HaLa_TM

@t_HaLa_TM

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

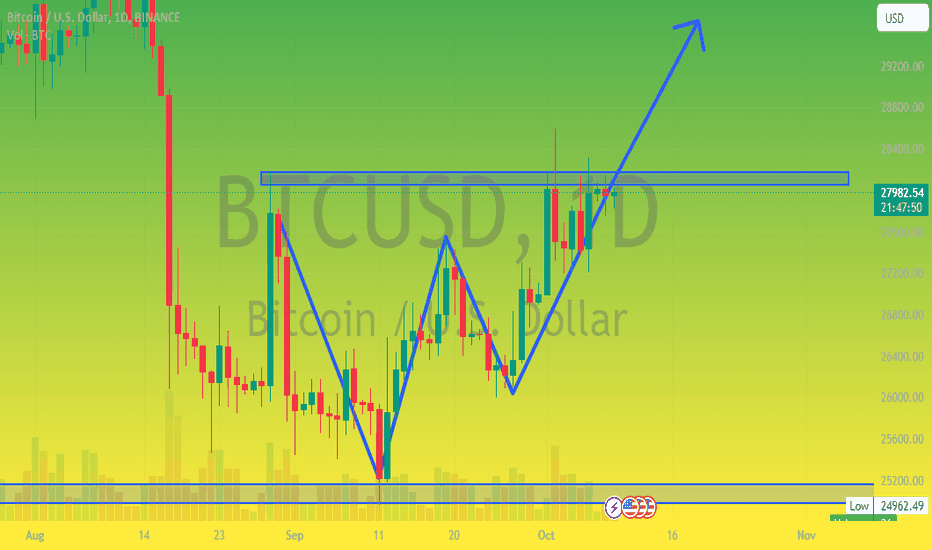

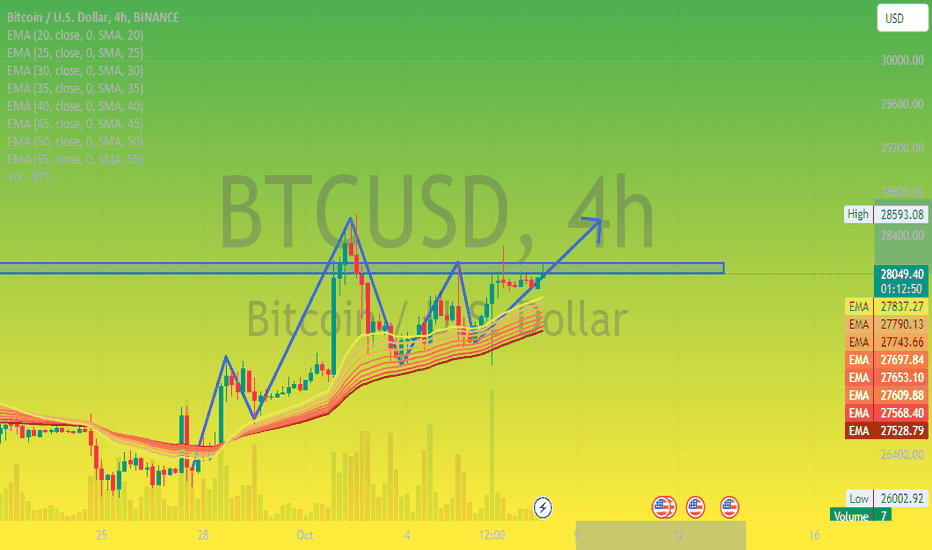

October has historically proven to be a significant month for Bitcoin and the overall cryptocurrency markets. The increased focus on Bitcoin and crypto trading during this month often leads to substantial gains, with the potential for significant profits in relatively minor trades. However, the path to earning $20 million is not without its challenges.In recent weeks, especially in September, Bitcoin's value has become a beacon of potential, albeit one that carries its risks. Seasoned investors know that navigating this landscape is far from straightforward, especially given the regulatory restrictions. Those who have been in the game for years are aware that the market doesn't allow weaker players to repeat their past actions.An analysis conducted by Jacobo Maximiliano, a renowned analyst at Bitget, indicates that a significant dip, potentially testing the $20 million support and buying range, seems likely. He points out that this pattern resembles the previous All-Time High (ATH) set in late 2018 and the principles observed in 2019.Maximiliano's insights highlight the nuanced nature of crypto trading. While the potential for substantial profits exists, it's crucial for investors to remain vigilant. Market dynamics, regulations, and global events all play a role in shaping the cryptocurrency landscape, making it imperative for traders to adapt their strategies accordingly.As October unfolds, investors are closely monitoring these developments, eager to capitalize on the market's fluctuations while remaining mindful of the inherent risks. In the ever-evolving world of cryptocurrency, adaptability and knowledge remain key to navigating the complexities and maximizing potential gains.

