BlackBull Markets

@t_BlackBull Markets

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

پیشبینی حرکت بعدی بیت کوین: تحلیل 4 تایمفریم، آیا زمان برگشت فرا رسیده است؟

Weekly A sustained move through the key resistance on this timeframe at105,000 to 110,000, could confirm a reversal. For now, the weekly outlook shows a potential market in correction rather than reversal. Daily After dropping nearly 5% yesterday, Bitcoin has rebounded sharply today with a gain of about 6.7%. The price is currently up $5775 at $92,060. Today’s low at $86,190 followed yesterday’s deeper dip to $83,814. The daily chart may suggest further upside potential. 4H Momentum on RSI has turned higher on the 4-hour chart, lifting from oversold conditions and breaking back above the midline. This suggests improving intraday demand and provides a base for further upside if price continues to hold above the recent breakout level. The next resistance sits around 96,500, the prior swing high on this timeframe. 1H The hourly timeframe shows the price bouncing back above the 50, 100 and 200-hour moving averages, which are currently clustered around $87,500 and $89,320. If the price stays above these converged moving averages, it can signal continued buying pressure in the near term.

چرا ارزهای دیجیتال سقوط کردند؟ راز عقبنشینی بیت کوین و اتریوم فاش شد!

Bitcoin, Ether, and other cryptocurrencies extended their losses on Monday, even as stocks traded mostly higher. Bitcoin hovers near $106,980, down about 3% in 24 hours, while Ethereum fell roughly 7% to around $3,642. Most major altcoins mirrored the decline (but more pronounced), reflecting a broader pullback in market sentiment. Investors may have turned cautious after U.S. Treasury Secretary Scott Bessent suggested that the Federal Reserve’s interest rate policy may have already pushed parts of the economy (particularly housing) into recession.

رمز ارز بیت کوین: آیا میانگین متحرک 50 هفتهای مسیر رسیدن به ۱۵۰ هزار دلار را نشان میدهد؟

Bitcoin has consistently held above its 50-week moving average since March 2023. Each time the market has attempted to break below, buyers have quickly stepped in, keeping the uptrend intact. This moving average has become a key indicator defining Bitcoin’s broader bullish structure. As long as price remains above it, the focus potentially stays on new record highs, with the next major target projected between 140,000 and 150,000. This outlook aligns with MicroStrategy co-founder Michael Saylor, who expects Bitcoin to reach $150,000 by the end of 2025. He described 2025 as the most transformative year yet for the digital-asset industry. According to Saylor, the $150,000 target also reflects the consensus among equity analysts covering both MicroStrategy and the broader Bitcoin ecosystem.

خلاصه بازار امروز: فدرال رزرو نرخها را کم کرد، طلا ثابت ماند، و غولهای فناوری چه کردند؟

The Federal Reserve cut interest rates by 25 basis points, marking the lowest level since 2022. However, Fed Chair Jerome Powell hinted at a possible pause in further rate cuts for the rest of the year. Still, the S&P 500 gained 0.2%, and the Nasdaq gained 1%, both hitting fresh record highs. Gold remained flat at $3,950 an ounce after Powell warned that a December rate cut is not guaranteed. Potential progress on the US-China trade framework has also reduced some safe-haven demand. In corporate earnings, Microsoft beat expectations but saw a ~2.5% drop in after-hours trading due to a slight miss in cloud revenue. Meta posted strong results but fell ~8% after hours, driven by concerns over capital expenditure. Alphabet exceeded earnings and revenue forecasts, with strong performance across Search, YouTube, and Cloud, sending shares up ~5% in after-hours trading.

صعود ناگهانی جِی.دی. وَنس: زلزلهای در بازار سهام و سرنوشت غولهای فناوری!

