CandleSmithChartsman

@t_CandleSmithChartsman

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

CandleSmithChartsman

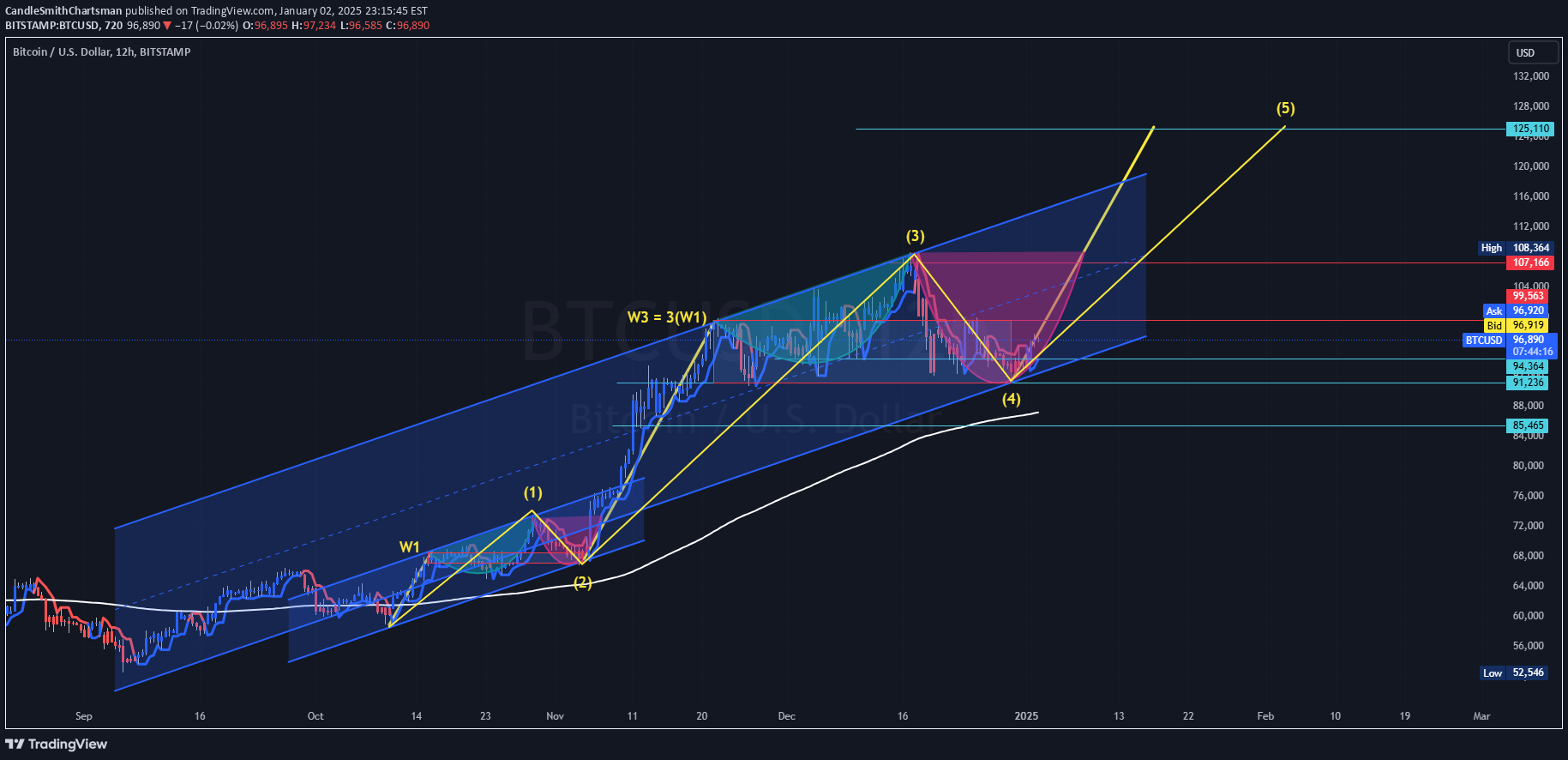

Elliott Wave Analysis:The chart shows a Elliott Wave count, maintaining the ascending channel structure. Here's the detailed interpretation:Wave 1 (W1):The initial impulsive move upward, establishing the bullish trend.This wave sets the foundation for the larger five-wave structure.Wave 2 (W2):A corrective wave, retracing part of Wave 1.The retracement respects the Fibonacci levels (not explicitly shown here but likely aligning with 0.5 or 0.618 levels).Wave 3 (W3):A strong, extended impulsive wave.In this chart, Wave 3 is approximately 3 times Wave 1 (as marked), indicating strong bullish momentum.This wave also breaches mid-channel resistance, confirming strength.Wave 4 (W4):A corrective phase following Wave 3’s strong rally.The correction has formed a clear cup-like consolidation, respecting the channel’s support and suggesting preparation for the next upward move.Wave 5 (W5):The projected final wave, anticipated to break above key resistance levels.Based on the projection, Wave 5 could target the $125,110 level or beyond, aligning with the upper boundary of the ascending channel.Scenarios to Consider:Bullish Case:A breakout above $99,563 confirms the start of Wave 5, targeting $107,166, $108,364, and ultimately $125,110 or higher. Strong volume during the breakout would reinforce confidence in the continuation of the uptrend.Bearish Case:A breakdown below $94,364 could lead to further retracement, testing $91,236 or the lower channel boundary near $85,465. This would likely delay the start of Wave 5 but may still respect the long-term channel.

