Gems-Trades

@t_Gems-Trades

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

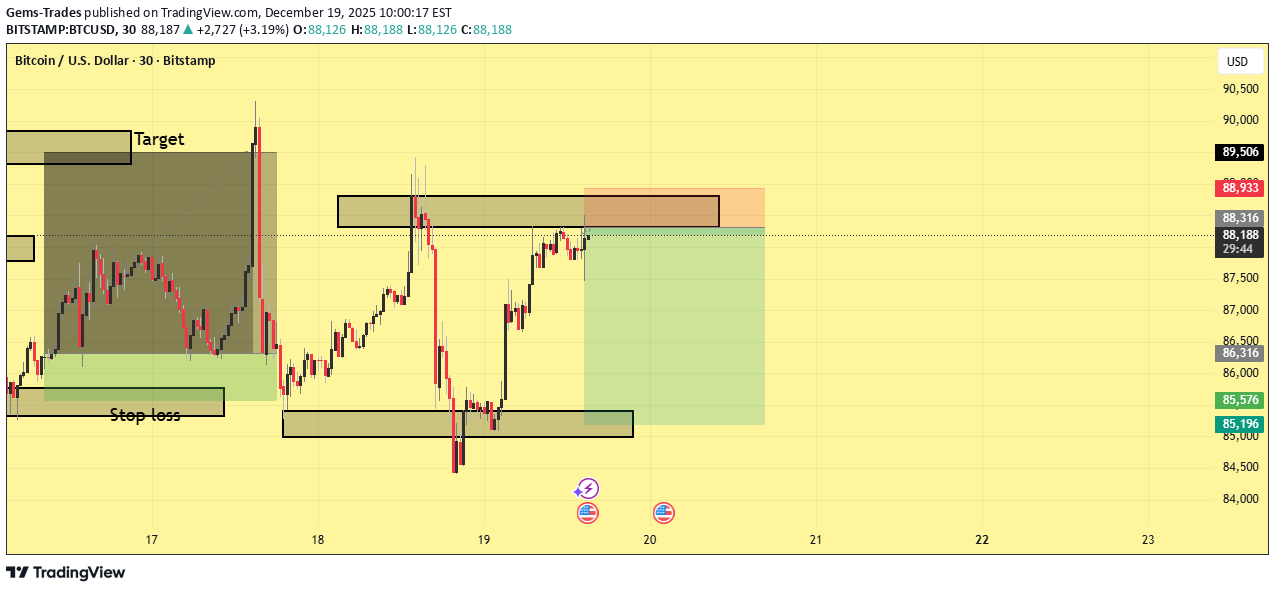

BTCUSD – Short-Term Sell from Supply Zone (30m)

Bitcoin is currently trading back into a well-defined supply/resistance zone after a strong impulsive move up. Previous price action shows clear rejection from this area, suggesting sellers are active and defending this level. Trade Plan: Bias: Short (sell from resistance) Entry Zone: 88,300 – 88,900 (supply area) Stop Loss: Above 89,500 (invalidates bearish setup) Target: 85,500 – 85,200 (demand/support zone) Rationale: Price has rallied into a prior rejection zone Structure shows potential lower high formation Risk-to-reward is favorable from resistance Target aligns with previous demand and liquidity area Invalidation: A strong close above the supply zone would invalidate the setup and suggest continuation to the upside.

ETHUSDT – Short Setup from Resistance (Supply Zone Rejection)

ETH is showing a clear rejection from a strong supply / resistance zone after a corrective move up. Price previously swept liquidity above this zone and failed to hold, confirming sellers’ presence. The current structure suggests a bearish continuation with price respecting lower highs and rejecting resistance. This provides a favorable short opportunity with defined risk. Trade Plan: Entry: Around 2,957–2,980 USDT (retest of resistance) Stop Loss: Above 3,010–3,020 USDT (above supply zone invalidation) Target: 2,790–2,800 USDT (demand / support zone) Confluence: Strong resistance / supply zone Liquidity grab above highs Bearish market structure Clear risk-to-reward setup Invalidation: A strong close above the resistance zone would invalidate the short bias

ETH/USDT | Buyer Strength from Demand – Targeting Supply

Ethereum has completed a sharp sell-off and is now reacting strongly from a well-defined demand zone on the 30-minute timeframe. The impulsive bounce indicates active buying interest, suggesting a corrective retracement toward the previous consolidation and supply area. Price is currently approaching a key resistance zone, which aligns with the proposed entry area. This level previously acted as support before the breakdown, increasing the probability of a pullback and continuation move after a healthy retest. Technical Overview: Market structure: Impulsive drop followed by corrective recovery Key support: Lower demand zone (strong buyer reaction) Key resistance: Prior support turned resistance / supply zone Bias: Bullish retracement toward higher supply Trade Plan: Entry: On confirmation within the highlighted entry zone Stop Loss: Below the marked support level Target: Upper supply / liquidity zone

ETHUSDT (30-Minute) — Bullish Reversal From Demand Zone

Ethereum has experienced a strong impulsive sell-off from the upper supply zone, followed by a period of consolidation at a clearly defined demand/support area. Price is currently respecting this base, indicating potential absorption of selling pressure and the possibility of a bullish retracement. The marked entry zone aligns with previous structure support, making it a favorable area for long positions. A tight stop loss is placed below the demand zone to protect against a breakdown and continuation of bearish momentum. The upside target is set near the prior supply zone, where selling pressure is expected to re-enter the market. Trade Bias: Bullish (counter-trend / retracement) Entry: Near demand/support zone Stop Loss: Below the demand zone Target: Previous supply / resistance area This setup offers a favorable risk-to-reward ratio if price confirms support and shows bullish continuation. Risk management is essential, as failure to hold the demand zone may lead to further downside.

