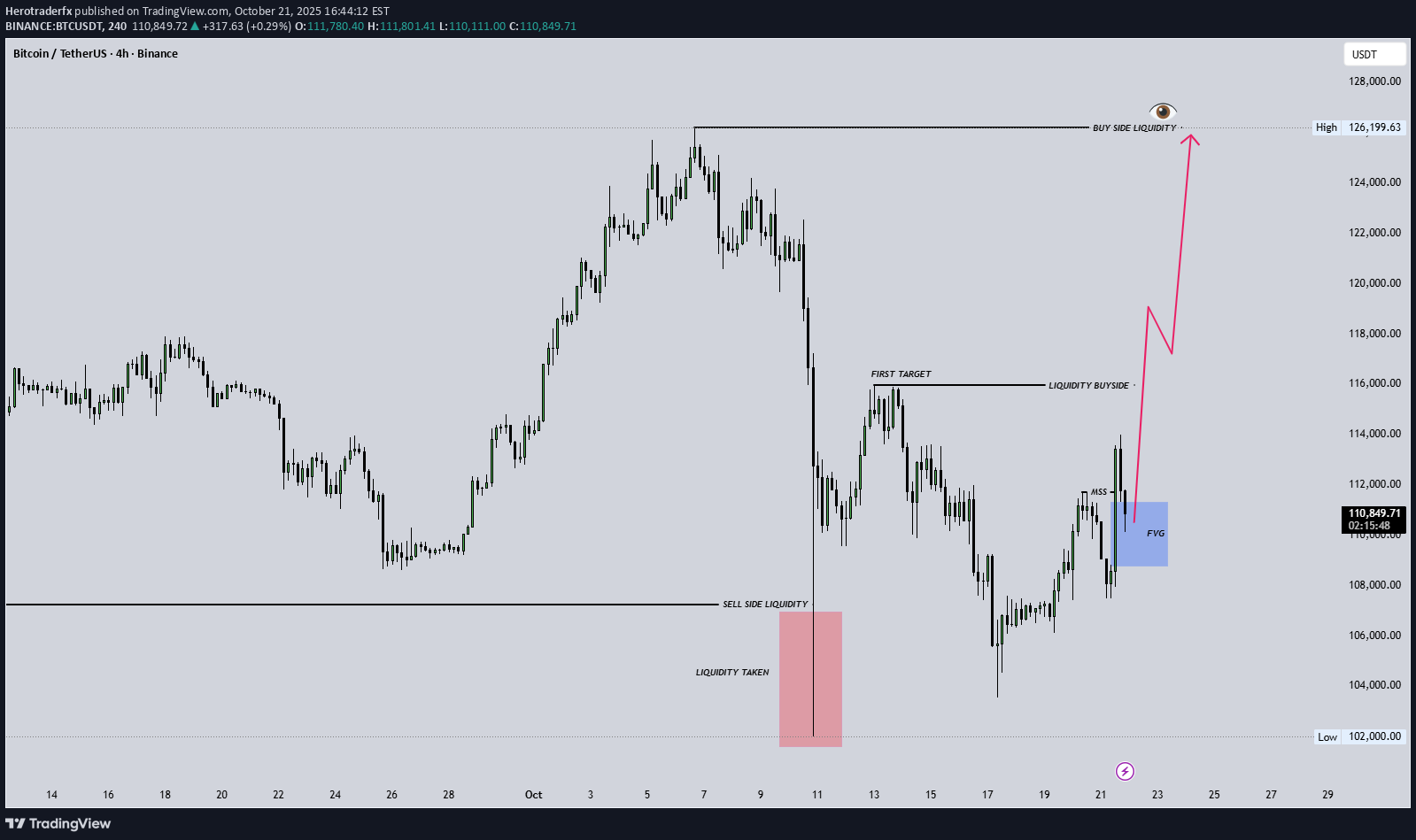

تحلیل بیت کوین 4 ساعته: آیا BTC آماده صعود به 126 هزار دلار است؟ (بر اساس مفاهیم اسمارت مانی)

After taking out the sell-side liquidity, Bitcoin has shown signs of reversal and filled previous imbalance zones. Currently, price is reacting from a Fair Value Gap (FVG) around the 110K area after a market structure shift (MSS). 🟢 The bullish scenario suggests that if this FVG holds, BTC could aim for the next buy-side liquidity around 126K as the main target. 🎯 First target: 115K – liquidity area above the short-term high. 🚀 Final target: 126K – buy-side liquidity sweep. 📌 Key zones: Sell-side liquidity taken ✅ FVG (Potential bullish continuation area) Buy-side liquidity at 126K 📅 Analysis based on Smart Money Concepts (SMC) and liquidity flow. 📖 For educational purposes only — not financial advice.

