Dion-FX

@t_Dion-FX

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Dion-FX

BTCUSD MID-WEEK ANALYSIS UPDATE 08/10/2023

📈 BTC/USD: Short-term Drop with Upside Potential 📉 Recent USD weakness fueled a rise in BTC 🚀. Now, with the Dollar initiating a pullback, I anticipate a short-term drop in BTC/USD. After that, I'm looking for a continuation to target the $31,500 level. Here's what to keep in mind: - USD Influence: Recent Dollar weakness played a role in BTC's ascent 📉. - Short-term Drop: Expect a temporary pullback in BTC as the Dollar regains strength 📉. - Upside Target: The goal is to target $31,500 as the next potential move upward 🚀. - Risk Management: Set clear stop-loss and take-profit levels to protect your capital ⚖️. - Technical Analysis: Use technical indicators, like moving averages or RSI, to time your entry and confirm trends 📊. - Stay Informed: Keep an eye on news and events that could impact both BTC and the USD 🌐. Remember, this analysis is not financial advice, and all trading carries risks 🚨. Make sure to do your own research and tailor your strategy to your risk tolerance. Good luck with your trading journey! 🍀📈💹BTCUSD ANALYSIS UPDATE 15/10/2023TP 2 30000 OF Main chart HIT TARGET 31500 HITFULL TARGET REACHED MARKET WILL EVENTUALLY GO AN TAKE THE HIGHS

Dion-FX

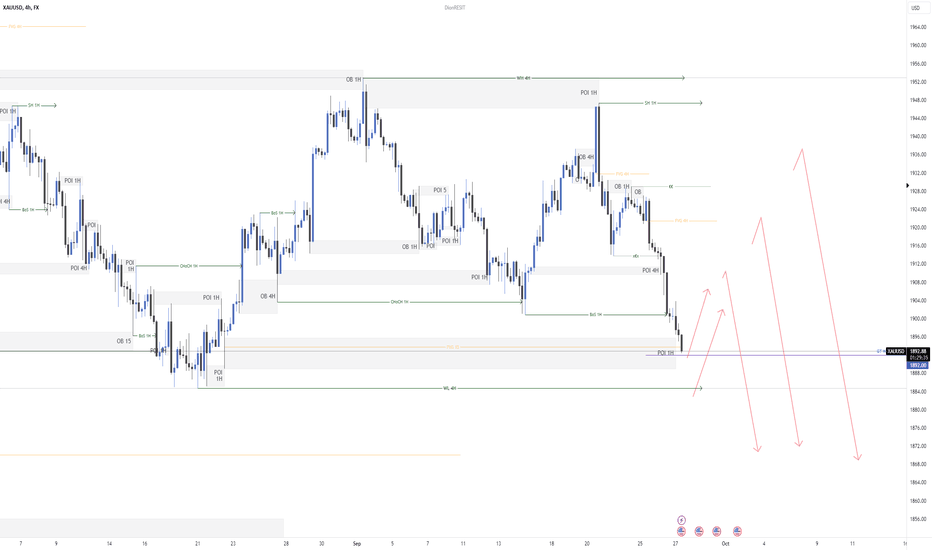

XAUUSD END-WEEK ANALYSIS UPDATE 08/10/2023

📈🌟 Gold Market Analysis: Potential Retracement Ahead Gold has been on a bearish trend over the past month, but the recent developments indicate a possible retracement. Notably, the DXY (US Dollar Index) has broken its structure to the downside and re-entered a range that dates back to August 30, 2023. This shift in the DXY suggests a change in the gold market. Keep an eye on potential retracement opportunities in the coming days. Stay vigilant and manage risk effectively. 📉🪙 #Gold #Forex #TradingView #MarketAnalysisFLYbig bullish candle up any pullback will give me opportunity for bullish continuationMarket showed its hand so we will be continuing downMarket wont be going that deep as DXY is almost at its highest i can think that it can goAs said yesterdayMAIN TARGET REACHED SO IM DONE WITH THIS PAIR NOW I DONT LIKE THE STRUCTUREXAUUSD ANALYSIS UPDATE 15/10/2023POI D touched this is what im looking forUpdate last week octoberBullish trend has started again so i would like to see the market take out the WH D

