Happy_Candles

@t_Happy_Candles

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Happy_Candles

Right-Angled Broadening Wedge: Possible FVG setup after BoS

An obvious Right-Angled Broadening Formation (Bullish) Possible setup on weekly at S/R above pattern . Fair value gaps (FVG) after a break of structure (BoS) are powerful. Orders that didn't fill after a strong move create a zone that usually gets revisited. This would be an ideal area for smart money to re-enter the market. Need to wait for this weekly to close before confirming a FVG. Perhaps CPI today will see a continuation in momentum further cementing this weekly's low. Selling pressure at ATH might send price back to the potential FVG for an entry trigger. If price pulls back into structure then this idea is invalid. N.F.A.

Happy_Candles

NEAR, Butterfly Pattern

Near has put up a butterfly pattern along with a descending wedge. There is a divergence setting up on the OBV. R:R is 2:1 Alt cap is also in a descending wedge. 50% off load @ TP1, another 30% at TP2. SL of 20% = to 2% of acct.Broke out on the weekly, Near is up 25% since first post. Watching TP1, sticking to plan

Happy_Candles

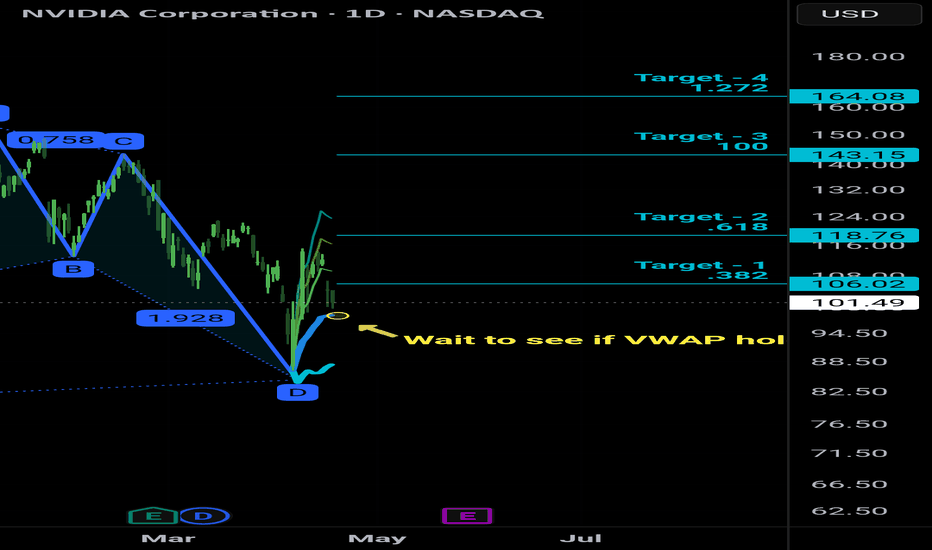

NVDA, CONFIRMED BAT, SWING TRADE

Wait for PA to pullback to VWAP after recent advance (100). VWAP may provide a good entry for a swing to TP2. Good risk to reward, stop just below lower band (light blue) loss = 1% of acct. 30% profit taking at TP1, exit at TP2 or if PA closes under TP1 after hitting TP1.Update: Today's close at 98.89 just above the vwap. Going to start building a position on this reclaim. SL at close below 93, 5%. Remember, 5% should = no more than 1-2% of entire trade acct. That ll keep your acct alive, so long as R:R is reasonably 2:1, you'll come out ahead over the long run, even if you have a string of losses. NFAHit TP1 (106) Thursday, offloaded 50% at 7% gain. Stop moved to entry, watching TP2Trailing stop here, hit 117 which is close enough to TP2, up 20% since entry

