EZIO-FX

@t_EZIO-FX

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Idea on Gold

Bearish Flaghe highlight of the day was the Federal Open Market Committee (FOMC) Minutes from the December meeting, released in the American afternoon. The Minutes showed that most participants are willing to deliver additional rate cuts if inflation declines over time. The document also showed that economic growth is projected to move modestly faster than at the October meeting. US Dollar Index (DXY) trades in the 98.20 price zone on Tuesday, gaining 0.2% for the day as the market digests the Federal Open Market Committee (FOMC) minutes released earlier today

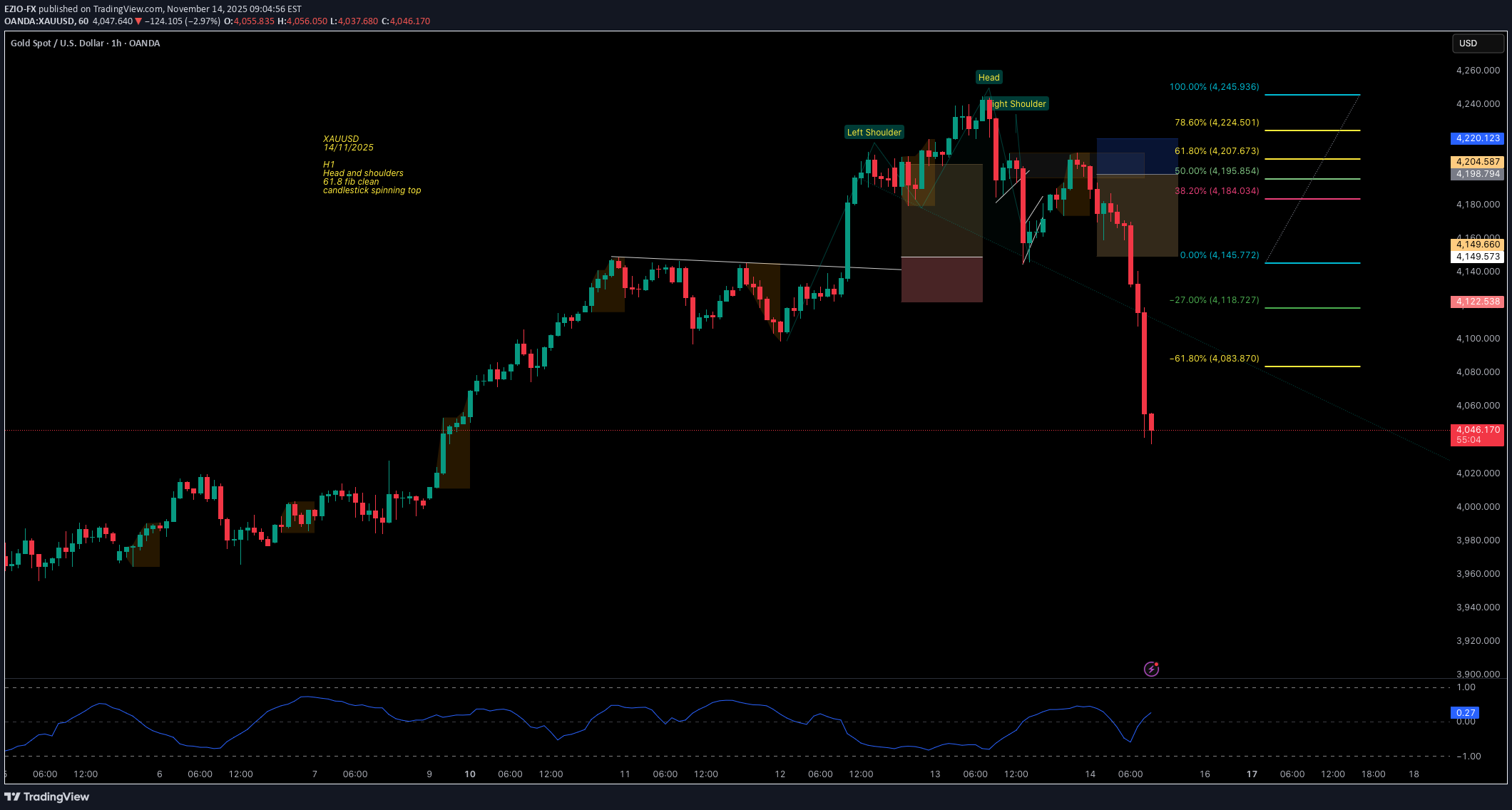

الگوی سر و شانه طلا (XAUUSD): ریزش بزرگ در راه است؟ تحلیل تکنیکال دقیق!

