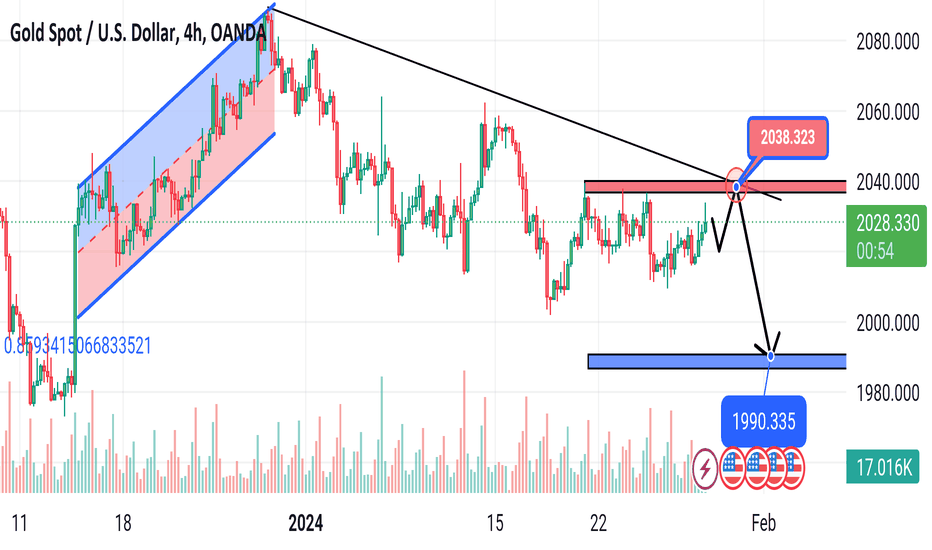

Technical analysis by FxAlena77 about Symbol PAXG: Sell recommendation (1/29/2024)

GOLD DOWN 👇 (READ CAPTION)

Gold price (XAU/USD) catches fresh bids on the first day of a new week and builds on its steady intraday ascent through the early part of the European session. The precious metal breaks through the 50-day Simple Moving Average (SMA) barrier, though bulls need to wait for a move beyond the $2,040-2,042 supply zone before positioning for any further gains ahead of the FOMC decision on Wednesday. Heading into the key central bank event risk, a further escalation of conflicts in the Middle East turns out to be a key factor acting as a tailwind for the safe-haven Gold price. Meanwhile, the flight to safety drags the US Treasury bond yields lower and further lends support to the XAU/USD. Meanwhile, the US Dollar (USD) remains below a one-month high touched last week and does little to provide an impetus. That said, diminishing odds for a more aggressive policy easing by the Federal Reserve (Fed) in 2024 might continue to act as a tailwind for the USD and cap the upside for the non-yielding Gold price. This, in turn, warrants some caution for bullish traders and makes it prudent to wait for strong follow-through buying before confirming that the precious metal has bottomed out near the $2,000 psychological mark.