ColdSai

@t_ColdSai

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

ColdSai

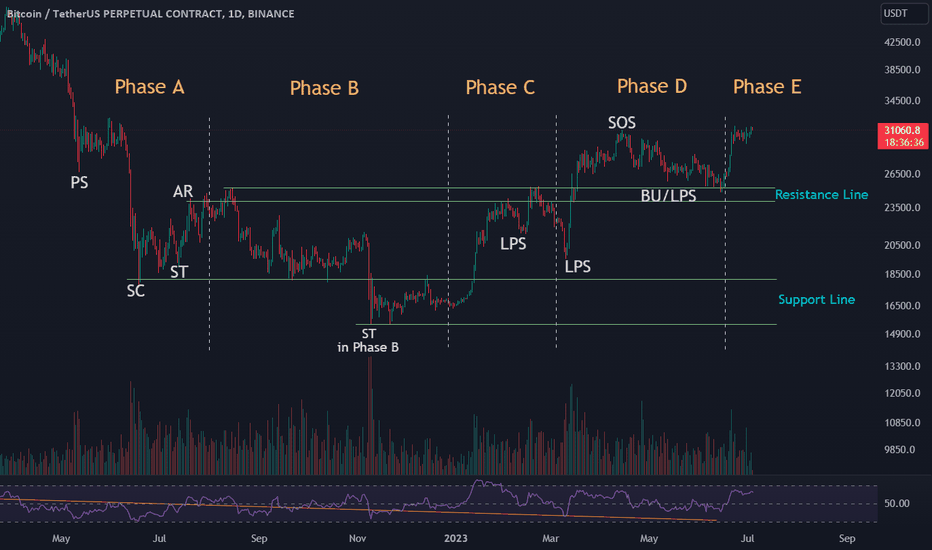

This is an updated outlook on BTC’s current price structure based on Wyckoff methodology. 🔹 Structure Overview: BTC has broken out above its previous resistance and reached a new ATH. Based on current price action and volume behavior, I believe we are at the Sign of Strength (SOS) phase in a Wyckoff Re-Accumulation Phase 2. Key Wyckoff Labels in this structure: PSY – Preliminary Supply BC – Buying Climax AR – Automatic Rally ST – Secondary Test UT – Upthrust LPS – Last Point of Support SOS – Sign of Strength (For those unfamiliar with the terms, I suggest looking up the Wyckoff Method for detailed definitions.) The breakout is happening with volume support, and we’ll need to observe how sustained the demand is. 🔹 RSI Observation: In June, RSI pivoted at 64, and has now reached 73 Both price and RSI are printing higher highs Daily RSI has not yet reached overbought territory (80+) If RSI crosses above 80 and then rolls over, it could signal a bearish divergence → followed by a retracement 🔹 Possible Scenarios (3 Outcomes I’m Watching): 📈 Another Re-Accumulation Phase forms after this move 🧊 Market tops out at ATH and enters a Distribution Phase 🚀 A parabolic move (Blow-off Top) happens, followed by a sharp crash and Distribution 🔹 My Personal Trading Plan: As price enters the next phase, I’ll be watching closely for signs of PSY and BC (Preliminary Supply & Buying Climax). If bearish divergence aligns with these, it may indicate an upcoming retracement. Once BC forms, I expect an AR (Automatic Reaction) to follow I’ll look for short entries during the retracement A Trading Range could form between the BC (resistance) and AR (support) ⚠️ Be cautious of fakeouts, especially during breakout attempts at the range boundaries. 🔹 Price Projection (Fibonacci Extension – For Reference Only): Using Fibonacci Extension based on the following price coordinates: Point A: 49,577 Point B: 109,356 Point C: 74,434 🎯 Target Zones: 0.786 extension → 121,420 1.000 extension → 134,213 Again, these are not predictions — just reference points based on market structure. 🔹 Final Note: This analysis reflects my personal interpretation of the current market structure. Price action can change rapidly based on macro and technical factors. Patterns and phase transitions may take days or even weeks to fully develop. Feel free to share your thoughts, criticisms, or alternate views — I’m open to feedback from fellow traders. #Wyckoff #BTC #Bitcoin #CryptoTA #Reaccumulation #TradingPlan #TechnicalAnalysis #RSI #FibExtension #MarketStructure