J.D. Vance’s sudden rise to the Presidency could mark a dramatic shift for financial markets if he breaks from his current boss’s stance on how to govern an economy. Before being picked as Trump’s VP, Vance was known for his opposition to corporate monopolies. In the past, he criticised the power of firms like Google, Apple, and Amazon, calling for antitrust enforcement. A sudden shift to a Vance-led administration could crash markets that have priced in continued support for the “Magnificent Seven,” who have driven much of the S&P 500’s recent performance. Ultimately, In the long run, however, breaking up dominant players can spark greater innovation (and potential stock gains), as the incumbents lose their ability to acquire and bury emerging competition. Meanwhile, one of the defining trends of Trump’s second term has been the significant decline of the U.S. dollar. A change in leadership, especially one less inclined toward isolationist policies and piling on national debt, could potentially strengthen the dollar in the short term. Gold might also take a hit and find a medium-term price level below $4000.

پایان تب طلا؟ سقوط آزاد قیمتها و واقعیت ۴۰۰۰ دلاری!

Thousands queuing for hours in central Sydney to buy gold last week was a potential warning sign that gold was vulnerable to correction. Today, gold prices saw their largest one-day fall in over ten years. After several failed attempts to break above 4,400, resistance held and momentum reversed sharply. The first key support now potentially sits near 4,000 (200% retracement). Despite the correction, long-term outlooks might remain positive. Ongoing inflation risk, lower interest rates, geopolitical tensions, and U.S. government dysfunction are still ever present. This might be why Goldman Sachs raised its December 2026 price target to 4,900 per ounce, up from 4,300, citing Silver also slumped more than 7%, marking their biggest daily loss since 2021, as overbought signals flashed extremes.

