HaribonALT

@t_HaribonALT

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

HaribonALT

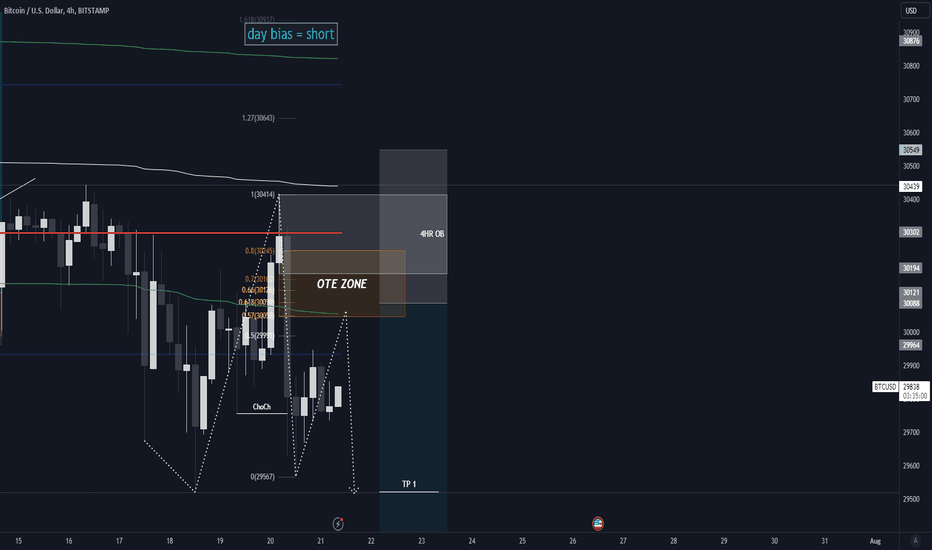

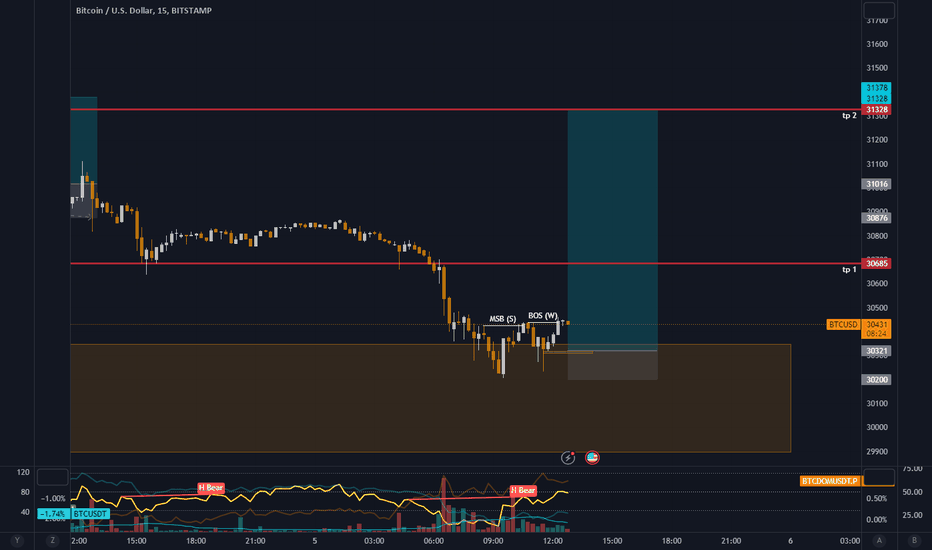

Short Trade = Daily Anti Cypher + Bearish Maxlev Pattern Short Trade = Daily Anti Cypher + Bearish Maxlev Pattern Price seems to be in a downtrend, creating lower low market structures. Confluences: 1. Price below FRVP POC 2. Price below AVWAP bands 3. Large Bearish Harmonic Pattern 4. Bearish Maxlev Pattern Target: 1. Liquidity Hunt from Maxlev Pattern 2. FVG

