Dar00

@t_Dar00

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Dar00

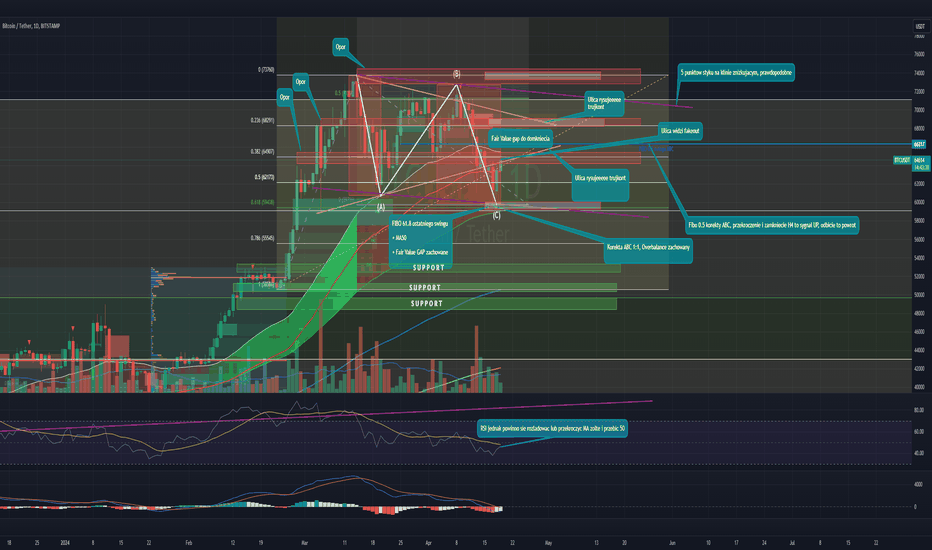

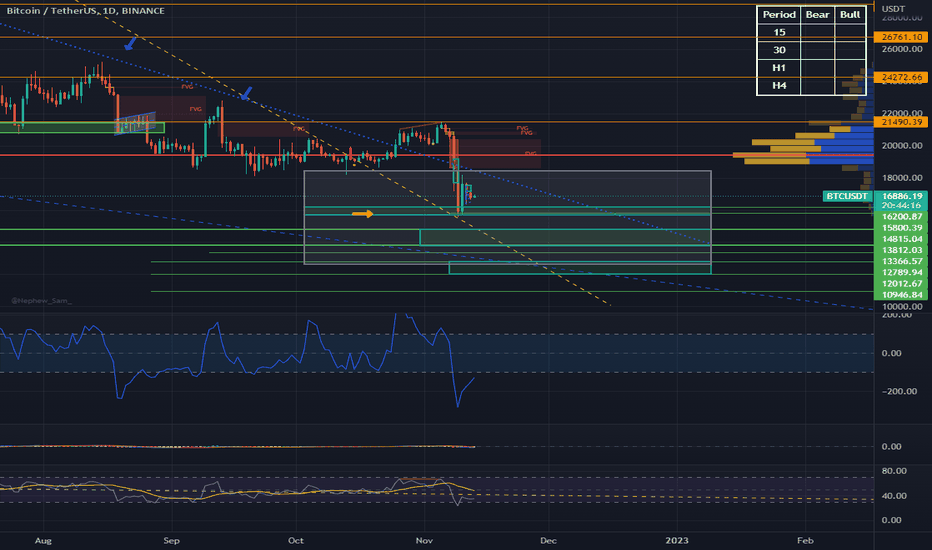

dosc skomplikowany schemat na BTC biorac pod uwage rozne technik

Tutaj rozrysowane kluczowe poziomy dla BTC, biorac pod uwage srednie kroczace, fale Eliota, overbalance, wsparcja i opory oraz zebranie plynnosci na poszczegolnych poziomach a takze rozciagniecia Fibonacciego.