Herotraderfx

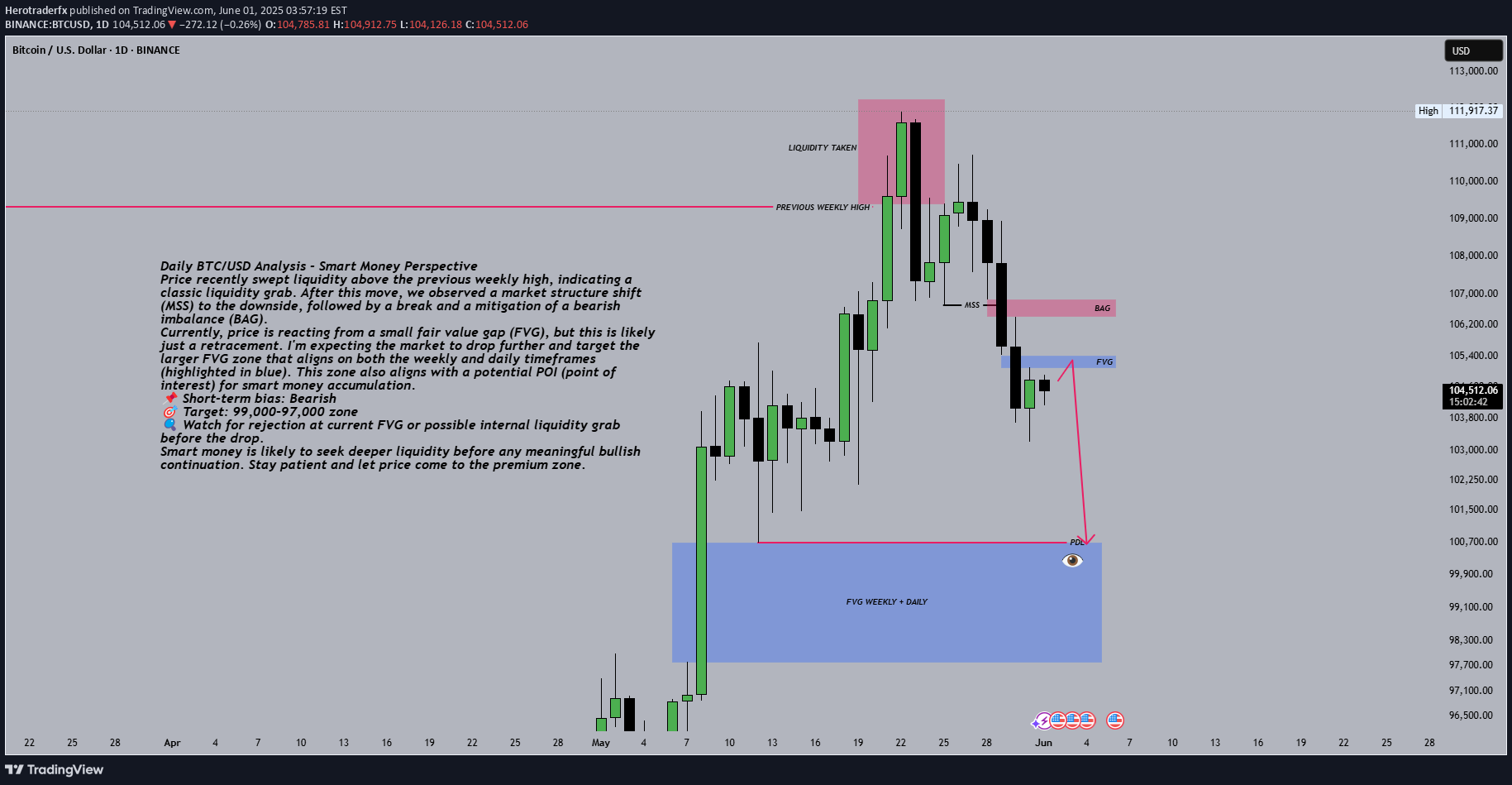

Daily BTC/USD Analysis - Smart Money Perspective

Price recently swept liquidity above the previous weekly high, indicating a classic liquidity grab. After this move, we observed a market structure shift (MSS) to the downside, followed by a break and a mitigation of a bearish imbalance (BAG).Currently, price is reacting from a small fair value gap (FVG), but this is likely just a retracement. I'm expecting the market to drop further and target the larger FVG zone that aligns on both the weekly and daily timeframes (highlighted in blue). This zone also aligns with a potential POI (point of interest) for smart money accumulation.📌 Short-term bias: Bearish🎯 Target: 99,000–97,000 zone🔍 Watch for rejection at current FVG or possible internal liquidity grab before the drop.Smart money is likely to seek deeper liquidity before any meaningful bullish continuation. Stay patient and let price come to the premium zone.

