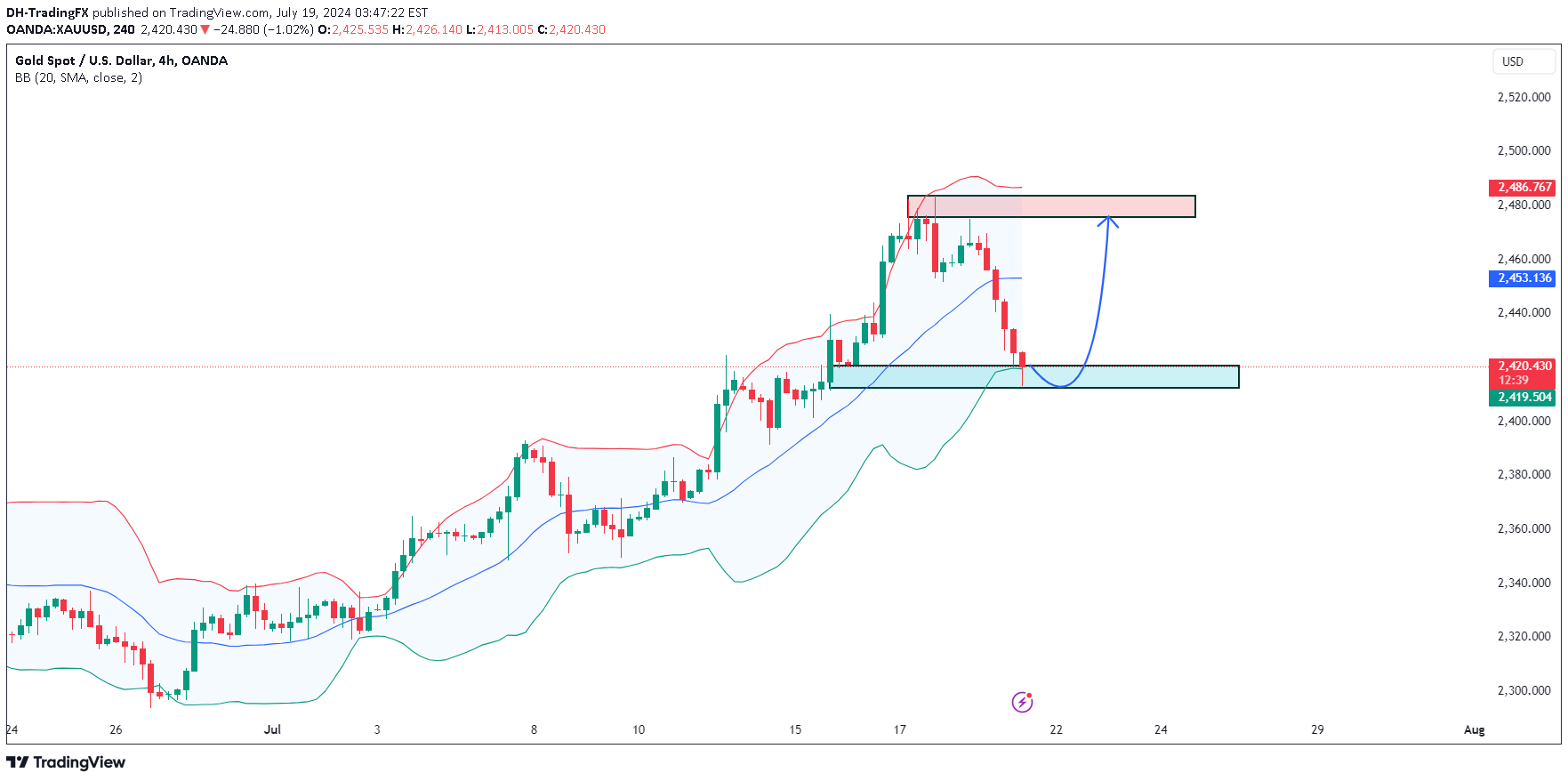

Technical analysis by DH-TradingFX about Symbol PAXG: Buy recommendation (7/19/2024)

DH-TradingFX

Gold prices continued to decline today but were still recorded at a record high price compared to the previous session, because of expectations of an interest rate cut in September from the US Federal Reserve (FED). continue to increase. However, it is predicted that this precious metal will grow in the long term thanks to the FED's preparations to cut interest rates and the belief that inflation is being controlled, geopolitical instability and central bank demand are also increasing. creates a positive medium and long-term outlook for gold. According to CME's FedWatch Tool, the market is pricing in a 98% chance that the United States will cut interest rates in September. The appeal of non-yielding bullion tends to shine in low interest rate environments.