Eaglizer

@t_Eaglizer

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Eaglizer

Ethereum (ETH) has been a focal point in the cryptocurrency world, drawing both admiration and skepticism. As Q4 unfolds, Ethereum has shown remarkable resilience, staying on its intended path despite market fluctuations. This article explores Ethereum's journey, its current standing, and the potential for it to reach the ambitious target of $8,500. Everyone criticizing Ethereum should take note: ETH is still on track and hasn't deviated from its course. In Q4, Ethereum was never expected to reach new all-time highs (ATH). Despite performing better than anticipated, ETH remains steadfast on its intended path. It exhibited a bearish pattern, forming higher lows and lower highs before stabilizing. It then marked a higher low, established a bear market high, broke through this high, retested it just before Q4, and began its upward trajectory. Here's how the forecasted ETH pattern looks—believe me, we're still on track. 📈 Ethereum's chart demonstrates a clear path forward, with key indicators suggesting sustained growth. The technical analysis points towards Ethereum reaching significant levels, with the 2.0 Fibonacci extension level being a crucial milestone. I believe $8,500 is a realistic target for Ethereum, corresponding to the 2.0 Fibonacci extension level. The Fibonacci extension tool is commonly used in technical analysis to predict future price movements based on past price trends. The 2.0 Fibonacci extension level suggests that the price could potentially double from its previous move. In this case, reaching $8,500 fits within the expected range of this extension level, making it a plausible target. When ETH's price reaches the 2.0 Fibonacci extension level, its market cap will be approximately $625 billion, reflecting a 155% increase. If the price continues to rise and reaches the 2.618 Fibonacci extension level, the market cap would soar to around $859 billion, marking a 214% increase. These levels are calculated based on today's price. To all the Ethereum doubters out there: Keep talking while ETH keeps building. 📈 Your doubts fuel our progress. Watch and learn! 💪🔥 Ethereum's journey is far from over, and its resilience in the face of criticism only strengthens its position. As it continues to build and innovate, ETH is poised to reach new heights, potentially hitting the $8,500 mark and beyond. Ethereum's path is filled with potential, and the signs are pointing towards significant growth. With the 2.0 Fibonacci extension level serving as a realistic target, $8,500 is within reach. Whether you're an investor or a skeptic, keeping an eye on Ethereum's progress is essential, as it continues to defy expectations and carve its path in the crypto world.

Eaglizer

The ongoing discussions surrounding the potential approval of a Bitcoin Exchange-Traded Fund (ETF) in January by the U.S. Securities and Exchange Commission (SEC) have prompted in-depth conversations within the cryptocurrency community. In this comprehensive analysis, we will explore the different perspectives circulating in the market and highlight recent events that have influenced sentiments. Market Speculation on Bitcoin Price: As the anticipation for the SEC's decision on the Bitcoin ETF grows, market sentiment is at a crossroads. Some investors are echoing the sentiment of "buying the rumor, selling the news," anticipating a potential price drop after the ETF approval. On the flip side, a contrasting view suggests a bullish surge, speculating that the ETF's approval will inject a substantial amount of institutional money into Bitcoin, pushing it towards all-time highs. Recent Market Trends and Liquidations: In the midst of these speculations, recent market trends reveal a substantial wave of liquidations, witnessing over $540 million being liquidated from the crypto market in the past 24 hours alone. What adds a distinctive note to this scenario is the notable insider selling observed in crypto stocks, exemplified by the nearly 20% downturn in COIN (Coinbase). Intriguingly, this insider activity preceded the broader sell-off in Bitcoin, raising questions about its impact on market sentiment. These developments prompt a reflective pause on whether everything is indeed already priced in, particularly in the aftermath of Bitcoin's impressive 2023 rally. This rally significantly contributed to some of the stock market's most remarkable gains this year. Media Influence and Timing: Amidst the market turbulence, a valuable lesson emerges: caution when the media becomes overly optimistic. The observation that bullish sentiments often coincide with the proliferation of Bitcoin ETF commercials and positive analyst predictions suggests a need for independent thinking amid media influence. Becoming a pessimist when the majority turns optimistic becomes a prudent strategy. Jim Cramer's Take and Media Timing: In a humorous twist, Jim Cramer's historical track record is mentioned. The observation that he tends to be bearish at market bottoms and bullish at the tops serves as a reminder to be cautious about getting advice solely from mainstream media figures. This underlines the significance of not relying solely on talking heads or analysts for investment decisions, as they may be late to recognize market trends. The Power of Fear and Panic: A crucial takeaway from the current market dynamics is the recognition that fear and panic can create opportunities. Amidst uncertainty, adopting a level-headed approach and considering the potential buying opportunities that arise during moments of fear can be a strategic move. ---- As the cryptocurrency community awaits the SEC's decision on the Bitcoin ETF, it's clear that the market is navigating a complex landscape of speculation, liquidations, and media influence. This analysis underscores the importance of maintaining a balanced perspective, being wary of herd mentality, and staying informed about both market dynamics and historical patterns. Regardless of the outcome, the journey through these market fluctuations offers valuable lessons for investors, reinforcing the need for adaptability and independent thinking.

