CryptoPAMM

@t_CryptoPAMM

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

CryptoPAMM

BTC Bulls, this one is for you ;)

As most of you know, I’ve been bullish on Bitcoin for quite a while now. And today, I want to show you exactly which resistance levels I’m watching if the breakout continues. On the weekly BTC/USDT chart, I’ve marked out five key upside targets, all based on Fibonacci extension levels — not just random lines, but technical zones that often attract serious reaction from the market. Let’s break them down: 🔸 Target 1 — $124K This lines up with the 141.4% Fibonacci extension and also happens to match the projected move of a textbook Cup & Handle pattern. It’s the first big checkpoint. 🔸 Target 2 — $137K Here we’ve got the 227.2% Fib level — a classic continuation zone if momentum remains strong. 🔸 Target 3 — $145K Next up is the 241.4% extension, where we could see some heavier resistance and price interaction. 🔸 Target 4 — $155K One of the strongest zones on the map. Why? Because it merges four separate Fibonacci extensions in one cluster. A real decision point. 🔸 Target 5 — $167K And the final target (for now) — the 261.8% extension. If BTC gets here, it’ll be a major event. 🎯 My View: This isn’t hopium. These levels are based on market structure, Fibonacci math, and historical behavior. As always, I’ll adjust based on price action, but these are the areas I’m preparing for.

CryptoPAMM

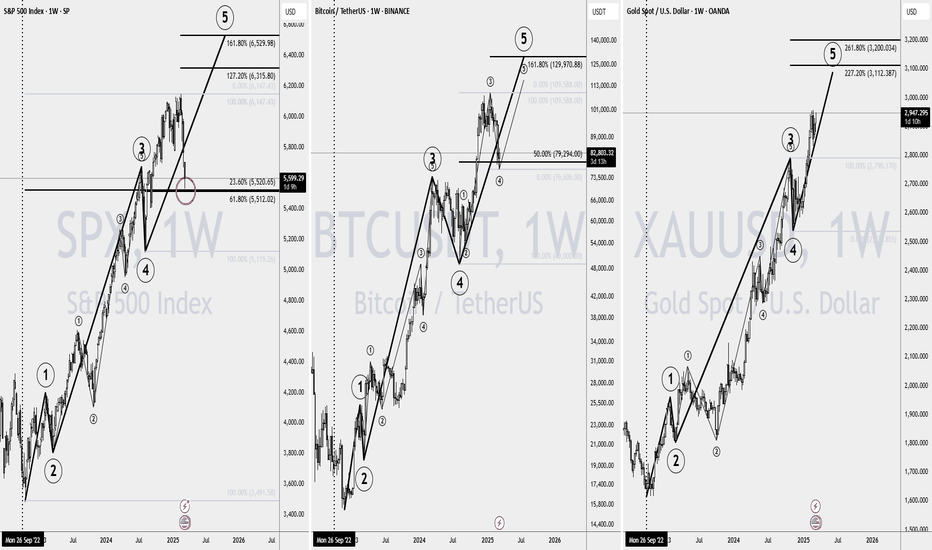

S&P 500 Index, Gold, and Bitcoin

Today, I’m analyzing the weekly charts of the S&P 500 Index, Gold, and Bitcoin. Notice anything interesting? 🤔 Since late 2022, these assets have been moving in sync, showing an unusually strong correlation. At times, it almost feels like they’re behaving as a single market. But spotting these connections provides valuable insights we can use to our advantage. One chart that stands out is the S&P 500 Index, particularly its rebound from the dual Fibonacci support zone around $5520. This is a critical level, and as long as it holds, both Bitcoin and Gold are likely to maintain their upward momentum. For now, the overall market sentiment remains bullish, and this trend could continue throughout the year. 🚀

CryptoPAMM

KAVA/USDT 300% Growth Potential

KAVA is one of the few coins that held exceptionally well during the recent market manipulation. While most cryptos printed new lower lows, KAVA/USDT formed a solid double bottom around the psychological support at $0.40. From a technical perspective, this setup suggests strong upside potential. If the support holds, we could see a significant bullish breakout in the coming months. I wouldn't be surprised if the price skyrockets by 300% over the next three months. Are you bullish on KAVA?

