EdwinPus

@t_EdwinPus

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Gold and BTC, only one can prevail.

What does this chart tell us? It does tell us that one asset is about to outperform another short term, then we have the blow off top for BTC in relative terms, if we stick to the pattern.

Watch this unfold

Let the lines do the speaking. And yes it's a very brief description, since my work doesn't get exposure anyways.

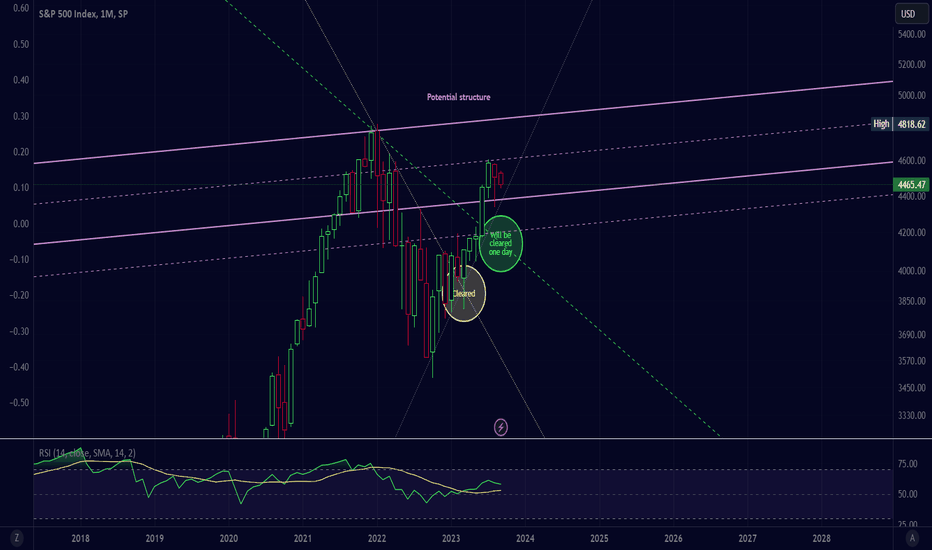

BTC and possible entry points

The green trendline serves as the ultimate go signal, and a close above it would typically signify the onset of the parabolic movement stage for the asset. Besides that, every bounce presents potential trade opportunities for those who prefer not to hold this particular asset class long-term. I foresee the first substantial test for this asset class occurring towards the end of the decade. It's possible that this test could coincide with a significant bubble bursting event. However, at the moment, there appears to be a catalyst on the horizon, potentially a force majeure event, that could prompt a reduction in interest rates and support a prevailing trend of reinflation. This is my hypothesis, primarily based on macro chart analysis, and it's expected to materialize in the coming months, possibly during the fall or by April at the latest.

PAXG/BTCUSD where we're at

We've observed a clear bearish rejection on the weekly chart for both Bitcoin and PAXG (tokenized gold) spread. However, on the monthly chart, we've experienced a breakout. This situation presents two possible scenarios: Micro Moves and Bullish Retest: It's possible that we are currently in a phase of smaller, more intricate price movements, and the market could be gearing up for a retest of the purple level before potentially turning bullish. Weekly vs. Monthly Dynamics: Alternatively, this could be one of those exceptionally rare instances where the weekly close takes precedence over the monthly close. While it's challenging to ascertain with absolute certainty, I would anticipate a retest of at least 50k for Bitcoin before considering the possibility of a complete collapse. The pivotal point to watch closely is the outcome of the purple retest. You can find a version of the chart without the spread in the related ideas section for further analysis.

