ChristMarcus

@t_ChristMarcus

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

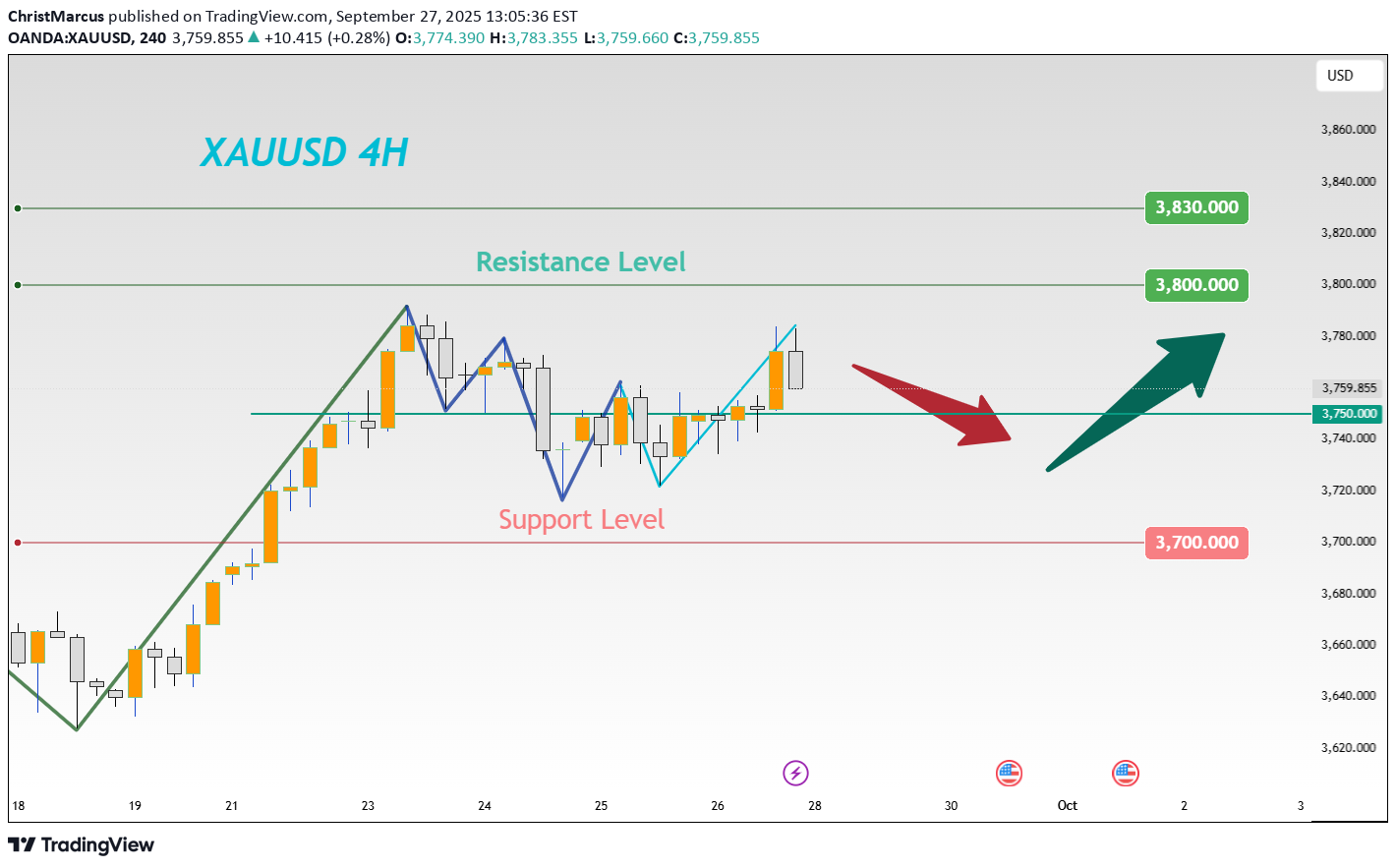

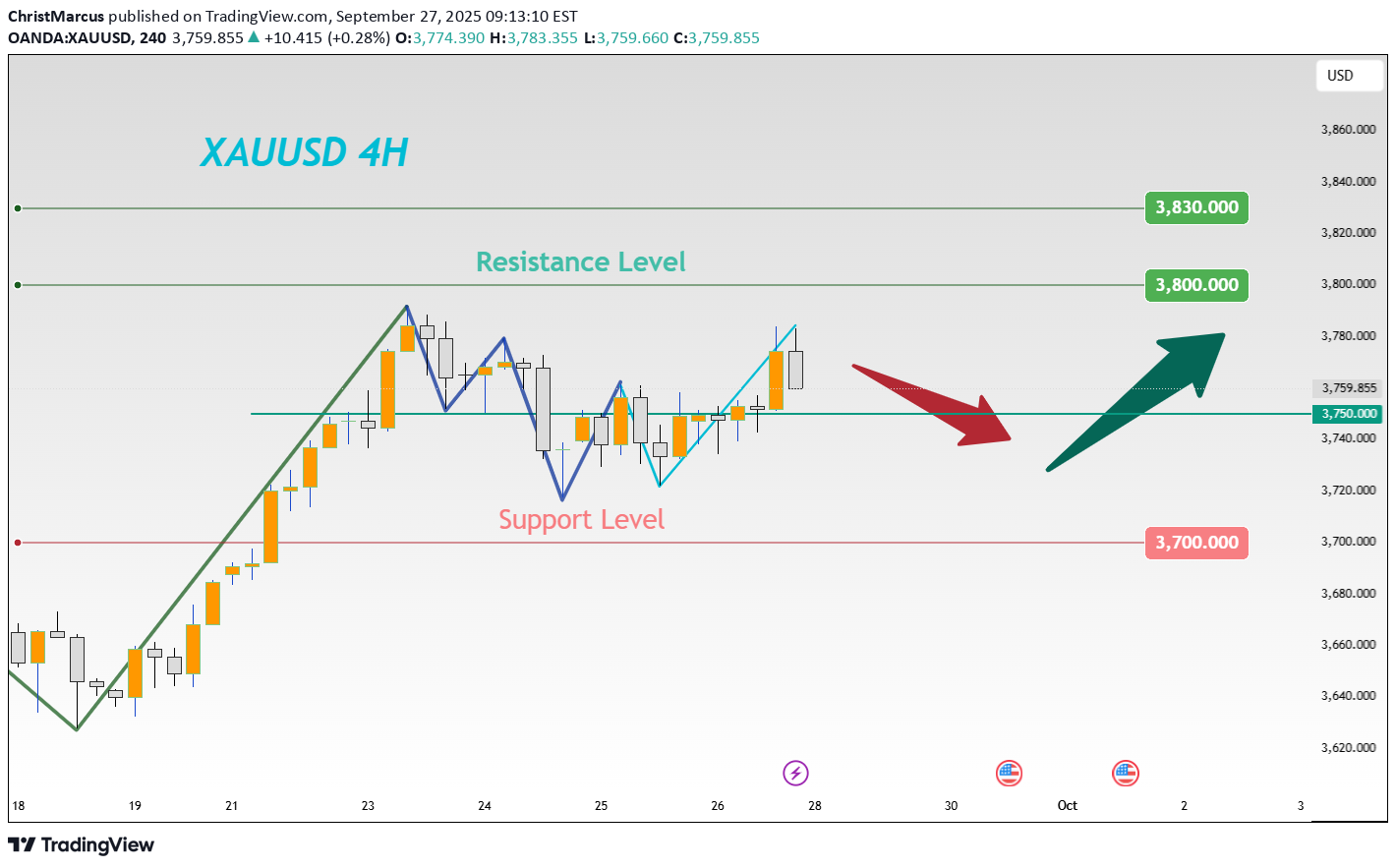

Last week, the Gold market exhibited the characteristics of "a rally with a breakout + high-level consolidation": Gold approached the 3800 mark at one point last week. Despite pullbacks during the week, it maintained an overall strong trend and remained firmly above 3750 by last Friday. Next week, gold is likely to maintain a pattern of "consolidating within the 3750-3820 range while waiting for a breakout opportunity". If policy signals become clear or geopolitical risks escalate, gold is expected to test the 3850 level; if expectations of interest rate cuts cool further, it may dip to test the support at 3720.

