EmmaSaxton

@t_EmmaSaxton

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

EmmaSaxton

Full analysis of gold operation strategies

Technically, gold rebounded quickly in the Asian session and was under pressure from the 3055 level, then fell and fluctuated. In the afternoon European session and the evening US session, it was under pressure from the 3045 level, then fell and fluctuated downward, breaking the bottom. In the early morning, the price of gold accelerated downward, broke through the 2960 level and reached around 2957, where it stabilized and rebounded. The daily K-line closed at a high and then fell back to the hanging neck middle shadow. After the overall gold price reached the high point of 3167 last week, it was suppressed and fell downward for three consecutive trading days. The hourly moving average of gold was in a volatile operation, and the strength of gold shorts had not weakened. Gold rebounded or continued to be short, and gold was still weak overall. Gold was still under important pressure near 3055, and continued to be short after the rebound was blocked. Affected by trade tariffs, the global market encountered a "Black Monday". Gold had a big intraday shock on Monday, with an intraday amplitude of nearly $100, and finally broke down in the US session. Investors turned to the US dollar for risk aversion due to tariff concerns. The gold market showed a sharp decline, continuing the downward trend at the end of last week. The daily level has closed negative for three consecutive days.At present, gold has fallen by $100 for three consecutive days. The daily price has hit the 30-day moving average support for three consecutive days. It is difficult for gold to hit a new low today. Gold is in the fourth trading day of decline and adjustment. Although there was a rebound in the morning, the 1-hour moving average still showed a short arrangement with a death cross downward, and the short volume has not decreased, indicating that the short-term short trend is still continuing. After the gold price fell, it is also trying to regain lost ground, but the rebound is weak. Now the bottom signal has not been confirmed. At present, given the obvious short trend, it is recommended to rebound short as the main, and callback long as the auxiliary, and pay close attention to the upper 3025-3030 resistance and the lower 2956-2950 support.Operation strategy:1. It is recommended to buy gold at 3025-3030 rebound, stop loss at 3040, target at 3000-2970, break at 2050.2. It is recommended to buy gold at 3000-2994 pullback, stop loss at 2988, target at 3020-3030.

EmmaSaxton

Gold Attack and Defense Guide

After the opening of the market on Monday, the three major U.S. stock index futures all fell sharply, with the Nasdaq futures falling by more than 5.5%, the S&P 500 index and the Dow Jones Industrial Average falling by more than 4.7% and 4% respectively, and crude oil prices also falling below $60 per barrel. Although gold and silver have rebounded after a sharp drop, they still cannot escape the selling pressure as a whole. The market panic is quite similar to the outbreak of the new crown epidemic in March 2020. The U.S. tariff policy and the trade war it has triggered have caused the biggest disruption crisis in the global supply chain since the epidemic.As the new trading week begins, global risk aversion shows a significant sign of rising, and precious metal assets have ushered in a strong performance. U.S. officials announced on Monday that they would launch reciprocal tariff measures against global trading partners the next day, completely shattering the market's previous residual expectations that negotiations might ease at the last minute. As the deadline for policy implementation approaches, the tense atmosphere in the financial market has heated up sharply.Against this background, mainstream banks continue to hold optimistic expectations for the medium- and long-term trend of precious metals. The current price is driven by two factors: one is the unexpected demand for reserve increases by central banks of various countries, and the other is the continued inflow of funds from gold-linked ETF funds. It is worth noting that the U.S. benchmark Treasury yield fell in a gap on Monday, and the yield curve is rapidly approaching the stage low of 4.172% set in March.Technical patterns show that gold prices continue to rise strongly after breaking through the psychological barrier of $3,100, indicating that the current main trend is still expanding upward along the line of least resistance. If the price falls back and loses this integer, it may trigger a technical correction, and long position closing operations may push gold prices back to the key support of $3,000. Short-term trading needs to focus on the upward resistance band formed in the $3,148-50 range, which may become a new battlefield for long-short games. I suggest that gold should pay attention to the suppression of the 3080 line above and the 3000 integer mark below. The news has stimulated the recent volatility, and the recent high-altitude is the main focus. Long orders must be cautious.Operation strategy:1. Try the 3055-3060 line above the gold short order, and make a stop loss. The target is 15 US dollars.2. The long order below the gold can be tried at the 3000 line, looking at 10-15 US dollars, and make a stop loss. No long orders can be participated without loss. The 2980 line below can be regarded as a position for replenishment.Long 2995-3000, stop loss 2990, target 3015-3020, click the link to get accurate trading signals

