Bitcoin_Analyzer

@t_Bitcoin_Analyzer

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Bitcoin_Analyzer

#Bitcoin stagnant; will BTC bears force prices below $30k?

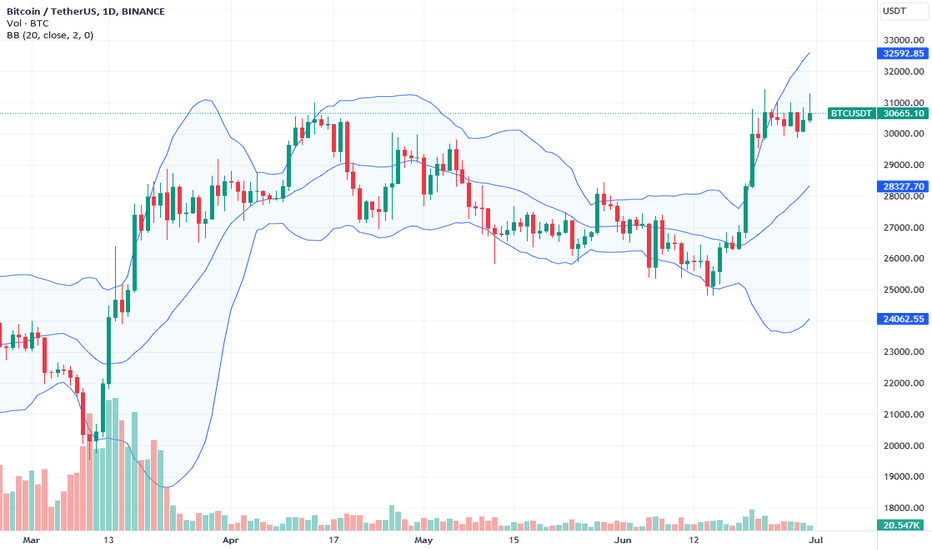

Past Performance of Bitcoin Bitcoin prices were technically unmoved over the weekend, looking at price charts. Therefore, while there was a notable contraction on July 6 at the back of expanding volumes, the rejection on July 7 relieved buyers. Still, from an effort-versus-result perspective, sellers have the upper hand in the short term. This can only change if buyers flow back, reversing the June 6 loss at the back of rising trading volumes. #Bitcoin Technical Analysis The path of least resistance remains to be northwards despite the current consolidation, from a top-down preview. Prices are boxed inside a $1.5k zone with caps at around $29.8k and $30k on the lower end, and $31.3k on the upper end. As it is, BTC prices are inside a developing bull flag where volumes are relatively light. Therefore, unless there is a conclusive close with rising volumes confirming sellers of July 6 below $29.8k, buyers of the second half of June are in control. For now, aggressive sellers may search for entries, unloading on attempts higher but below $31.3k with targets at $30k and $29.8k in the short term. What to Expect from #BTC? For now, traders should be patient considering the light trading volumes and the failure of bulls to wipe losses of July 6 that skews price action in favor of sellers. This formation could be a precursor for more losses this week, slowing down the upside momentum, especially if prices dip below the $29.8k and $30k support zone. Resistance level to watch: $31.3k Support level to watch: $29.8k Disclaimer: Opinions expressed are not investment advice. Do your research.