XAUUSD — 14/11/2025 H1 timeframe Head and Shoulders pattern forming/confirmed 61.8% Fibonacci retracement respected cleanly Spinning Top candlestick indicating indecision at key level Gold extends losses below $4.150 with the US Dollar supported amid higher risk aversion. Dwindling hopes of a December Fed cut are weighing on precious metals on Friday. XAU/USD is under growing bearish pressure, approaching an important support level at $4,100.

افزایش قیمت طلا به بالای 4000 دلار: رمزگشایی از حرکت صعودی و پیشبینی بازار

Gold price settles above $4000 as safe-haven demand strengthens on U.S. shutdown and weaker dollar outlook. Bulls defend the 50-day moving average at $3878.45, keeping gold's short-term bias tilted to the upside. Technical breakout above $4046.60 could trigger a run toward $4133.95–$4192.36 resistance zone.uncertainty around the delayed U.S. non-farm payrolls report — a result of the shutdown standoff — helped renew safe-haven demand, especially after private sector data showed job losses in October. Traders are now pricing in a 66% chance of a December rate cut, according to CME Group’s FedWatch Tool. That dovish repricing, alongside softening Treasury yields, is helping underpin gold despite broad risk aversion.

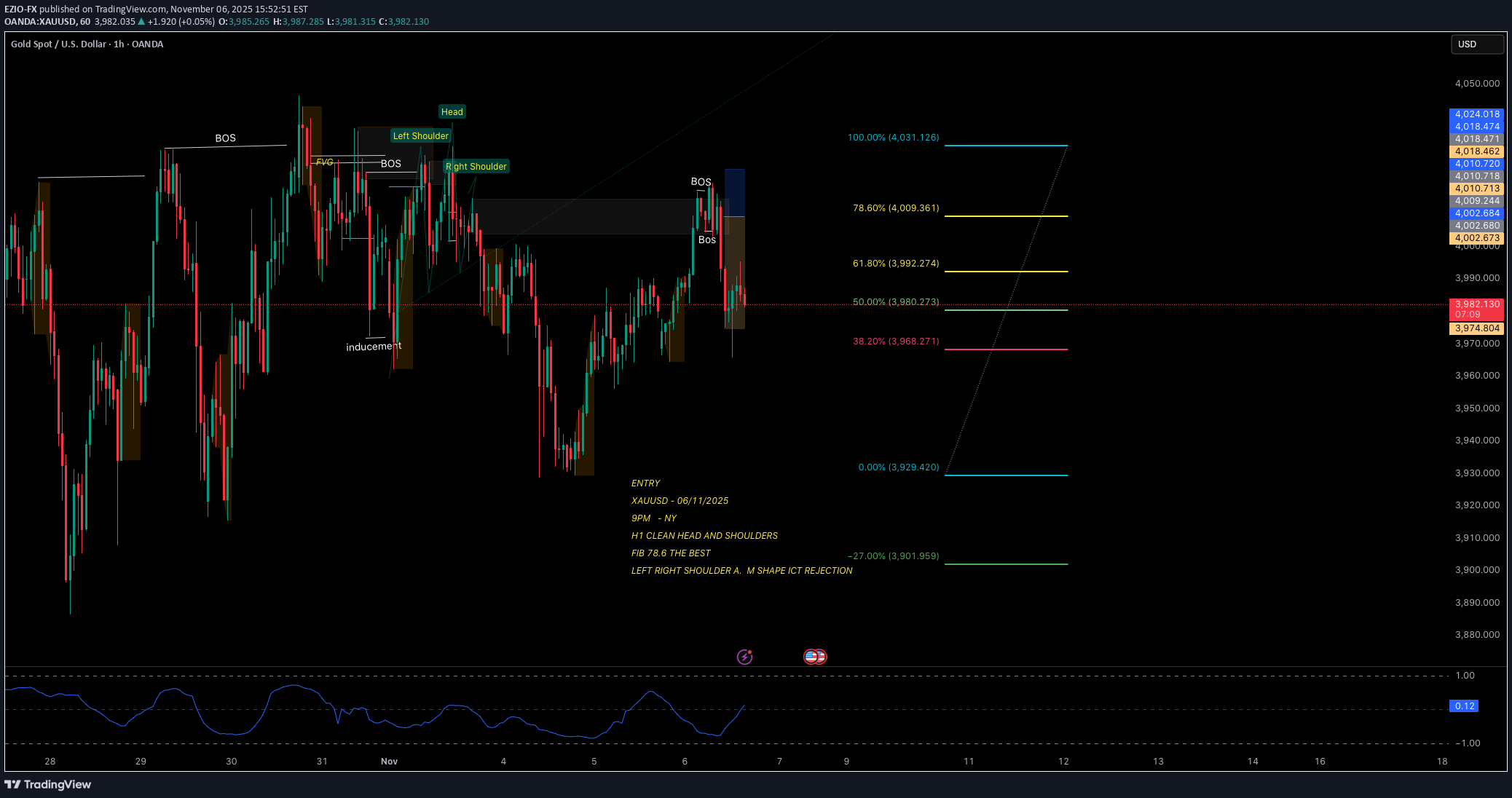

ترید طلا (XAUUSD): راز کسب سود با الگوی سر و شانه و سطوح حیاتی فیبوناچی!

ENTRY XAUUSD - 06/11/2025 9PM - NY H1 CLEAN HEAD AND SHOULDERS FIB 78.6 THE BEST LEFT RIGHT SHOULDER A. M SHAPE ICT REJECTION Gold holds near $4,000 as US shutdown, layoffs boost safe-haven demand Gold peaks $4,019 as a weaker US Dollar and lower Treasury yields lift Bullion. US shutdown warnings from Republican leader boost safe-haven demand for Gold. Mixed Fed tone and softer jobs data revive December rate cut bets, supporting the Gold outlook. The US Challenger report by Gray & Christmas showed that employers fired over 150,000 people in October.

