HelioHelix

@t_HelioHelix

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

HelioHelix

ICP Short-term Elliot Wave Outlook

ICP is currently in a short to medium term corrective phase which has lasted just over half of the year. In terms of the macro count it is completing the last leg of a zig-zag in either wave 2 or a B wave. The primary count in white shows an impulse with five completed waves. In this instance, it is a non-overlapping ending diagonal where the impulse sub-divides as 3-3-3-3-3. This count is invalidated if price breaks below the aqua support area. If price breaks below the aqua support area the alternate count becomes more likely. In this case, we're looking at a WXYXZ in yellow. Z can be either 61.8, 100.0, 123.6 or 138.2 of W. Generally targeting the area between 4.22 and 3.35

HelioHelix

DOGE in long-term correction. Regular Flat ABC in X of WXY.

DOGEUSD Function: Corrective Wave Family: Regular Flat ABC in X of WXY Macro count: Complex Zig-Zag in Cycle 4 Invalidation points: Below Wave B in X or higher than the 78.6 of May 4th, 2021 high and the October 9th, 2023 low. Description: DOGEUSD is moving impulsively in the C wave of a regular flat (ABC) in a complex zig-zag (WXY). The regular flat has a simple zig-zag in Wave A and a complex zig-zag in Wave B that retraces 90% of Wave A and Wave C is expected to extend to either 61.8, 100.0, or 123.6 of Wave AB. Price is expected to move down to retest the 21W SMA (light blue) in wave ((ii)) of C before moving higher in wave ((iii)) of C.DOGEUSD 4H

HelioHelix

ADA Double Top Pattern

ADA price has moved below the neckline forming a double top pattern. Expected price target is the measured move at ~0.27 cents.

HelioHelix

Wyckoff Phase E Nearing Completion

BTC at present is ranging on the $20,000 support and as long as the price remains above $17,567.5 BTC is bullish. Price below $17,567.5 is bearish. From a waves perspective the only remaining bullish count is a diagonal in wave 1 which is valid above $17,567.5. Expect further downside if price confirms below the origin of wave 1 at $17,567.5. Expected downside in a best case scenario is around $12,500 worst case scenario is around $4,000.My thoughts on the leading diagonal idea...Wave ((v)) of either C or 5 appears to be well under way

HelioHelix

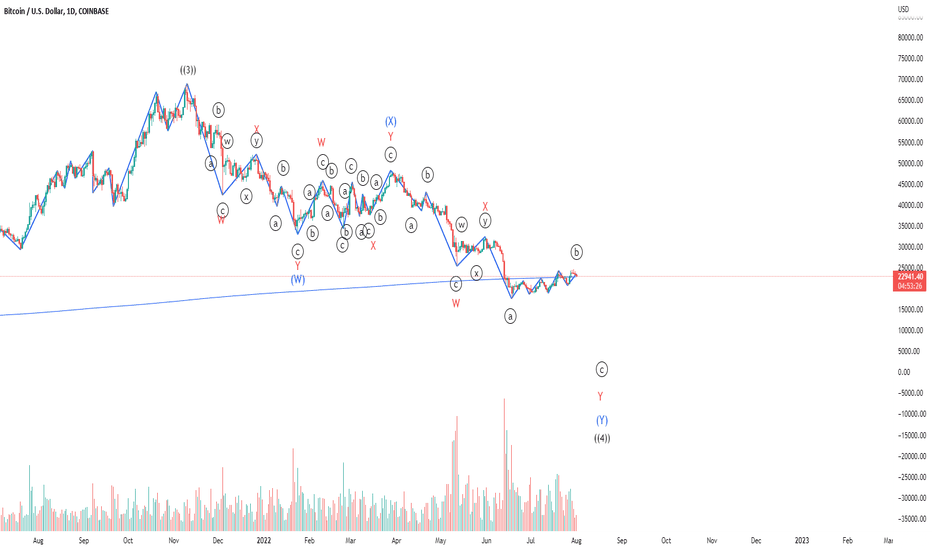

Bitcoin Elliott Wave Intermediate WXY in Primary 4

As an alternative to the ABC count bitcoin could also be in a combination wave from 69k which is evidenced by the price structure that appears as 3-3-3 in each wave. In this pattern, wave Y should not exceed the 1.618 of intermediate (W) which is around 11,000 or so. The main difference between the WXY and ABC counts is the maximum depth of the correction. ABC allows for a lower wave 4 end point because wave C can be the 1.618 or greater of AB.