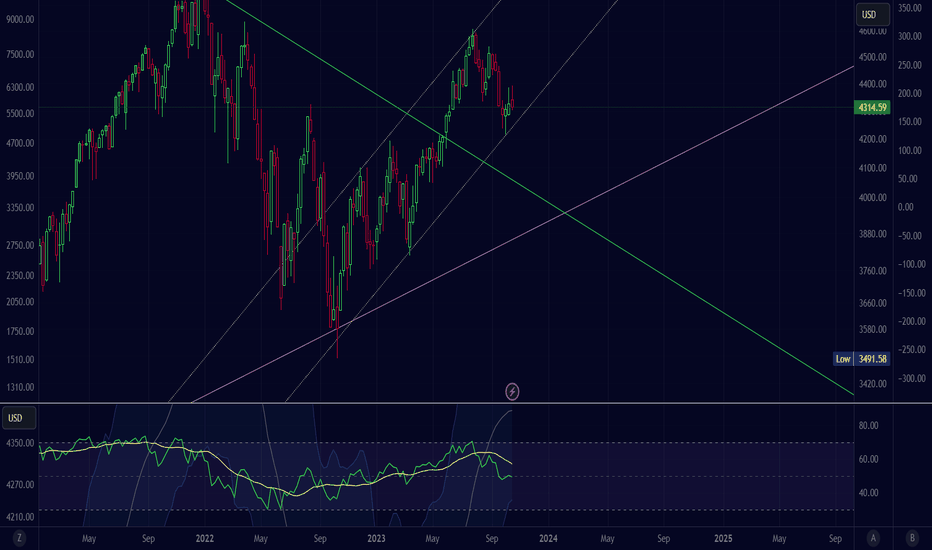

BTC current positioning and supports/resistances

Bitcoin is currently in a challenging position, teetering on the edge of two crucial support levels. However, the prevailing market conditions could easily trigger a steep decline if they deteriorate further. The current positioning suggests two potential outcomes: either a swift reversal is imminent, or we might be on the brink of a rapid deleveraging event, possibly driving Bitcoin down to unforeseen depths, akin to black swan levels. This scenario could unfold either now or in the coming months. Nevertheless, it's important to note that a significant alarm should only be sounded if we breach the purple support level, which is already at the 17k mark. This would represent a substantial and abrupt drop from the most recent peak. Until that level is breached, it's crucial to remain vigilant but not overly panicked.

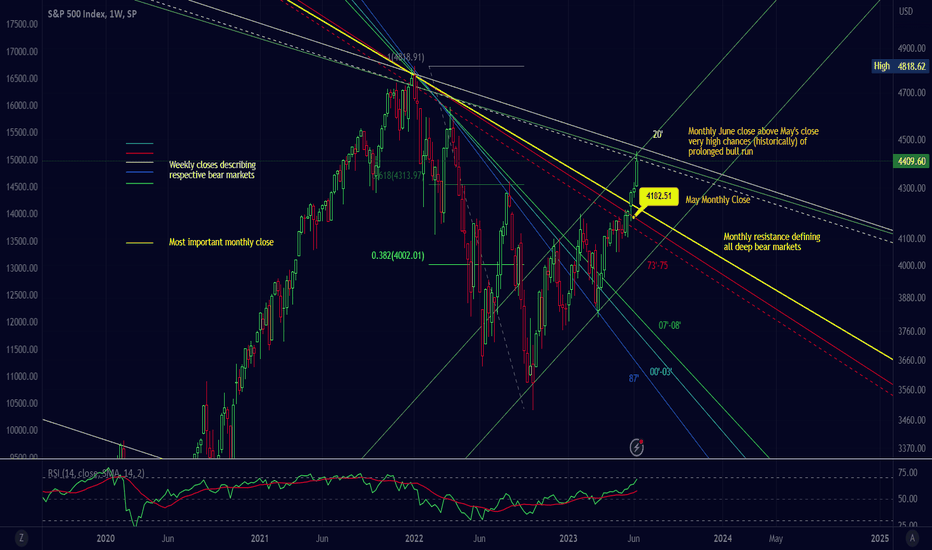

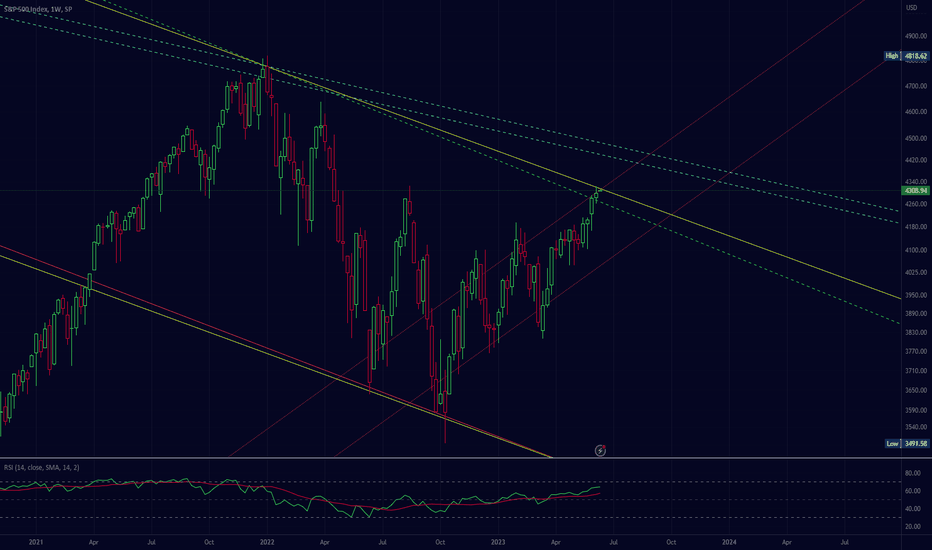

My SPX projections based on historical resistances

I've employed a historical resistances approach to identify the most critical monthly levels that tend to hold significance when considering new positions. Currently, the green level has not yet been surpassed, although I strongly believe it's likely to occur, possibly either now or following a move towards the pattern resistance, which should align with a new all-time high (ATH). This potential development should result in declining Treasury Bills (TBills), a risk-on sentiment for TLT, and a peaking DXY (US Dollar Index), presenting an opportunity for a short position with a target in the high 3000s. The timing of this move, whether it unfolds now (then the target should be 4100's) or a bit later, will depend on how the monthly close plays out. I'll be closely monitoring this to determine the more probable scenario. Currently am short but watching with caution given the signal if we need to switch long.

