EL_STOCKTROOPER

@t_EL_STOCKTROOPER

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

EL_STOCKTROOPER

EL_STOCKTROOPER

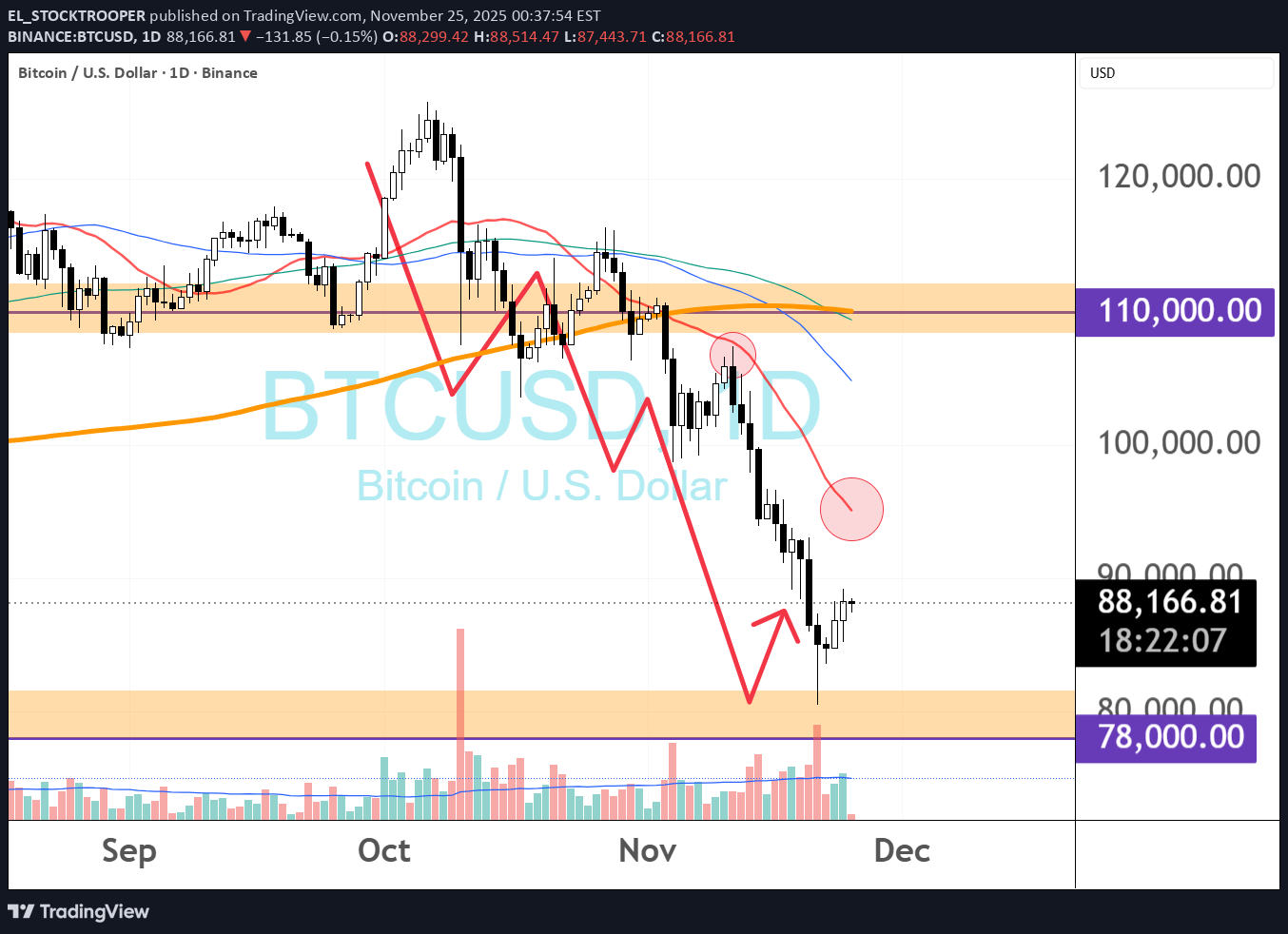

چکش صعودی ظاهر شد: آیا بازار به زودی اوج میگیرد یا سقوط ادامه دارد؟

Spotted two consecutive hammer candles — a short-term rebound is on the table. If price gets rejected at $100,000, the bears remain firmly in control. If price can break and hold above $100,000, then the bulls may stage a comeback and push toward the next resistance at $111,000.

EL_STOCKTROOPER

اصلاح ۳۰ درصدی در راه است؟ فرصتهای خرید پنهان کجا هستند؟

2024 March - August = 32% 2024 Dec - Apr 2025 = 31% 2025 Oct - current = 30% a 30% correction is around the corner. lets see any rebound opportunity from this zone..?

EL_STOCKTROOPER

بیت کوین زیر فشار: خرسها کنترل را به دست گرفتند؛ آیا سقوط به زیر ۹۸ هزار دلار قطعی است؟

Bitcoin remains under pressure as price continues to struggle breaking above $111K. The 20-day MA crossing below the 200-day MA confirms bearish momentum in control. A break below $98,800 could trigger a deeper correction and invite stronger selling pressure across the crypto market. Until a decisive breakout occurs, BTC is likely to consolidate within the $98,800–$110,000 range in the near term.break down below $100,000