Herotraderfx

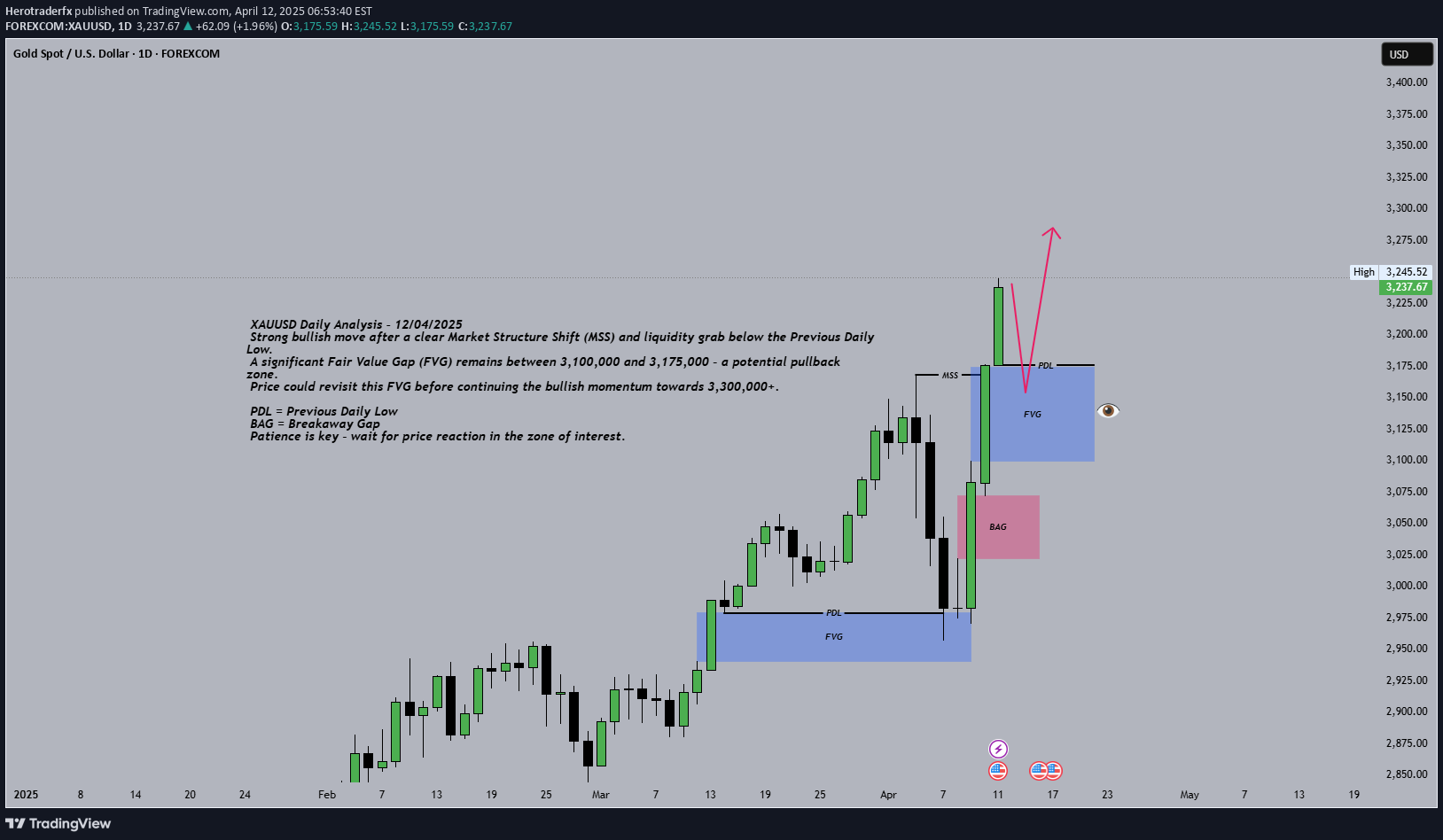

XAUUSD Daily Analysis

📈 XAUUSD Daily Analysis – 12/04/2025🔥 Strong bullish move after a clear Market Structure Shift (MSS) and liquidity grab below the Previous Daily Low.📉 A significant Fair Value Gap (FVG) remains between 3,100,000 and 3,175,000 – a potential pullback zone.📍 Price could revisit this FVG before continuing the bullish momentum towards 3,300,000+.🔹 PDL = Previous Daily Low🔴 BAG = Breakaway Gap🧠 Patience is key – wait for price reaction in the zone of interest.📌 For educational purposes only – not financial advice.💬 Drop your thoughts in the comments ⬇️🔁 Like if you found this helpful!

Herotraderfx

BTC/USDT Monthly Outlook

📊 BTC/USDT Monthly Outlook – Smart Money PerspectiveBitcoin is currently trading around $83,565, with price consolidating after a Market Structure Shift (MSS) on the higher time frame.🔹 Key Highlights:A strong bullish impulse led to a break of monthly structure (MSS), creating Fair Value Gaps (FVG) both above and below.Price is currently within a monthly FVG, showing indecision and potential for either continuation or deeper retracement.Liquidity buy side rests near $110,000, marking a logical target if price respects current FVG support.On the downside, a deeper retracement could aim for the lower FVG and sweep sell-side liquidity around $48,000–52,000.📌 Scenarios:Bullish case: Rejection from current FVG zone, followed by continuation toward the buy-side liquidity.Bearish case: Break below current FVG, targeting the next zone and filling imbalances below.🧠 Watch how price reacts to the current FVG. Smart money will likely seek liquidity before committing to a clear direction.⚠️ This analysis is for educational purposes only and not financial advice.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.