CryptoPAMM

BTCUSDT VIP Signal № 367

Panic Rising, Opportunity Brewing Bitcoin is headed for $130-140K this cycle is a reasonable target. Right now, the market is drowning in fear, with traders getting ready for a steeper drop. But let’s be real—that’s exactly when the big players make their move. The Trend Is Still Our Friend Sure, markets can be chaotic, but probabilities are still leaning bullish. Just take a look at the price action—the trendline has already proven itself as support twice. The demand is there, institutional money is pouring in, ETFs are shaking up the game, and with a crypto-friendly Trump back in the picture, the narrative is stronger than ever. Besides, the bullish scenario seems to be supported by the Elliott wave theory as well. I’m Stacking Bitcoin Sharp pullbacks wipe out weak hands, but they also set the stage for massive upside. Fear is the fuel for opportunity. Or as Baron Rothschild once put it: "The best time to buy is when there’s blood in the streets—even if it’s your own."1. Gold Reaches a New Record High Gold has once again set a fresh all-time high, climbing to $2,942 per troy ounce. The latest surge was largely driven by investor concerns over the economic fallout from Trump’s tariffs, prompting a flight to safe-haven assets like gold. 2. Indications of a Potential Reversal However, according to Elliott Wave theory, the price appears to be finalizing its last upward wave, which could indicate an upcoming correction. Additionally, XAU/USD is currently pulling back from the 161.8% Fibonacci extension level, a signal that bullish momentum may be weakening. 3. Investors Eye Riskier Assets If gold has indeed reached a peak, investors may start redirecting capital toward riskier assets, including cryptocurrencies. This shift could breathe new life into the crypto market, with altcoins potentially seeing significant upward movement. 4. A Turning Point for Altcoins With gold showing signs of exhaustion, a shift in market dynamics could be underway. Traders looking for higher returns may increasingly turn to digital assets, potentially sparking a strong rally in altcoins.

CryptoPAMM

CHEEMSUSDT VIP Signal № 355

The CHEEMS/USDT appears to have shifted its short-term trend from bearish to bullish, with the price stabilizing above the 200-day EMA. This presents a favorable risk-reward ratio for a long position, which I am sharing with you. My target for this setup is conservative, as I believe we are at the onset of an altcoin season. Let's see how it plays out.

CryptoPAMM

SAND/USDT Triangle Breakout: A Buying Opportunity

Let me share my latest trade setup for SAND/USDT. From my perspective, it looks like altcoins may have finally bottomed out and are gearing up for potential gains of 100% or more. That said, I’m keeping things conservative with this setup, targeting a 17% profit from my entry point. What stands out in this chart is the clear breakout above the triangle and the bounce off the uptrend line, both of which are strong bullish signals. However, it’s worth noting that some stop-loss hunting could push the price slightly lower before the next move. Overall, with a solid risk-reward ratio, this setup offers a promising opportunity for those looking to capitalize on the potential trend continuation.

CryptoPAMM

Premium Long Trade Setup: DUSKUSDT

Today, I’m excited to share our premium long trade setup for DUSKUSDT. Let’s start by focusing on the critical $1.45 support level, where we observed a clean rejection of the 161.8% Fibonacci support. This rejection is a strong positive signal, indicating a potential trend reversal for DUSK. Currently, we see the completion of a 5-wave move to the upside, which confirms that this rally is not merely an ABC correction. With the 5-wave structure complete, it’s logical to anticipate an ABC correction to the downside. We’ve strategically placed our buy limit order at $0.2211, offering a robust 1:3 risk-reward opportunity. Additionally, we’ve set three upside targets. Upon reaching the first target, we plan to secure 50% of the profit and simultaneously eliminate the trade’s risk. This approach allows us to manage the trade with confidence, knowing that we’re in a strong position for potential gains. Let’s monitor this setup together and enjoy the process. Happy trading!

CryptoPAMM

BANDUSDT Elliott Wave Breakdown

In this video, we conduct an in-depth analysis of BANDUSDT, examining its price action across multiple timeframes. By applying Elliott Wave theory, we aim to map out the potential future price movements and identify key turning points in the market. Additionally, we integrate insights from the Smart Money Concepts indicator, which provides us with a clearer understanding of market dynamics and potential zones of interest. This comprehensive approach allows us to develop a well-rounded trading strategy for BANDUSDT, balancing both short-term and long-term perspectives.Our Premium trade setup... usually shared privately

CryptoPAMM

Bitcoin Bull Run Continues: Why Bitcoin Could Break Through $74k

The long-term Bitcoin trend remains distinctly bullish, highlighted by a powerful breakout above the top of the average-price uptrend channel. This breakout propelled BTCUSDT to a high of $73,881, followed by a significant 33% correction. This pullback found strong support at the 50% Fibonacci retracement level, around the critical $50,000 psychological mark. This price level is pivotal for several reasons.Firstly, it was previously a strong resistance zone that has now flipped into solid support, demonstrating a classic technical analysis principle. Secondly, this level aligns with the concept of equilibrium, based on the Smart Money Concepts indicator, demonstrating a balance between buyers and sellers at this price area. Thirdly, it's the bottom boundary of the average-price ascending channel, adding further significance to this support zone.Moreover, the robust defense of this 50k area by buyers underscores the healthy long-term demand for Bitcoin. This combination of factors suggests that as long as BTCUSDT stays above the 50k support zone, the overall trend will remain bullish. Consequently, the likelihood of a continued price increase outweighs the possibility of a downturn.Looking forward, we expect BTCUSDT to continue its upward trajectory, with a potential target at the previous high near 74k. If this resistance level is breached, the next target could be the 161.8% Fibonacci retracement level, corresponding to the 90k psychological price mark.However, it’s essential to remain vigilant. A sharp break below the 50k support zone could trigger a significant decline, potentially pushing Bitcoin down to the 40k or even 25K support areas. Traders and investors should be prepared for such a scenario, balancing their bullish outlook with prudent risk management strategies.

CryptoPAMM

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.