CryptoMainly

@t_CryptoMainly

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

CryptoMainly

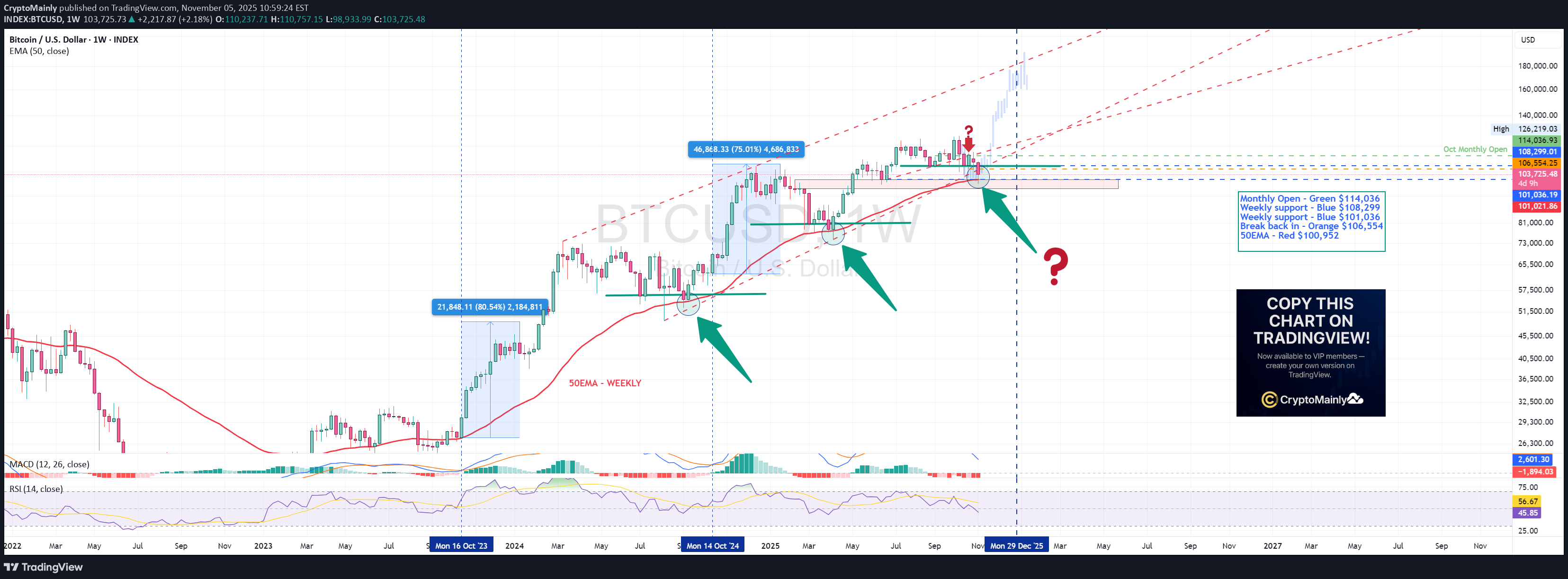

تحلیل هفتگی بیت کوین: آیا سقوط ادامه دارد یا فرصت خرید است؟

This cycle so far has seen no Parabola, no Euphoric stage, no retail newbs, and an Alt Season that was not worth mentioning. This cannot be the end in my opinion. Tops in Crypto cycles do not look like this and Alt Season is a huge part of the cycle. Yes, things have changed but not to the extent, that this was it!! Take a look at this Weekly Bitcoin chart and note, we are below Weekly support AND below the upward sloping trendline BUT this week has not closed yet. You will also note that the 50EMA is where price found CANDLE BODY support that then launched us into the next leg to the upside. We have not even tested the 50EMA with a wick as yet. I know it is scary but I just dont believe things are done here. All eyes on the Weekly close this week and next!

CryptoMainly

Gold vs Bitcoin

Fed up with Gold bugs continually saying what a great store of value Gold is compared to Bitcoin. Let's take a look when we consider the M2 classification of monetary supply (inflated money supply adjusted value)

CryptoMainly

🚨PLEASE PAY ATTENTION❤️ $BTC - Bitcoin 3Day 2018 RSi comparison

🚨PLEASE PAY ATTENTION❤️ BTC - Bitcoin 3Day 2018 RSi comparison Please keep an eye on the RSi on the 3 Day timeframe, you will note that it is currently at a level comparable with the Nov 2018 breakdown (which resulted in a 52.09% downside move). I have marked the 2018 RSi breakdown level in turquoise at 43.67 and you will note we are currently below at 42.14. As you can see, there is also a similar lower high scenario on the RSi which I have also marked on the chart. Beware if you see the RSi break below 41.44 (marked in Red) as that would be the confirmation, the downside move is coming and it will be significant! Also, note the timeframe between ATH and the breakdown! 😳🙈RSi only - zoomed in FYI

CryptoMainly

Bitcoin Hash Ribbons

A Powerful and highly accurate indicator has now fired on the Bitcoin chart - The Hash Ribbon Indicator The history of the Hash Ribbon indicator provides and interesting insight in the potential Bullish move that could be just around the corner. As you can see from the chart, the indicator does not necessarily mean the bottom is definitely in, but it is fair to say we are very close! Let's hope the world markets do not spoil the party...... China needs to bounce and find support here or else!

CryptoMainly

Bitcoin

Interesting to see, every time the the Bull Market support band crosses below the 50SMA, there is a correction in excess of 55% and even up to as much as 70% The depth of the correction appears to be becoming more shallow as the Market matures ETH / BTC losing key support suggesting the downward pressure will continue and Alts are not the place to be for the coming weeks

CryptoMainly

Bitcoin - Bullish Divergence

Several signs suggest we are already at or close to a temporary bottom. The low Bitcoin prices at $22-$24K range are not due until towards the end of this year according to previous cycle comparisons! Summer Alt Season followed by actual capitulation year end is my opinion. Watch for everyone being super Bullish as we get back above the Bull Market support band, bounce along it as if it will hold as support before the big rejection from the 200SMA after the Summer Alt season.

CryptoMainly

#Ethereum - $ETH

Alt Season still shaping up nicely for the summer in my opinion.

CryptoMainly

#Bitcoin - $BTC

Interesting to see the downward pressure building - are the sellers exhausted or will support be broken? I think the capitulation candle is near and it will be nice to see it over and done with. Classic Wyckoff Accumulation in effect right now, collecting up the liquidity from the Short AND the long positions before lifting off into the Summer Alt Season :-D Trade carefully right now! Patience will be rewarded imo

CryptoMainly

Bitcoin Bear Market continuation - dont be fooled

Whilst I still believe we will have a nice Summer Alt Season, the back end of the year is looking to create new lows before the start of the next cycle and lead up to the next halving which is currently estimated as May 2024. Trade carefully all, any pumps will be short lived with a max of $56K-$58K followed by the decline.. In the summer Alt Season - Take profits and buy something real x

CryptoMainly

$AXS

AXS - breaking out 👀 Next Bullish move incoming New price target on the chart

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.