Financebroker

@t_Financebroker

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Financebroker

Yesterday's bullish consolidation pushed the price of Ethereum to the $2644 level. With this jump, this year's new high was formed, and the previous time we were at that level was in May 2022. Today, we are looking at consolidation taking place in the $2560-$2620 range. The price of Ethereum remains high, which could influence us to see a break above and the formation of a new high. Potential higher targets are $2680 and $2700 levels.

Financebroker

The price of Cardano followed the movement of other cryptocurrencies yesterday. This led to a pullback to the 0.500 level from the 0.600 level. We are gaining support and moving above the 0.540 level. After that, the price consolidates slightly, recovering to the 0.570 level. We need a continuation of this consolidation in order to go up and reduce yesterday's losses. Potential higher targets are 0.580 and 0.600 levels. We have additional pressure in the zone around the 0.600 level in the EMA50 moving average. We need a negative consolidation and a drop to the 0.540 support level for a bearish scenario. Slipping below it intensifies the bearish pressure and affects further withdrawal and testing of lower support levels. Potential lower targets are 0.520 and 0.500 levels.

Financebroker

This week, we saw a continuation of the bullish consolidation in the price of gold. We started the week at the $1925 level, and now we see the formation of a new high at the $1985 level. The bullish momentum is still very strong, and we could expect to see a continuation to the $1990 level. Above, we would be tempted to go ahead and test the $2000 level. The previous time, the price of gold was at the $2000 level in May of this year.

Financebroker

This morning, we saw the formation of a new weekly low at the 0.05738 level. We stayed down there briefly, and the price retreated to the 0.05820 level. We are currently consolidating around that level and need a break above to continue to the next resistance at the 0.05850 level. In that zone, we could expect more resistance that could send the price of Dogecoin down again. Potential lower targets are 0.05750 and 0.05700 levels. We need a price jump above the 0.05850 level for a bullish option. Then, we need to stay above and form a new bottom at that level. With the next impulse, we would have the opportunity to continue on the bullish side. Potential higher targets are 0.05900 and 0.05950 levels. We will have additional pressure and resistance in the EMA50 moving average in the zone around the 0.05900 level.

Financebroker

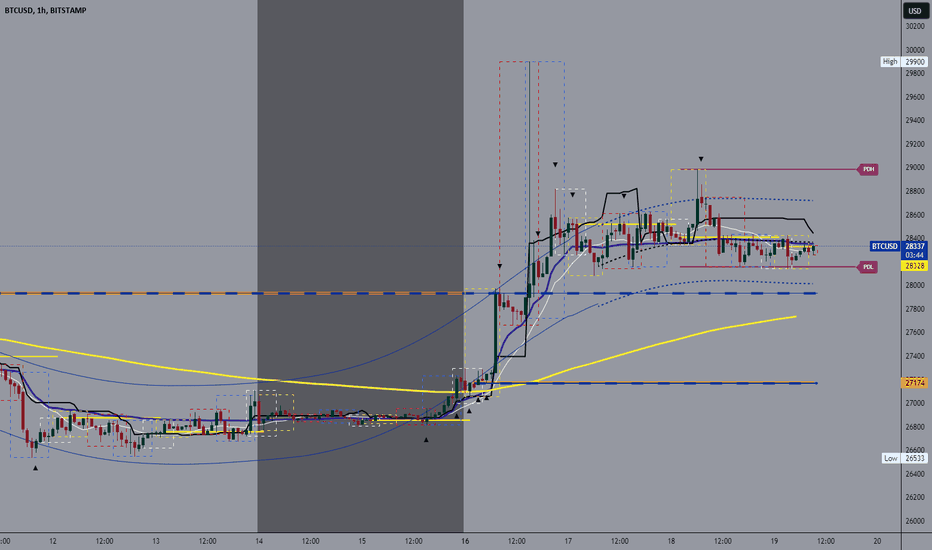

Bitcoin chart analysis The price of bitcoin in the previous 12 hours moved in the $28200-$28400 range. At the moment, we are still in that zone, and we are continuing with consolidation. A certain bearish pressure prevents us from breaking above the $28400 level. So it is possible that we will see a decline below the $28200 level and visit the support at the $28000 level. The EMA50 moving average is in the zone around $27,800, and we could expect more specific support there. We need a positive consolidation and a break above the $28400 level for a bullish option. Then, we would have to hold above there in order to launch a continuation to the bullish side from there. Potential higher targets are $28600 and $28800 levels.

Financebroker

the price of gold is on the way to $1930, we have a good consolidation and indicator support to continue to the bullish side

Financebroker

With this positive consolidation, Bitcoin has a chance to recover to the $27000 level. Thus, we would get closer to the EMA 50 moving average at the $27500 level.

Financebroker

Ethereum price retested support at the $1200 level yesterday. After this, we returned to the zone of the previous movement around the $1220 level. We need a more concrete break above and a move to $1250 if we want to see any progress. Then we need to hold up there and form a new bottom for the next bullish impulse. then we would have a chance to reach $1,275, and maybe $1,300.

Financebroker

After the support at $1225 yesterday, the price of Ethereum started a bullish impulse that moved it to the $1295 level. We are very close to reaching the $1300 level and climbing above it. We need a non-positive consolidation and a break above to continue the bullish option. If we succeed, we will have a good chance to see the price recovery. Potential higher targets are $1325 and $1350 levels. We need a negative consolidation and a price pullback below the $1275 level for a bearish option. A drop below that level could mean that we will see a deeper pullback in the price of Ethereum. Potential lower targets are $1250 and $1225 levels.

Financebroker

The price of Bitcoin formed its new four-week high at the $17420 level this morning. Currently, the price of Bitcoin is forming a minor pullback as the previous bullish impulse has slowed down. We are now testing support at the $17250 level. A price breakout below could cause the price of Bitcoin to fall further to the $17,000 level. If the consolidation around that level continues, the bearish pressure could increase. This would lead to a breakout below, and we are looking for the first next support at the $16750 level. A potential lower target is the $16500 level. For a bullish option, we need positive consolidation and a return to the previous high. A break above would bring us closer to the $17,500 level. Then we would have to hold above and, with a bullish impulse, start a further recovery. Potential higher targets are $17750 and $18000 levels.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.