DH-TradingFX

@t_DH-TradingFX

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

DH-TradingFX

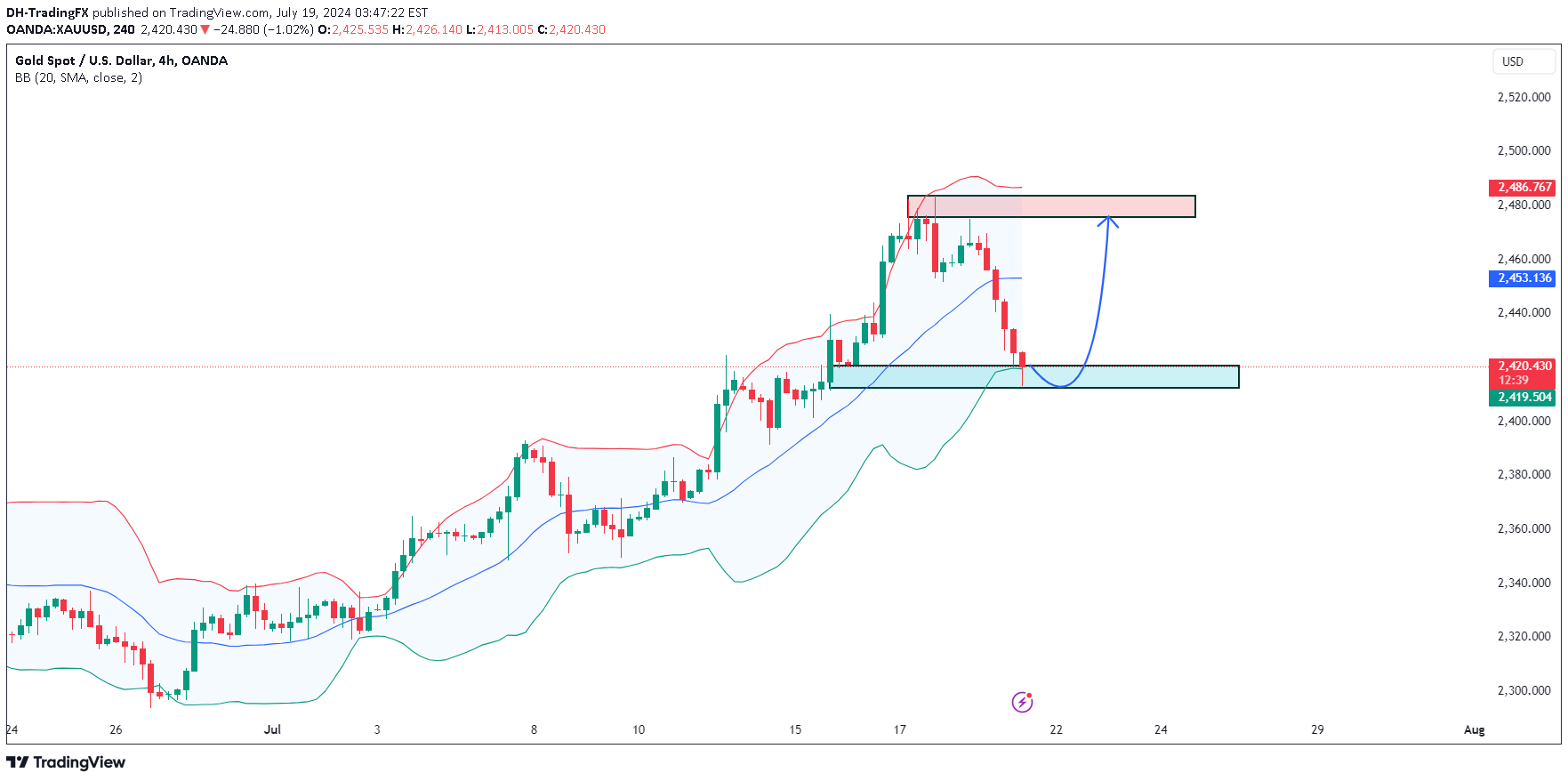

Hello dear traders. Let's discuss and strategize after a volatile week! Unfortunately, gold has struggled to gain any significant momentum and remains confined to a tight trading range, just below $2,428. This movement seems to be influenced by the convergence of the EMA and nearby resistance levels. The reason for the decline in gold prices is due to the strengthening of the Dollar and profit-taking activities that took place after gold prices reached a record peak earlier this week, fueled by growing expectations that the US will cut interest rates. capacity in September. Besides profit-taking, the market is also falling in anticipation of a soft landing, which could put pressure on gold prices as investors will shift money from safe investments to risky investments more risky. I am expecting from the 2400 USD support area the price will bounce back and from 2428 USD where the price will react at the 2 EMA 34.89 which will be in line with our selling strategy and targeting for the levels lower.Trade activeComment: This week, 16 Wall Street analysts participated in the Kitco News Gold Survey and the results were clear: 6 experts, or 38%, expect gold prices to rise next week, while the same number predict price will decrease. The remaining 4 analysts believe that gold will tend to move sideways next week.Comment: +70 pips from entry 2400Comment:

DH-TradingFX

Gold prices continued to decline today but were still recorded at a record high price compared to the previous session, because of expectations of an interest rate cut in September from the US Federal Reserve (FED). continue to increase. However, it is predicted that this precious metal will grow in the long term thanks to the FED's preparations to cut interest rates and the belief that inflation is being controlled, geopolitical instability and central bank demand are also increasing. creates a positive medium and long-term outlook for gold. According to CME's FedWatch Tool, the market is pricing in a 98% chance that the United States will cut interest rates in September. The appeal of non-yielding bullion tends to shine in low interest rate environments.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.