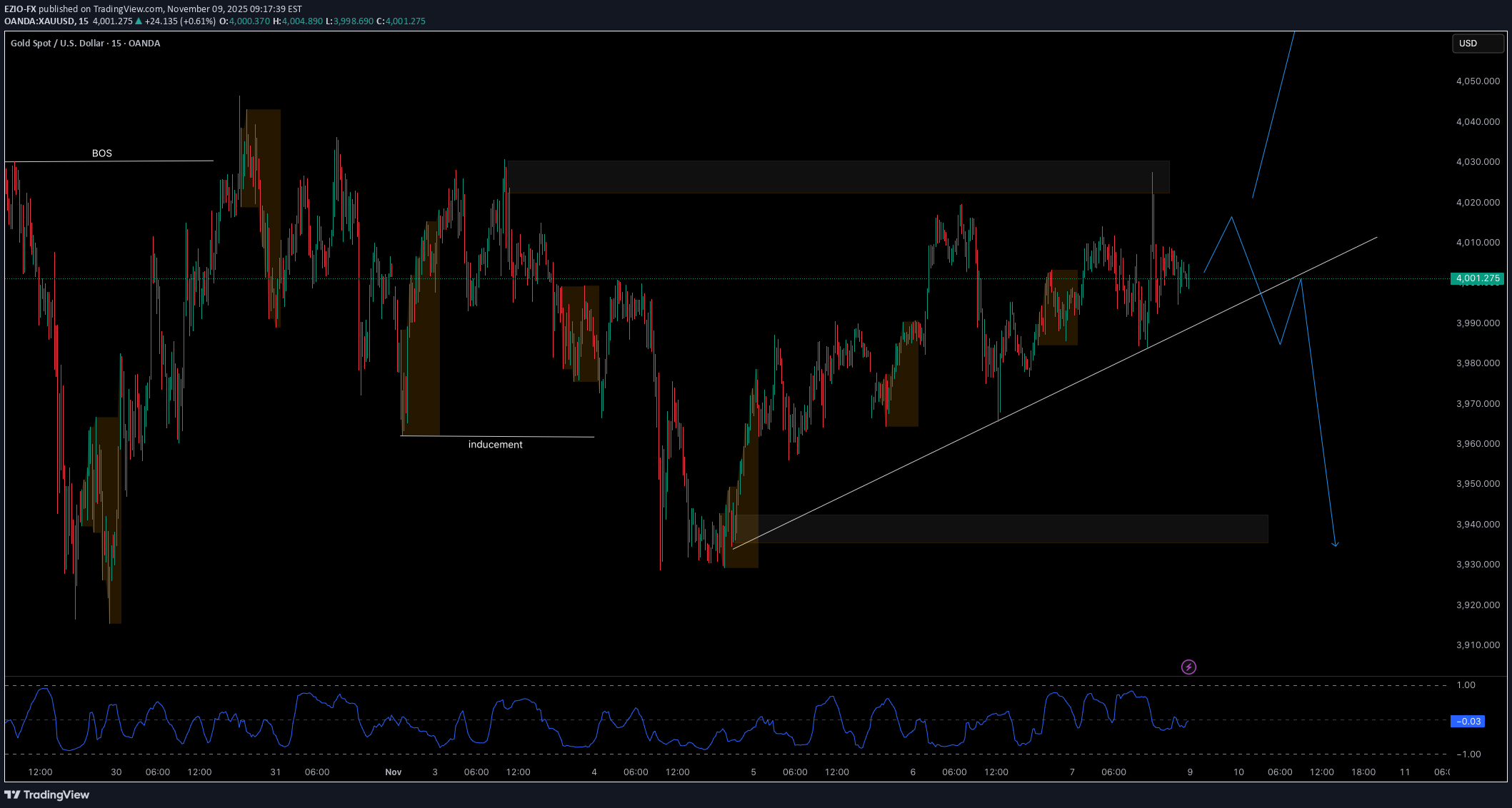

سه برد متوالی در بازار: راز موفقیت با ساختار ساده بازار!

This is my 3 ack to ack trades simple market structure. Gold off lows but in the red below $4,100 early Monday as risk flows dominate. US Dollar slips on dovish Fed bets, risk appetite, while US Treasury bond yields climb on easing US-China trade concerns. Technically, Gold risks renewed downside amid a Bear Cross on the 4H chart and bearish RSI.

GOLD idea nice Flag pattern

Gold steadies after setting a fresh all-time high near $3,871 on Tuesday. US shutdown fears rise after White House talks fail to reach a deal. US data failed to boost the Greenback, as weaker Consumer Sentiment offset a modest uptick in Job Openings. Gold (XAU/USD) trims earlier losses on Tuesday, trading around $3,848 at the time of writing. The metal is clawing back gains after sliding from its fresh all-time high near $3,871 to the $3,800 zone, as buyers stepped back in following the release of weaker US Consumer Confidence data. The underlying bid for Bullion remains intact, supported by investor demand for safe havens amid the growing risk of a United States (US) government shutdown, should lawmakers fail to strike a funding deal before Tuesday at midnight. At the same time, ongoing geopolitical frictions continue to underpin Gold’s appeal as a go-to safe-haven asset, while renewed US tariffs stir concerns over global trade, reinforcing demand for the yellow metal as a hedge against uncertainty.

Idea on GOLD

Gold trades lower on Thursday as the US Dollar strength weighs. The Fed delivered its first rate cut since December, lowering the federal funds rate to the 4.00%-4.25 range. The Fed's updated dot plot signaled scope for two more cuts in 2025. Gold (XAU/USD) extends losses on Thursday after a sharp reversal