Dar00

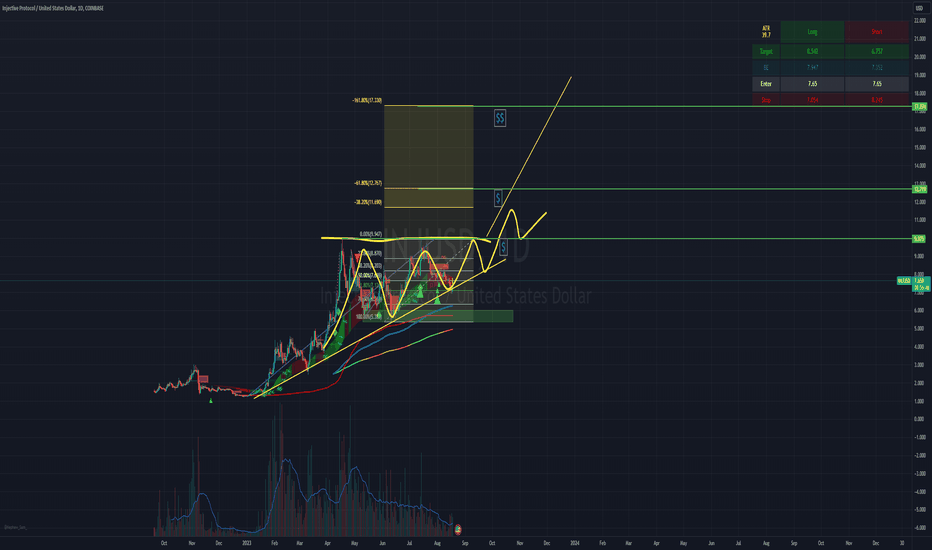

$INJ

Injective protocol potential Bullish price action and potential take profit levels.The ascending triangle scenario iust still valid, whether the yellow global support will be the resistance at 8 USD or whether the triangle will be longer and slower in time, will be revealed at price point of around 8 USD