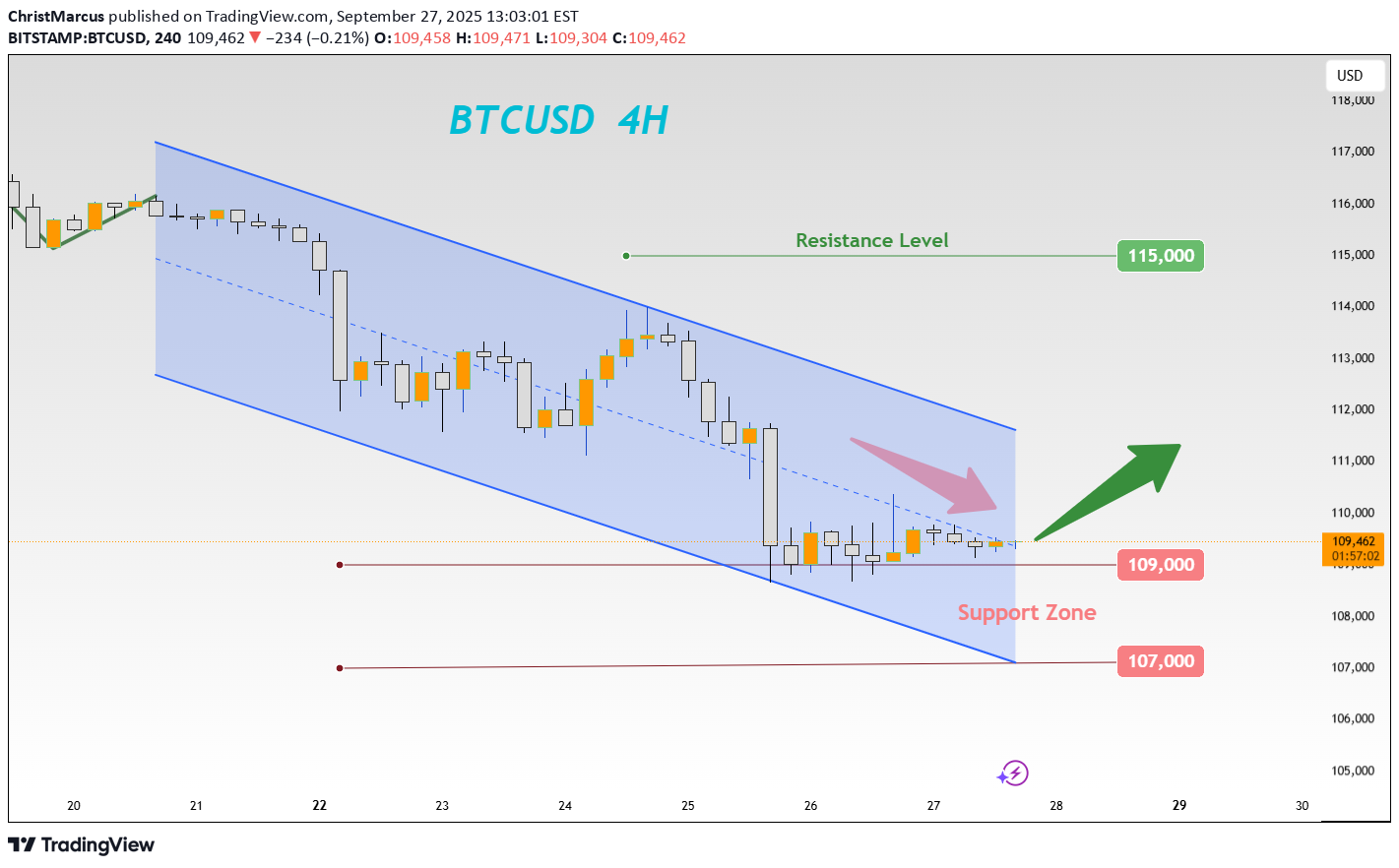

BTC's price is consolidating above the 109000 level on the day. While it has edged slightly higher from yesterday's support level, the asset remains in a weak consolidation phase. Amid low market liquidity over the weekend, intraday trading volume has shrunk significantly compared to weekdays, preventing the price from staging a trendline breakout and substantially increasing the probability of continued consolidation. Buy 109000 - 109200 TP 109700 - 110000 SL 108600 Daily-updated accurate signals are at your disposal. If you run into any problems while trading, these signals serve as a reliable reference—don’t hesitate to use them! I truly hope they bring you significant assistance

Last week, the Gold market exhibited the characteristics of "a rally with a breakout + high-level consolidation": Gold approached the 3800 mark at one point last week. Despite pullbacks during the week, it maintained an overall strong trend and remained firmly above 3750 by last Friday. Next week, gold is likely to maintain a pattern of "consolidating within the 3750-3820 range while waiting for a breakout opportunity". If policy signals become clear or geopolitical risks escalate, gold is expected to test the 3850 level; if expectations of interest rate cuts cool further, it may dip to test the support at 3720.