HelioHelix

Bitcoin Double Top Formation

BTC is forming a double top after attempting to break above the 200WMA for the second time in ten days. Expecting the price to drop around 27% to 16,800 or so.

HelioHelix

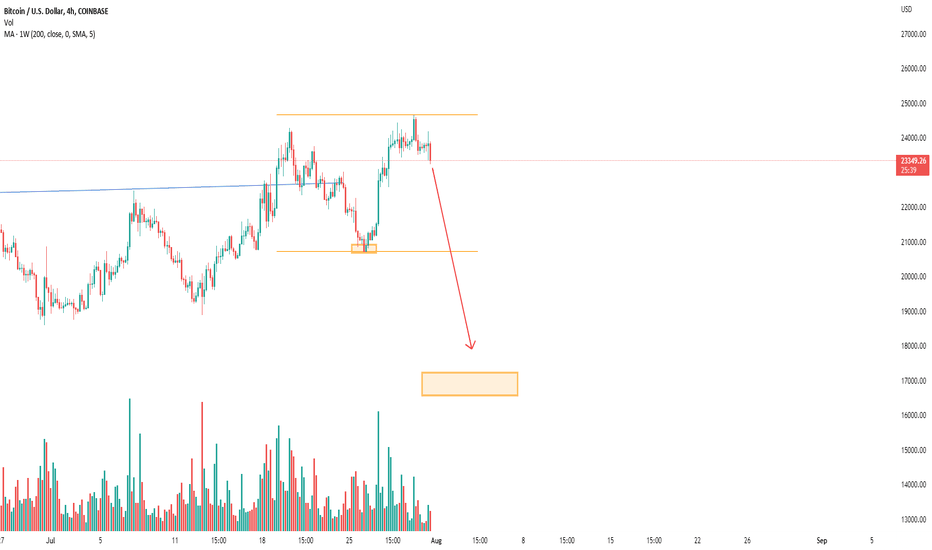

Last stand for BTC Bulls

There is a lack of a clear impulsive structure to the upside which makes it difficult to clearly say whether or not the price action is bullish or bearish . This is the only real bullish count that would pave the way for new all time highs. If we assume that ~17,500 was the bottom then we are looking at an impulse in minor 1 a complex correction in minor 2 and a three of three extension in wave ((i)) of 3. The price rejected at 24,666 which is the 1.618 of W in the bearish count so in order to consider this current move a wave 3 we would need to see that pivot get cleared. Price below 20,670 will invalidate the bullish impulse since wave (ii) will have retraced >100% of wave (i). It's important to note that the volumes are very low for a wave 3 which casts doubt on the bullish count.I will be long above ~24,600 or when the pivot of (i) is cleared. This is currently my main count since it is the closest to being invalidated.Never confirmed above 24.6k so I'm still out.

HelioHelix

Intermediate ABC Extension in Minor 3 Complex Correction in 4

Bitcoin has been in a corrective pattern from the low of 17,500 on June 18th and is beginning to exhibit signs that it could either be a reverse expanding triangle or a WXYXZ pattern. Case for the triangle: Each side subdivides into a zig-zag C is 123.6 of A A and C made higher highs while B and soon D will be making higher lows 1H 30mn 15mn Case for WXYXZ: X is between 61.8% and 76.4% of W Y is less than 123.6% of W X is on target to be around 61.8% of W Alternate WXYXZ Finally, as a bullish alternative this could also be a leading diagonal in a wave 1 since the rules for leading diagonals are that each wave 1-5 subdivides as a zig-zag although this feels less likely due to the way the pattern starts contracted and then expands as the correction continues.Adding some context to support my reasoning for the extension in minor 3 in (C). Alternation between sharp and sideways corrections on both the minor and minute counts. MACD Divergence between ((iii)) and ((v)) High volume spikes on both ((iii)) and 3 Creating a trend channel between 1 and 3 through the extreme of 2 shows that we are outside the trend channel thus in a wave 4.Looking more like an ((abc)) with a flat in ((b)) rather than a triangle or ((wxyxz)) at the moment. I was incorrect about the flat in ((x)) idea and it seems we got five waves up in ((c)) instead. It appears we are now in a three-of-three extension in ((1)).Updated count based on the pump that invalidated the prior comment about the third wave extension in (iii).Wave 4 in? Reviewing the count, I have changed it from the triangle idea to a WXY with a zig-zag in W, double three in X and double three in Y where Y is 1.618 of W. With the New Moon which has historically marked tops in BTC can we safely assume that we're done with this corrective rally?SPX appears to have completed a minutte ABC correction in minute X of minor 4. BTC follows SPX so if SPX continues to move impulsively to the upside it could become a wave 3 which would cause BTC to correct higher. Main bullish count micro 4 of subminutte iii of minutte iii Considering the WXYXZ my alternate count for now.

