FenzoFxBroker

@t_FenzoFxBroker

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

FenzoFxBroker

صعود انفجاری XRP در راه است؟ پیشبینی قیمت و سطوح کلیدی حمایت و مقاومت

FenzoFx— Technical indicators show oversold conditions and bullish divergence in momentum. As a result, we expect a potential rebound toward higher resistance levels before the broader downtrend resumes. In this scenario, XRP could rise toward $2.2230, then pull back to $1.9220, with major sell-side liquidity resting at $1.7710.

FenzoFxBroker

لایتکوین در آستانه سقوط: آیا حمایت ۹۳ دلاری میشکند؟

FenzoFx—Litecoin remains in a bear market, down 2.00% today and trading near $93.00 within the bullish fair value gap. Key support lies at $89.30. A break below this level could accelerate the downtrend, potentially driving the price toward $78.60. If selling pressure continues, the next support zone is $71.70, aligned with the lower band of the bearish channel.

FenzoFxBroker

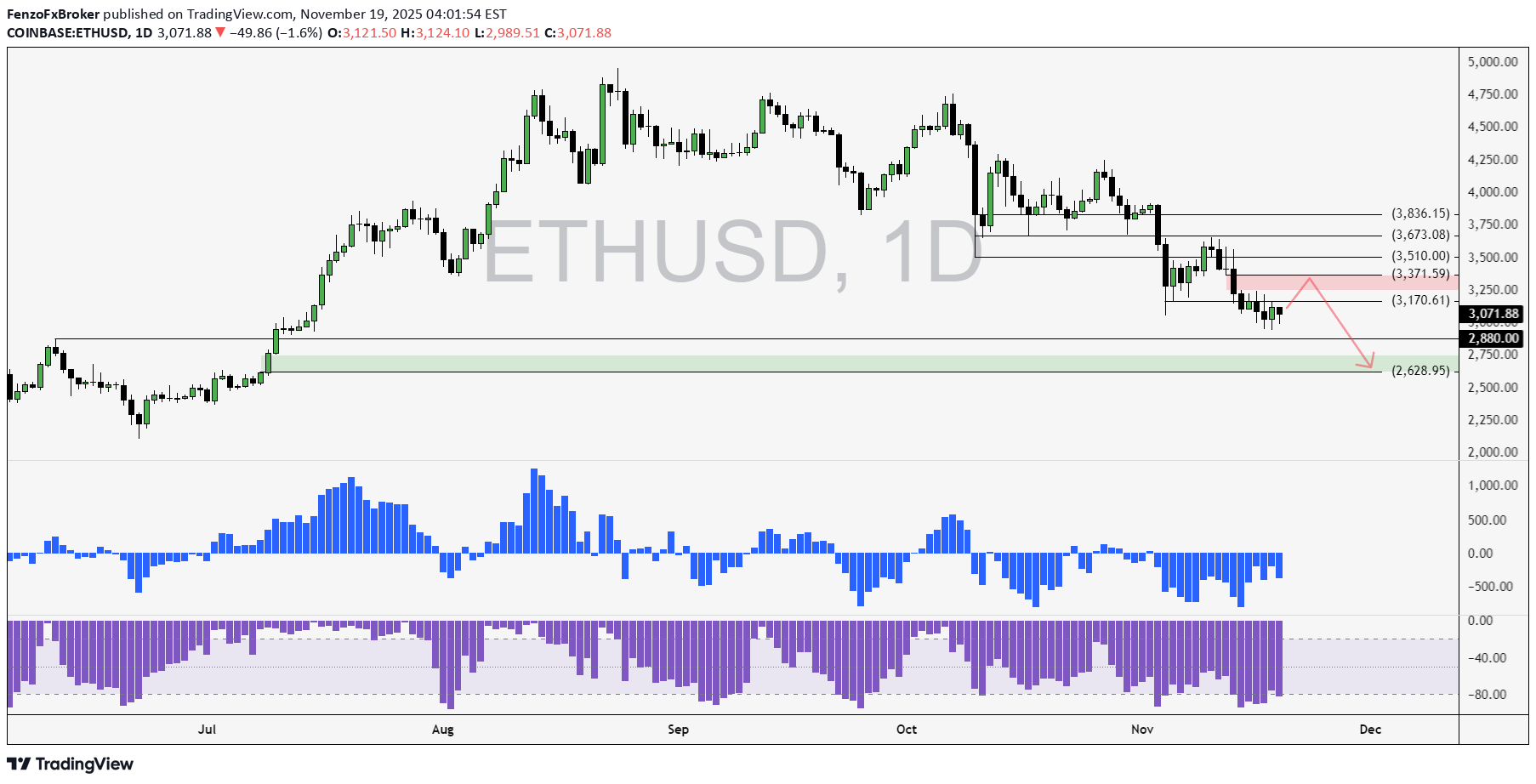

اتریوم زیر مقاومت کلیدی: آیا زمان خرید فرا رسیده است؟

FenzoFx—Ethereum remains bearish, trading near $3,078.00. Price is below $3,170.00, with a bearish fair value gap overhead and resistance at $3,371.00. Technical indicators show an oversold market with bullish divergence, and candlestick patterns suggest accumulation around this zone. Despite the bearish setup, a short-term rise may occur to grab liquidity before the downtrend resumes. In this case, Ethereum could target the bearish gap and resistance at $3,371.00.