ColdSai

I won’t say much — the chart speaks for itself.Based on my ongoing study of Wyckoff methodology, it appears that Bitcoin is currently in the Test phase within a re-accumulation structure. This suggests the Mark-Up phase is not yet complete, and we may still have room for price expansion before the next major distribution.This is not a prediction, but a reference for structural context using classical Wyckoff logic.As always, price confirmation and volume behavior will be the key to validate the next move.Observations:Strong support zone holding after Spring/TestPrice respecting higher lowsVolume profile supports continuationFeel free to share your perspective below 👇#Wyckoff #Bitcoin #BTC #Reaccumulation #MarketStructure #PriceAction #TradingView #CryptoTA

ColdSai

Over the past few months, I’ve been closely studying Bitcoin’s macro structure from June 2022 to June 2025, and I believe we’re witnessing a textbook example of Wyckoff theory unfolding in real time — not just once, but in multiple phases.🔍 Phase 1: Classic Wyckoff Accumulation (June 2022 – Oct 2023)Starting June 2022, BTC began forming a major bottoming structure.By November 2022, price made a lower low — but RSI (14) was making higher lows, a clear sign of bullish divergence.From there until October 2023, BTC moved sideways in a Wyckoff accumulation range.This was Phase A–E in classic Wyckoff terms:Selling Climax (SC)Secondary Test (ST)Spring (false breakdown)Last Point of Support (LPS)Sign of Strength (SOS)🚀 Phase 2: Markup with Re-Accumulations at Each LegAfter the October 2023 breakout, BTC has followed a highly structured rally with multiple consolidation phases and healthy corrections:✅ Breakout 1:From ~$31K to $48K → +53% moveFollowed by a ~20% pullback to ~$38K➜ This formed a re-accumulation phase, consolidating above prior resistance✅ Breakout 2:From $38K to $73K → +50% moveThen a deeper ~31% correction to ~$50K✅ Breakout 3:From $50K to $109K → +48% moveCurrent pullback to ~$74K → ~31% retracementNow trading near ATH region again🧠 Key ObservationIn this cycle, we’re seeing not only one accumulation at the bottom, but also clear Wyckoff Re-Accumulation zones forming after each breakout, especially after Breakouts 1 and 3.This suggests institutional accumulation continues during the trend, supporting the idea that:Pullbacks are for re-loading, not distributionTrend strength remains intact as long as prior re-accumulation lows hold🧭 What This Means for the Current CycleIf this structure continues, BTC may be preparing for another markup leg above $110KHistorical fractals from past bull markets (e.g., 2020–2021) show similar behaviorRSI structure and market rhythm continue to favor trend continuation, not exhaustion📌 ConclusionWe are likely in the mid-to-late phase of a well-structured bull market, supported by:Wyckoff Accumulation at the bottomRe-Accumulations after each breakoutHealthy 20–31% pullbacksRSI confirming internal strength🔔 Next levels to watch:Support: $74K, $88KResistance: $111K–$115KBreakout target (if pattern continues): $145K–$175K zone📢 Let me know what you think!Do you see similar Wyckoff structure?Drop your thoughts or charts below 👇#BTC #Bitcoin #Wyckoff #CryptoTA #TradingView #BTCAnalysis #Reaccumulation #RSI #BullMarket

ColdSai

Disclaimer: I am not an expert in technical analysis. However, in order to track whether my views are correct or not over time, I’d like to share my current analysis here.After reviewing the market structure, I believe that Bitcoin (BTC) will not surpass 100K in this bull run. Instead, we are likely to see a shift in momentum towards a reversal. Here's how I see it unfolding:Peak Below 100K: Bitcoin will likely face strong resistance around the 100K level and will not break past this in this cycle.Correction Wave A (~54K): After the peak, I expect a decline forming the Wave A correction, targeting around 54K, which aligns with the support level we saw in September 2024.Wave B Bounce (~81K): Following the decline, a Wave B bounce could push Bitcoin back up to 81K before we see another reversal.Bearish Wave C (~42K or Lower by 2026): Finally, we could see a deeper correction as Bitcoin enters Wave C, potentially taking prices down to 42K or lower by 2026.This is my current outlook based on technical analysis, but as always, markets are unpredictable. I’ll be watching for confirmation of these levels in the coming months.

ColdSai

Wyckoff Accumulation Schematic - Test After long consolidation, it seems like the bear market is over and ready to start bull run. According to this Wyckoff Accumulation Schematic, Phase E will start soon.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.