Bitcoin's price is consolidating above the 109000 level on the day. While it has edged slightly higher from yesterday's support level, the asset remains in a weak consolidation phase. Amid low market liquidity over the weekend, intraday trading volume has shrunk significantly compared to weekdays, preventing the price from staging a trendline breakout and substantially increasing the probability of continued consolidation. Buy 109000 - 109200 TP 109700 - 110000 SL 108600 Daily-updated accurate signals are at your disposal. If you run into any problems while trading, these signals serve as a reliable reference—don’t hesitate to use them! I truly hope they bring you significant assistance

BTC is experiencing a trend of "consolidation after a breakdown and decline". When BTC fell below the critical support level of 110000, a large number of long positions triggered forced liquidation, forming a negative feedback loop of "decline - liquidation - further decline", which further amplified the decline. From the perspective of technical indicators, BTC is currently in a stage of competition near the key support level: although the price has declined, the trading volume remains at a high level, indicating that there is a large number of share swaps in the 108000 - 110000 range. If there is a signal of shrinking volume and stabilization near the support level in the future, it may indicate that the short-term downward trend will slow down and the momentum for further sharp decline will weaken. It is necessary to strictly control the position and avoid blindly bottom-fishing. The current price is still in the correction stage of the upward channel, and a bottoming rebound may occur at any time. If there is no systematic risk, investors can deploy in batches on dips, but they need to be alert to changes in macro policies and sudden changes in regulatory policies. Buy 109000 - 109200 TP 109700 - 110000 SL 108600 Sell 109800 - 110000 TP 108500 - 108800 SL 110200 Daily-updated accurate signals are at your disposal. If you run into any problems while trading, these signals serve as a reliable reference—don’t hesitate to use them! I truly hope they bring you significant assistanceToday's range-bound fluctuations have repeatedly confirmed that the signals we provided are correct Buy 109000 - 109200 TP 109700 - 110000 SL 108600

After a consecutive upward move, gold has fallen into high-level consolidation. In the short term, bulls and bears are locked in repeated back-and-forth, with room for both upward and downward movements. From the daily timeframe perspective, the correction is expected to be a "time-for-space" adjustment. It is still too early to conclude that 3791 marks the peak—further observation is needed, and one should not arbitrarily bet on a top during a trending phase. The short-term trend is characterized by disorderly fluctuations. In terms of operation, it is crucial to take profits when conditions are favorable. The price movement lacks continuity, with each move being a "one-wave move" without sustained follow-through. For resistance level, focus on 3800 and the previous high at 3791. The small-timeframe trend is relatively unclear, so it is recommended to look for opportunities to enter positions. Buy 3740 - 3745 TP 3755 - 3760 - 3770 SL 3635 Daily-updated accurate signals are at your disposal. If you run into any problems while trading, these signals serve as a reliable reference—don’t hesitate to use them! I truly hope they bring you significant assistanceAs we anticipated, gold has extended its uptrend; focus on 3800 and the previous high at 3791.

After a consecutive upward move, Gold has fallen into high-level consolidation. In the short term, bulls and bears are locked in repeated back-and-forth, with room for both upward and downward movements. From the daily timeframe perspective, the correction is expected to be a "time-for-space" adjustment. It is still too early to conclude that 3791 marks the peak—further observation is needed, and we should not arbitrarily bet on a top during a trending phase. The short-term trend is characterized by disorderly fluctuations. In terms of operation, it is crucial to take profits when conditions are favorable. The price movement lacks continuity, with each move being a "one-wave move" without sustained follow-through. For resistance levels, focus on 3800 and the previous high at 3791. The small-timeframe trend is relatively unclear, so it is recommended to look for opportunities to enter positions. Buy 3740 - 3745 TP 3755 - 3760 - 3770 SL 3635 Daily-updated accurate signals are at your disposal. If you run into any problems while trading, these signals serve as a reliable reference—don’t hesitate to use them! I truly hope they bring you significant assistance

After the strong one-way trend shifted to consolidation, short positions can also be traded; there are opportunities for both short-term long and short positions, but it is necessary to seize the right levels. Pay attention to shorting on rebounds near the 3765/3770 resistance, and look to go long near the 3710 support and the daily MA10 level. Currently, price volatility is relatively high, so be sure to control risks properly.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.