XAUUSD – Bullish Reversal From Demand Zone (30M)

Gold is showing signs of bullish continuation after a corrective move into a strong demand zone. Price previously respected this area and is now attempting to push higher, suggesting buyers are stepping back in. Trade Plan: Entry: Around 4300.70 Stop Loss: Below 4273.20 (below demand structure) Target: 4426.60 (prior supply / resistance zone) Rationale: Price reacting from a well-defined demand zone Higher-timeframe bullish structure remains intact Previous resistance zones above act as logical profit targets Favorable risk-to-reward setup Invalidation: A strong close below the demand zone would invalidate the bullish scenario. Always manage risk properly. This is not financial advice.

BTCUSD – 30M | Sell the Pullback After Breakdown

Bitcoin has experienced a strong bearish impulse, breaking below a key demand area and shifting short-term market structure to the downside. After the sell-off, price is now consolidating at lower levels, suggesting a pause before the next move. The upper highlighted zone represents a previous support turned resistance (supply). Any pullback into this area offers a potential short-selling opportunity in line with the dominant bearish momentum. The trade idea is based on: Clear break of structure (BOS) to the downside Strong displacement confirming bearish intent Price holding below key resistance levels Trade Plan: Entry: On pullback into resistance / bearish confirmation Target: Upper marked target zone (liquidity & imbalance fill) Stop Loss: Below the lower demand zone (invalidation of structure) As long as price remains below the marked resistance, bearish bias remains valid. A clean reclaim above resistance would invalidate this setup. Always wait for confirmation and manage risk accordingly.**Trade Update: Target Achieved Successfully** The projected upside move has played out as expected, with price reaching the marked target zone. The reaction from this level confirms the effectiveness of the prior demand area and the bullish continuation structure. Partial or full profits can be secured at this level as planned. Going forward, traders should monitor price behavior around the target zone for either consolidation or a potential retracement. Any pullback holding above key support may offer continuation opportunities, while failure to hold could signal a short-term correction. Overall, this setup delivered a clean execution with disciplined risk management and favorable risk-to-reward.

XAUUSD (Gold) – Supply Zone Rejection | Short Setup on 45M

Gold price has rallied into a major supply / resistance zone where previous selling pressure was strong. After the impulsive bullish move, price is now showing signs of exhaustion and rejection near the upper supply area, indicating potential distribution. Market structure suggests a lower-high formation inside the supply zone, favoring a bearish continuation. A downside move is expected toward the key demand zone around 4200, which aligns with prior accumulation and liquidity. Trade Plan Bias: Bearish from supply Entry: Rejection or confirmation inside the supply zone Stop Loss: Above the marked supply area Target: Lower demand zone (≈4200) Risk Management: Wait for confirmation before entry

احتمال بازگشت بیت کوین پس از نقدینگیزدایی: استراتژی خرید در حمایت ۹۰,۰۰۰ دلاری

Price has tapped a well-defined demand zone around 90,000 after a sharp selloff, showing early signs of reaction and potential reversal. The setup builds on a clean liquidity sweep below previous lows, followed by stabilization within the demand block. A long position is positioned at the current support, with a protective stop below the zone to mitigate downside risk. If bullish momentum follows through, upside continuation toward the 94,000 to 94,600 supply area remains the primary target, where prior rejection and heavy selling pressure were observed. This creates a favorable risk-to-reward structure, contingent on buyers defending the demand level and reclaiming short-term structure.

BTCUSD Long Setup: Demand Zone Retest with High R:R Potential

This setup highlights a potential long opportunity on BTCUSD following a clean retest of a key demand zone. After a sharp impulse move upward, price pulled back into a previously established support block, confirming it as a valid re-accumulation area. The market respected this zone with multiple rejections, signaling buyer interest. The entry is positioned directly on the retest of the demand zone, aligning with structure and maintaining a favorable risk-reward profile. The stop loss is placed safely below the zone to account for volatility and prevent premature invalidation. The target aims for a continuation toward the next liquidity pocket above, reflecting the expectation that buyers will reclaim control and push price higher. This idea leverages market structure, zone retest, and momentum recovery to outline a disciplined, high-probability long setup

بیت کوین در آستانه صعود: آیا قیمت به ۹۲ هزار دلار بازمیگردد؟

Bitcoin has completed a sharp corrective move after forming a double-top near the 92,200–92,400 major supply zone. Price then retraced back into a strong demand zone around 89,600–89,900, where buyers aggressively stepped in. The market has shown a clear liquidity grab below previous lows, followed by a bullish reaction, signaling potential trend continuation. 🔍 Key Technical Highlights Demand Zone Rejection: Price tapped into the 89.6k–89.9k support block and instantly bounced. Bullish Structure: After the liquidity sweep, price began forming higher-low structure indicating reversal momentum. Upside Target: The next major objective remains the 92,200–92,400 supply zone where previous liquidity resides. Risk–Reward Setup: Long entries from demand aim toward the upper resistance block for a favorable R:R. 📈 Bias: Bullish Rebound Toward Major Supply Zone As long as Bitcoin holds above the highlighted demand area, the expectation remains for a bullish push toward the 92.2k–92.4k zone.The target is reached

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.