FxAlena77

@t_FxAlena77

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

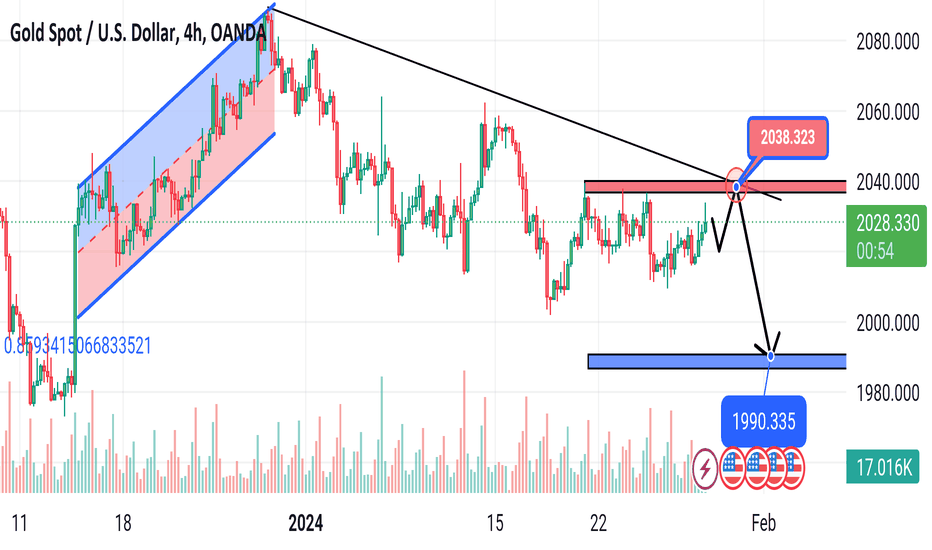

GOLD DOWN 👇 (READ CAPTION)

Gold price (XAU/USD) catches fresh bids on the first day of a new week and builds on its steady intraday ascent through the early part of the European session. The precious metal breaks through the 50-day Simple Moving Average (SMA) barrier, though bulls need to wait for a move beyond the $2,040-2,042 supply zone before positioning for any further gains ahead of the FOMC decision on Wednesday. Heading into the key central bank event risk, a further escalation of conflicts in the Middle East turns out to be a key factor acting as a tailwind for the safe-haven Gold price. Meanwhile, the flight to safety drags the US Treasury bond yields lower and further lends support to the XAU/USD. Meanwhile, the US Dollar (USD) remains below a one-month high touched last week and does little to provide an impetus. That said, diminishing odds for a more aggressive policy easing by the Federal Reserve (Fed) in 2024 might continue to act as a tailwind for the USD and cap the upside for the non-yielding Gold price. This, in turn, warrants some caution for bullish traders and makes it prudent to wait for strong follow-through buying before confirming that the precious metal has bottomed out near the $2,000 psychological mark.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.