Harkaran_Singh_Karan

@t_Harkaran_Singh_Karan

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Harkaran_Singh_Karan

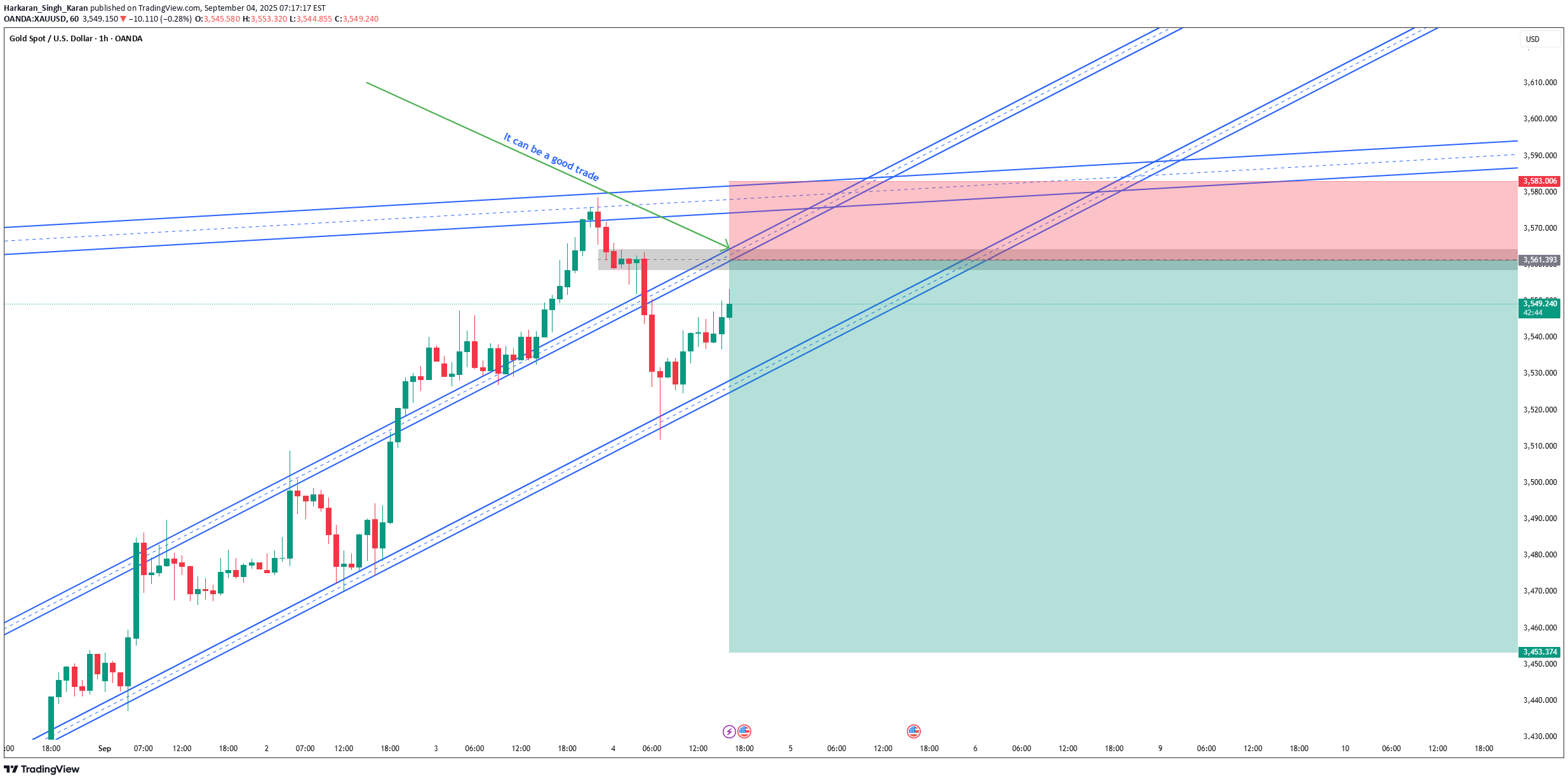

معامله طلا (XAUUSD): فرصت خرید روزانه یا نوسانگیری کوتاه! (با رعایت مدیریت ریسک)

It can be a good trade, but make sure you are following your risk-reward ratio

Harkaran_Singh_Karan

معامله طلا (XAUUSD) خرید: فرصت نوسانگیری روزانه با مدیریت ریسک!

It can be a good trade, but make sure you are following your risk-reward ratio

Harkaran_Singh_Karan

If anyone takes this signal. Make sure to book 25% trade on 25% target and follow the same rule for the full trade.

Harkaran_Singh_Karan

The market is reaching an all-time high every day. According to the analysis, we should see a good corrective move in the coming days.We have SL in the past two trades. We are planning a swing sell trade with a 1-10 risk-reward ratio; if this fails, we will plan the next swing trade with a 1-12 risk-reward ratio.The market is at levels where a corrective move should occur, but the view on gold is still bullish. Because the market is already at an all-time high, planning a long trade, for now, can be more risky, so to be active in long trades for this month, we need to wait for at least 70-100 points of correction in price. you are all kindly requested to follow proper risk management to follow these analyses and execute the provided trades.

Harkaran_Singh_Karan

The market is reaching an all-time high every day. According to the analysis, we should see a good corrective move in the coming days. From our previous analysis, we gained almost 200 pips from 2830 to 2808. Now, we are planning a swing sell trade with a 1-5 risk-reward ratio; if this trade fails, we will plan the next swing trade with a 1-8 risk-reward ratio. you are all kindly requested to follow proper risk management to follow these analyses and execute the provided trades.

