FTSGroup

@t_FTSGroup

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

FTSGroup

BERA/USDT

BERA has completed a bullish butterfly harmonic structure, received a type I reaction and is now give a type II return. Its trading below local support resistance but achieving a 3:1 RR for the first target is still possible with a stop loss beneath the all time .886 and all time lows since TGE. Trade safely.

FTSGroup

STORJ/USDT

Storj has completed a bullish butterfly pattern, type I and type II return, with a marginally lower low on the second low. I think this is the easiest to manage risk area on the chart and represents a potential 117% upside for TP1. Trade safely! Thanks!

FTSGroup

PYTH/USDT

Pyth has completed a bullish butterfly harmonic pattern and is now showing the beginnings of an inverse head and shoulders. Given its distance to any local support or resistance this is a very high risk trade, however this is likely the zone where this coin will find its bottom due to it being at the all time .886 of the TGE candle. Trade safely.

FTSGroup

SUI/USDT

SUI is now locally showing accumulation on the 4hr chart and has just confirmed 2.37 as support and is now actionable for a good R:R long position. Trade safely.

FTSGroup

WIF/USDT

WIF is is at the completion zone of an informal M-shape structure completing at the 1.13 fib extension. Local price action is showing signs of accumulation with a low, lower low and now higher low. This provides the lowest risk opportunity to take a long term position. This is generally quite a high risk trade given it has made lower lows than TGE but if this cycle is real and Friday goes well, I could this this retracing to at least go see the all time .886. Trade safely! Thanks!

FTSGroup

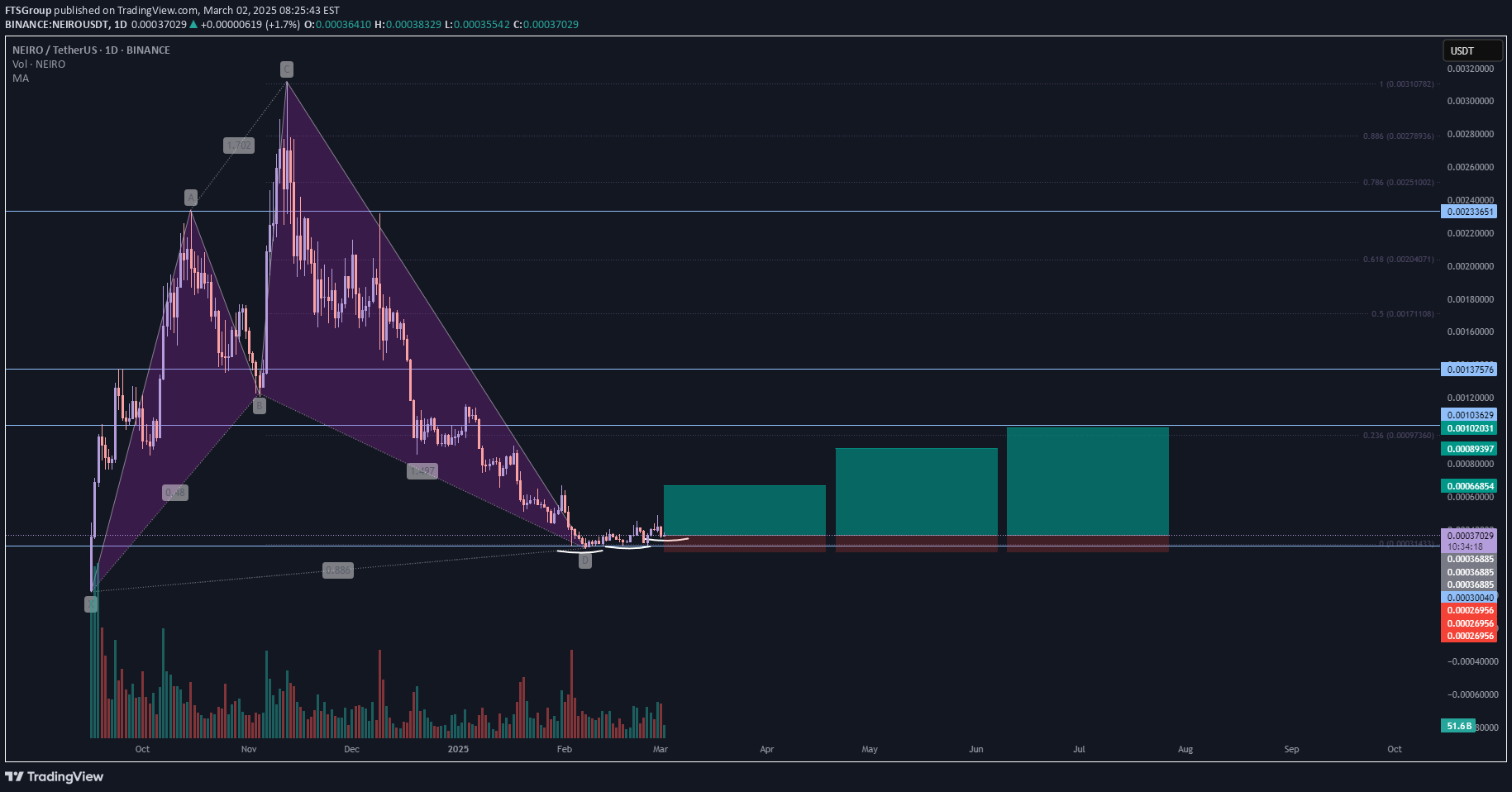

NEIRO/USDT

NEIRO has printed an informal bullish shark on the daily chart and has started to signal that accumulation is happening at the all-time basement. Easy to manage risk, insane upside potential. Enjoy! : )

