DBStudio_X

@t_DBStudio_X

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Cardano has significant potential, but from a technical perspective we still need to see a decisive confirmation candle above the black trend line before a sustained breakout can be confirmed. If we break this trend line with strong momentum, the next mid-term targets are $1.20 and $1.60. On the fundamental side, there is a strong pipeline of catalysts: BTC DeFi on Cardano enabled by its shared UTXO structure, the upcoming Leios upgrade for scalability, Hydra L2 for faster transactions, and the launch of the first Cardano partner chain Midnight, which focuses on privacy and selective disclosure to meet enterprise demand. Looking further ahead, the possible targets for 2026 are in the $3 to $8 range, which align with the mid-line of the second ascending channel. Considering both the technical setup and the fundamentals, I see substantial upside potential for Cardano in late 2025 and into 2026, with the possibility of outperforming BTC, ETH, and SOL as adoption and utility expand.

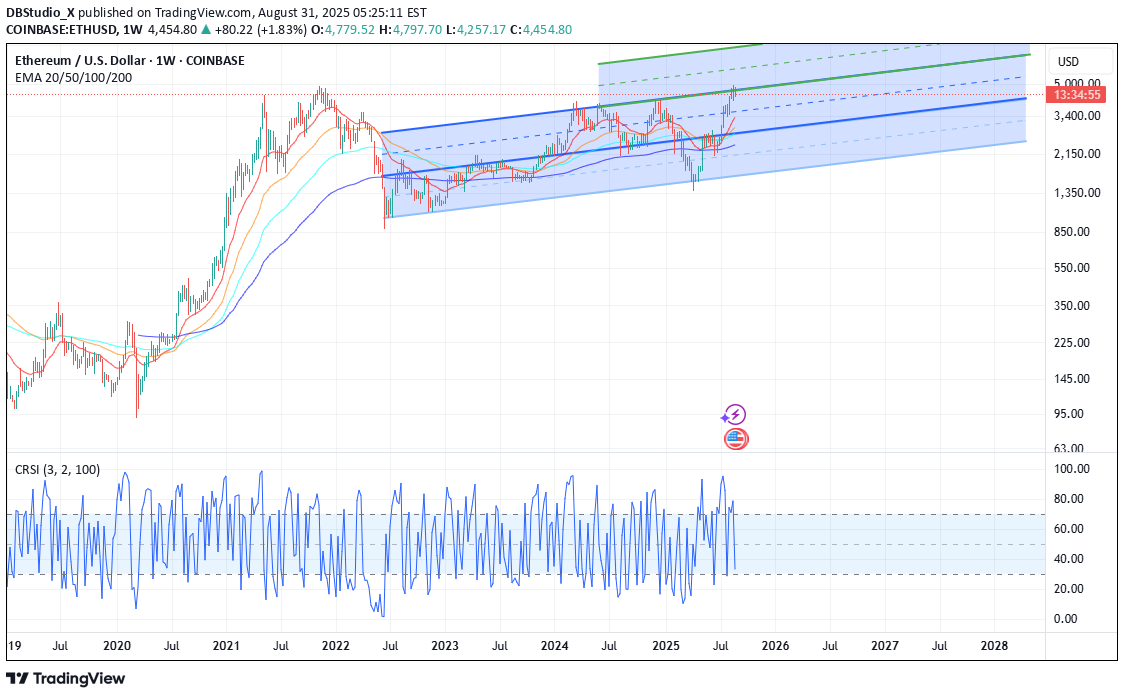

The larger structure remains bullish, but the simultaneous test of the channel top and the ATH zone makes a cooling-off / ranging phase likely. Ethereum has held support above the lower boundary of the channel and has now reached the top of the second channel. The bullish outlook remains intact, and if the price secures a weekly close above $4,900, it may enter the green channel. In that case, reactions at both the mid-levels and tops of the channels can be expected as the trend continues. Key support levels to watch are in the $4,200–4,300 zone (previous breakout area), followed by $3,300–3,500 (aligned with EMA20 and the channel midline), and then $2,900–3,100 (cluster of EMA50/100). As long as these supports hold, the overall bullish structure remains valid. The uptrend is projected to extend into mid-2026, unless Ethereum breaks down and falls back into the lowest channel, which would invalidate the bullish outlook. Additionally, the bearish structure of the Bitcoin dominance chart further supports this bullish scenario for Ethereum.

This is my bullish scenario for Solana in 2025–2026. It is moving in an ascending channel and is likely to continue toward the upper boundary of the channel. We will face resistance around the middle of the upper channel and experience many corrections along the way. The midline of the lower channel will act as a support line on the way, but overall this remains a bullish case for Solana. The passing of the Clarity Act will be a catalyst for this.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.