Bitcoin_Analyzer

#Bitcoin Falters and Drops 2%, BTC Bulls Find Support at $30k

#Bitcoin Falters and Drops 2%, BTC Bulls Find Support at $30k Past Performance of Bitcoin Bitcoin is lower when writing, dropping towards the $30k level. The sell-off stems from developments on July 6 and follows a refreshing surge to $31.3k before tumbling to spot levels. Despite traders--and the general BTC structure supporting buyers, the failure of buyers to push prices above the April high is a concern. Subsequently, the series of lower lows registered this week could fast-track the dump toward $30k or worse in future sessions. #Bitcoin Technical Analysis The path of least resistance, from the top-down preview, is northwards—but this is fast changing considering the sell-off of the past few trading days. The support zone between $29.8k and $30k is critical for now. Moreover, the long-upper wick of July 6 suggests that sellers are firm, and there could be more room for bears to press on today. Still, conservative traders can wait until there is a clear breakout below $29.8k before committing. In that case, a clean break with expanding volumes may open up BTC for a retest of $28.3k. Conversely, a recovery reversing yesterday's loss may be the base for a retest of $31.3k. What to Expect from #BTC? BTC is weak and could reverse recent gains posted in early July. At spot rates, the odds are high for more sell-off below $29.8k. Based on this formation, risk-on traders should wait for a clear definition below $29.8k, or $31.3k, before riding the emerging trend. Resistance level to watch: $31.3k Support level to watch: $29.8k Disclaimer: Opinions expressed are not investment advice. Do your research.

Bitcoin_Analyzer

#Bitcoin in a Bullish Formation with Caps at June 2023 Highs

#Bitcoin in a Bullish Formation with Caps at June 2023 Highs Past Performance of Bitcoin Bitcoin prices slipped on July 6 but remain bullish, per the formation in the daily chart. At spot rates, the coin remains within a consolidation, moving tightly inside a $1.5k zone with caps at $31.3k and $29.8k on the lower end. Technically, buyers have the upper hand, but there can be more upsides if traders shake off the current weakness and boost prices above immediate liquidation levels. #Bitcoin Technical Analysis The June 30 doji bar defines the current trade range. Even though prices increased in early July, there must be a conclusive break above $31.3k for buyers to be in control. As it is, the consolidation might offer entries for aggressive buyers loading the dips. However, being on the cautious side, conservative, risk-on traders can wait for a clean, high-volume breakout in either direction before riding. Any confirmation of buyers above $31.3k may see BTC rise to $32.5k in a buy trend continuation formation. Conversely, losses below $29.8k cancel this upbeat forecast, paving the way for sellers angling for $28.3k, and lower. What to Expect from #BTC? Traders are confident, but the failure of higher highs in the past few days has been heaping pressure on bulls and slowing down the uptrend. Nonetheless, there could be more upswings should BTC break $31.3k. Resistance level to watch: $31.3k Support level to watch: $29.8k Disclaimer: Opinions expressed are not investment advice. Do your research.

Bitcoin_Analyzer

#Bitcoin Bulls Firm, Primary Support at $30k

#Bitcoin Bulls Firm, Primary Support at $30k Past Performance of Bitcoin Bitcoin prices are steady and bullish despite the contraction on July 4. Overall, the $31.3k remains a critical buy trigger level. For the uptrend of June's last few trading days to continue, there must be a comprehensive, high-volume close above this level. Even so, aggressive traders could find entries to load on dips above $30k in the days ahead. #Bitcoin Technical Analysis BTC prices broke higher on July 3, but buyers failed to maintain yesterday's uptrend. At this pace, the uptrend remains despite the losses. Technically, in a bullish formation led by the July 3 bar following consolidation, traders can look to buy the dips above $30k with targets at $31.3k and later $32.5k. Conversely, conservative traders can wait for a clean break above April highs while targeting $32.5k or $35k. Any loss below $30k will slow down buyers, and BTC could drop toward $28.3k in a cool-off. What to Expect from #BTC? Buyers are upbeat, but this can change if BTC continues falling today. The uptrend remains, but there can be more gains above $31.3k in future sessions, validating the June 21 and 23 bull bars. Resistance level to watch: $31.3k Support level to watch: $30k Disclaimer: Opinions expressed are not investment advice. Do your research.