FenzoFxBroker

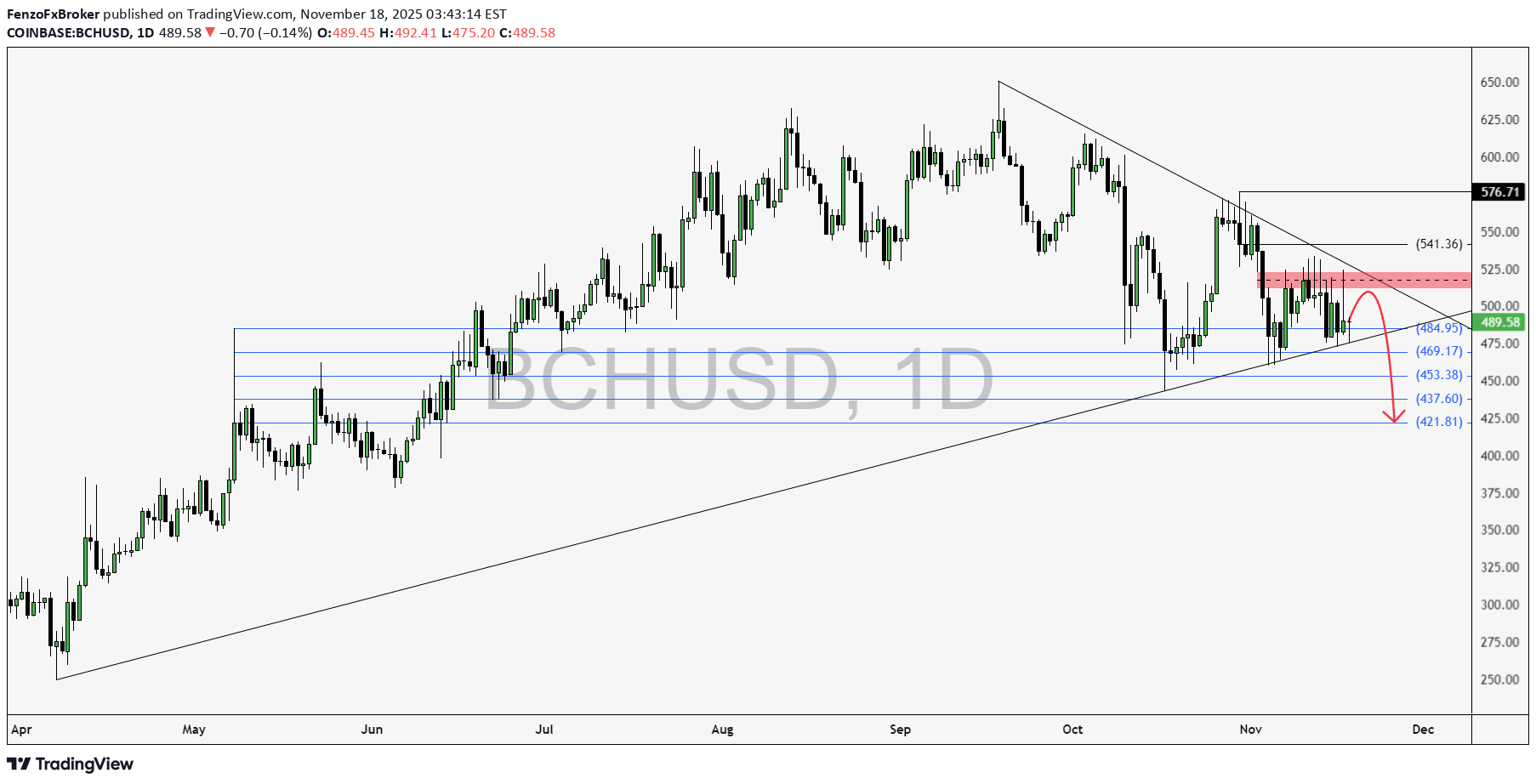

بیت کوین کش در آستانه سقوط: آیا حمایت حیاتی دوام میآورد؟

FenzoFx—Bitcoin Cash is in a bear market, down 6.50% since yesterday, now trading near $490.20. BCH is still holding above the ascending trendline, but this support has been tested five times, making it fragile. Technically, further downside is expected. A break below $469.10 could trigger a deeper decline toward $437.60. If selling pressure continues, $421.80 may be targeted. The bearish outlook remains intact while the price stays below the key resistance at $541.30.

FenzoFxBroker

خطر بزرگ بیت کوین: خلاء نقدینگی چه سقوطی را رقم میزند؟

FenzoFx—Bitcoin dipped below $99,000.00 as expected and now trades near $95,630.00. Friday’s selloff created a bearish fair value gap, viewed as a liquidity void. Technically, price is expected to revisit resistance between $96,700.00 and $99,000.00. If the gap remains partially unfilled, especially in its upper half, further downside is likely. In this scenario, Bitcoin’s next bearish target could be $90,000.00. The bearish outlook remains valid while price stays below $108,800.00.

FenzoFxBroker

منطقه خرید XRP کجاست؟ پیشبینی کوتاهمدت قیمت ریپل

FenzoFx—XRP (Ripple) is under selling pressure, down 0.50% today, trading near $2.309. The daily chart shows accumulation, suggesting sideways momentum may continue. Open interest supports this phase, with strong support between $2.072 and $2.223. XRP could rise slightly, potentially revisiting $2.456. If resistance at $2.456 holds, a bearish wave may follow, targeting $2.072. Continued selling pressure could push the price toward the liquidity void at $1.922.

FenzoFxBroker

سولانا در آستانه سقوط: خرسها کنترل کامل را به دست گرفتند!

