Gold_Pips_Trading

@t_Gold_Pips_Trading

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Instrument: XAUUSD (Gold vs USD) Timeframe: Daily (D1) Analysis: Gold is trading near the 3465 support zone. This level has acted as a demand area in the past, and buyers are showing interest here again. If the price holds above 3492, a potential bullish move towards higher levels can be expected. Trade Plan: Entry Level: 3492 (after confirmation) Stop Loss: Below 34 (setup becomes invalid if price closes under this zone) Target 1: 3510 (partial profit) Target 2: 3525 (final target) Risk Management: The setup offers around 1:1.5 risk-to-reward. Position size should be managed so risk per trade remains small (around 1–2% of equity). Invalidation: If price closes below 3465, the bullish outlook will no longer be valid.congratulation target 1 has been reached 200 pips done

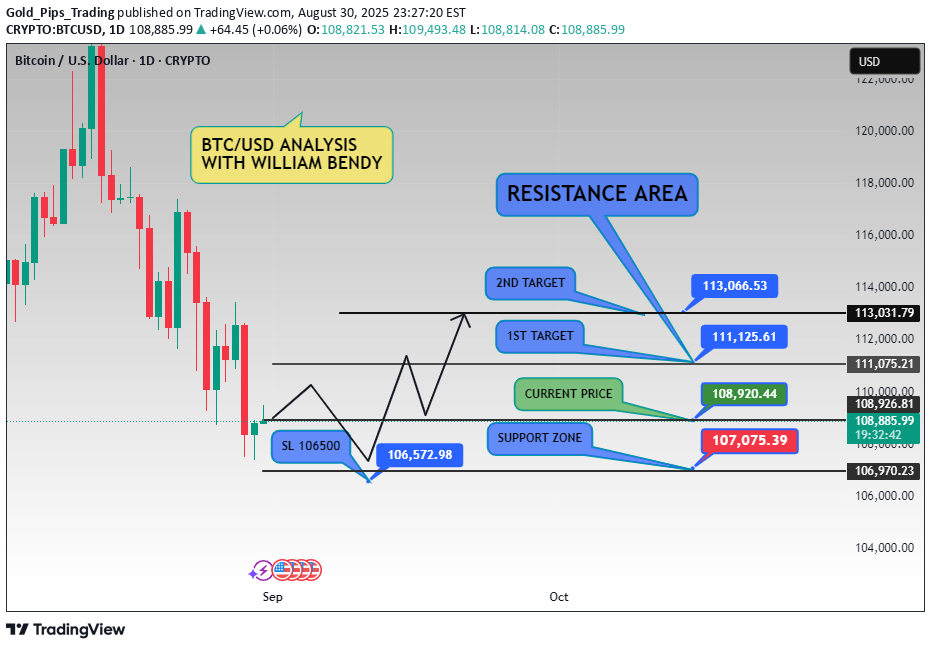

📊 Analysis Overview: Bitcoin currently trading around $108,900. Price is holding well above the support zone $107,000 – $109,000. If bulls maintain control, we may see upward momentum towards the next resistance levels. ✅ Key Levels: Support Zone: $107,000 – $109,000 1st Target: $111,125 2nd Target: $113,066 Resistance Area: $113,000 – $114,000 Stop Loss (SL): $106,500 ⚡ Trading Plan: As long as Bitcoin stays above support, long positions can be considered with targets towards $111K and $113K. Break below $106,500 may invalidate this setup. 📌 Note: This is educational analysis only, not financial advice. Always manage risk before entering trades.

Gold price is currently trading near the 3410–3420 resistance area. This zone has acted as supply in the past, and sellers may show interest here again. If the price fails to break above 3420 and rejects this resistance, a potential move towards the downside can be expected. --- 🔹 Trade Plan (Educational Idea) Entry Area (observation): 3410 Target 1: 3395 Support Zone: 3380 Stop Loss (invalid level): 3435 --- 🔹 Risk Management This setup provides around 1:1.5 risk-to-reward. Risk per trade should remain small (about 1–2% of account equity). --- 🔹 Invalidation If price closes above 3435, the bearish outlook will be invalidated.

