Hannya-waves

@t_Hannya-waves

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

پیشبینی قیمت بیت کوین تا سال ۲۰۲۶: تحلیل موج الیوت و فیبوناچی

mmm.. my entry analysis for bitcoin... 🧠 BTC/USD Elliott Wave & Fibonacci Analysis – Daily Chart This technical analysis applies Elliott Wave Theory and Fibonacci retracement levels to forecast Bitcoin's potential price trajectory from late 2025 into mid-2026. 🔍 Key Insights: • Elliott Wave Structure: The chart outlines a complex corrective pattern, with wave labels (X), A-B-C-D-E, and impulsive subwaves i-v. This suggests a potential completion of a larger corrective phase and the beginning of a new impulsive cycle. • Fibonacci Levels: Key retracement zones are highlighted: • 0.382 at $101,947.9 • 0.5 at $96,057.3 • 0.618 at $90,707.0 These levels act as potential support/resistance zones and confluence points for wave reversals.

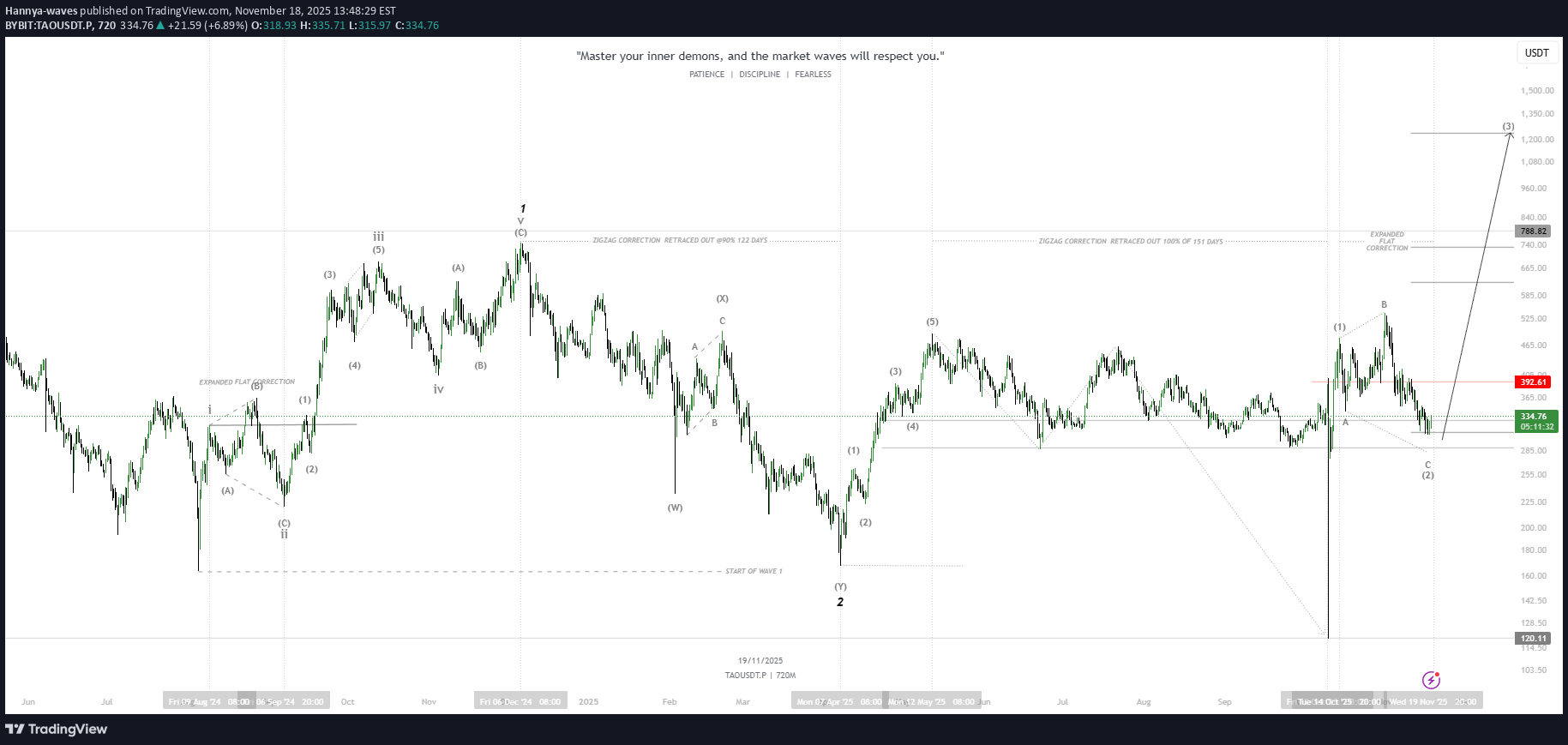

تحلیل TAO/USDT: آیا موج سوم انفجاری آغاز میشود؟ (اهداف ۶۶۵ تا ۱۲۰۰)