Happy_Candles

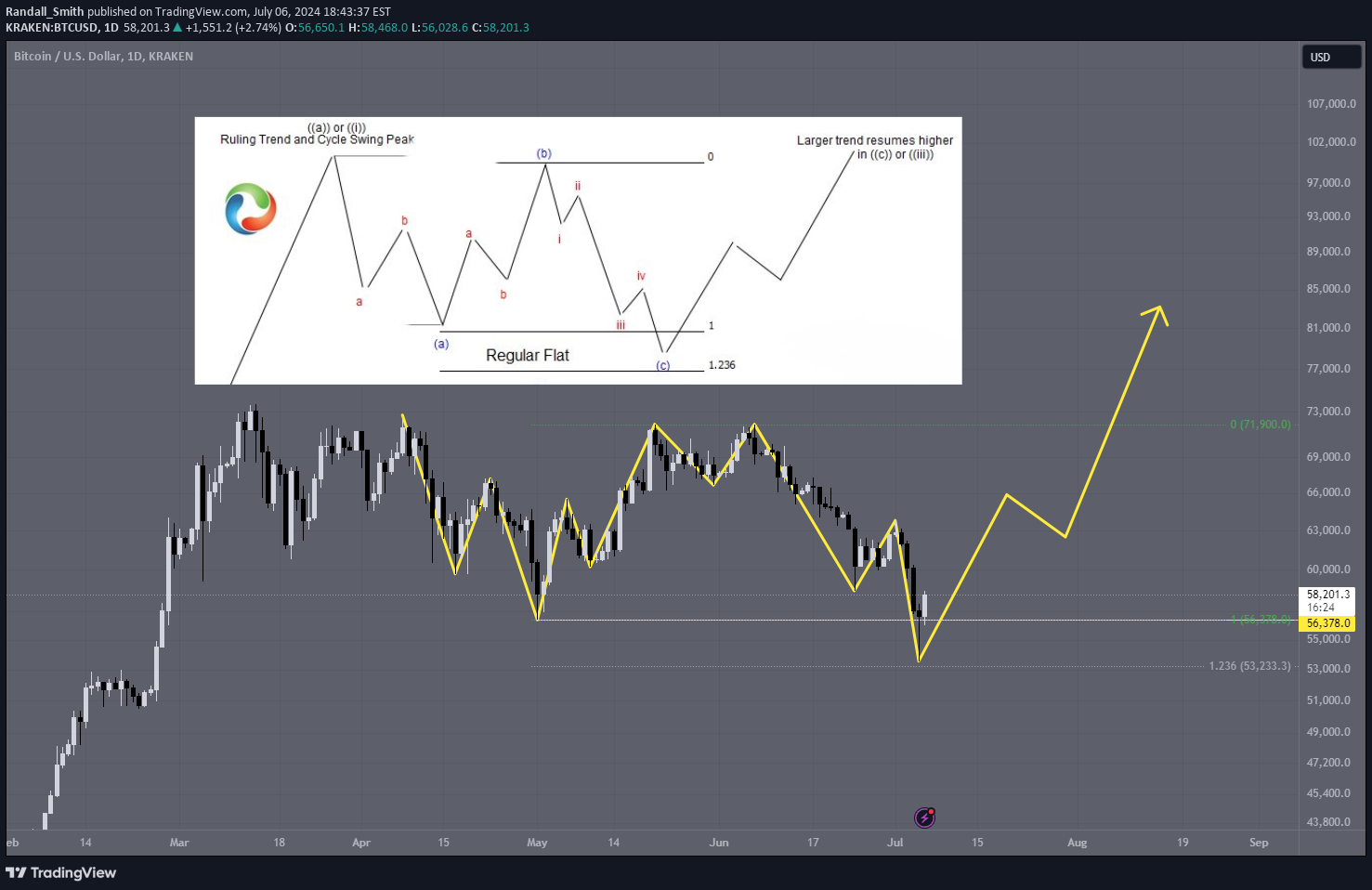

BTC Forecast: Regular Flat Correction

Keep in mind, the macro is a bullish uptrend. Above the weekly 50. Early post halving. Now we have what loos like a regular flat correction. What we would like to see... an impulse move above 62k and a daily close. Could enter or add at breakout or retest of 62k. Invalid if BTC closes below the ext 1.236.

Happy_Candles

Happy_Candles

BTC: Triple Bottom

I wouldn't short here, nothing like the previous channel.

Happy_Candles

BTC: The right time to go long

For a more conservative less riskier entry, if you're a seeing is bullieving kind of swing trader\investor, you could always wait for the 1st monthly close above the 8ema after the capitulation candle. Historically, that has been the right time to enter.

Happy_Candles

ATOM: Busted Symmetrical Triangle

A few ways you could trade this. Because price had closed on the other side of the triangle from where it had broke out, it is now a busted pattern. A single bust has the highest probability (67%), you could go short with SL above dotted horizontal or wait for price to close further than 10% away to confirm direction (down). If stopped out and green pathway becomes null, next highest probability is the blue path, short once price closes on other side of triangle once again. If the least probable plays out and red path is followed then enter when price closes outside of 10% area for confirmation to go long. You could also be conservative about your entry (least aggressive) simply waiting for price to close outside the 10% area before taking an entry in whichever direction the cool breeze sends it. NFA DOYR

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.