EmmaSaxton

Gold 100% Trading Strategy

Gold plummeted at the opening of Monday, reaching the lowest point of 2972, and then rebounded to 3055. We successfully placed a short order at 3052, and have already made a profit. The hourly moving average of gold crosses downward, and the short position is arranged, and it continues to open downward. So gold is now the home of the shorts. Gold rebounds or continues to short. Gold is now in a short trend below the gap. We continue to pay attention to the short-term suppression of 3055 above, and continue to short if the rebound does not break.From the 4-hour analysis, today's upper short-term resistance is 3055, and the lower line is 3000-3008. In terms of operation, the rebound pressure at this position continues to be short and follow the trend to fall. It is necessary to rely on the rebound to rely on 3055-60 to go short once, and the lower target continues to break the bottom.Gold operation strategy:1. If gold rebounds to 3055-3058, short it, stop loss at 3066, target 3015-3020, continue to hold if it breaks;2. If gold falls back to 3000-3006 but does not break, you can buy it, stop loss at 2993, target 3045-53, continue to hold if it breaksLong 2995-3000, stop loss 2990, target 3015-3020, click the link to get accurate trading signals

EmmaSaxton

Gold operation strategy

Gold plummeted at the opening of Monday, reaching the lowest point of 2972, and then rebounded to 3055. We successfully placed a short order at 3052, and have already made a profit to the target. The hourly moving average of gold crosses downward and the short position is arranged, and it continues to open downward. So gold is now the home of the short position. Whether gold rebounds or continues to be short, gold is now in a short trend below the gap. We continue to pay attention to the short-term suppression at 3055.From the 4-hour analysis, today's upper short-term resistance is 3055, and the lower line is 3000-3008. In terms of operation, the rebound pressure at this position continues to be short and follow the trend to fall. It is necessary to rely on the rebound to rely on 3055-60 to go short once, and the lower target continues to break the bottom.Gold operation strategy:1. If gold rebounds to 3055-3058, short it, stop loss at 3066, target 3015-3020, continue to hold if it breaks;2. If gold falls back to 3000-3006 but does not break, you can buy it, stop loss at 2993, target 3045-53, continue to hold if it breaksGold rebounds to 3055-3058, short at 3066, stop loss at 3066, target at 3015-3020, continue to hold if it breaks. I wish everyone can recover the loss of last week's crazy gold on Monday. Everyone is welcome to come and communicate

EmmaSaxton

Gold 100% Profit

Gold failed to hit 3200 and turned to fall. In the early morning, it bottomed out and rebounded under the influence of the news of the implementation of the tariff policy. It continued to rise in the morning and reached the highest level of 3167, with an increase of 62 US dollars from 3105-3167.However, the market rebounded from the high and fell in the Asian session, and fell sharply in the afternoon, reaching the lowest level of 3116. This continuous decline basically bid farewell to the possibility of continuing to rise today. The watershed was broken in the morning, and there was no hope of breaking the high.Today's continuous sharp decline is mainly due to the implementation of the tariff policy, buying expectations and selling facts, and the actual implementation of the news. Longs took profits.The European session may rebound from the low sideways. In the evening, we will focus on the pressure of 3140-3150. If the intraday low of 3116 breaks, it may fall to 3100 again.The more tests are made, the greater the probability of breaking. There have been three downward tests before. The breaking market will initially turn to short, opening up the space below. Focus on the big non-agricultural data tomorrow Friday.The current gold price has risen again and again, and it has deviated from the technical structure, and the risk has increased accordingly. The market has repeatedly forced to rise. No one knows where the top is, and there is no previous high for reference. The risk area can be preliminarily judged by the increase. In short, don't be too arrogant, and stability is more important than anything else.In terms of trading, the overall market of gold yesterday was in line with the expected judgment. The bullish market turned to shock and adjustment, with a range of 3138-3100. In terms of operation, I went short at 3131 in the morning, reduced my position at 3118, took profit at 3110, and earned 21 US dollars; I waited and saw whether it would break above 3138 or below 3100 in the European session; I went short at 3119 in the evening, and went up to 3130 with a light position and added shorts, and finally took profit at 3116-3117, earning a profit of 13 US dollars.