FTSGroup

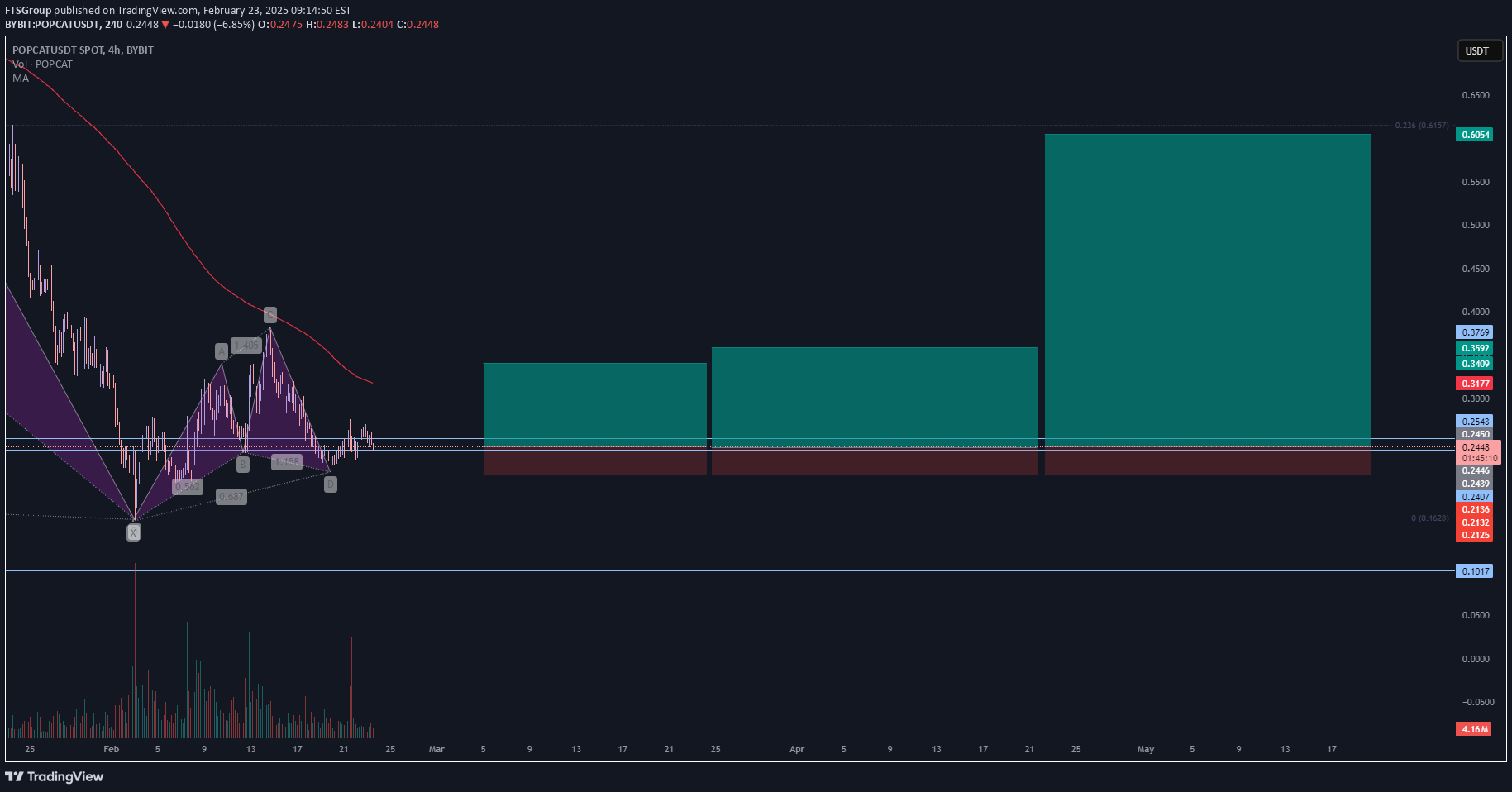

POPCAT/USDT

Huge shark on the daily chart at a very real historical key level looking left. Locally showing an informal cypher-esque structure and looks to be confirming this level as support. Super easy to manage risk here with a stop marginally below the D wave completion, sets you right under this insane level and gives a nice 3:1 RR targeting the top of the A wave which is confluent with the .786 fib node. I'm not entirely confident that BTC is bottoming here and oscillators aren't giving an edge, but if this was a chart disconnected from crypto you'd be stupid not to take the shot given the R:R.

FTSGroup

JUP/USDT

The solana dex volume kingpin presenting two harmonic structures at the basement with clear accumulation above a key level. Good chart, good sector, great asset. Njoy.

FTSGroup

BTC Winter Outlook.

It looks like bitcoin has just laid the foundations of a major trend reversal and potentially given itself the launchpad needed to push out of this 215 day consolidation structure. Momentum appears to be shifting with the chart printing the first higher low, higher high and now a higher low with strong price action to support a continuation to the upside to AT LEAST test the upper bounds off the consolidation structure. We have also just broken into the bullish control zone on the RSI and ar working on printing the first bullish MACD histogram wick to boot. An outcome where market makers push price down to quick-wick out late longs could still be on the cards but even in such a scenario I anticipate buyers to maintain their dominance through till the end of the year. Happy trading!

FTSGroup

PYTH/USDT

This is already an active trade setup but looks like the chart is providing another opportunity to get a good R:R entry. Large M shape harmonic structure. Lower demand line appearing to show a partial decline and seller exhaustion at the key level. Bullish engulfing candle off the key level to boot. What is not to love here? : )

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.