HelioHelix

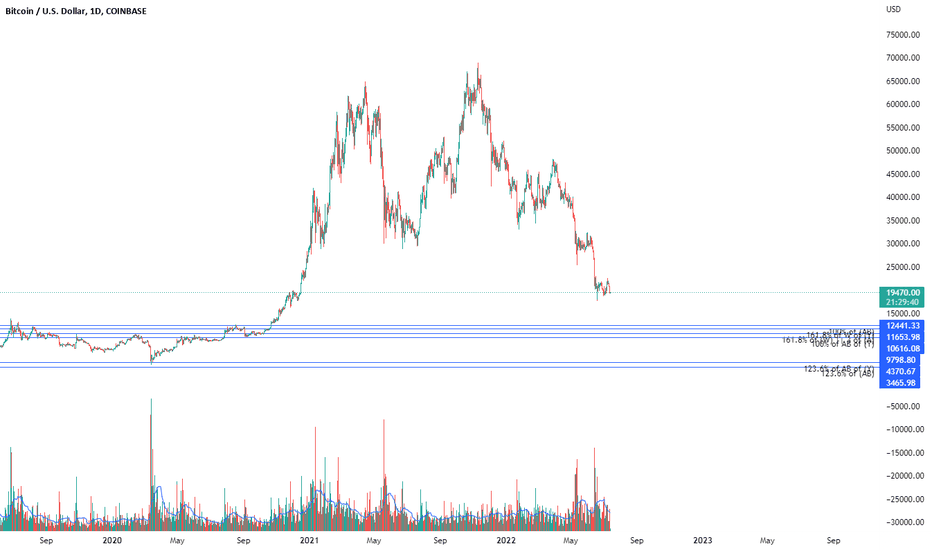

Possible “Bottom” Targets Based on Elliott Wave

BTC is currently correcting from an ATH of 69,000 in either an ABC zig-zag or a WXY combination wave and I've attempted to find possible bottom targets using Fibonacci clusters based on rules for both zig-zags and combo waves. Two ranges have appeared as a result of this study. First, is the range from 12,500 to 9800 and the second is a range from 4,500-3,400. A key level to watch is 10,800 which is the 1.618 of W where there could either be a bounce to the upside in a WXYXZ pattern or a continuation to the downside in an ABC. High Level Count: CME gaps within the ranges:

HelioHelix

BTC Near Term Alternative

As an alternate to my previous BTC near term idea of a micro a,b, and c in subminutte iv I think that this could also be a WXYXZ pattern given the complex mess of zig-zags the target for Z is either 61.8 at $28869, 100.0 $31037 at or 123.6 at $32376.Sub-micro (A) and (B) are in, price target lowered to 31768.66 if sub-micro (C) extends to the 161.8 of AB.Bearish price target downgraded to 30,800; bullish price target at 34,593. Subminutte WXYXZ sub-division: Zig-zag in W, running flat in X, expanded flat in Y, regular flat in X and an expanded flat in Z. The limit of Z is the 161.8 of W at 34,593. The submicro C (expanded flat) in subminutte Z hasn't yet met the 161.8 (~30,800) extension of submicro a and b so it may push for more.Extension in submicro (3). Updated price target to around 32,500.Original target met. Possibility for a little bit more upside but expect subminutte i of minutte (v) to begin unfolding over the next few days.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.