Eaglizer

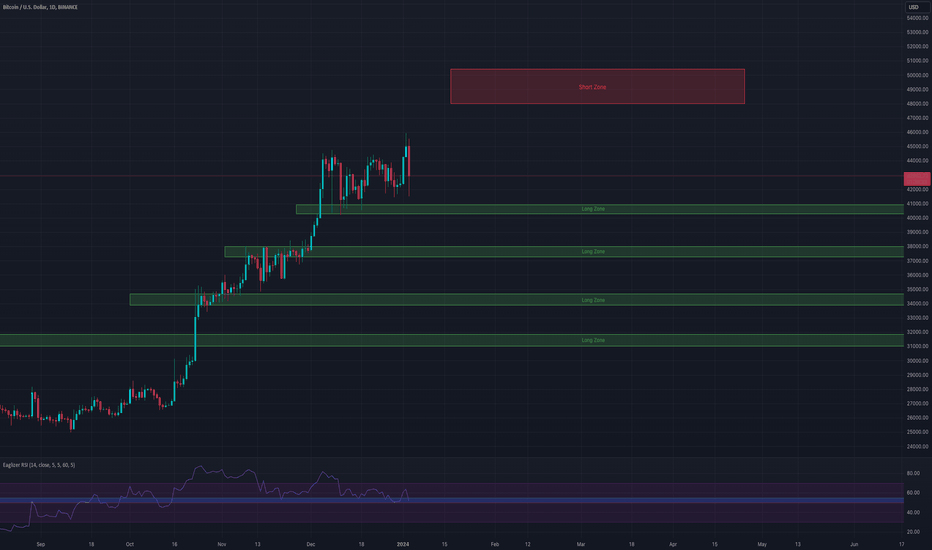

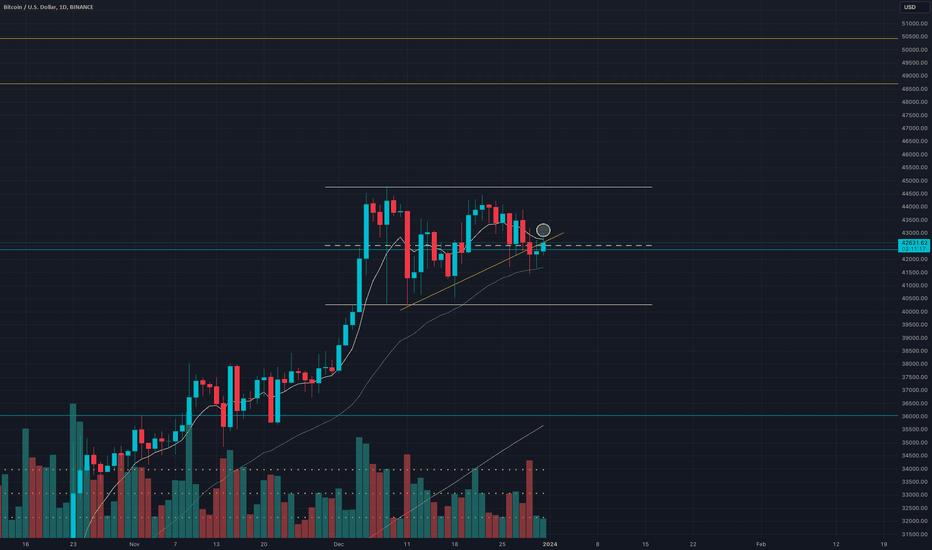

So many ways you can look at Bitcoin and all say the same thing. My goal is to highlight the different perspectives in the market Crypto. 1. Eaglizer Strat Daily: Price needs to reclaim 8 EMA (white moving average) for upside. 2. Range: Price needs to reclaim the Median level (white dotted line) for more upside. 3. Trendline: Price needs to reclaim the Trendline (yellow) on for upside. In summary we're at an area that will determine if we are going to reclaim and continue higher or go down for a correction.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.