CandleSmithChartsman

The PA of BTC looks to be following a similar trend as it did prior to the increase to a new ATH. If Wave 3 follows the 3x increase Wave 2, the upside is massive (180,000 - 200,000).

CandleSmithChartsman

Short term price action - Another push toward 100k could materialize if we bounce.

CandleSmithChartsman

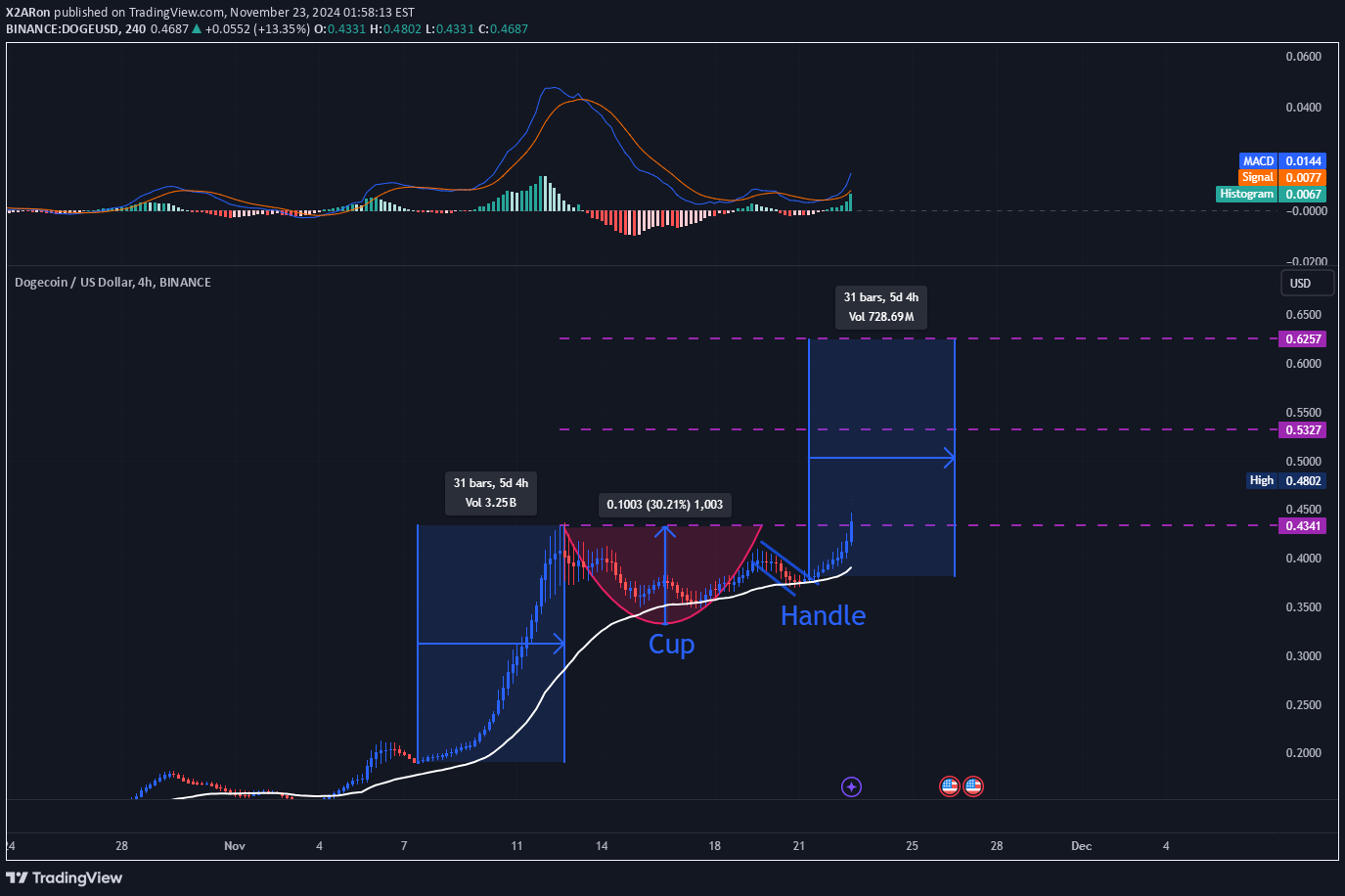

Some conservative price considerations breaking out from the handle.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.