FractalNoise

@t_FractalNoise

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

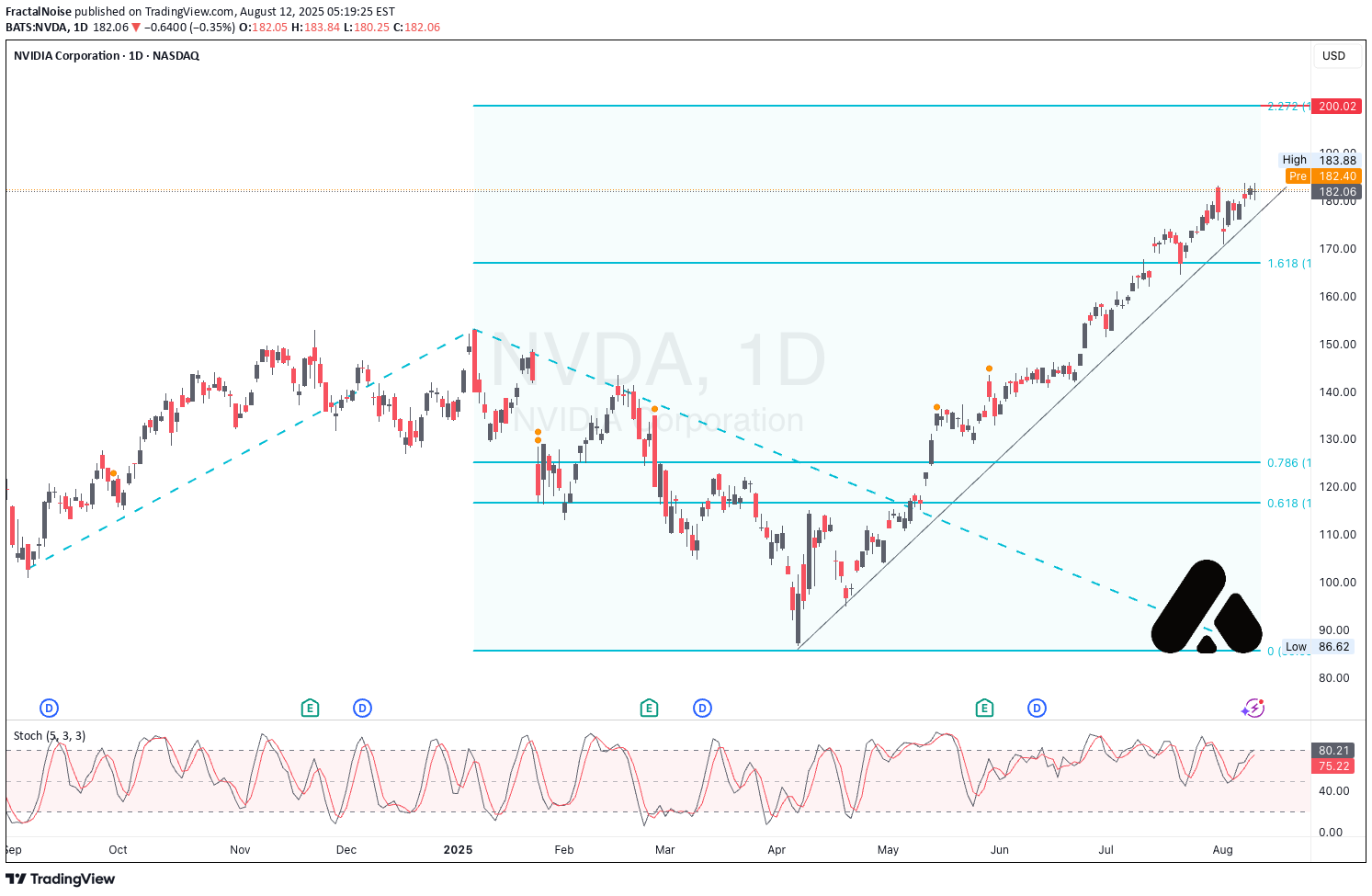

NVDA keeps pushing towards $200 major resistance area, a very good momentum showed by a clear bullish trendline and stochastic momentum. No sign of bearish yet but still we've seen a slow but steady gain over the last couple days. Trend-based fibonacci is used to project the target price for NVDA. Short-term downward momentum might appear, however if NVDA isn't break down the 1.618 fibonacci level ($165-$170 price range) from the previous trend-based fibonacci, we could say that NVDA still remain bullish. Stop loss is optional on that level.

Current Trend :The price is trading below both the 21 & 34 EMA, indicating bearish momentum in the short term to medium term. A declining EMA slope confirms the weakening price actionKey Support and Resistance :Support range around $92,000 - $90,000.Resistance range around $96,000 - $100,000 (psychological level).Indicator :Volume is in a declining pattern suggesting a reduced market participation, which could lead to either a continuation of the trend or a consolidation phase.Stochastic is in the oversold region below 20, suggesting a potential reversal or relief bounce in the near term if buyers step in.Possible Scenarios :1. Bearish Continuations : If the price fails to reclaim the 21 EMA and the stochastic remains oversold, Bitcoin could retest lower support levels around $88,000–$90,000.2. Bullish Reversal: A bullish divergence in the Stochastic coupled with strong buying volume could lead to a bounce towards $96,000 or higher, potentially testing the 34 EMA.Outlook :Short-term : Cautiously bearish unless the price reclaims key EMA levels with convincing volume.Medium-term : Monitor for a potential bounce if oversold conditions persist and buyers show strength.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.