Dar00

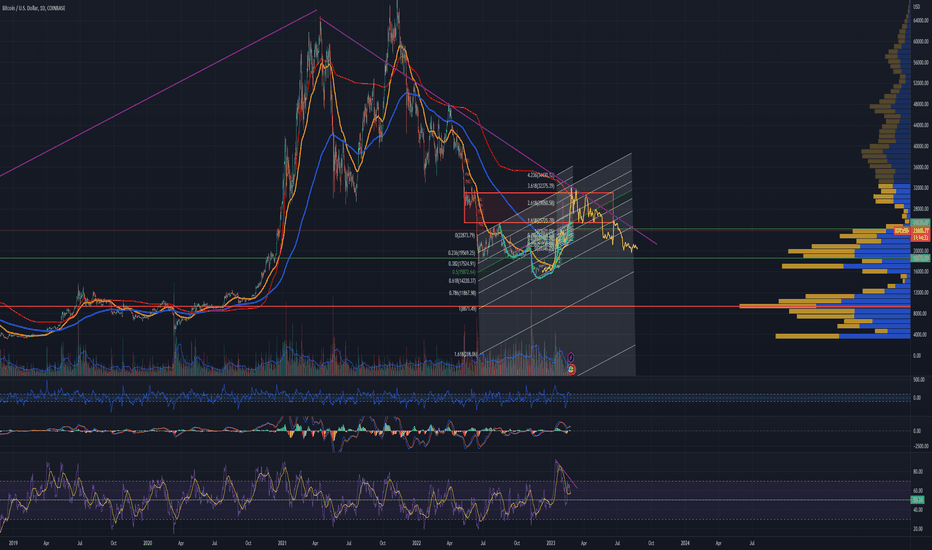

A potential BTC price action rH&S

When we look on a larger time-frame, foremost 1D, we can see more and more evidence that BTC moves with a channel, respecting the FIBO retracements. Also on a global scale we can see a reverses head and shoulder formation, that could lead to a short and rather rapid price explosion towards the uptrend. the RSI 13 illustrates that BTC returned from overbought to a normal level, expecting to retest or maintain top upper channel from 50 RSI 13 above. Recharging for a larger move. We also see that there is not much liquidity at higher price levels, hence the cohort of investors is not deciding to sale, but rather take profit and move some liqudity into the Altcoins, which pop-up. On a larger time frame we see a massive resistance at 27.5-31.5k, indicated with a red rectangle . The bitcoin seems to follow closely recovery from 2019 bottom, with a rapid uptake towards higher prices. Will this scenario play-out? This is a bit foreseeing but we see on the chart even more evidences for potential price speculation towards the uptrend. Important to highlight is the analysis of social sentiment: a large cohort of investors yet believes that this is a suckers rally, hence they do not participate in the market, but their belief may be invalidated when breaking out 25.3 and maintaining this regime, pushing them to loss aversion due to missing the opportunity (also known as FOMO). A confluence of: - The rH&S, FIBO extension - Massive volume resistance at arround 27-32k - VPVR at around 27-32 - Potential resistance line draw from the 2021 Mai ATH, that has been respected - On-chain analysis suggesting that the peak of the last bulllrun was in fact in Mai 2021 - On chain analysis, mainly aSOPR but also other parameters suggest a change in Investor's perception of the market towards the bull trend - Historic fractal pattern from 2019 bottom that has been a black swan event too - Golden Cross on 1D - PRice action multiply respecting the 50% retraction - MACD - STOCH RSI (not shown in analysis) This is surely a bet, but backed by several parameters that confluence. Good luck with trading

Dar00

A potential BTC price action rH&S

When we look on a larger time-frame, foremost 1D, we can see more and more evidence that BTC moves with a channel, respecting the FIBO retracements. Also on a global scale we can see a reverses head and shoulder formation, that could lead to a short and rather rapid price explosion towards the uptrend. the RSI 13 illustrates that BTC returned from overbought to a normal level, expecting to retest or maintain top upper channel from 50 RSI 13 above. Recharging for a larger move. We also see that there is not much liquidity at higher price levels, hence the cohort of investors is not deciding to sale, but rather take profit and move some liqudity into the Altcoins, which pop-up. On a larger time frame we see a massive resistance at 27.5-31.5k, indicated with a red rectangle. The bitcoin seems to follow closely recovery from 2019 bottom, with a rapid uptake towards higher prices. Will this scenario play-out? This is a bit foreseeing but we see on the chart even more evidences for potential price speculation towards the uptrend. Important to highlight is the analysis of social sentiment: a large cohort of investors yet believes that this is a suckers rally, hence they do not participate in the market, but their belief may be invalidated when breaking out 25.3 and maintaining this regime, pushing them to loss aversion due to missing the opportunity (also known as FOMO). A confluence of: - The rH&S, FIBO extension - Massive volume resistance at arround 27-32k - VPVR at around 27-32 - Potential resistance line draw from the 2021 Mai ATH, that has been respected - On-chain analysis suggesting that the peak of the last bulllrun was in fact in Mai 2021 - On chain analysis, mainly aSOPR but also other parameters suggest a change in Investor's perception of the market towards the bull trend - Historic fractal pattern from 2019 bottom that has been a black swan event too - Golden Cross on 1D - MACD - STOCH RSI (not shown in analysis) This is surely a bet, but backed by several parameters that confluence. Good luck with trading