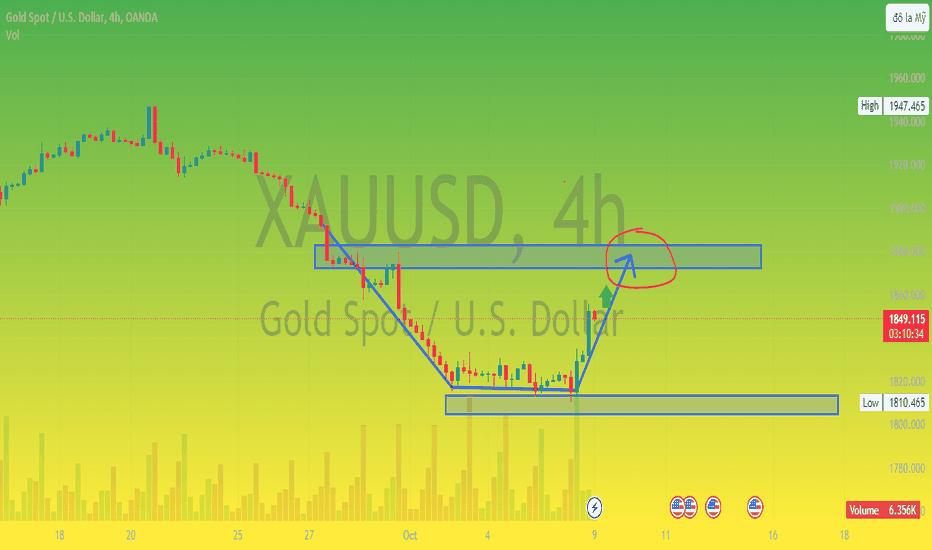

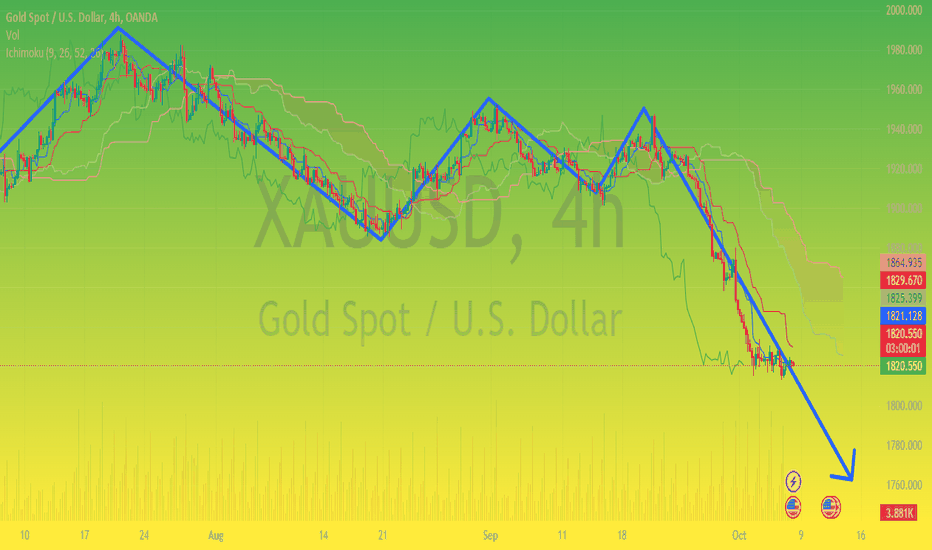

The global gold price has been under noticeable pressure and volatility recently. Currently, gold is listed at $1,848 per ounce on Kitco, showing an increase of $26 per ounce compared to early morning prices, catching the attention of both experts and investors alike.A recent survey by Kitco News has painted a multifaceted picture of gold's direction this week. According to the survey, 38% of analysts believe gold prices will rise, while an equal percentage predicts a decline, and 24% foresee stability. In the retail market, 43% of investors expect gold prices to rise, whereas 42% anticipate a decrease, and 15% think prices will remain stable in the short term.There seems to be a division in opinions regarding gold's prospects this week among experts and investors. Michael Moor, the founder of Moor Analytics, forecasts a decrease in gold prices. However, he notes signals indicating gold might have hit bottom and could be ready for a turnaround. Conversely, James Stanley from Forex.com does not believe a significant decline will occur, emphasizing that gold might maintain its recent range.In this context, the gold market continues to face uncertain factors, from economic growth to investment psychology. This creates an emotionally charged and unpredictable environment. Investors and market observers should closely monitor and stay updated with the latest information to make smart investment decisions in this uncertain period.1h

Bitcoin, the kingpin of cryptocurrencies, has recently weathered a storm, slipping below the crucial yellow support line. This descent has left many, myself included, bearish on BTC's future, speculating a downtrend possibly stretching into 2023.Following the initial plunge, Bitcoin astoundingly managed a significant recovery, clawing back a substantial part of its losses. Currently, it's teetering on the top-tier violet support level, displaying a notable degree of resilience.However, until we confirm a breakthrough with a weekly close above the resistance, the bears maintain technical control. I'm on the lookout for a rejection at this resistance, a signal