Bitcoin_Analyzer

#Bitcoin Firm, Buyers Targeting New 2023 Highs to $32.5k

#Bitcoin Firm, Buyers Targeting New 2023 Highs to $32.5k Past Performance of Bitcoin Bitcoin prices are firm when writing, floating above the 31K level as the recent consolidation proves to be an accumulation. How fast bulls will push above $31.3k and even new 2023 highs will determine the speed of the rebound after the slowdown in the final days of the last days of H1 2023. #Bitcoin Technical Analysis From the daily chart, the path of least resistance is northwards from an effort versus result perspective. Presently, buyers have the upper hand, and this forecast holds, provided prices are floating above the $29.8k support level. Considering the expansion yesterday, traders can look for long entries, buying the dips and looking to align with the short-term uptrend set in motion by the June 21 anchor bar. As it is, BTC buyers may look for $32.5k and $35k as immediate targets. What to Expect from #BTC? Buyers are optimistic, and this holds, reading from the candlestick arrangement. Overall, the uptrend remains, and every low above $29.8k and $30k support zone provides entries for determined traders. BTC is likely to start July from a stronger footing at this pace, registering new 2023 highs. Resistance level to watch: $32.5k Support level to watch: $29.8k Disclaimer: Opinions expressed are not investment advice. Do your research.

Bitcoin_Analyzer

#Bitcoin Bulls Firm, BTC Stuck in a Choppy Sideways Consolidatio

#Bitcoin Bulls Firm, BTC Stuck in a Choppy Sideways Consolidatio Past Performance for Bitcoin Based on the performance in the daily chart, bitcoin prices remain volatile and choppy. Even though the primary trend remains northwards, there are hints of weakness, looking at the candlestick arrangement. The only positive is that sellers have been unable to break below the $29.8k and $30k primary support. The $31.3k is a liquidation level to watch out for. #Bitcoin Technical Analysis The uptrend remains, and prices are inside a bull flag, looking at the performance in the daily chart. The consolidation remains, but the breakout direction would shape the short-to-medium-term trend. For now, conservative traders can wait until there is a clear trend definition, aware that gains above $31.3k would likely pump the coin to $32.5k or better. Conversely, sharp losses below $29.8k invalidate the current preview, possibly allowing the coin to retest $28.3k and later $27k. What to Expect from #BTC? Buyers are optimistic, but the current formation points to balanced price action. The overall trend, set by events in the last weeks of June, dictates price action. Aggressive, risk-off traders may load as prices move sideways, aligning with the primary trend if prices are above $29.8k. Resistance level to watch: $31.3k Support level to watch: $29.8k Disclaimer: Opinions expressed are not investment advice. Do your research.

Bitcoin_Analyzer

#Bitcoin Consolidates, BTC Resistance Remains At $31.3k

#Bitcoin Consolidates, BTC Resistance Remains At $31.3k Past Performance of Bitcoin At spot rates, there is nothing to write home about BTC. Prices remain within a consolidation, moving below $31.3k and above the primary support zone at between $29.8k and $30k. Even though buyers are optimistic, the rejection of higher highs can be a concern for bulls. Still, with prices consolidating horizontally, the breakout direction could shape the short-to-medium-term trajectory. #Bitcoin Technical Analysis Buyers are confident; every low should theoretically provide entries for buyers targeting $31.3k or better. The rejection of higher prices on June 28 was with light volumes. Therefore, the uptrend remains from an effort-versus-result perspective unless there are deep losses below $30k. Conversely, there could be a reprieve if there are gains above $31.3k. Before committing, conservative, risk-on traders can wait for definitive, high-volume breakouts above/below $31.3k and $29.8k, respectively. What to Expect from #BTC? Traders are closely watching how price action unfolds in the daily chart. As it is, the path of least resistance is northwards at least from a top-down preview. Even so, the weakness in the recent retracement questions the strength of buyers. Therefore, while bulls remain in control, a break below last week's lows could define the immediate trend for Bitcoin. Resistance level to watch: $31.3k Support level to watch: $29.8k Disclaimer: Opinions expressed are not investment advice. Do your research.

Bitcoin_Analyzer

#Bitcoin Soaks Selling Pressure; Will BTC Rally Above $31.3k?