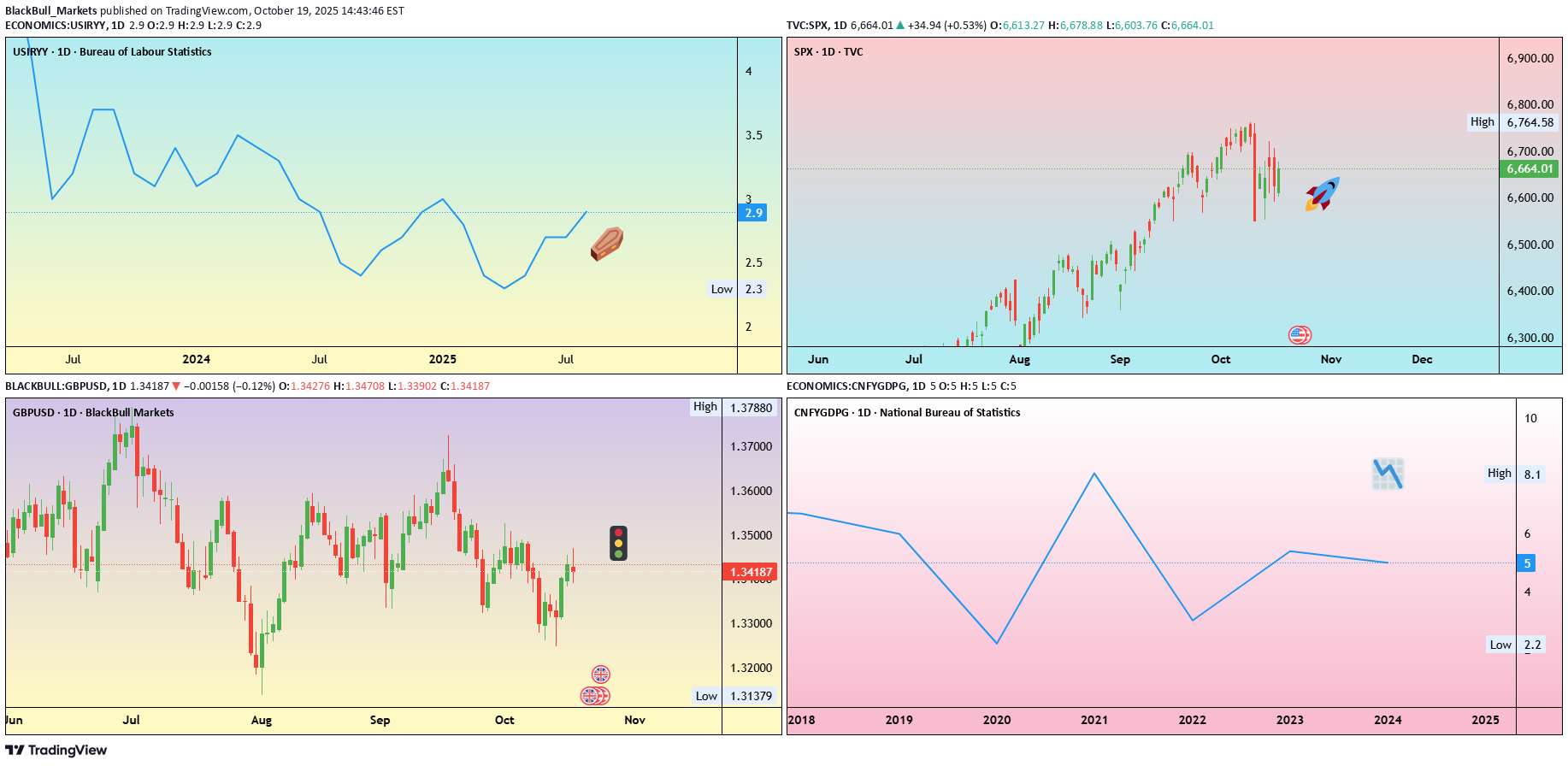

فرصتهای معاملاتی هفته: از GDP چین تا گزارش تورم آمریکا (۲۱ تا ۲۵ اکتبر)

• Monday: China GDP data China’s third-quarter GDP report will be closely watched as growth is expected to slow to 4.8% year-on-year from 5.2% in Q2. Slowing growth in China could reduce demand and prices for commodities. A surprise upside could support commodity prices. • Tuesday: Coca-Cola and Netflix earnings. Earnings season continues with Coca-Cola, Netflix, and others including Tesla, IBM, and Intel. Strong results could offset soft U.S. data and help reignite the risk-on environment. • Wednesday: U.K. inflation data and Tesla earnings U.K. inflation is expected to edge back toward 4%. A softer reading could boost U.K. equities and pressure the pound. • Thursday: Intel earnings • Friday: U.S. CPI report With the U.S. government shutdown entering its fourth week, the CPI release remains the week’s key data point. A hotter print could lift the dollar.

طلا در اوج، منتظر اعلام کاخ سفید درباره چین؛ چه اتفاقی در راه است؟

Gold’s impressive rally has been powered by a mix of rate-cut expectations, political risk, central bank buying, and dollar weakness. Gold traders’ focus this week has been on the escalating U.S.–China trade tensions though. Markets are standing by for a statement from the White House, expected within the hour. We’ll post updates here once the White House statement is released and markets begin to react.