Dar00

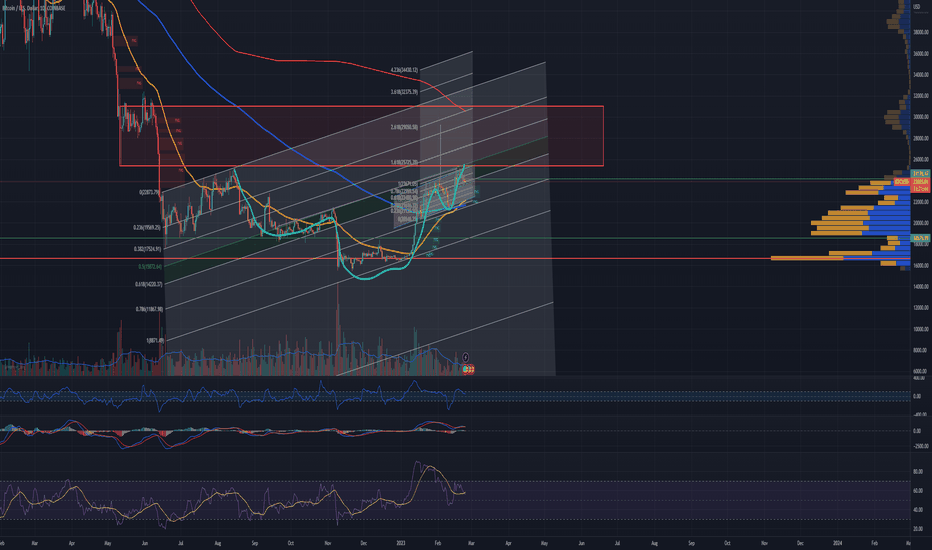

Potential playout of the 2022 BTC Bottom

This is a potential play out of the BTC 2022 market bottom after the FTX collapse. There are two scenarios as always, The option to rebound up: The BTC has reached the potential bottom at 15kk USD zone and it may retest it or form an Adam and EVA type of a reversal pattern. This option assumes also a play out of a book-made Wyckoff accumulation phase, after a successful retest of the 17-19k zone. This option aligns with the FIBO level. The economic scenario looks promising for the next quarter, when it comes to the stock market. Having seen "positive" market feedback from US market (and this is the one that the cryptocurrency is following) with YoY inflation (decreasing more than anticipated), but increasing unemployment and all the flash news information about some massive company lay-offs of stuff (Meta, Former Facebook 11000 e.g.). The DXY index also seems to have a peaked and is due the correction. The market currently prices in economic slow down, but is focused mainly of the interest rate hikes. Current 4.5 or maybe 4.75 are already priced in according to my analysis and pre-released information from FOMC (distribution of votes of members according to their average interest rates have averaged at around 4.5, from 3.1-5.2). Hence the market already knows what interest rates are and sees a potential start of a downtrend for the inflation and potential economic slow down both leading to a dovish action from FED and pivot. On top of that we hear a positive news from Ukraine that makes big steps day by day in reclaiming the land, while Russian forces retreat. This is not yet priced in in the market in my opinion and a potential settlement would turn expectations of many investors into bullish. Already at levels of 19-21 K as much as 22% Bitcoins have change the hands, id, est: weaker players of the market capitulated and sold it to smart money or other retail investors. This is gigantic number and simplifies that this is a decisive point for many investors, and interesting buy point for stronger market players. Clearly FTX was a little unexpected black swan of 2022 (gosh, a second one). The option below: The market is currently extremally fearful due to the recent FTX collapse and even more spicy news coming out as the days pass. The chance that there are "more bodies" in the wardrobe is high. We know now what FTX was doing, How Alameda research contributed in the collapse how FTX was overleveraged and it gives away its collateral of FTT tokens that are artificially pumped. Now the bigger picture emerges and we start seeing strange connections between the CEO of FTX SBF and Gary Gensler Head of SEC. A Co-CEO of Alameda research is a daughter of the Head of economic department at MIT, whom Gary Gensler used to report to as he was previously teaching at MIT. Yesterday a FTX hack on both FTX and FTX US doesn't look good either, as some speculation on the more experienced professionals point out toward the potential insider job. It is impossible to predict what will come out after this but we may see this to be a trigger point with respect to regulations. If another crypto service collapses and/or stablecoin problem will come out, the market may enter into a panic sell and we will see lower lows. If not the FTX disaster we would be quite likely seeing now much higher prices on the cryptocurrency market. The potential buy in zones are shown on the screen as well as take profit levels until the 30k region. At this point I want to give all the condolences to Customers of FTX, Voyager, BlockFi and other companies that got affected by this reckless, and quite likely a criminal (lets see what comes out) behaviour of SBF and Alameda research. I feel sorry for you to suffer such a loss and hope, please remember this is only money and life and people around you are much more important!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.