#Bitcoin Soaks Selling Pressure; Will BTC Rally Above $31.3k? Past Performance of Bitcoin Bitcoin is roughly 20% from June 2023 lows and resilient, soaking selling pressure, looking at the performance in the daily chart. Even though there were attempts for lower lows, prices are firm above the $30k psychological level and $29.8k. Meanwhile, the coin is defying selling pressure and may break above $31.3k in the days ahead in a buy trend continuation formation. #Bitcoin Technical Analysis Traders are upbeat, but BTC, at the moment, remains inside a horizontal range with caps at $31.3k and $29.8k support. Unless there is a comprehensive, high-volume close above last week's highs, conservative, risk-on traders can wait for trend definition. Only after then can they search for loading entries to buy on dips in a buy trend continuation formation that could lift BTC towards $32.5k. Even so, BTC remains within a bullish formation, and the contraction from last week has formed a minor bull flag. The uptrend will be valid if prices are inside the June 21 to 23 trade range. What to Expect from #BTC? Risk-off traders can load on dips, expecting Bitcoin to resume the uptrend. Traders are bullish, but this can change if the upside momentum is not sustained above the $29.8k primary support level. Resistance level to watch: $31.3k Support level to watch: $29.8k Disclaimer: Opinions expressed are not investment advice. Do your research.

Bitcoin_Analyzer

#Bitcoin at 2023 Highs, will BTC hold above $30k?

#Bitcoin at 2023 Highs, will BTC hold above $30k? Past Performance of Bitcoin Bitcoin remains in an uptrend despite liquidity shrinking over the weekend. From the daily chart, the path of least resistance is definite and northwards. Even though there are hints of weakness, bulls may look to buy above the $29.8k and $30k area, searching for entries for a retest of $31.3k or better in future sessions. #Bitcoin Technical Analysis Bitcoin is trading at around 2023 highs following sharp gains from June 20 to 23 at the back of expanding volumes, as visible in the daily chart. Subsequently, traders can continue looking for entries on dips, aligning with the primary trend established last week. Notably, the coin is within a bullish breakout formation, syncing with March to April gains. The anchor remains at the base of June 2023 lows at around $24.8k. Meanwhile, any retest of $30k or even $28.3k could be areas of loading if there is a retracement from last week's peaks. The immediate target is at $31.3k, later $32.5k, and $35k if bulls press on. What to Expect from #BTC? Traders are optimistic and fundamental factors could pump the coin to new highs. Even so, for now, the rejection of higher highs over the weekend could translate to retracements. Immediate support levels remain $29.8k and $28.3k on the lower end. Any expansion above last week's high could trigger more demand, pushing BTC to 2023 highs. Resistance level to watch: $31.3k Support level to watch: $29.8k Disclaimer: Opinions expressed are not investment advice. Do your research.

Bitcoin_Analyzer

#Bitcoin Breaks Out, Will Traders Take Out $31k?

#Bitcoin Breaks Out, Will Traders Take Out $31k? Past Performance of Bitcoin Bitcoin is firm at spot rates, adding 20% from June 2023 lows. Trading above $30k, the coin is within a bullish breakout formation, and buyers are confident. Therefore, per the candlestick arrangement in the daily chart, traders can look for entries on dips above $28.3k, expecting even more gains above $31k. Any upswing above April highs could pump the coin towards $35k or better, registering new 2023 highs. #Bitcoin Technical Analysis The uptrend is clear, and BTC is back to the upswing of March and April 2023. Following gains, BTC is within a breakout formation, surging above a multi-week resistance trend line. At spot rates, every low above $28.3k allows aggressive traders to load up and target $31k. This preview is supported by strong underlying momentum, considering bars are banding along the upper BB. At the same time, there is high volatility looking at the divergence between the middle BB and the upper BB. As BTC prices look to break out from the bull flag, there could be an opportunity for conservative traders to explore entries with targets at $31k. A comprehensive close above April highs may offer even better entries. What to Expect from #BTC? Traders are upbeat and confident. Even so, unless BTC edges above 31K , closing above April highs, sellers stand a chance. Notice that prices are within a bull flag after the drop in May 2023. Resistance level to watch: 31K Support level to watch: $28.3k Disclaimer: Opinions expressed are not investment advice. Do your research.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.