HaribonALT

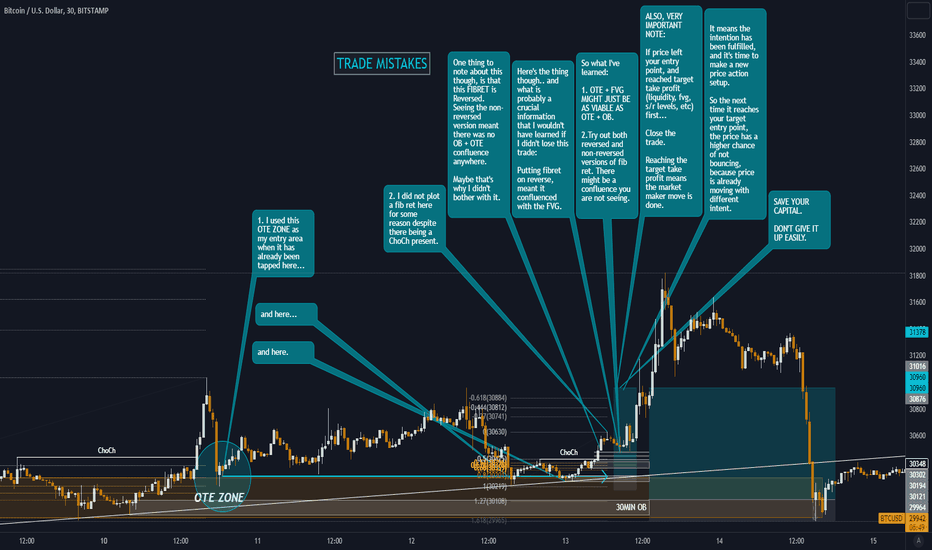

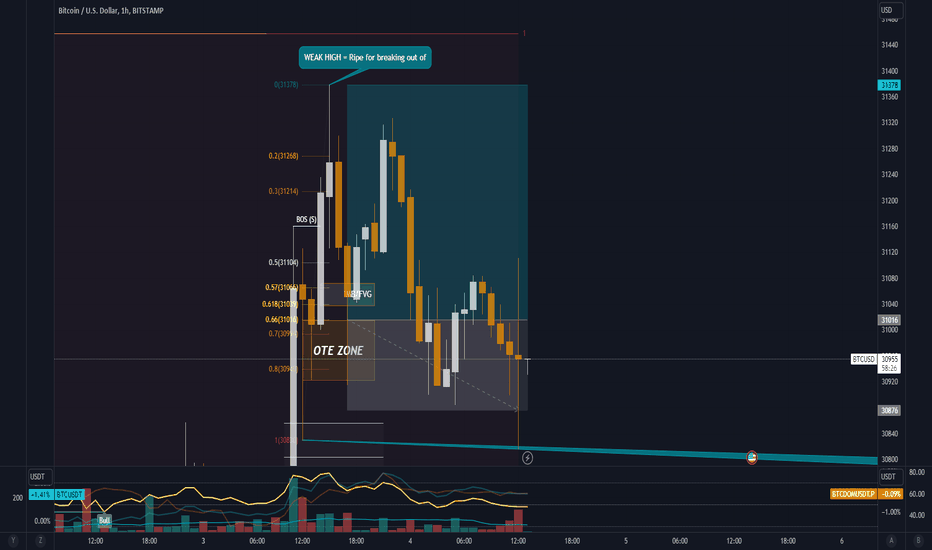

Harmonic + OB + IMB + OTE: Failed 1. I used the Previous OTE ZONE as my entry area when it has already been tapped a few times... 2. I did not plot a fib ret on the latest swing low/high for some reason despite there being a ChoCh present. One thing to note about this though, is that the FIBRET is Reversed. Seeing the non-reversed version meant there was no OB + OTE confluence anywhere. Maybe that's why I didn't bother with it. Here's the thing though.. and what is probably a crucial information that I wouldn't have learned if I didn't lose this trade: Putting fibret on reverse, meant it confluenced with the FVG. So what I've learned: 1. OTE + FVG MIGHT JUST BE AS VIABLE AS OTE + OB. 2.Try out both reversed and non-reversed versions of fib ret. There might be a confluence you are not seeing. ALSO, VERY IMPORTANT NOTE: If price left your entry point, and reached target take profit (liquidity, fvg, s/r levels, etc) first... Close the trade. Reaching the target take profit means the market maker move is done. It means the intention has been fulfilled, and it's time to make a new price action setup. So the next time it reaches your target entry point, the price has a higher chance of not bouncing, because price is already moving with different intent. CANCEL COMPLETED TRADES. SAVE YOUR CAPITAL. DON'T GIVE IT UP EASILY.

HaribonALT

Harmonic + OB + IMB + OTE Harmonic + OB + IMB + OTE Check the pic. Main Reason for Entry is the harmonic pattern. Waited for Choch, and there it was. Entry point will be the Orderblocks confluence with the OTE Zone, based on Fibonacci .57-.8, Targeting Previous Daily High. Stop Loss at below liquidity points. I made 2 entry points in case the first one gets SL hunted. Overall good trade if it works.