EmmaSaxton

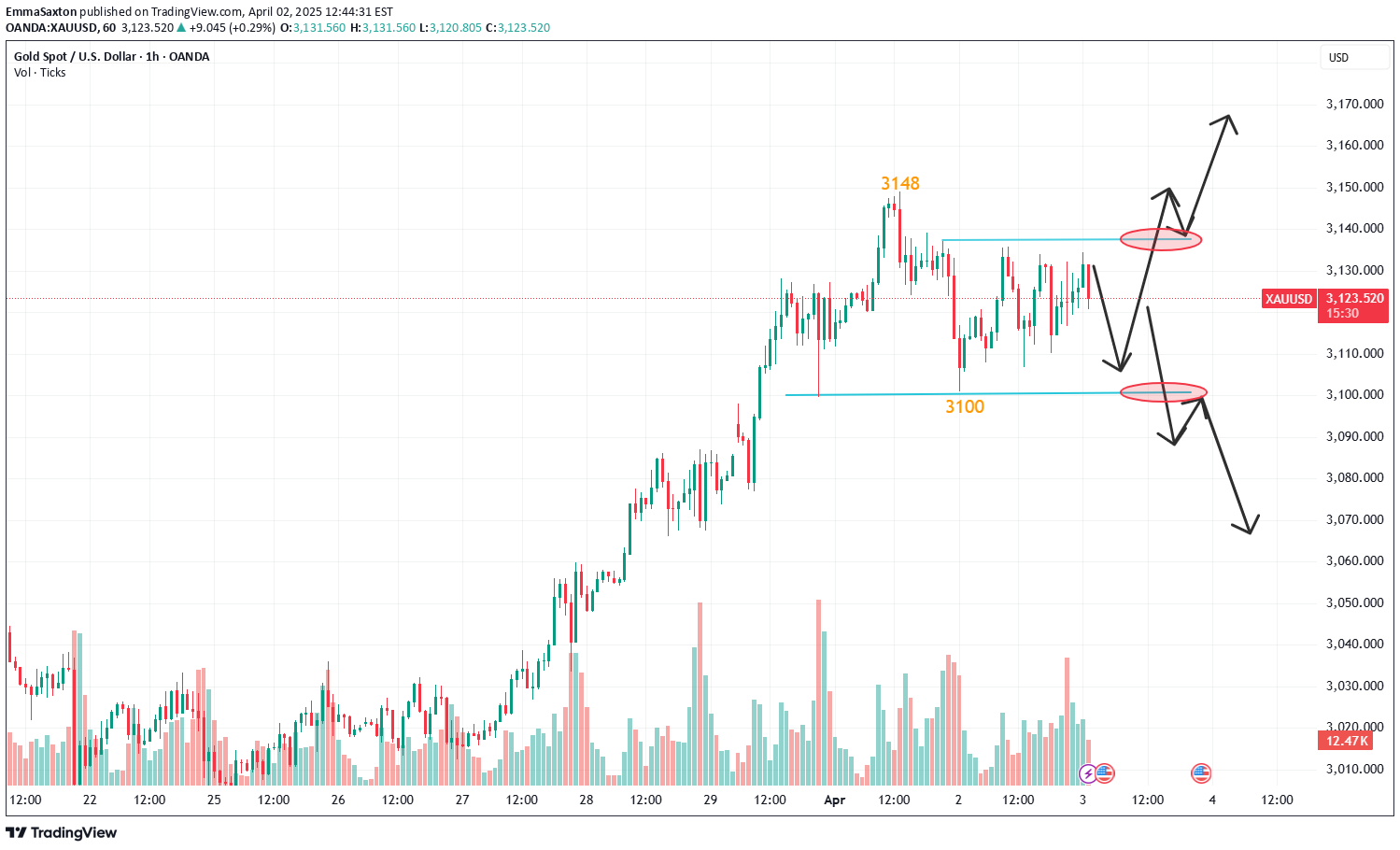

Online real-time guidance on gold trends

Gold went up in the early trading, but the price fell again after rising to 3135. The fluctuation range of European trading narrowed. ADP employment data exceeded expectations. The market failed to break out of the trend. The current market is in the range of 3135-3109. The market is waiting for the details of the reciprocal tariffs and industry-specific tariffs to be announced at 3 am. The tariff policy announced by Trump is expected to have an adverse impact on the global economy, especially the United States. The current structure of gold is still bullish. After the correction, continue to go long at the key support level.At the 4-hour level, the current market is shrinking and oscillating at a high level. The K-line is running above the middle track, and the oscillating and strong trend is maintained above the middle track. Focus on the 3100 support break. Only when it breaks below 3100 will the downward space be opened. There can be more at 3080-3060 below, and only when it stands above 3135 can it further hit a new high. Before the data, continue to see range oscillation, the small range is 3110-3135, and the large range is 3100-3150. In the short term, you can quickly enter and exit in the small range with high altitude and low long.Gold falls back to 3083-3087, stop loss at 3077, target at 3130-3135, continue to hold if it breaks. If you are hurt in the market, you can click on my link and I can help you get back on track.

EmmaSaxton

Gold market trend analysis

Gold risk aversion pushed up gold prices, but the bulls failed to continue, and gold prices fell after rising. From a technical perspective, the 4-hour gold price remained above the moving average, and the bullish trend remained unchanged. Structurally, the rise in gold prices was symmetrical in time and space, and the early decline was in line with expectations. The hourly chart showed a weak bearish signal and diverged. The upper resistance is currently at 3137-3141, and the lower support is at 3111-3106. In terms of operation, I suggest that the callback is mainly long, and the rebound is supplemented by high short.Operation strategy 1: It is recommended to buy at 3105-3100, stop loss at 3092, and the target is 3130-3150.Operation strategy 2: It is recommended to sell at 3139-3144, stop loss at 3150, and the target is 3120-3105.Gold falls back to 3083-3087, stop loss at 3077, target at 3130-3135, continue to hold if it breaks. If you are hurt in the market, you can click on my link and I can help you get back on track.

EmmaSaxton

Gold market analysis strategy