tao-usdt Thesis (one-liner): Looks like a completed Wave 1 up and a Wave 2 corrective structure has finished — price is sitting on the lower edge of the Wave-2 support zone (~₱334), so the more likely path is the start of an impulsive Wave 3 that aims much higher (targets shown on your chart around ₱665 → ₱788 → ₱1,200+). Why I like this count (plain English) The left–to–right structure shows a clean five-wave advance earlier (labelled 1), followed by a multi-leg corrective pattern (A-B-C / expanded flat / zigzag annotations). That is textbook for a Wave-1 → Wave-2 sequence. Wave-2 retraced and built a horizontal support band — price is back at that band (near ₱334), which often marks the springboard for a strong Wave-3. The projected Wave-3 on your chart is aggressive (typical: Wave-3 is often the longest); the chart’s measured expansions line up with major resistance levels at ~₱665, ₱788, then ~₱1,200. Key levels (from your chart) Current / support area: ~₱334 (immediate). Near resistance / breakout confirmation: ₱392.6 (red line). A clean daily close above here is a strong confirmation for the bullish case. Primary invalidation: a decisive break and daily close below the support band (~₱285–₱300 on your annotated box) would invalidate the bullish Wave-3 projection and point to a deeper corrective leg (the chart also shows a lower anchor near ₱120 as extreme scenario). Targets (progressive): first target ~₱665, next ~₱788, extended target ~₱1,200+ (these are on your Fibonacci/expansion rulers). Practical trade ideas (clear, with risk control) Conservative: Wait for a break & daily close above ₱392.6. Enter on retest if price pulls back — stop below ₱334 (or tighter depending on your edge). Aggressive (scalp / partial): Buy small size at current support ~₱334, add on a confirmed breakout above ₱392.6. Place a stop below ₱285 (invalidates the bullish structure). Targets & sizing: Scale out at the defined target bands (take partial profits at ~₱665, more at ~₱788) and let a small runner aim for ₱1,200+. Keep position sizing small enough that the stop is an acceptable % loss. Risk notes & alternate scenario If price collapses below the support band (~₱285) with volume, the count likely fails and a deeper correction to much lower levels becomes probable (your chart shows the lower extreme near ₱120). Treat that as invalidation, not a surprise — adjust risk accordingly. Always respect timeframes: this count is multi-month (weekly/daily structure). Short-term noise will happen; wait for your confirmation rules. Quick Elliott refresher (one paragraph) Elliott Wave reads markets as repeating psychology: impulses move in 5 waves (1–5) and corrections in 3 waves (A-B-C). After a 5-wave advance, a correcting 3-wave set (Wave-2) often retraces a portion of the move — when that correction ends at a logical support zone, the next impulse (Wave-3) tends to be the strongest and most profitable. Final thought (trading etiquette): keep stops tight, size small on unconfirmed moves, and only let a portion of the trade run for the big target. As your chart says up top — “Master your inner demons, and the market waves will respect you.” Patience + rules = edge.

تحلیل ICPUSDT: موج چهارم تمام شد؟ آماده جهش نهایی به سوی قله!

"ICP Ride: Wave by Wave!" What we’re looking at here is a classic Elliott Wave setup — basically, price movements with rhythm, structure, and a bit of trader psychology mixed in. 🌀 Wave Count Breakdown We completed Wave iii, the big momentum wave — that’s where the market said: "Let’s moon!" Now price is chilling down into Wave iv, which is normal. Waves need to exhale too — they can't pump forever. The current correction looks like it’s finishing up, holding above the 0.5 – 0.618 retracement zone — healthy pullback territory. ✨ Why That Zone Matters That retracement area is like the market’s coffee stop: Too shallow? It wasn’t done running. Too deep? Maybe the trend’s losing fuel. But here — it’s just right for Wave iv. 🎯 What Happens Next? If this is truly building the final Wave v, then we’re lining up for another leg — the one that often surprises traders who gave up on the pullback. You’ve got possible upside targets marked, and it’s realistic as long as structure holds and Wave iv doesn’t dip too deep. In short: "Wave iv is just stretching before the final sprint. Patience, discipline, and wave-count faith — the market respects those who respect the waves." Let the chart breathe, and let Wave v cook.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.