HaribonALT

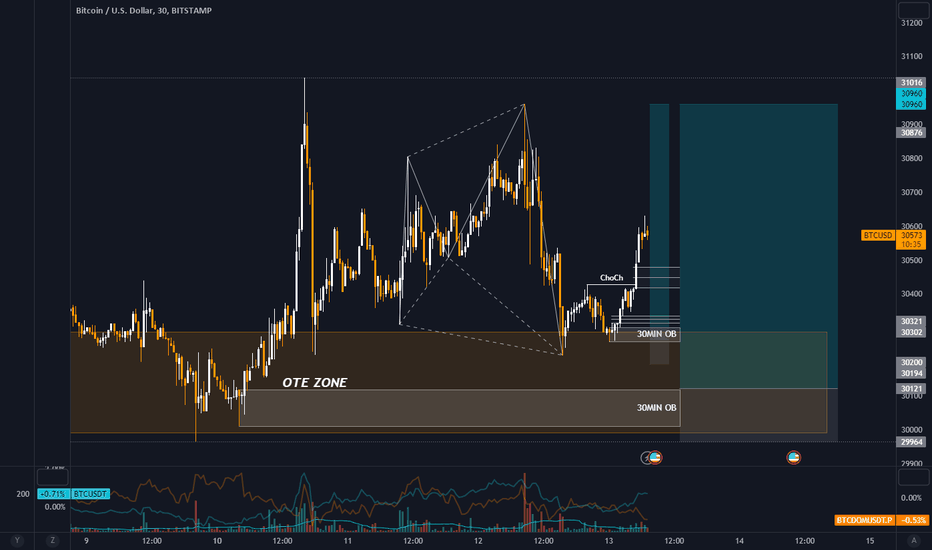

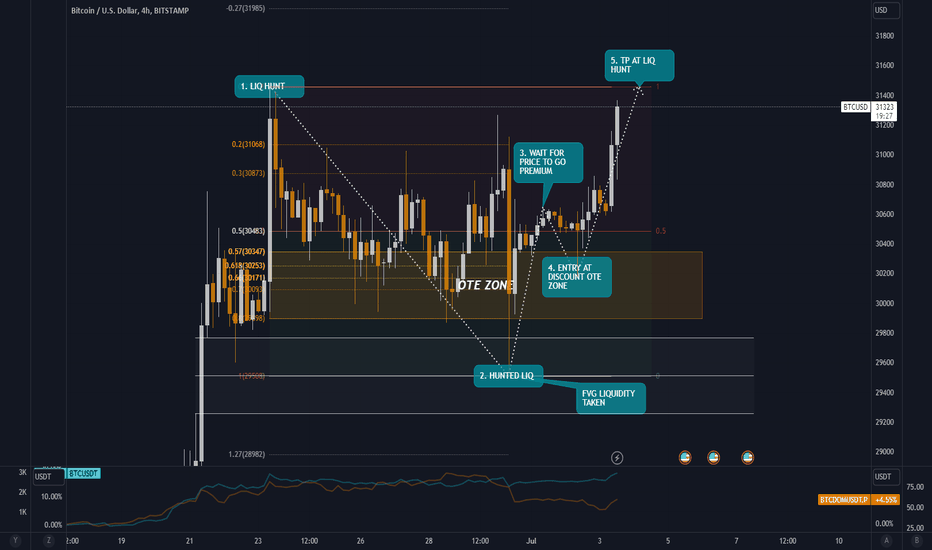

WinLev Continuation: Entry Point Missed, Pumped to Original TP WinLev Continuation: Entry Point Missed, Pumped to Original TP, AND THEN DUMPED. Hitting my Entry Point and immediately SL. Sad. Glad it's not real money I guess. So. What could I have done better? 1. Did a manual entry after seeing the entry point be "liquidity grabbed" and missed? 2. Waited for another long opportunity to enter trade. I think that's it. Target TP points were well researched. Price reached both the entry point(missing by a few pips) and target point in the order that was predicted. It was good. Entry point placement was just unlucky.

