Cozybanana78

@t_Cozybanana78

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Cozybanana78

ANKR Possible Playout Chart

The price movement for ANKR is predicted to increase because it is now in the ID support area. September 25th can be a determinant of whether ANKR will experience a decline or increase, but at the price of $0.01935 it has several supports of 5x retest support and resistance so this price is the key price for the next movement. The potential increase for ANKR is 6.53% in the next 1 week. To confirm bearishness, ANKR needs to close the candlestick below the price of $0.01879.

Cozybanana78

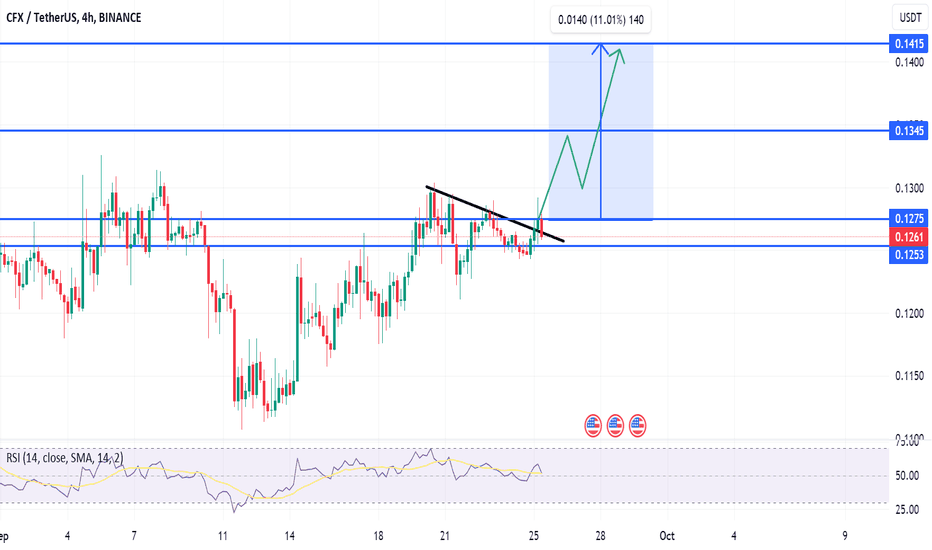

Conflux Possible Playout Chart

CFX price movements are predicted to increase because there is bullish confirmation after breaking the resistance line at $0.1275. However, this confirmation certainly has the potential to experience bearish again, but here the movement is quite positive for bullish. The upside potential for CFX is $0.1415 with a potential gain of 11.01% this week. Of course, this potential goes back to existing market conditions. There are several key levels for CFX, namely $0.1345 as the nearest resistance.

Cozybanana78

FTM Possible Playout Chart

FTM price movements are predicted to increase after indications of a double bottom on Monday. Of course, this is a consensus that FTM is likely to experience quite a strong increase this week. The potential increase for FTM is at $0.1979 with a potential of 5.56% and for bearish confirmation from FTM it is at $0.1837 if the price closes below. In terms of RSI, currently FTM is in the golden cross area and is in area 43, which means it is in consolidation and sideways. paraphrase and provide the necessary sentences

Cozybanana78

ETH Possible Playout Chart

The movement of ethereum is predicted to experience a decline with a target price of $1522 with an estimated decline of around 3.69% this week. In contrast to bitcoin which is predicted to experience bullishness, ethereum technically shows no signs of pulling back. Therefore, please be careful about crypto price movements this week. There has been no confirmation regarding the decline that will occur in Ethereum. Ethereum has the potential to pull back if the price is above $1600 this week and the upside target for ethereum is the next resistance at $1650.

Cozybanana78

SOL Possible Playout Chart

Solana's price experienced a notable increase following the announcement of its collaboration with Visa Inc., a multinational company operating in the financial and electronic payment industry. Visa is one of the major payment networks globally, primarily facilitating electronic financial transactions, including credit and debit card transactions. The company serves as an intermediary between cardholders, card issuers (usually banks), and merchants in the payment process. This collaboration resulted in a price surge for Solana, with a gain of +7.25%, reaching a peak price of $20.6 on September 5, 2023. However, since then, Solana's price has retreated and has been trading within a sideways range between $19 and $20. Currently, there are indications that Solana may continue to experience a decline, especially from a technical perspective, as the price is below a crucial support level at $20. Predictions suggest that Solana could decline to $18.46 in the coming days. This reflects the volatility in the crypto market, and investing in cryptocurrencies always carries risks. It is essential to continuously monitor price movements and conduct thorough analysis before making investment decisions.