Instrument: XAUUSD (Gold vs USD) Timeframe: Daily (D1) Analysis: Gold is trading near the 3355 support zone. This level has acted as a demand area in the past, and buyers are showing interest here again. If the price holds above 3372, a potential bullish move towards higher levels can be expected. Trade Plan: Entry Level: 3372 (after confirmation) Stop Loss: Below 3350 (setup becomes invalid if price closes under this zone) Target 1: 3390 (partial profit) Target 2: 3410 (final target) Risk Management: The setup offers around 1:1.5 risk-to-reward. Position size should be managed so risk per trade remains small (around 1–2% of equity). Invalidation: If price closes below 3350, the bullish outlook will no longer be valid.trade was active target 1 has been reached 200 pips doneCongratulations Guys All Targets has been reached 400+ pips done

Instrument: XAUUSD (Gold vs USD) Timeframe: Daily (D1) Analysis: Gold is trading near the 3320 support zone. This level has acted as a demand area in the past, and buyers are showing interest here again. If the price holds above 3336, a potential bullish move towards higher levels can be expected. Trade Plan: Entry Level: 3336 (after confirmation) Stop Loss: Below 3310 (setup becomes invalid if price closes under this zone) Target 1: 3350 (partial profit) Target 2: 3370 (final target) Risk Management: The setup offers around 1:1.5 risk-to-reward. Position size should be managed so risk per trade remains small (around 1–2% of equity). Invalidation: If price closes below 3310, the bullish outlook will no longer be valid.Target 1 has been Reached 300 pips doneTarget 2 has been reached 400 pips done

XAUUSD (Gold vs USD) Timeframe: Daily (D1) Analysis: Gold is currently holding above the 3320 support zone. This level has acted as a demand area, and buyers are showing signs of defending it. If price sustains above 3333, a bullish continuation towards higher levels becomes likely. Trade Idea: Entry: Above 3333 with bullish confirmation Stop Loss: Below 3310 (setup invalid if price closes under this zone) Target 1: 3310 (partial profit) Target 2: 3320 (final target) [11:07 am, 01/08/2025] Gold Pips Trading: XAUUSD Daily | Long Setup from 3292 towards 3320 [11:14 am, 01/08/2025] Gold Pips Trading: Instrument: XAUUSD (Gold vs USD) Timeframe: Daily (D1) Analysis: Gold is trading near the 3280 support zone. This level has acted as a demand area in the past, and buyers are showing interest here again. If the price holds above 3292, a potential bullish move towards higher levels can be expected. Trade Plan: Entry Level: 3292 (after confirmation) Stop Loss: Below 3275 (setup becomes invalid if price closes under this zone) Target 1: 3350 (partial profit) Target 2: 3370 (final target) Risk Management: The setup offers around 1:1.5 risk-to-reward. Position size should be managed so risk per trade remains small (around 1–2% of equity). Invalidation: If price closes below 3310, the bullish outlook will no longer be valid.

Instrument: XAUUSD (Gold vs USD) Timeframe: Daily (D1) Analysis: Gold is trading near the 3320 support zone. This level has acted as a demand area in the past, and buyers are showing interest here again. If the price holds above 3344, a potential bullish move towards higher levels can be expected. Trade Plan: Entry Level: 3344 (after confirmation) Stop Loss: Below 3310 (setup becomes invalid if price closes under this zone) Target 1: 3360 (partial profit) Target 2: 3380 (final target) Risk Management: The setup offers around 1:1.5 risk-to-reward. Position size should be managed so risk per trade remains small (around 1–2% of equity). Invalidation: If price closes below 3310, the bullish outlook will no longer be valid.

Instrument: XAUUSD (Gold vs USD) Timeframe: Daily (D1) Analysis: Gold is currently holding above the 3310 support zone. This level has acted as a demand area, and buyers are showing signs of defending it. If price sustains above 3337, a bullish continuation towards higher levels becomes likely. Trade Idea: Entry: Above 3337 with bullish confirmation Stop Loss: Below 3305 (setup invalid if price closes under this zone) Target 1: 3360 (partial profit) Target 2: 3380 (final target)

**"This is a D1 (Daily) technical analysis for XAUUSD. Key levels to watch: Support Zones: 3310 & 3340 Entry Point: 3355 (on breakout confirmation) Resistance Area: 3380 Stop Loss: 3385 A breakout above 3355 could indicate further bullish momentum towards 3380, while failure to hold above 3340 may bring price back towards 3310 support. Traders should watch price action closely around these levels."**congratulatiion guys 1st support zone has been reached

BTCUSDT daily chart shows a strong bullish parallel channel. Price is in an uptrend, and after a pullback, there’s a high probability of a new bullish wave starting. 📌 Entry: 118,500 (after pullback confirmation) 🎯 Target: 120,500 (just below resistance for a safe exit) 🛡 Stop Loss: 117,500 (below support zone) Risk-to-reward ratio is approximately 1:2. A perfect setup for short-term traders — trade with the trend and capture the momentum.all target reached 400 pips done

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.