EpicmindJournyFX

@t_EpicmindJournyFX

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

EpicmindJournyFX

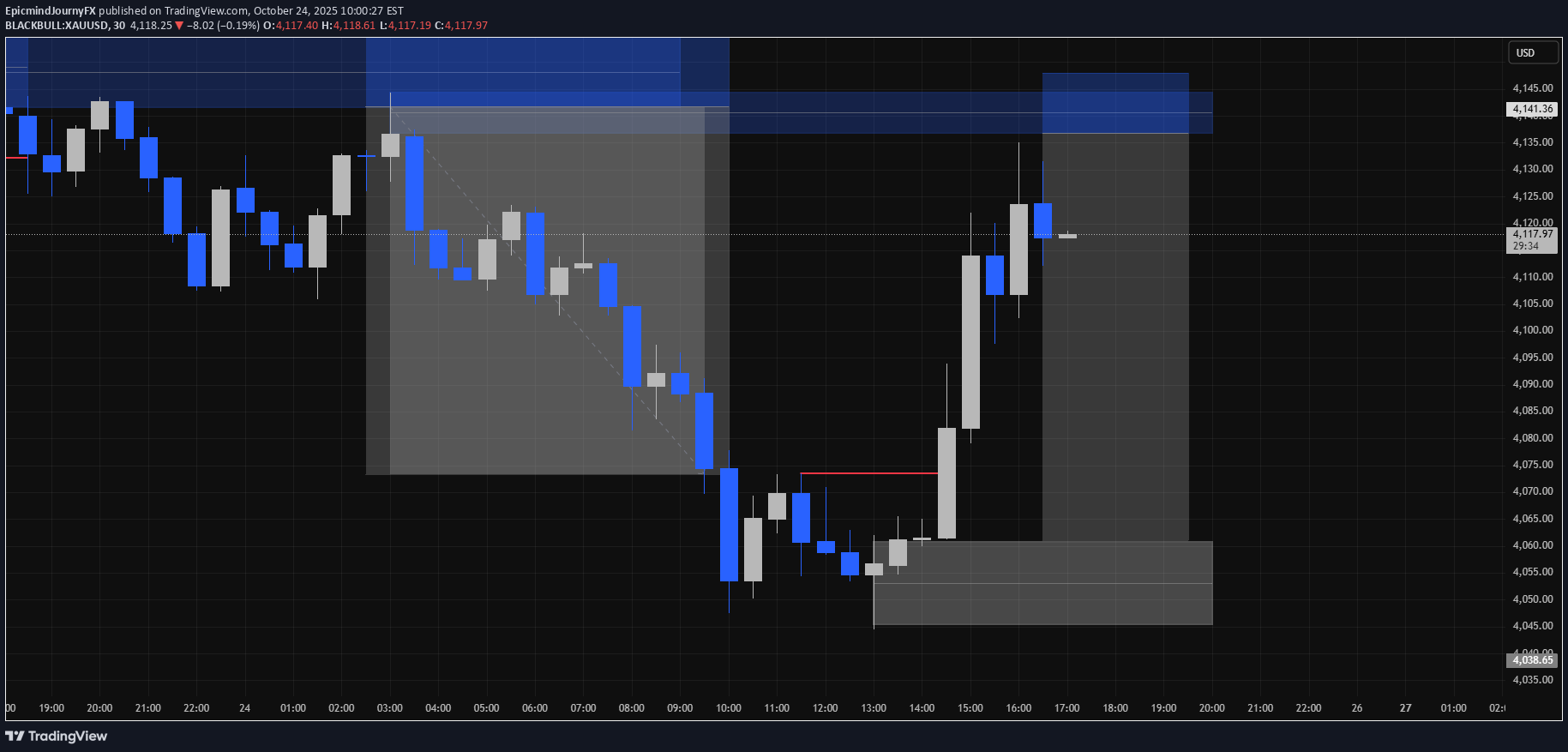

پیشبینی ریزش طلا: سیگنال فروش XAU/USD با ریسک کم و سود بالا

XAU/USD Short Setup Symbol: XAU/USD Position: Short Entry: 4136.90 Take Profit (TP): 4060.99 Stop Loss (SL): 4147.99 Analysis: I anticipate a bearish move in XAU/USD due to [add your reasoning here, e.g., technical indicators like RSI, moving averages, support/resistance levels, or fundamental factors like interest rate expectations]. The entry at 4136.90 offers a favorable risk-reward ratio, with a TP at 4060.99 and an SL at 4147.99 to limit risk. Risk Management: This setup provides a risk-reward ratio of approximately [calculate the ratio, e.g., (4136.90 - 4060.99) / (4147.99 - 4136.90) ≈ 6.9:1]. I recommend risking only a small portion of your capital (e.g., 1-2%) on this trade.