Technical analysis of gold: From the market point of view, the trend has not changed. The negative line of the upper shadow of the single K line in the daily chart appears at a high level, which is a turning point. Whether a reversal can occur today will verify the validity of this K line. This wave of rise is caused by fundamentals and the atmosphere of the entire market. However, there is never a market that only rises and never falls. In other words, we do not go to dead short or dead long. Shorts only enter the market at important points. From a structural point of view, the rise has entered a symmetrical space in terms of time and span. It fell below the upper line in four hours, and the early high and fall were the same as expected. The structure has become weak short. The hourly chart is close to the upper line area and is currently running in a divergence, so the overall European market is still high and unchanged. It seems that gold bulls have not been able to go to a higher level with the support of the news, so gold bears may have opportunities at any time; gold is directly short at the current price of 3128 in the afternoon!Gold fell below yesterday's low of 3124 support as expected, and came all the way to 3100. I have been emphasizing that gold will have a big retracement, but the current decline is far from enough. Gold will continue to fall. The 1-hour moving average of gold has begun to turn downward, and gold may open up room for decline. The 1-hour moving average of gold has now formed a head and shoulders top structure. Rebounds will continue to be short. The market has weakened. Gold has not yet broken through the 3100 mark for the first time, but the direction of the market has turned short. If it does not break for the first time, I believe there will be a second attempt in the future. Then the bearish situation has been finalized. Long positions must be put aside first, because it is a bearish market now. Gold rebounds and adjustments can continue to be short. Pay attention to the 3128 line of pressure above. You can go short directly when it rebounds! On the whole, today's short-term operation strategy for gold is to focus on rebound shorting and supplemented by callback long positions. The short-term focus on the upper side is the 3138-3130 line of resistance, and the short-term focus on the lower side is the 3100-3083 line of support.Short order strategy:Strategy 1: When gold rebounds around 3128-3130, short (buy short) 20% of the position in batches, stop loss 6 points, target around 3110-3100, break to look at 3085Long order strategy:Strategy 2: When gold falls back to around 3083-3085, buy (buy up) 20% of the position in batches, stop loss 6 points, target around 3100-3110, break to 3120Gold falls back to 3110-3116, buy more, fall back to 3100-3105, add more, stop loss 3097, target 3130-3135, continue to hold if it breaks, welcome friends to click on the link to communicate with me. I hope I can help you, wish you a happy trading

