Blueishon

@t_Blueishon

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Blueishon

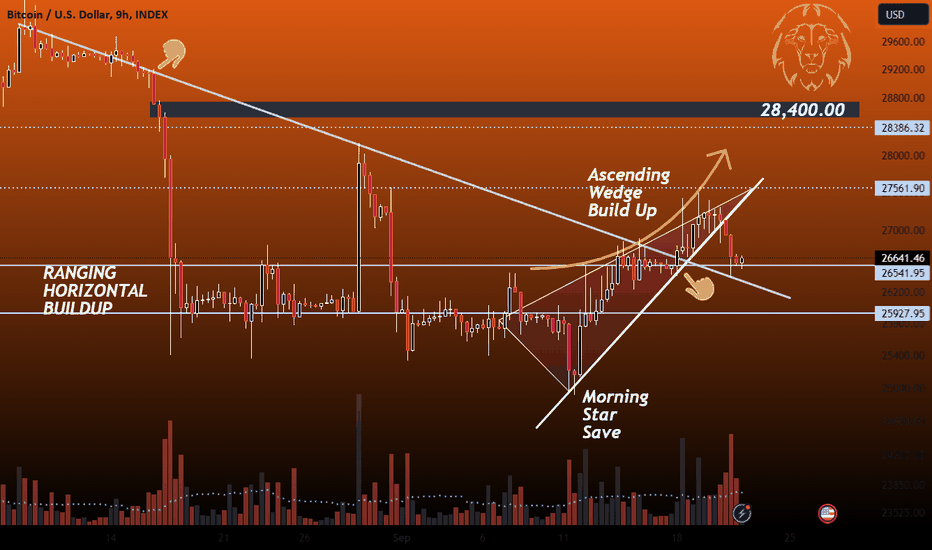

BTC has seen a great deal of sell pressure since the idea that institutions were to instate and approve ETF's. Which in essence is a dilution of BTC, it is not a factor that the original creator, named 'Satashi Nakamoto', had in mind. However beyond the greed of each corporation and institution, lies the belly of the beast. They want as many BTC as they can get. Here we have a rejection VECTOR candle engulfing to the left, as well as ranging interest at the 26k level area - with NEWS events as such about GREYSCALE - ETF approval and then delays. Naturally these are liquidity traps, and the game is now to spot the capitulation zone. However this idea proposed very simply, if we hold the area above here, we will see a leading charge up to the 28,400.00 levels. Not only to retest the imbalance and supply, but to utilise the mass amount of PERMA BEAR liquidity that we have. Expect however turbulence and to modify your leverage and spread size, based on the turbulence that will naturally be presented.Following on from here, we have had an increase in total volume - the support sector of 26,600.00 is of prime importance. Aspects in indicators such as KDJ Bands - as well as the following indicators show a clear consolidation and pressure buy zone.Bull sentiment has not worked well in these interesting and turbulent times. You see bearish narrative taking the fold, with consistent pressure on the retail eye. I don't think this is wise. I think we are personally reaching a boiling point and have attached a bottom formation in this update - which is detailed with the clear factor of the three white soldiers, with clear suppression acted out. This look non other than consolidation currentlyFurther technical outlinedExhibit [A] -

Blueishon

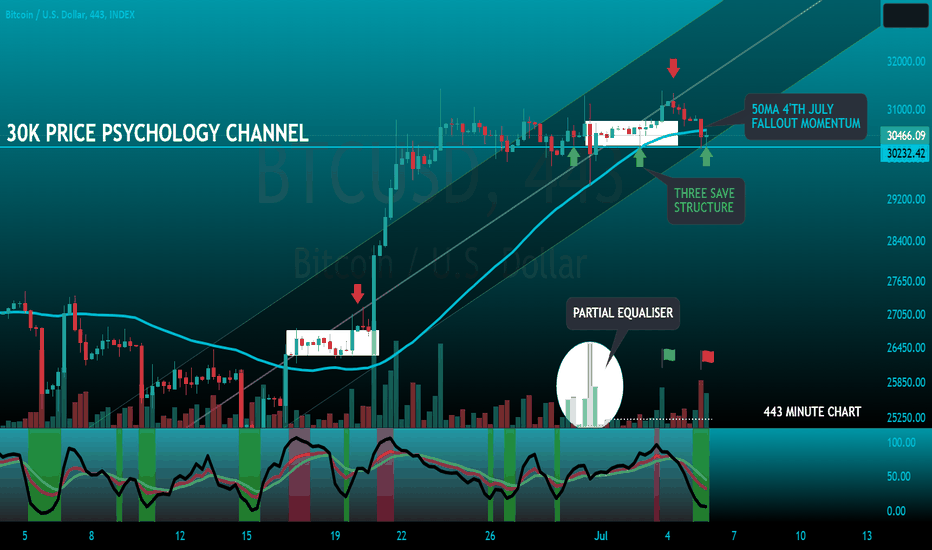

30K Psychological Pavlovian Area Passage; 👨💻 There once lived a set of market makers who used Pavlovian signaling, and price drop 🫳 techniques, alongside an extended bear market. It was said that human nature assumed the worst factors, on past historic responses. ‐------------------------------------------ In simple words, let's not make quick assumptions. Whilst it's clear the market can cool down, before retesting the weekly structure. Remain vigilante. Data analysis Aside the fear aspects that have been promoted above. I want to represent a clear view mental understanding of what I am looking at with the current bull trend. ✴️ Fourth of July represented lower key volume zones. Based on overall stock market opening times. ✴️That pivot of volume is key to the midline of the main channel leading. ✴️For now we will represent the "three driver save structure." ✴️KDJ which is our pressure indicator - bellow, is upturning. 📊 Volume which has been marked with points - Has been equalised to attack high leverage. Then drive the price up, just in time for the lower stock market volume. Your attention should be noted at the point of the main channel. The fear aspect is losing that within an engulfing body. As the force of volume to bring us up, is significant. I am still currently seeing a bull trend. Historic Weekly factored points are telling, a retest on the breakout, alongside prior trained pesimistic sentiment, tends to drive bull trends.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.