Bongos45

@t_Bongos45

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Bongos45

Breakout in progress - has a 4x to reach the target of the descending wedge.

Bongos45

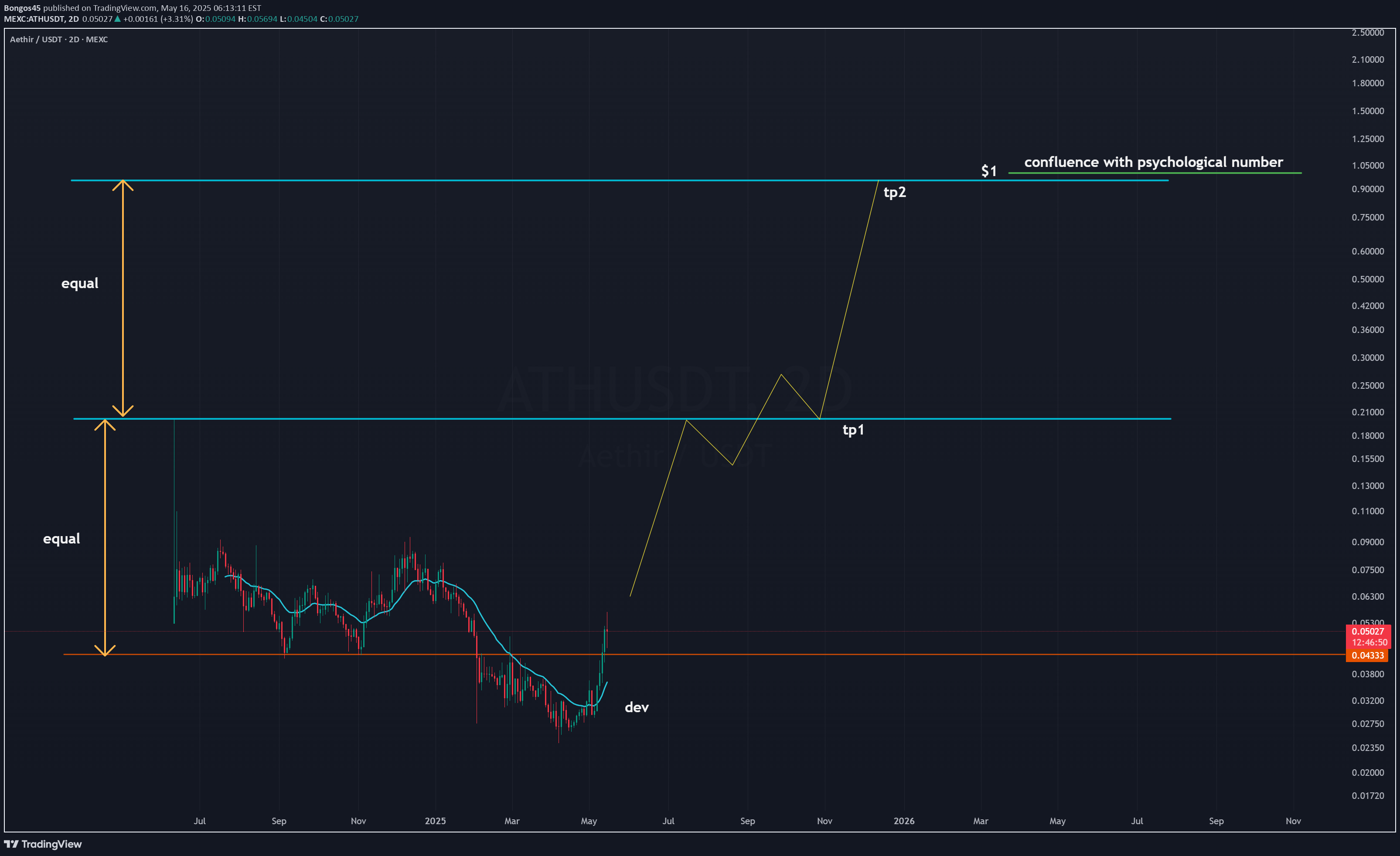

Looks like liquidity was taken from under the lower channel. We should now see a swing to take out the liquidity at the top of this channel. After consolidation, we'll push into the next channel (Equal height of the first in LOG scale), and target the upper bounds of this one. Athir has enormous potential, so $1 is a first stage target.

Bongos45

A rising MACD formation has taken place, and looks like it wants to bounce off the 'zero' line. This would be significant, as it signalled the start of the bull run in Oct 23, and this would be the first time it has done this ever since.

Bongos45

The RSI has lost 50, and the MACD is turning down. If this is a descending wedge, I expect price to bottom at 52 - 53k range.

Bongos45

- we also see FET has gained support on the EMA34, - RSI is also holding above 50 target $2.60 seems likely.

Bongos45

As per chart, target is $10.7 or 6x from current price.

Bongos45

It's not a perfect wedge obviously. However the backtest, and quick rejection of it's lower trendline was clear. If this pattern holds true, we should see 4.8 - 4.9.

Bongos45

Waiting to see that the breakout holds. Target of $9.50 which is approx 50% move.Oh dear, it’slost support and had an initial rejection. Needs to regain it in short order.

Bongos45

We can see the descending triangle (A), ascending wedge (B) both played out as per charting principles. Wedge pattern (C) has broken down, and backtested the wedge. Should now see a reversal down to high 19K.Looks like this hit the target give or take a few bucks.

Bongos45

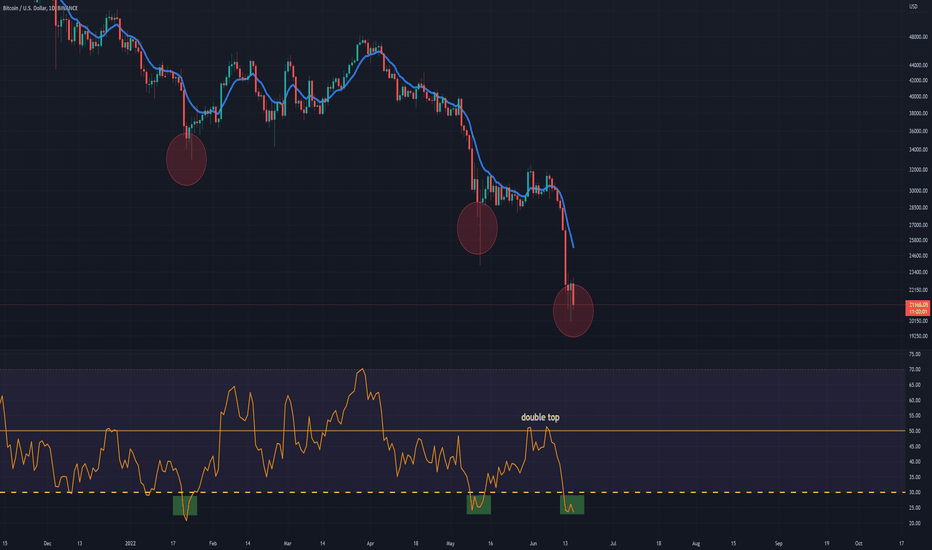

RSI was actually at resistance (RSI 50 - which is the watershed between an asset being in bull mode or bear mode) - and double-topped at 50. It was an excellent signal to get out of your trade. See chart.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.