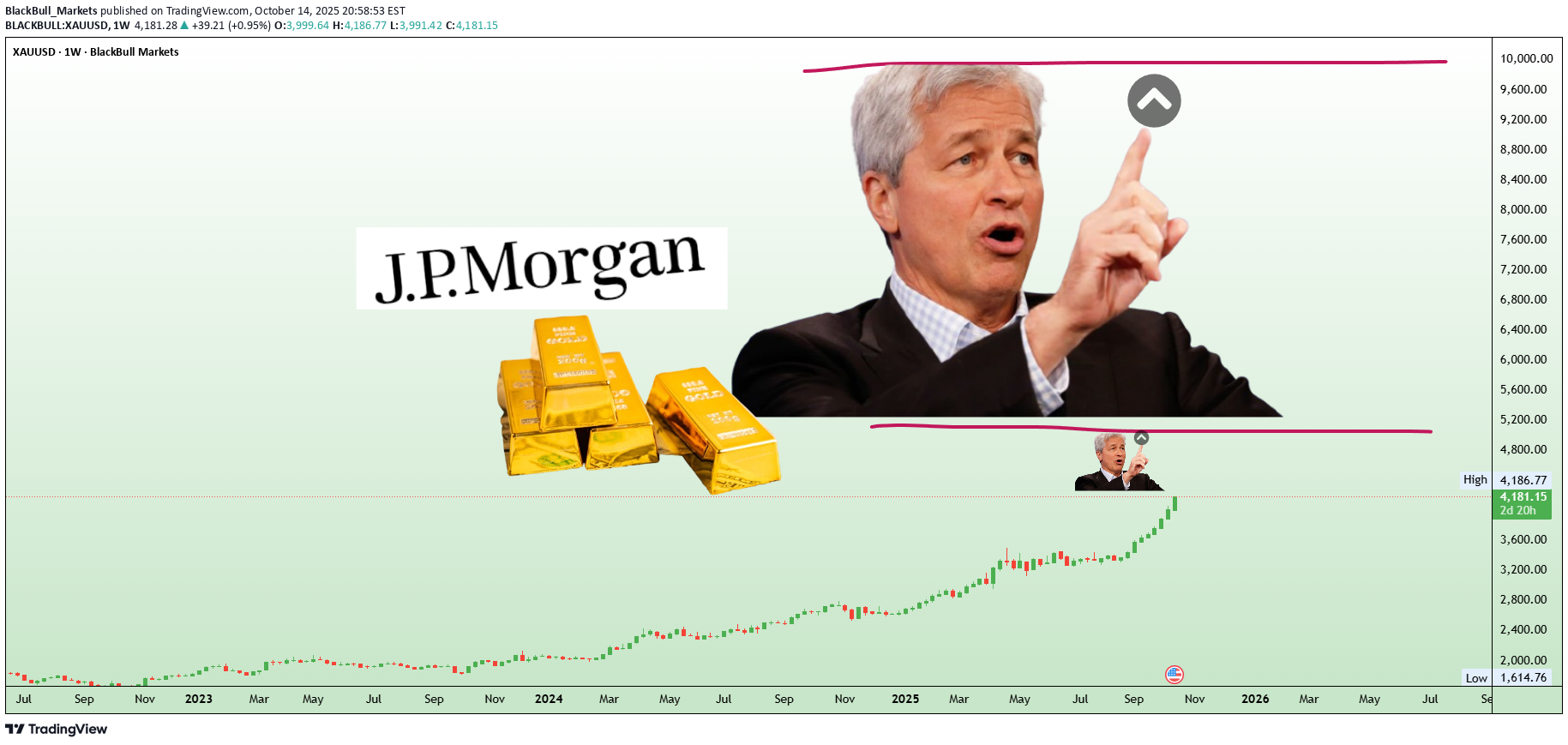

پیشبینی دیوان: طلا در مسیر ۱۰۰۰۰ دلاری؟ هر آنچه باید بدانید!

JP Morgan CEO Jamie Dimon , speaking at Fortune’s Most Powerful Women conference in Washington, said there is “some logic” in holding gold even at its current record high price. He acknowledged that in the current macro environment, gold “could easily go to $5,000 or $10,000 .” Gold reached record highs above 4,100 per ounce the past week. Dimon also cautioned that asset valuations appear “kind of high across almost everything at this point,”.

آیا طلا این ماه از مرز 4000 دلار عبور میکند؟ تحلیل و پیشبینی مهم

Altın, ons başına 3.890 dolara ulaştıktan sonra psikolojik 4.000 dolar sınırına yaklaşıyor. Bu yükseliş, iki ana faktör tarafından desteklendi: ABD'de özel sektör istihdamında beklenmedik bir düşüş ve federal hükümetin kapanması. Kapanma, bu haftaki tarım dışı istihdam verileri ve bu ayın TÜFE gibi önemli verilerin açıklanmasını geciktirdiğinden, Federal Rezerv 29 Ekim toplantısında kritik veriler olmadan politika kararı almak zorunda kalabilir ve bu da faiz oranlarını değiştirmeden bırakma olasılığını artırabilir. Teknik olarak, altının trendi olumlu seyrediyor. Güçlü talep bölgeleri potansiyel olarak 3.760 dolar ve 3.720 dolar civarında yer alırken, bir sonraki önemli direnç seviyesi 4.000 dolarlık psikolojik seviye. Günlük kapanışın 4.000 doların üzerinde kalması, 4.025 dolar ve 4.101 dolarlık Fibonacci uzantı hedeflerine doğru yolu açacaktır. Aşağı yönde ise, 3.760 doların altında bir kırılma, 3.680 dolar civarında daha derin bir geri çekilmeyi tetikleyebilir.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.