EL_STOCKTROOPER

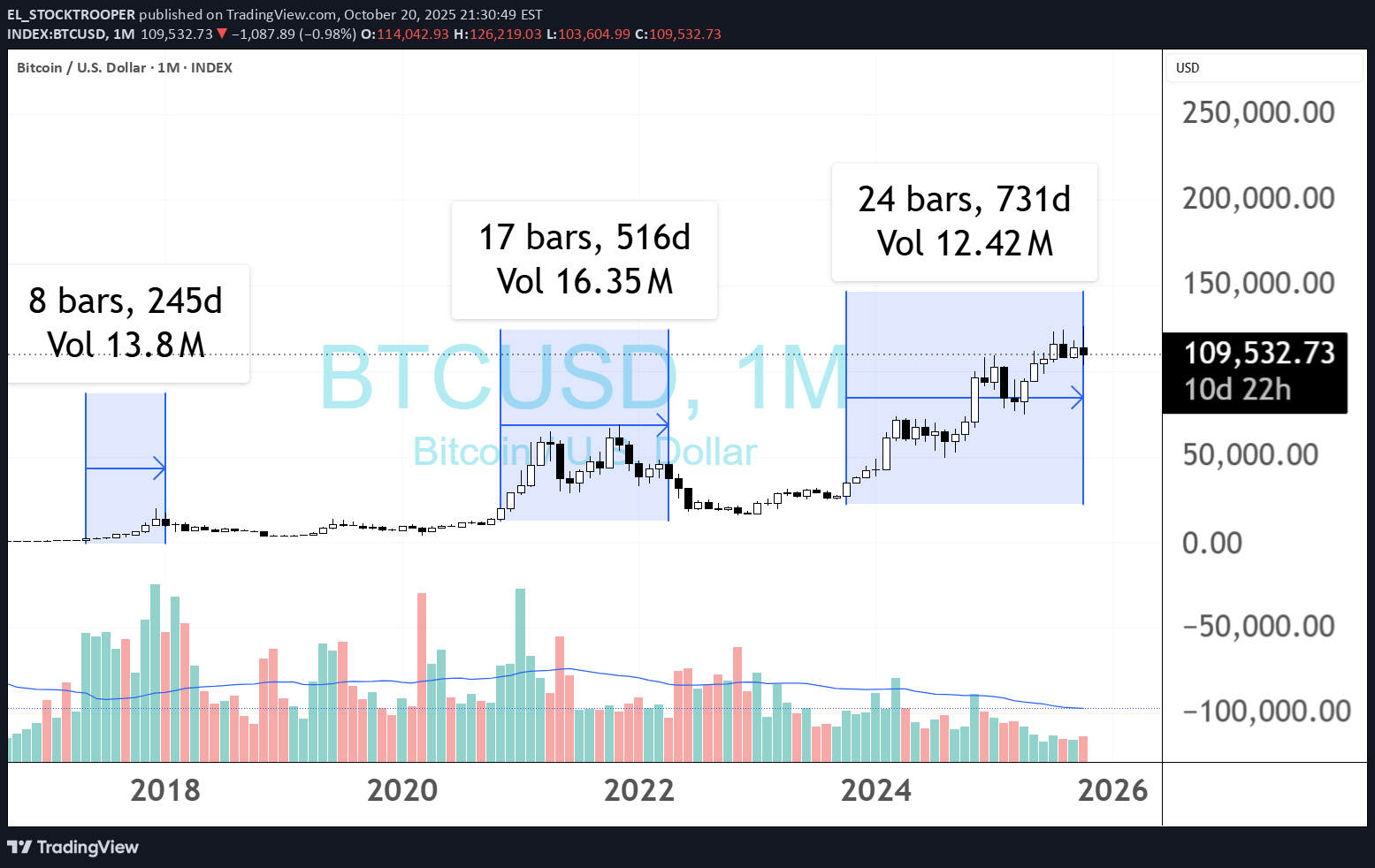

چرا این رالی بیت کوین فرق دارد؟ ورود وال استریت و آینده بازار

Back in 2017, Bitcoin’s rally was almost entirely retail-driven. There were no institutions, no solid regulatory framework — it was pure market emotion. That’s why it went up fast… and crashed just as fast. Then came 2021, and things started to change. We saw some institutional money coming in, which gave the rally more structure and scale. But at that time, Bitcoin was still not fully recognized by major financial institutions or governments. So even though that bull run looked strong, it didn’t last long — and wasn’t sustainable. Now, this current cycle is a whole different story. Wall Street is in the game. Spot ETFs have been approved, institutional adoption is broadening, and Bitcoin is finally entering the mainstream financial system. That’s why this rally feels healthier, more structured, and more mature. But let’s be real — when Wall Street steps in, they’re not here to let everyone make easy money. They’ll use data, leverage, and algorithmic precision to flush out both overleveraged longs and shorts, until they have full control of the market flow. So yes, the volatility may slow down, the moves might look more “managed”… but the uptrend could be stronger, more resilient, and far more sustainable than anything we’ve seen before.

EL_STOCKTROOPER

آیا تاریخ تکرار میشود؟ بیت کوین پس از رالی، اصلاح عمیق خواهد داشت یا مستقیماً به اوج جدید میرسد؟

Would history repeat itself — or would this time be different? In previous rally, Bitcoin often rallied, consolidated, then experienced a deep washout before breaking into a new all-time high. Now we’re seeing a similar setup: a strong rally, followed by consolidation… but the question is — will we see another deep correction first, or will Bitcoin break directly into a new ATH this time?Deep wash as planned

EL_STOCKTROOPER

POL breakout

POL has been consolidating sideways since March 2025 and is now showing a breakout above 0.26 and 0.28. To account for potential stop hunts during volatile swings, we’ll anchor support at 0.26 instead of 0.28. As long as the price holds above 0.26, the breakout remains intact.

EL_STOCKTROOPER

consolidate & breakout

EL_STOCKTROOPER

EL_STOCKTROOPER

ETH $3,900–$4,000 Major Resistance: Can This Rally CLEAR $4,000?

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.