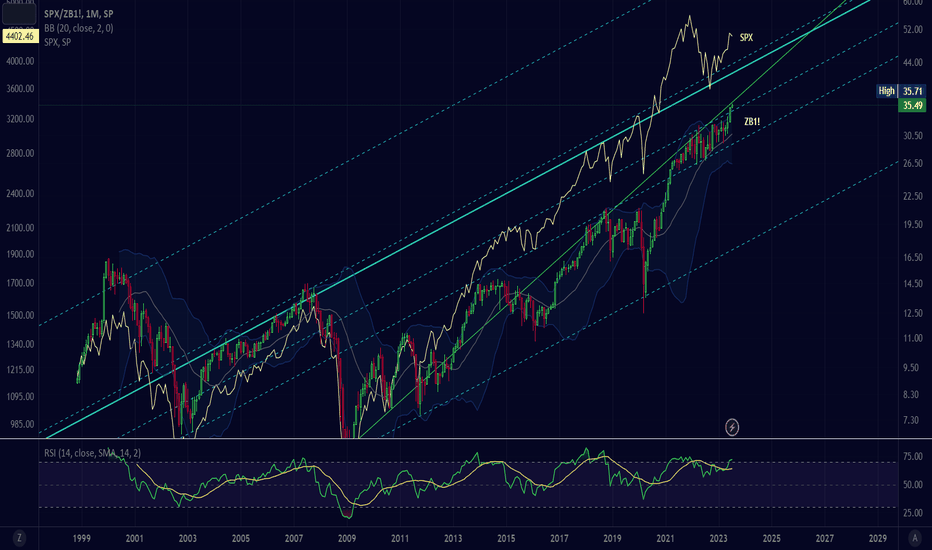

Follow the rabbit ZB1!/SPX

Cannot understate the importance of the treasury market and how powerful this chart is.

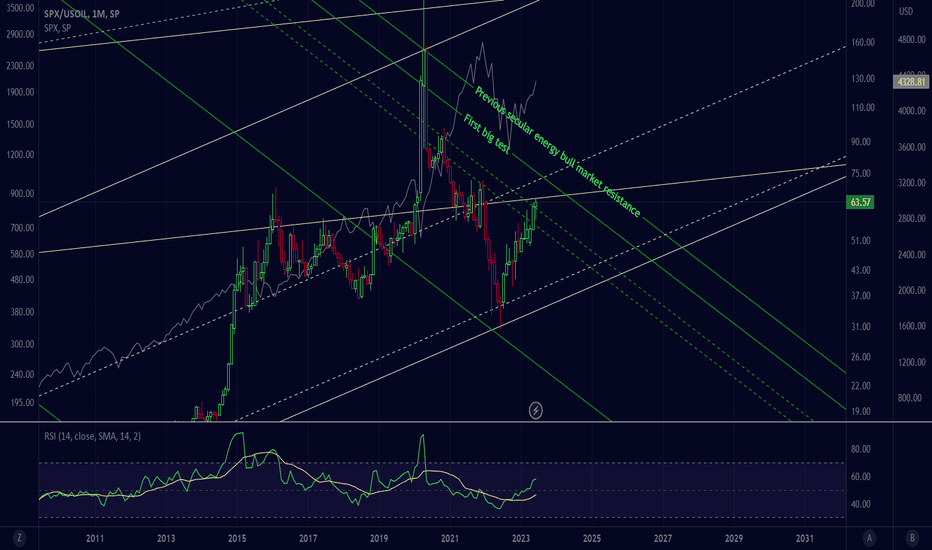

Long term trading almanac to OIL and SPX

Richest spread when it comes to the amount of information we have since they both trade to early 20th century. Ask in the comments if you want me to expand on the chart.

Another noteworthy weekly resistance

We've beaten a bunch of bearish resistance and according to some technicals are in a bull market, however I'm still waiting for a monthly close above 4250, including the closes for this and next week (if we manage to pull above next stop is late 4400's. Day trading is lucrative at this stage so no big biases to either side when it comes to short term plays.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.