HaribonALT

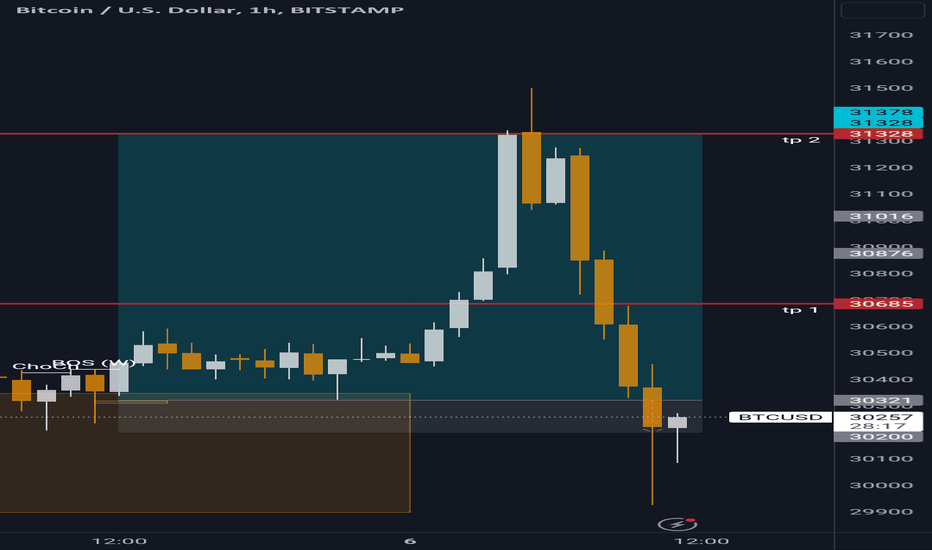

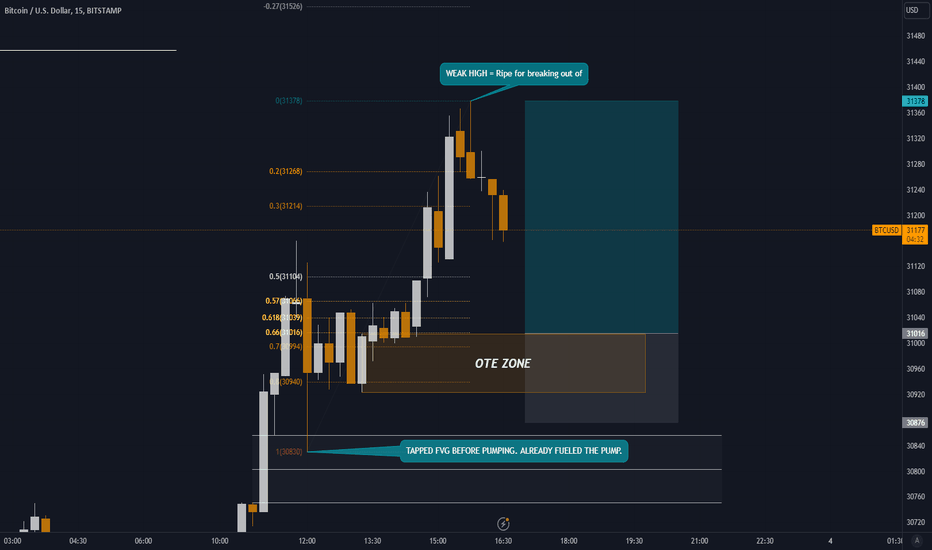

WinLev Continuation: Double Bottom Pattern After Hitting .618 Re-taking this trade. Double Bottom Pattern + Higher Low Present on OTE Zone. Plus, Winlev pattern is not yet invalidated(just the stoploss that I set). So, re-taking the trade and expect it to hit the original tp. Just tp 1 on opposite orderblock and tp2 on original target. This is good because I'm re-entering on a lower price point. = Recoup initial loss + Higher Profits if tp 1 and tp 2 is taken.

HaribonALT

WINLEV + PULLBACK OTE OB Pattern: Failed. WELP. SL HIT. It got so close to TP point yesterday though. Sad. Anyway. Reason trade failed? 1. Strong resistance 2. Too ambitious tp point? 3. I should have closed the trade once I saw price made a lower high and flipped to the downside. 4. Maybe I should have made the SL or even entry point a lot lower than the FVG? Current price just bounced from the FVG and it looks like a good re-entry point. I'll see what I can do.

HaribonALT

Pullback OTE + OB Trade Strategy Pullback OTE + OB Trade Strategy Pump + Pullback to OTE + Orderblock Strategy. Tapped FVG below + Weak High = ripe for more pump. Just has to gather more gas at the orderblock to fuel the breakout. I just can't think of any good or new thing to say about this. I've done this several times. You can follow this or not, it depends on you. Just put a stoploss and proper position sizing so you're good.

HaribonALT

"WinLev" Pattern At this point it's just called WinLev and MaxLev Patterns lol. Bullish = WinLev Bearish = MaxLev I was away from charting for a few days, so I didn't see this forming. Well, there's that. There will always be new opportunities for trading.Comment: Also, it will be good to turn off indicators you use before you try to chart. So it isn't messy, and you get to practice your brain before using indicators to cheat your way into a trading setup.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.