EpicmindJournyFX

BTC/USD Long Setup – Bullish Reversal Play

After a sharp drop, BTC is testing a key liquidity zone around 78.2k. The market structure suggests a potential bullish reversal, with a fakeout and recovery in sight.📌 Trade Idea:Entry: After confirmation of a reclaim and bullish structure break (above ~79.3k)SL: Below recent low ~77.6kTP: 82.8k zoneRRR: ~3.2📅 Timeframe: 30min📈 Bias: Counter-trend long🔁 Watch for: Price reaction at current support and market structure shift🚨 Wait for confirmation – patience is key in volatile conditions!

EpicmindJournyFX

BTC/USD Long Setup – Bullish Reversal Play

After a sharp drop, BTC is testing a key liquidity zone around 78.2k. The market structure suggests a potential bullish reversal, with a fakeout and recovery in sight.📌 Trade Idea:Entry: After confirmation of a reclaim and bullish structure break (above ~79.3k)SL: Below recent low ~77.6kTP: 82.8k zoneRRR: ~3.2📅 Timeframe: 30min📈 Bias: Counter-trend long🔁 Watch for: Price reaction at current support and market structure shift🚨 Wait for confirmation – patience is key in volatile conditions!🔗 Connect with us: 🌍 Website: epicmindJourney.com📸 Instagram: Epicmindjourney📲 Telegram: t.me/+MVthvHZLyNE3OWU6

EpicmindJournyFX

BTC/USD – Long Setup

Price is testing a key structure level. If we get the right reaction, this could be the next move.📍 Entry: 83085.00🎯 Target: 88765.00🛑 Stop-Loss: 81585.00Risk-to-reward looks solid. Let’s see how this plays out! 🔥

EpicmindJournyFX

Bitcoin Rejection from Resistance – Short Setup with Bullish Pot

Bitcoin is currently testing a key resistance zone around $85,500, where previous price action showed strong selling pressure. A rejection from this level could lead to a short-term pullback towards $83,750 - $83,250 , aligning with a retest of the broken trendline before a potential bullish continuation.🔹 Entry: $85,200 - $85,500🔹 Stop-Loss (SL): $86,000🔹 Take-Profit (TP): $83,750, with potential long re-entry from this zone targeting $86,000+📊 Watch for price action confirmation within the resistance zone before entering. If BTC holds above $85,500, the bullish breakout could accelerate. 🚀

EpicmindJournyFX

SOL/USD Technical Analysis (March 31, 2025)

🔹 Potential Scenarios:✅ Bullish Path (Green): If the price holds above the Golden Pocket (119.89 - 121.15) and breaks 147.38, it may continue rising toward 165-176 and possibly 201-210.❌ Bearish Path (Red): A drop below 112.40 could push the price toward 109-119, and further breakdown may lead to 78-86 or even 51-57 in extreme cases.🔄 Neutral/Alternative Path (Yellow): If support holds but no strong breakout occurs, the price may consolidate and later move in either direction.💡 Key Levels to Watch:Resistance: 147.38, 165-176, 201-210, 272+Support: 119-121 (Golden Pocket), 112.40, 78-86, 51-57📌 Keep an eye on price reactions at these levels to confirm the next move.

EpicmindJournyFX

SOLUSD Trade Setup

🔥 SOLUSD Trade Setup 🔥📌 Entry: 134.08📌 SL: 130.30📌 TP1: 152.91📌 TP2: 179.28📌 TP3: 209.13The price is respecting the ascending trendline and forming a bullish structure. Watching the 4H FVG as a key demand zone for a potential long entry! 🚀📈#SOL #Crypto #Trading #Forex #PriceAction📌 SL: 128.26

EpicmindJournyFX

BTC/USD Breakout Setup

🔥 BTC/USD Breakout Setup – Key Resistance in Focus! 🔥I'm watching this critical breakout level on BTC/USD! 📈 A confirmed breakout above the trendline could trigger strong bullish momentum. A 30-minute candle close above resistance is crucial for confirmation.🔹 Entry: After a confirmed 30-minute breakout above 84,332.35 USD or on a retest🎯 Targets:TP1: 86,511.16 USDTP2: 88,467.33 USDTP3: 91,116.43 USD🛑 Stop-Loss: 83,321.02 USDPatience is key—waiting for confirmation minimizes risk and improves accuracy! Will you take this trade? Let me know below! 👇🔥 Textbook Breakout! 🔥 TP1 hit! SL moved to BE for risk-free gains! 🚀📈 #BTC #Breakout #Trading

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.