EmmaSaxton

Gold continues to move lower today!

Gold is running fast in small steps above 3100, and the strong bull market has been rising again and again, with no intention of stopping. Yesterday, it opened directly and broke the high. The European market was under pressure and corrected sideways at 3130, and the US market bottomed out and rebounded to close near the high point.This kind of strong market closed strongly at a high level, especially the market that rose in the early morning. In any case, there must be more in the morning of the second day, and generally there will be continued rises. The same time cycle is true on Monday.At present, gold bulls are rising strongly, and you can just go with the trend and be bullish. Don't guess the top easily. There may be a small correction in the process of rising, but it does not change the overall upward trend. It mostly appears in the form of bottoming out and rebounding, which is also a kind of correction.The real big top needs a certain amount of time to brew, or there is an obvious top signal. If there is a large-scale high-rise fall and close with a large cross, you should pay attention; or if there is a large decline, it is not appropriate to continue to be bullish.For now, gold can still continue to see more. After all, there is no previous high to refer to, so the risk area can only be judged by the increase.For gold today, the price rose from 3120 to 3148 in the morning, an increase of nearly 30 US dollars. So the afternoon adjustment continues to be bullish, focusing on the 3133 first-line support, the watershed is at 3120, and the upper pressure is 3150-3160! If the European session fluctuates sideways without rising, beware of the bottoming out and rebounding at night, repeating yesterday's trend.In terms of trading, a total of four orders were operated yesterday, and one order was loss-making:1. The 3073 long market was not given a slight difference, so I directly aggressively long at 3081, and stopped profit at 3110 after reducing positions at 3100;2. After the rise, there will be a correction in the afternoon, and the stop loss at 3120 is 3122;3. The European session continued to be lightly short at 3124, and the target position of 3100 was reached after reducing positions at 3110;4. There were many orders at 3100, and the stop profit was 3124 before the break.Gold operation suggestions: Go long at around 3122-3125, stop loss at 3115, target first at 3155. If you are hurt in the market, click the link. I have the confidence to help you get back on track.

EmmaSaxton

Gold 100% Profit Signal

This week, multiple factors intertwined to affect the gold price. The tariff policy was settled on Wednesday, and the ADP data also caused market turmoil; the non-farm data on Friday will test the market again, with risks and opportunities coexisting. Against this background, gold has shown its charm as a safe-haven asset. The decline of the US economy, the intensification of the US debt crisis, and the geopolitical tensions in the Middle East have all provided impetus for the rise in gold prices.From a technical perspective, gold fell back quickly after opening high in the morning, but then stabilized and rebounded. The weekly, daily and 4-hour lines all showed a bullish trend, with strong upward momentum. On the hourly chart, gold maintained a good upward trend, with previous highs and lows rising continuously, and bulls dominated. The current upper resistance is in the 3135-3138 range, and the lower support is in the 3111-3107 range. In terms of operation, it is recommended to do more on the callback and supplement it with high rebound.Operation strategy 1: It is recommended to buy at 3105-3100, stop loss at 3093, and the target is 3120-3140.Operation strategy 2: It is recommended to sell at 3130-3135, stop loss at 3142, and the target is 3110-3100.Gold operation suggestions: Go long at around 3122-3125, stop loss at 3115, target first at 3155. If you are hurt in the market, click the link. I have the confidence to help you get back on track.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.