Harkaran_Singh_Karan

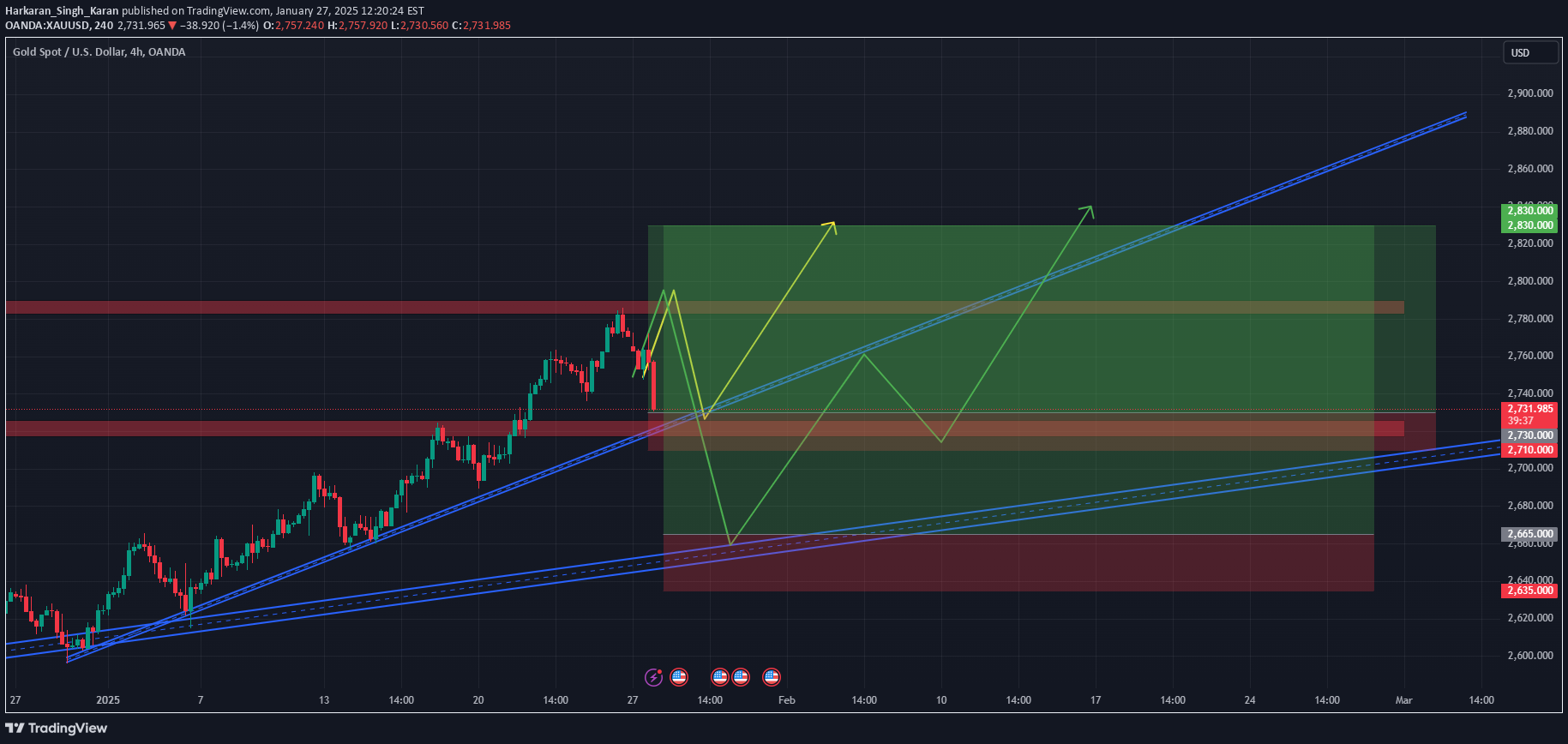

According to our last analysis, gold was preparing to reach a new all-time high, which we achieved only last week. The expectation is to get a good correction from the 2830 area to 2759-2764 or 2728-2733. Both can be good long entries. The 2760 zone is good for intraday trading, but the 2730 zone can be good for swing trading with at least 1-5 RRR. This post is for weekly analysis. Meanwhile, if a good trade is activated, I'll post it here at the same time. kind request to all while using our analysis please do your risk calculation always.

Harkaran_Singh_Karan

Gold is preparing to make a new all-time high. a good correction move is coming, which is expected to the 2728-2733 zone. buy position from this zone can be good with proper calculation and risk management and a good swing trade with a 2800 - 2830 zone target. At the same time, we have to understand that big data reports also coming in this week like Federal Funds Rate and GDP Growth Rate QoQ Adv which can move the market a lot in one direction which can be unpredictable move in the market. so trade management will be very important and crucial. So you can plan trades as mentioned in the provided post same time keep an eye on all important data reports coming in this week. if you wanna check all the reports below is the link for the website. babypips.com/economic-calendar?week=2025-W05

Harkaran_Singh_Karan

The market is showing a bullish move according to technical analysis, before 20-jan-2025, the market can either take support from the small trend line and go bullish or retest the zone of 2630 and give a bullish move. This analysis is only for learning purposes. Please calculate your risk before making any trade. The bullish side target is 2730 before 20th Jan 2025.

Harkaran_Singh_Karan

The market is showing a bullish move according to technical analysis, before 20-jan-2025, the market can either take support from the 200 EMA and go bullish or retest the zone of 2630 and give a bullish move. This analysis is only for learning purposes. Please do your risk calculation before taking any trade.

Harkaran_Singh_Karan

According to analysis, these trades can be good move-catching trades, but following your own risk management is always advisable. And these ideas are only for swing trades.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.