that could lead to increased selling in the near future.Conversely, a weekly close above this resistance signifies a bullish sentiment, at least in the short term. The bulls seem to be gaining ground. The question remains: do they have the strength to push through?It's crucial to keep in mind that the broader stock market is currently on a downward trajectory. Historically, a bearish stock market rarely bodes well for BTC. In this volatile landscape, Bitcoin's fate hangs in the balance, with traders closely monitoring every move, hoping for signs of a more stable future.27974,341 hours

Gold prices have finally halted their downward spiral, driven by the weakening US dollar. The greenback continues to suffer losses following weaker-than-expected US employment data. The higher yields on US Treasury bonds have outperformed non-interest-bearing assets like gold.Gold prices put an end to their losing streak on September 25th, trading around $1,830 per troy ounce at the opening of the Asian trading session on Thursday. However, gold might face challenges due to market caution regarding the interest rate trajectory of the US Federal Reserve.Market sentiment leans towards a lower year-end forecast for spot gold prices due to persistently high expectations of a prolonged period of higher interest rates from the Federal Reserve.The US Dollar Index (DXY) has rebounded from its 11-month high after weak US employment data on Wednesday, potentially tempering the interest rates of the US Treasury. The DXY was trading slightly lower around 106.60 at the time of writing.Psychology, discipline, and capital management stand as the three factors constituting a winning strategy.In conclusion, while gold prices have shown signs of recovery amid oversold conditions, market caution regarding the Federal Reserve's interest rate policies continues to pose challenges. Investors are advised to keep a close eye on evolving economic indicators and the central bank's signals to make informed decisions in the ever-changing financial landscape.The market is following analysis in the right directionThe market is showing signs of improvement .

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.