FenzoFx—Solana is up by 3.30% today, after the sharp decline on November 25. The daily candle of this date is a bearish engulfing, meaning the sellers are in control of the $171.70. This level has the highest volume spike level as shown on the chart. The immediate resistance is at $171.70. From a technical perspective, the downtrend will likely resume if the price holds below this level. In this scenario, the next bearish target could be the sell-side liquidity at $137.60, followed by $126.00.

FenzoFxBroker

لایتکوین زیر ۱۰۱ دلار؛ آیا ریزش قیمت ادامه پیدا میکند؟

FenzoFx—Litecoin is up 1.60% today, trading near $101.00. The price declined after tapping the liquidity void at $112.30, aligned with the upper band of the bearish channel. Immediate support lies at $98.00. A close below this level could resume the downtrend, targeting $93.70. If selling pressure persists, LTC may fill the bullish fair value gap with support at $89.30. The current momentum remains vulnerable to reversal.

FenzoFxBroker

سکه طلا به کجا میرود؟ هدف بعدی ۴۲۰۰ دلار!

FenzoFx—Gold bounced from $3,886.00 and accumulated around this range for 8 trading sessions. This was a bullish accumulation which resulted in Gold's price breaking out from the range in yesterday's session. Support is at $4,050.00. If this level holds, we expect Gold to target the liquidity void with resistance at $4,200.00 for profit taking. Furthermore, if the price breaks above $4,200.00, it will likely aim for the all-time high, the $4,379.00 mark. This level has equal lows, meaning stops are resting above it.

FenzoFxBroker

اتریوم در آستانه سقوط یا صعود بزرگ: آیا حمایت ۳۱۷۰ دلار دوام میآورد؟

FenzoFx—Ethereum is down 0.66% today, trading near $3,540.00 inside the liquidity void from October 10. Immediate support lies at $3,170.00, a level respected for 4 days on the daily chart. This accumulation may signal a potential move higher. In this scenario, ETH/USD could rise toward $3,836.00 before resuming its downtrend. A break below $3,170.00 would likely trigger a decline toward $2,880.00. The bearish outlook remains valid as long as the daily chart fails to print new higher highs.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.