Dion-FX

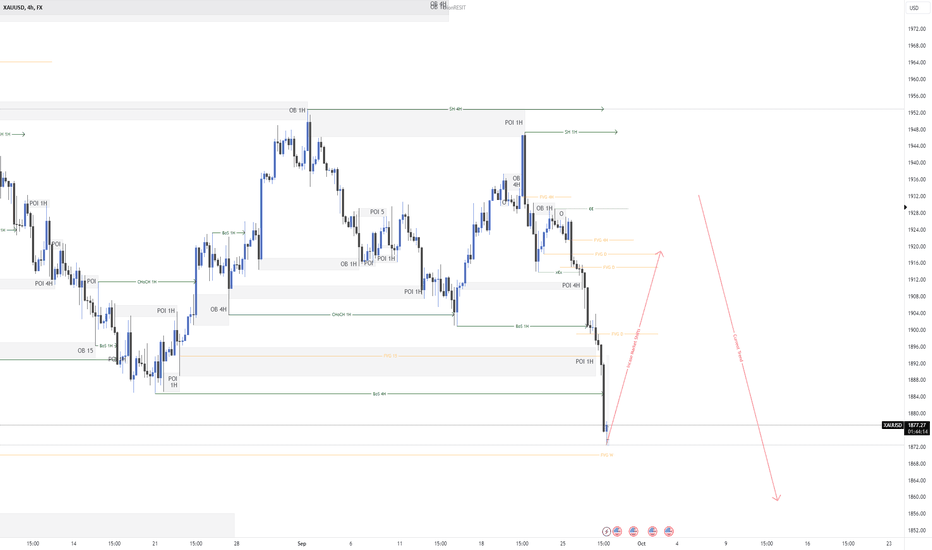

XAUUSD MID-WEEK 2 ANALYSIS-24/09/2023

XAUUSD MID-WEEK 2 ANALYSIS-24/09/2023 Market Shift on DXY Sparks Bullish Outlook for Gold The market has undergone a noticeable shift on the lower timeframes of the US Dollar Index (DXY), which has prompted me to shift my focus towards potential buy opportunities on gold. Join me in exploring this emerging bullish outlook for gold as we navigate the evolving market conditions. Stay tuned for further insights! 📈🪙 #GoldTrading #BullishOutlook #DXYShiftComment: The perfect buying time will be if price was to stay at where it is now at 1877 and then form some kind of Asian range and with the London open market drops down and take out the Asian low without taking out the 1872.50 level.Comment: As of now price has stayed above the 1872.50 level so I do think a continuation long bias is the setup to be played going in next week or at least till end of this week.Comment: Like predictedComment: This trade has turned out to be a smart move, and I'm pleased with its performance. My approach was to use the Dollar Index (DXY) as a predictive tool for trading decisions, particularly when it came to gold. Surprisingly, gold didn't follow the pattern of other major currency pairs in sync with DXY, likely due to its unique vulnerabilities. As it stands, it seems that gold might continue to decline if the Dollar Index starts rising again. However, we should keep a close eye on the situation and be ready to adjust our strategy as the market evolves. Staying informed and adapting to changing conditions is crucial to maintaining a successful trading approach.

Dion-FX

XAUUSD MID-WEEK ANALYSIS-UPDATE 24/09/2023

XAUUSD MID-WEEK ANALYSIS-UPDATE 24/09/2023 Anticipating a Bullish Turn Amid Recent Bearish Streak After experiencing a three-day bearish movement, gold has shown signs of a break in market structure, coinciding with the US Dollar Index (DXY) reaching its yearly high. These developments lead me to anticipate a potential bullish upswing in gold for the remainder of this week and possibly into the next. Stay tuned for updates as we closely monitor this market. Remember, trading involves risks, and it's crucial to manage them wisely and adapt your strategy to the evolving market conditions. Happy trading! 📈💰 #GoldAnalysis #BullishTurn #TradingView

Dion-FX

XAUUSD Short October

Going into the second half of the month my bias on gold is still a short bias and although many people seems to have a long bias but if we look at dxy is along in a strong phase so im still in a short bias for the gold coming 2 weeks.

Dion-FX

XAUUSD 26/07-30/07

As gold now sits on the support area whiles DXY also went and visited the 93.00, this gives us more knowledge about where the market will be heading next. Going into next week we have to have a clear mindset of what the actual trend of the market is and try to squeeze along in order to archieve something. Risk management should be tight because gold can potentially wipe up accounts.

Dion-FX

XAUUSD Great Opportunity For May!!!

As price comes to and important trendline the pressure on that line will be bigger so it will drive the price to retrace to the 61.8% retracement level for the long term.

Dion-FX

XAUUSD Chart Coming Week

A fall perspective to the as the market hits the 78.6% retracement level correlating with the same move as the EURUSD.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.