Crypto-RyGuy

@t_Crypto-RyGuy

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Crypto-RyGuy

The overall market is shaky and btc will be a driving factor whether Pepe can pump with bullish momentum. With this said we have flashed a golden cross which is a good indication that momentum could be building. When we mix this with oversold ti on most time frames and a few bullish divergences showing, I feel Pepe could be ab to break out of our falling wedge pattern. Breaking our rsi downtrend on the daily will be a good starting point to gauge further market sentiment. Wait for confirmation.

Crypto-RyGuy

Could we see another massive consolidation trend like our previous run just as we did it 2020-2021? I think this could be a likely scenario if we breakdown and are rejected from the 86-87k zone. If we breakdown this I think will see a rally into the 93-95k zone.Excuse the grammar rejected from redline will mean a further breakdown and drop back to 76k and possibly 69 areaBullish divergence successfully playedWell this played out nicely, will see some accumulation next few days before another big move!

Crypto-RyGuy

Btc tested a strong support level and made a strong bounce continuing a divergence on several TA indicators. Trend support on daily and weekly shows a bottom. I think will see a trend reversal over the next few weeks as tariff news settles and more talks of rate cuts. RSI top- daily time frame Trend strength bottom- weekly time frame Chart- daily time frameThe 90 day tariff pause caused an influx of money into the market. This is a good start to see what future news will produce in the market.Bullish divergence successful

Crypto-RyGuy

3 possible outcomes based on trend and resistance supports, demand zones, and market volume increases based on sec insight data from current oversight committee as being pro crypto (very good for crypto future). having a strong bounce from our current demand zone will give the best outcome for a new high above 111-112k. Rejection of the dynamic resistance we could see some sideways movement like the past few months where we saw swings between 48k and 73k forming a large flag pattern. Seeing the same setup could be likely to gain more support around the 95k range to make a higher high. breaking that 87k-89k range would mean previous falling back to 67k-73k support. Next new high would be somewhere around the high teens low 120ks.Saw bulls hold 100k support to make a new high. Doesn’t seem to have enough momentum for much more. But I do think our bull run will continue. Seems to be Alt coin season. Btcd loosing momentumdouble bottom bounce from btc support, gaining momentum for a new high at 120k?

Crypto-RyGuy

Personally I think we are holding a solid support and will move back to the 1.30 zone. If we fall back to our supply zone we could see a bounce or a further fall to our main support of .80ish cents. If we break our ultra support we can assume further sell off is likely.Reverse zone needs to extend down to the 1.15 levelPlayed out perfectly

Crypto-RyGuy

The next few weeks I think will see some more sideways movement, this is based on market cap maintaining a pretty steady flow. One good spike and I think will see 1inch start making moves toward the .30-.40 cent range by mid OctoberPlaying out nicely

Crypto-RyGuy

Drawn from previous macro and micro strategies we are currently finished our correction phase. With this said we are in a good supply zone. First wave should reach previous cycles 3 zone. Will do an updated chart for the short term play out possibilities.

Crypto-RyGuy

Symmetrical triangle set up can either breakout as a reversal pattern down or up. Wait till solid cancel closes to determine which.Accompanied with a rising rsi above 50 a bullish breakout seems to be the more likely outcome.

Crypto-RyGuy

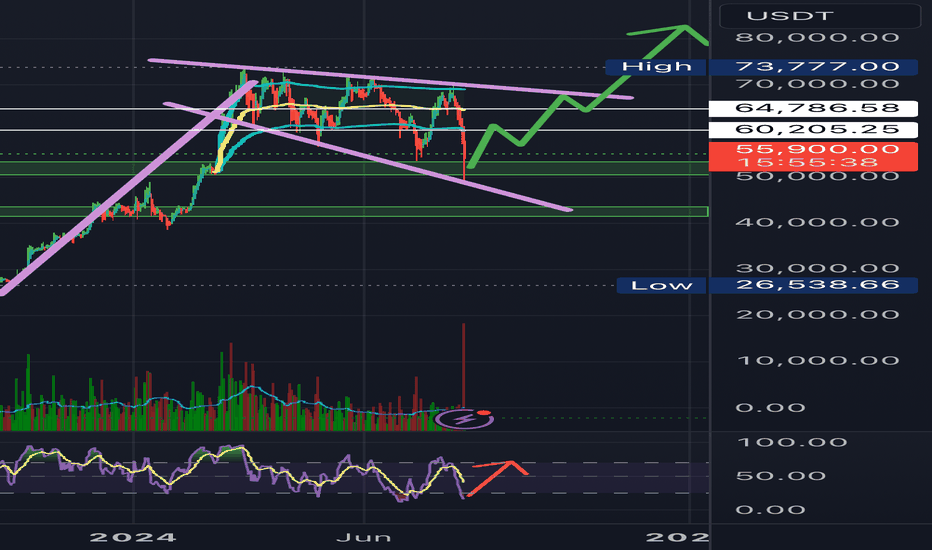

Lot of controversial information going around involving btc, whether we are in a consolidation phase and bounce or bears taking control and moving back towards the 40k range. Considering indicators on the weekly and daily time frame we are extremely oversold and our price still closed above the 53k on the daily. This is important because earlier this spring black rock launched thier Ibit ETF which bought 19billion worth of btc around the price range of 60k. This launching opens the door for more market investors with BlackRock reputation leading the way. Also the volume BlackRock purchased at along with the price range means they will defend this price range with thier lives. We will see a move towards 60k over the week making sideways moves. Our massive bull flag structure has shown strong support at key price levels. Don’t get shaken with bs market analysis. The inflation rate being what it is has actually started to push investors towards btc over the past few months ie our kick out of the 20-30 and 40k range relatively very quickly. Hodl your bag and watch the 82k range play out!forex-central.net/chart-patterns/img/right-angled-broadening-wedge.jpg Sorry less of bull flag more of a broadening wedge pattern. Example aboveStill consolidating though we are still seeing chart structure play out as posted! Next few weeks will be crucialPlaying out perfectly need break up 67

Crypto-RyGuy

Quick setup nice rev h&s, wana see a break above 68.5k min before we talk about a new ath

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.