Cozybanana78

ETH Possible Playout Chart

The news about ARK Invest submitting a proposal for the world's first Ethereum Spot ETF on September 6, 2023, has stirred up the market. This submission is considered the first of its kind globally, raising hopes that cryptocurrencies are now being recognized as a valid alternative investment. This sentiment is reinforced by the fact that Ethereum is seen as a more modern version of Bitcoin with various additional features. However, the market's movement following this submission may be more a result of FOMO (Fear of Missing Out), considering that ETF proposals submitted by entities like Ark Invest have not yielded positive news. This could indicate that market confidence in the ETH ETF is still not strong enough, potentially leading to the relatively stable crypto asset price movement we are currently witnessing in a sideways phase. Nevertheless, there is potential for Ethereum's price to increase in the coming days. Currently, Ethereum is trading at around $1,640 and has the potential to rise to approximately $1,686, with a potential profit of +2.89%. However, it's essential to monitor a crucial resistance level around $1,657.

Cozybanana78

Bitcoin Possible Playout Chart

The current movement of Bitcoin's price appears to be in a state of stagnation or sideways movement after the potential increase following ARK Invest's submission of an ETF Spot proposal for crypto asset ETH to the SEC on September 6, 2023. Previously, Bitcoin seemed to be trading below the $25,500 price level but experienced a brief surge to around $26,000. This submission has generated expectations that, if approved by the SEC, it could trigger price increases for both Bitcoin and Ethereum. Predictions for Bitcoin's price movement in the week ahead suggest the potential for a price correction after reaching the nearest support level at around $25,000. If Bitcoin is currently trading at around $25,900, there is a possibility of a correction of approximately -3.7%. To confirm whether there is potential for a Bitcoin price increase, it is necessary to monitor market sentiment and whether prices can surpass the resistance level above $26,500. It should be noted that the Relative Strength Index (RSI) also indicates a sideways condition, meaning there are no strong signals regarding price movement in the near term.

Cozybanana78

SUI Possible Playout Chart

There is a prediction of a potential price decline for SUI due to indications of a breakout from its support line, confirmed by being situated below its 200-day moving average. Additionally, the confirmation is supported by a substantial surge in trading volume, possibly signifying substantial sell-offs by traders. This projection suggests that the price movement could reach as low as $0.513, presenting a potential downside of approximately -7.56%.

Cozybanana78

Waves Possible Playout Chart

Waves is also anticipated to undergo a decline, similar to my Algorand analysis. The projection for Waves points towards a future price of $1.372, suggesting a potential downside of approximately 8.91% for an active short position. Waves has indeed confirmed a breakdown from its bearish flag pattern. This confirmation is characterized by a complete red candle and a death cross on the RSI below the 50-point mark. As a result, traders who have established long positions or those engaging in spot trading might want to reconsider their strategies. Waves is a blockchain platform that aims to facilitate the creation and management of decentralized applications (dApps) and custom blockchain solutions. It aims to simplify the process of building, launching, and managing blockchain-based applications for businesses and individuals. The platform utilizes a unique consensus mechanism called Waves-NG (Next Generation) to achieve high throughput and low latency for transactions.

Cozybanana78

Algo Possible Playout Chart

The Algorand movement is predicted to undergo a weakening of its price, from a technical perspective. Algo has indeed confirmed a flawless breakdown from its bearish flag pattern. The breakdown has been accompanied by a significant surge in trading volume, indicating an impending decline in Algo's value. This scenario suggests that Algo might experience a downturn in the near future. Algorand is a blockchain project that aims to provide a scalable and secure platform for decentralized applications and smart contracts. It employs a consensus mechanism called Pure Proof of Stake (PPoS) to enhance security and efficiency in transaction processing and validation.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.