following the Federal Reserve’s (Fed) interest rate decision. The metal briefly spiked to a fresh all-time high near $3,707 in the immediate aftermath of the widely expected 25-basis-point (bps) rate cut on Wednesday, but gains quickly faded as the outcome had already been largely priced in. At the time of writing, XAU/USD is edging lower, reversing after trading in positive territory earlier in the day. The metal is trading around $3,735 during the American session, down nearly 0.80% on the day, weighed down by renewed strength in the US Dollar.

All time High Gold

GOLD all time high level 3,500. Gold has surged above the top of its months-long ascending triangle, confirming a bullish breakout and signaling further upside. Momentum indicators remain supportive as prices near April’s $3500 peak, with $3575–$3600 the next key targets, Société Générale's FX analysts note. Uptrend resumes as Gold clears key resistance "Gold has broken above the upper boundary of the ascending triangle within which it consolidated since April, signaling a resumption of the uptrend. The daily MACD remains in positive territory and above its trigger line, indicating renewed upward momentum." "Gold is now approaching the April high of $3500. Should a brief pullback occur, the upper end of the recent range near $3450 is likely to serve as initial support. Beyond $3500, the next upside projections are at $3575/3600 and $3650."

GOLD A Top Win

What a great bullish Flag Gold went up. Gold tests new highs as traders focus on weak dollar and bet on dovish Fed. Worries about Fed independence provide additional support to gold markets. A successful test of the resistance at $3440 – $3450 will open the way to the test of the next resistance level at $3490 – $3500.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.